Australian Equities

Australia Small Cap Income

Investor updates

Below you will find this month’s commentary and portfolio update for TAMIM Australia Small Cap unit class.

December 2025 | Investor Update

Dear Investor,

We provide this monthly report to you following conclusion of the month of December and the calendar year 2025.

The TAMIM Small Cap Income Fund was down -1.69% (net of fees) during the month, versus the Small Ords down -1.48%. Year to date the Fund is up +21.50% (net of fees).

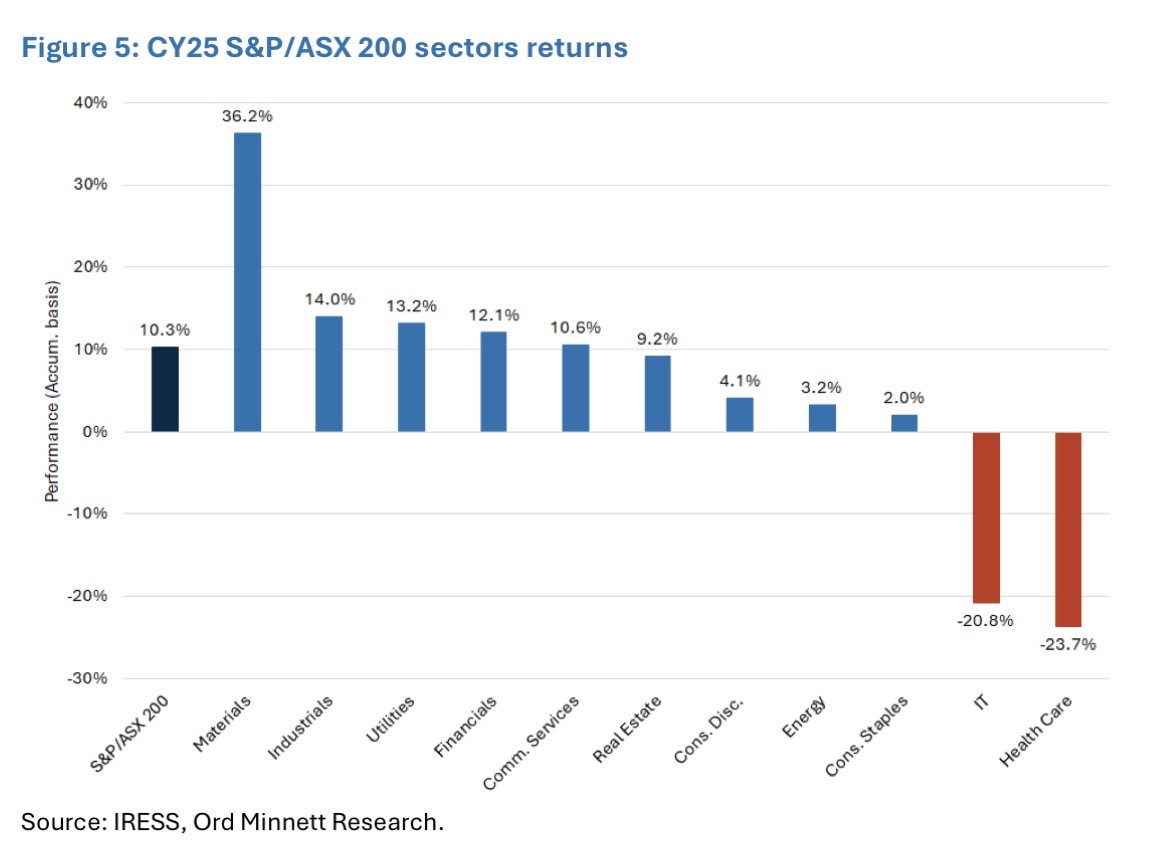

CY2025 performance was solid, but digging deeper shows the Fund performed well despite some significant headwinds during the year. The IT sector was down -21% for the year whilst the resources sector was up +36%. Since we are more exposed to technology based businesses and have no exposure to resources – the fund’s performance is even more commendable.

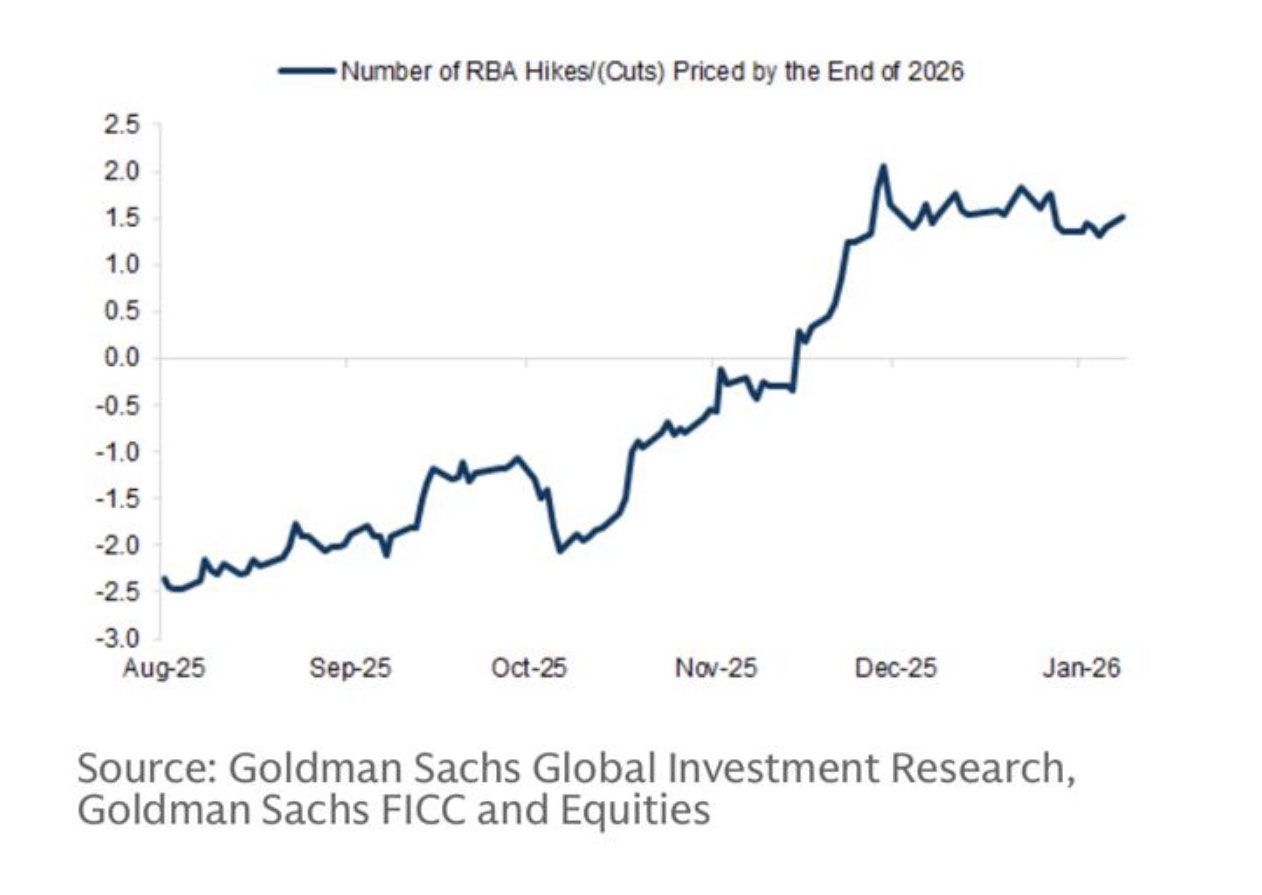

Part of the reason for the underperformance in tech was due to Australian rate rise expectations flipping from a couple of rate cuts expected back in October to now almost two rate hikes priced in. As we mentioned before, technology businesses valuations are highly sensitive to interest rate movements.

We still believe that small and mid caps will continue to outperform this year as earnings growth outlook is strongest within this part of the market. Our job is to find the right companies that can continue growing, outperform market consensus and in some cases provide attractive takeover targets to potential suitors.

We believe the portfolio is positioned well to perform in 2026 although we remind investors to expect some “air pockets” along the way – just like we experienced during 2025.

We provide a brief commentary on portfolio updates during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in February.

Sincerely yours,

Ron Shamgar and the TAMIM Team.

Fund Performance

Portfolio Highlights

Centrepoint Alliance Limited (ASX: CAF) released a material trading update in December 2025, reporting FY26 H1 forecast EBITDA of $6m, up 13% on H1 FY25, and guiding to FY26 EBITDA at the top end of the $11.5–12.0m range. The group’s adviser network expanded to 588 advisers, supported by strong recruitment and retention, lifting Centrepoint to the #2 licensee nationally. Regulatory education standards are being met with minimal expected attrition, while the IconiQ platform continues to scale with a $1bn transition pipeline, reinforcing earnings momentum into FY26.

Comms Group Limited (ASX: CCG) delivered a material balance sheet update in December 2025, refinancing its debt through a new Westpac facility on improved commercial terms. The new structure enhances liquidity, extends funding headroom, and includes additional undrawn capacity to support future acquisitions, alongside a new equipment leasing facility. The refinancing strengthens Comms Group’s financial flexibility at a key point in its growth and integration journey, positioning the group to pursue strategic opportunities while reducing near-term funding risk.

Cuscal Limited (ASX: CCL) delivered a material strategic milestone in December 2025, completing its 100% acquisition of Indue Limited. The transaction meaningfully increases Cuscal’s scale and diversification across payments and banking services, strengthening its position as a critical domestic payments infrastructure provider. Management expects the acquisition to deliver >25% run-rate EPS accretion and >20% ROIC once integration is complete, supported by $15–20m of post-tax annual cost synergies by FY29. While integration costs of $25–30m post-tax are expected over three years, the deal materially enhances Cuscal’s long-term earnings and strategic outlook.

EDU Holdings Limited (ASX: EDU) delivered a material update in December 2025, upgrading its FY25 financial guidance after stronger than expected results. Management now expects revenue to grow ~92%, EBITDA to expand ~215%, and net profit after tax to increase ~452% versus FY24, underpinned by robust student enrolments and cost timing benefits. The company also announced a selective buy-back of 18 million shares at $0.55 per share, funded from cash reserves and expected to be earnings-per-share accretive. These developments reinforce EDU’s operating momentum and capital discipline heading into 2026.

Humm Group Ltd (ASX: HUM) disclosed material takeover-related developments in December 2025. The company acknowledged receipt of a section 203D notice and a non-binding indicative proposal from Credit Corp Group Ltd to acquire 100% of HUM for 77 cents, initiating due diligence access discussions and highlighting potential changes in control.

A separate ASX filing confirmed the non-binding proposal details, noting that the transaction remains subject to further due diligence and is not assured. At the same time a group of activist shareholders are looking to remove the chair and 3 board members which we see as a positive catalyst if successful. We intend to support the vote to remove the current board.

Paragon Care Limited (ASX: PGC) reported multiple material developments in December 2025. The company completed the acquisition of Somnotec Group, expanding its medical device distribution footprint across Southeast Asia. It also agreed to acquire Haju Medical for A$70 million (A$30 m upfront plus contingent consideration), with Haju generating approximately A$30 m in revenue and A$7.7 m in EBITDA in FY24, and expected to be earnings accretive from FY26. These acquisitions support Paragon Care’s regional expansion strategy and broaden its product and services offering.

Separately, Paragon Care appointed Brendon Pentland as Chief Financial Officer, strengthening financial leadership during a period of increased integration and capital deployment. The company also addressed the appointment of administrators to 54 Infinity Retail Pharmacies, a counterparty previously involved in a restructuring arrangement, and is working with administrators to manage exposure and support an orderly outcome.

Symal Group Limited (ASX: SYL) reported multiple strategic developments in December 2025. The group agreed to acquire the assets of Timms Group and L&D Contracting for ~A$28 million, expanding its Queensland footprint and expected to contribute ~A$8 million of annualised EBITDA in FY26. Symal also secured a A$300 million revolving debt facility, including an increase in its performance bonding capacity from $50 million to $100 million, enhancing liquidity and execution capacity.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Australian Equities |

| Investment Universe: | Australian Small Cap |

| Reference Index: | ASX Small Ords |

| Number of Securities: | 20-40 (10-20 Value, 10-20 Growth) |

| Single Security Limit: | +/-5% |

| Market Capitalisation: | Small Cap |

| Leverage: | No |

| Portfolio Turnover: | <50% p.a. |

| Cash Level (typical): | 0-100% (0-50%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate + 2.50% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Distributions: | Semi-annual |

| Applications/Redemptions: | Monthly |

| Redemptions: | Monthly with 30 days' notice |

| Investment Horizon: | 3 - 5 years + |

Invest via TAMIM Fund

Request additional details by using the form or if you're ready to invest select the apply now button.

Invest via IMA

The TAMIM Australia Small Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.