Australian Equities

Australia All Cap

July 2025 | Investor Update

Dear Investor,

We provide this monthly report to you following conclusion of the month of July 2025.

The TAMIM All Cap Fund was up +6.12% (net of fees) during the month, versus the Small Ords up +2.82% and the ASX300 up +2.43%.

The Fund is up +18.74% net of fees over the last 12 months.

July was a very positive month for the Fund in what was a generally bouyant equity market environment. Several of our Fund’s holdings delivered strong trading updates which resulted in positive share price reactions. This is what we expect in a normal market behavior environment – good news rewarded and bad news punished.

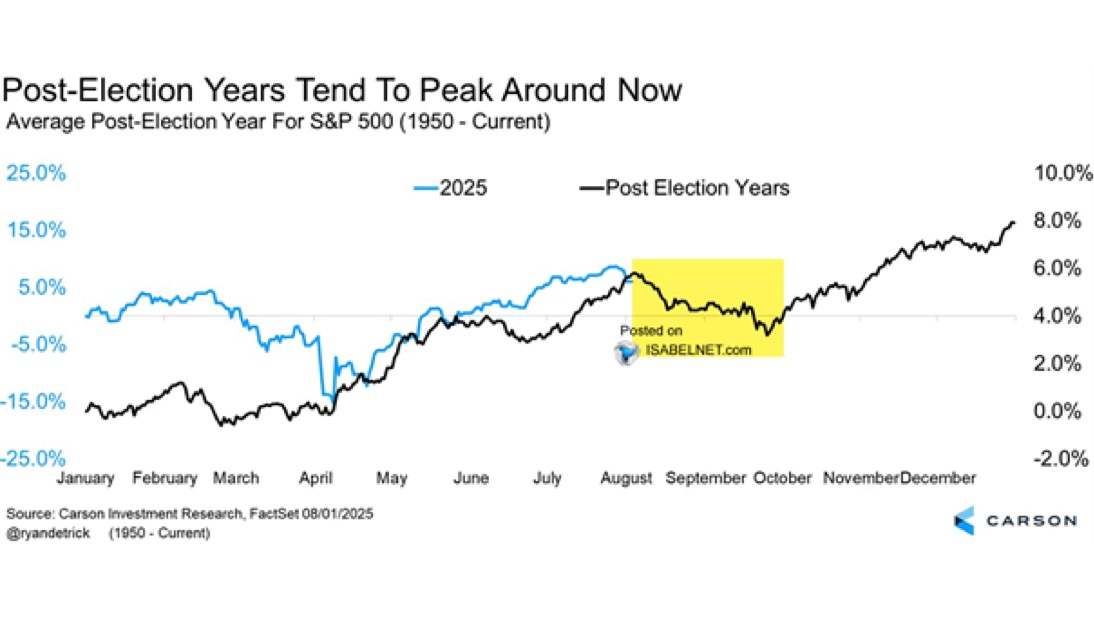

We are also experiencing significant Takeover activity in the Fund’s holdings and expect more M&A to emerge in the coming months. We are quite optimistic on the outlook for markets heading into the August reporting season and the second half of the year.

Investors should keep in mind that after several months of positive returns, it is always inevitable a possible market pullback may arise. We see any market pullback as a good opportunity to top up for the medium to long term.

Finally we provide a brief commentary on portfolio updates during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in September.

Sincerely yours,

Ron Shamgar and the TAMIM Team.

Fund Performance

Portfolio Highlights

Johns Lyng Group (ASX: JLG) has entered into a Scheme Implementation Deed with Sherwood BidCo Pty Ltd, managed by Pacific Equity Partners (PEP) during the month. PEP to acquire 100% of JLG shares at $4.00 per share with the Scheme valuing JLG's equity at approximately $1.1 billion.

JLG is a classic Tamim playbook stock pick. As can be seen from the chart below, JLG over the last few years traded at elevated levels we struggled to see value. We followed the story closely like most stocks - but could not justify what was a very popular stock with fundies yet carried a highly expensive multiple.

Over the last year or so, the company disappointed the market with multiple downgrades as its building restoration business was cycling a strong prior years performance but lower industry activity in the short term. This all culminated in a disappointing February 2025 results which saw the stock reach its lows of $2.00. Having followed the story closely and seeing management acquire material amount of shares on market, we took the opportunity to meet the company and initiated a position at $2.20.

JLG ticks the boxes of what we look for in a business: founder led and majority holder, industry leader, solid balance sheet, positive outlook as industry conditions improved, and finally an undemanding valuation. In June/July we were pleased that the company agreed to a takeover in what was a material premium of $4.00 vs our $2.20 entry price.

Qoria (ASX: QOR) is a leading global child safety and monitoring technology company. QOR has established a dominant position in the US year K to year 12 school market and is expanding with its direct to parents consumer product. We believe QOR is in the midst of a material profitability and free cashflow inflection point. Combined with strong top line growth, we see the stock catching up to its larger peer, Life360, material valuation premium over time.

During July QOR delivered record Q4ARR growth of $29 million (25% YoY) achieving Exit ARR of $145 million and a +13% EBITDA margin.

Strong result achieved despite a $4 million negative impact of the fall in the USD:AUD in the June quarter.

FY 2025 Highlights:

-

- Delivered EBITDA of $15.4 million, up 670% on FY2024

- Grew ARR by $29 million (up 25% YoY with net growth up 55% pcp)

- Added a record $14 million of net ARR for the 4th qtr (up 55% pcp)

- Grew Consumer ARR to US$18 million (up 21% YoY)

- Grew effective cash collections by 24% pcp

- Grew gross margin on services (service margin) to +91%

- Maintained operating cost growth at under 1%

- Grew our impact to 27m students, 32k schools & 8m parents

Qoria continues to lead the industry in growth and are now strongly profitable and free cash flow positive on an annual basis. Management provided FY2026 Guidance for 20% ARR growth, free cashflow and 20% Ebitda margin. QOR is a rule of 40 stock now but only trades on an ARR multiple of 5.1x vs peers at 7-12x. We think there’s further upside in the stock with our entry price at 42 cents versus the current price of 68 cents.

Alcidion Group (ASX: ALC) during the month released its Q4 FY25 Quarterly Activities Report which provided for strong financial performance:

-

- Q4 FY25 positive operating cashflow of $7.4M

- Record quarterly cash receipts of $22.4M

- FY25 positive operating cashflow of $5.8M, a $12.9M improvement on PCP

- Record annual receipts of $50.9M

- FY25 new TCV sales of $73.8M, up 109% on PCP

- Cash balance of $17.7M and no debt as of 30 June 2025

- Reconfirmed FY25 EBITDA guidance to exceed $4.5M

ALC is a workflow management software provider to hospitals. Their key markets are the UK and Australia. The company has recently won some large UK hospital contracts which should drive revenue growth in the short term until further deals are secured. We took a position in the stock last few months at 8 cents and the stock closed the month at 11.5 cents. We believe it’s only a matter of time before the company will find itself in the crosshairs of an acquirer.

Credit Clear Limited (ASX: CCR) reported strong unaudited FY25 financial results, with underlying EBITDA rising 76% to $7.4 million, surpassing guidance. Revenue reached a record $46.9 million, up 12% from FY24, driven by robust June 2025 performance and increased adoption of its digital collections platform. EBITDA margins improved to 16% from 10%, reflecting enhanced operating efficiency and cost control.

The company maintained a solid $15.6 million cash balance, supporting strategic growth. Credit Clear secured multi-year contracts with two major insurers, capturing 100% of their digital debt recovery budgets, reinforcing its market position and hybrid model’s competitive edge. Management indicated the FY26 is setup for growth which we estimate to be $52-$54m in revenue and $11-$12m in Ebitda. The sector is seeing M&A interest and we anticipate CCR to be involved in any future deals.

Austco Healthcare Limited (ASX: AHC) has provided a trading update and guidance upgrade for FY25. Highlights include:

-

- Revenue: $80-$82 million, up 37%-41% from FY24

- EBITDA: $12.5-$13.5 million, up 54%-67% from FY24

- Cash at bank: $14.4 million, up 6% from FY24

- Unfilled contracted revenue: $55.8 million

- Amentco acquisition outperformed expectations, leading to an additional $2.5 million earn-out expense

- G&S Technologies acquisition completed on 30 May 2025, funded through operating cash flows

AHC unfilled order book closed the year at $50m with a strong pipeline of opportunities. We anticipate FY26 Ebitda of at least $16m and an EPS of 2.8-3 cents. The stock has reached an inflection point of a market cap above $100m and an undemanding multiple - which should attract more eyeballs to the stock and potential investors to the register.

Enero Group Limited (ASX: EGG) sold its 51% stake in OBMedia to minority shareholders for a nominal amount, incurring a non-cash loss of A$14–16 million. The divestment aligns with Enero’s strategy to focus on its high-performing agencies—Hotwire Global, BMF, and Orchard—to drive growth and value.

Enero expects FY25 EBITDA at the upper end of its guidance ($22–26 million underlying, $18–20 million economic interest), fueled by new Australian client wins, strong cost control, and operational excellence.

We believe the core business will generate $12-$14m of Ebitda in FY26. The company has in excess of $30m of net cash versus a market cap of $90m. With the OBmedia business divested - the potential poison pill to a takeover has been removed. We expect the company to be acquired at some point or for the stock to re rate towards our $1.50+ valuation as capital management initiatives are announced.

Bioxyne (ASX: BXN), a relatively young public company, is rewriting the playbook for medical cannabis manufacturing through a combination of strategic vision by its Founder and CEO, Sam Watson, regulatory expertise, and operational efficiency.

Founded through a reverse takeover in May 2023, Bioxyne represents a transformation from a dormant shell company to a sophisticated medical cannabis and psychedelics manufacturing powerhouse. The company’s journey began when its current CEO identified an opportunity to consolidate a struggling public entity with his existing medical cannabis business, Breathe Life Sciences. From our discussions with Sam, he came across as a young but highly motivated founder with ambitious growth aspirations – exactly what we are looking for in our portfolio companies.

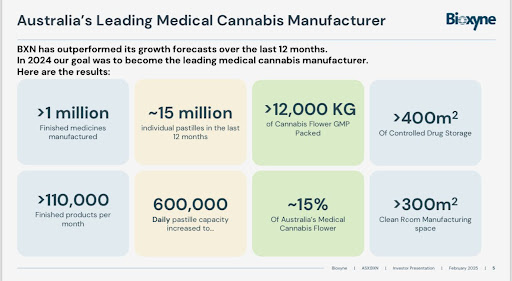

The company’s breakthrough came in February 2024 when it secured a comprehensive GMP (Good Manufacturing Practice) manufacturing license in Australia – a critical milestone that set it apart from competitors. Unlike most cannabis manufacturers who focused on limited product lines, Bioxyne obtained certification to produce an unprecedented range of products, including flower, oils, gummies, MDMA, and psilocybin.

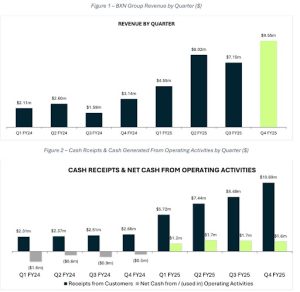

Bioxyne’s core strength lies in its manufacturing capabilities. We like to think of the company as the “Foxconn” to the industry. With fully automated production lines capable of processing up to 6,000 kilos of product monthly, the company offers something rare in the medical cannabis industry: scale, efficiency, and versatility. Their current market share stands at approximately 10-15% of the Australian flower packing market (estimated TAM $250 million in a $1 billion sales market), with revenues approaching $30 million annually in FY25. They currently service over 100+ customers with each one generating in excess of $250k p.a.

The company’s business model is elegantly simple. They primarily operate as a contract manufacturer for medical cannabis companies, charging per-unit fees for their sophisticated manufacturing services. This approach allows them to generate consistent revenue while minimizing the risks associated with brand development and direct patient sales. We think of BXN as a “Picks and Shovels” play to the sector, akin to Foxconn in China being the manufacturer for Apple products.

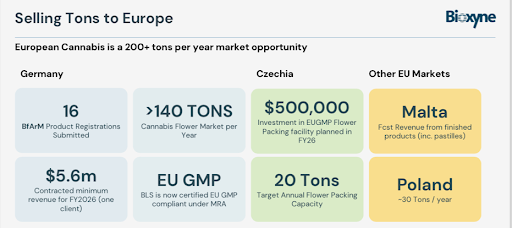

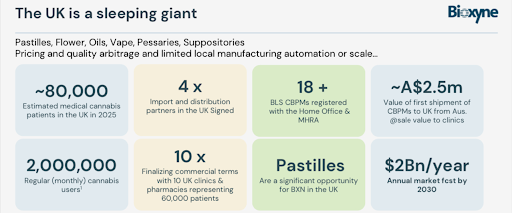

Bioxyne isn’t content with dominating the Australian market. The company has set its sights on international expansion, with particularly promising developments in Germany and the United Kingdom. In Germany, they’ve already secured a $5.6 million initial agreement to export cannabis flower products, tapping into a market that has recently seen significant deregulation and growth.

The UK presents another exciting frontier. Bioxyne is currently onboarding with nine of the top ten clinics and pharmacy businesses, positioning itself as a preferred manufacturing partner. Their ability to provide 12-18 months of product stability – compared to the typical 90-day limit for locally manufactured products – gives them a significant competitive edge. A recent $2.5 million contract win signals the start of an expanding opportunity.

The leadership team, led by a CEO who owns 29% of the company, appears committed to strategic, measured growth. Rather than pursuing rapid, potentially dilutive expansion, they’re focused on strategic acquisitions and market consolidation. The company ticks what we look for from a founder led business. We do expect M&A in Europe to consolidate BXN market position and enable pricing power in future as they grow.

Perhaps most intriguingly, Bioxyne is positioning itself at the forefront of the emerging psychedelics market. They’ve already signed their first commercial contract for MDMA capsules used in PTSD treatment, seeing significant potential in this nascent therapeutic space.

The medical cannabis sector remains volatile, with historical investor skepticism due to previous market failures. Bioxyne must continue to differentiate itself by emphasising its unique regulatory advantages, manufacturing expertise, and clear strategic vision. Apart from regulatory risks, the market is growing fast, with Germany legalising in 2024 and already running over $1B in sales and eclipsing Australia.

What sets Bioxyne apart is its approach to medical cannabis manufacturing. Like Foxconn in electronics, they’re building a business model centered on becoming the go-to manufacturing partner in a complex, regulated industry.

Their competitive advantages are multifaceted:

- Comprehensive regulatory licenses

- Advanced manufacturing infrastructure

- Highly skilled operational team

- Ability to manufacture multiple product types

- Efficient, scalable production processes

As the medical cannabis and psychedelics markets continue to mature, Bioxyne appears well-positioned to capitalise on growing demand. Their strategy of focusing on manufacturing excellence, rather than direct consumer sales, provides a more stable and potentially more profitable approach to this emerging industry unlike many peers who are yet to turn profitable.

With projected revenues approaching $100 million in 2-3 years, a lean cost structure, and expanding international footprint, Bioxyne represents an intriguing opportunity for investors seeking exposure to the specialty pharmaceutical and medical cannabis sector.

BXN ticks all the boxes we look for in a company:

- Industry leader

- Founder led and alignment with shareholders

- High growth and profitable

- Strong cashed up balance sheet and Free cashflow generation.

- Track record of under promising and over delivering.

- Significant room for growth in a large TAM

- Under the radar with no institutional ownership or broker research – yet!

- Large discount to our 8 cents valuation next year and potentially 15 cents if they can achieve $100 million of sales.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Reference Index: | ASX 300 |

| Number of Securities: | 20-50 |

| Single Security Limit: | 10% (typically 5%) |

| Investable Universe: | ASX (focus on ASX300 ex20) |

| Market Capitalisation: | Any |

| Leverage: | No |

| Portfolio Turnover: | < 25% p.a. |

| Cash Level: | 0% - 100% (typically 5 - 30%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of RBA Cash Rate + 2.5% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3 - 5 years + |

| Distributions: | Annual |