Australian Equities

Australia All Cap

August 2025 | Investor Update

Dear Investor,

We provide this monthly report to you following conclusion of the month of August 2025.

The TAMIM All Cap Fund was up +5.20% (net of fees) during the month, versus the Small Ords up +8.41% and the ASX300 up +3.16%.

CYTD the Fund is up +15.60% net of fees.

August saw equity markets continue to rally on the back of a positive but volatile reporting period for the ASX. Overall the Fund holdings experienced very positive results for most stocks. We have uncovered some new opportunities and exited a couple of underperforming ones. We feel the Fund is positioned extremely well over the next 6-12 months.

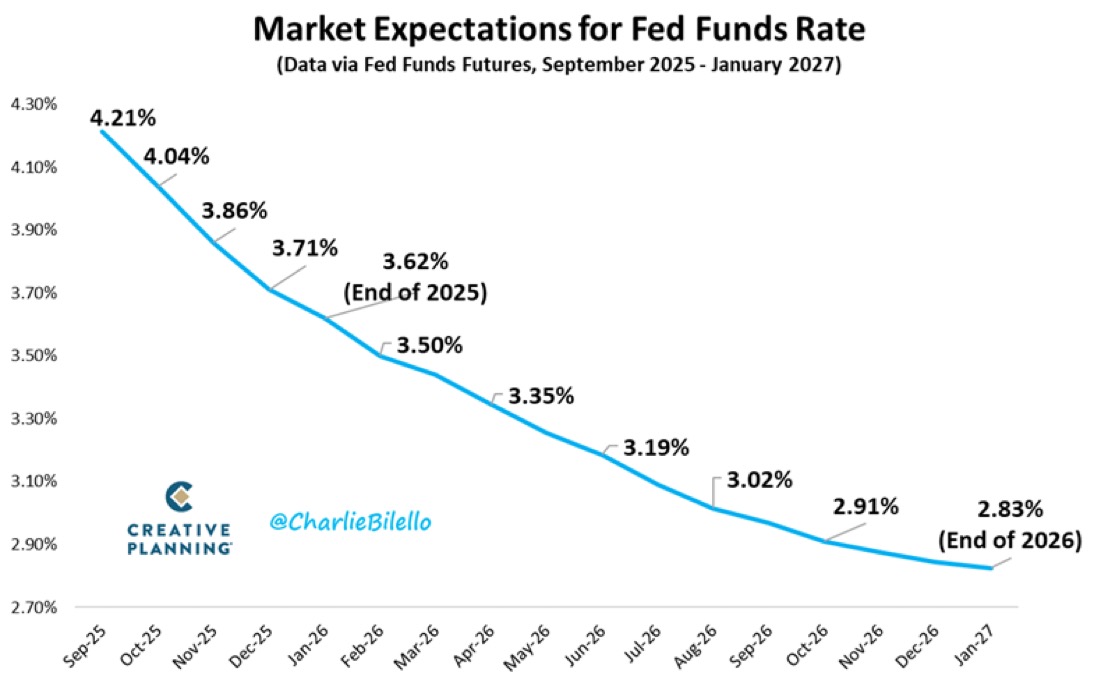

The market is increasingly positioning for rate cuts both in Australia and the US on the back of lower than expected inflation prints. The US bond market is now pricing in 3 rate cuts by year-end and 3 more cuts in 2026. That would bring the Fed Funds Rate down to 2.83%.

More importantly and as we have been highlighting for the last 12 months, small and mid caps are leading this rally and playing catchup to their larger peers. This catchup still has significant runway to go.

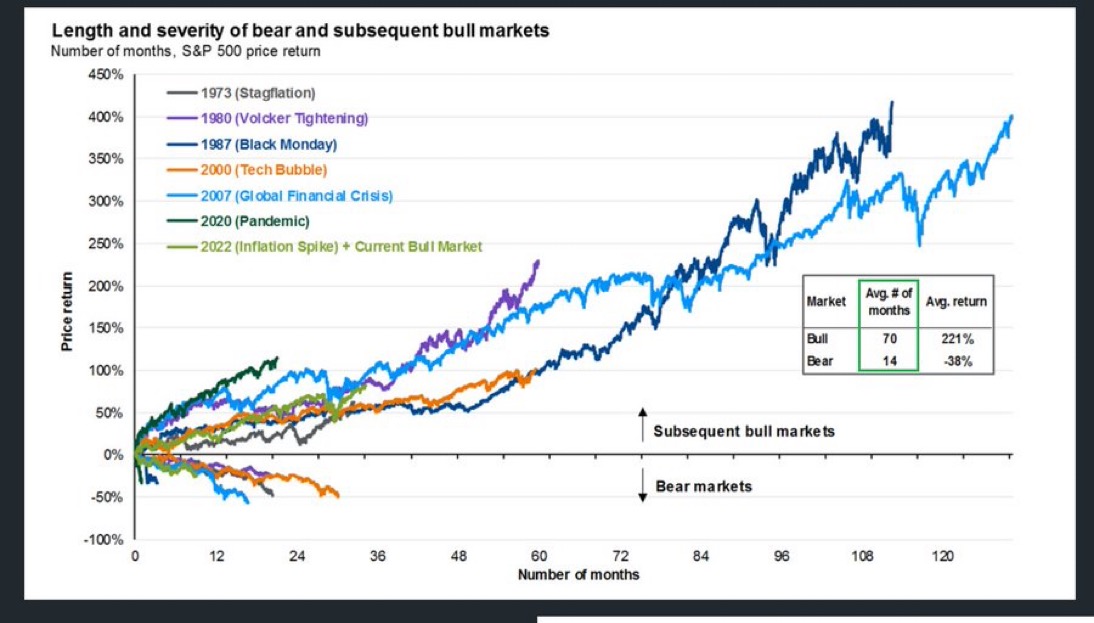

Finally this bull market turns 3 yrs old soon. As we’ve noted many times, this is still a rather young bull market and history would say there is likely many more years left. The past 50 yrs had 5 bulls get past their second birthday and the average was 8 yrs. The shortest was 5 yrs. We believe this bull market driven by AI thematic will be longer than average.

Investors should keep in mind that after several months of positive returns, it is always inevitable a possible market pullback may arise. We see any market pullback as a good opportunity to top up for the medium to long term.

Finally we provide a brief commentary on portfolio updates during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in October.

Sincerely yours,

Ron Shamgar and the TAMIM Team.

Fund Performance

Portfolio Highlights

EML Payments (ASX: EML) is undergoing a comprehensive transformation, rebuilding its commercial strategy and technological infrastructure. The company has revitalised its leadership and sales capabilities, signed 27 new clients, and established a global technology partnership with Visa Pismo to expand payment capabilities across multiple markets.

Financially, the company achieved strong performance with total revenue of $221 million, EBITDA at the top of guidance ($58 million), and increased interest income. The Arlo platform consolidation is expected to reduce technology costs by $12 million while enabling multi-product, multi-currency offerings across regions.

The strategic focus is on organic growth, with a disciplined approach to pipeline management and customer acquisition. Sales pipeline has grown to $66 million at June and the $90 million target is on track for December. The leadership team is prioritizing operational efficiency, global integration, and technology modernisation.

Future plans include potential debt reduction, continued investment in the Arlo platform, and leveraging the newly established global operating model to drive expansion and improve customer relationships. The next catalysts are AGM and Feb results updates on pipeline conversion of new sales. A positive update could see a significant re rate for the stock towards our $2.00+ valuation (100%+ upside).

Hipages (ASX: HPG), an Australian marketplace connecting homeowners with trade professionals, delivered strong financial performance in FY25. The company successfully transitioned 33,000 customers to a new integrated platform, achieving 10% revenue growth through strategic pricing and subscription adjustments. With a $32 return for every $1 spent, the platform provides significant value to trades.

For FY26, Hipages targets 10-12% revenue growth, 24-26% EBITDA, and $8-10 million in free cash flow. The company sees substantial expansion potential in the 300,000 Australian trade businesses market, currently serving 50,000 paying customers.

Strategic focus includes developing a comprehensive service ecosystem, implementing intelligent pricing, and exploring M&A opportunities. By enhancing software features, adding services like accounting integrations, and adopting a product-led growth approach, Hipages aims to improve customer retention and drive long-term value creation. Trading on 17x FCF we feel the stock is undervalued by the market and will continue re rate over time.

ReadyTech (ASX: RDY) is a mission-critical software company operating across four key segments: education, workforce solutions, local government, and justice. The company focuses on moving customers from legacy systems to cloud-based platforms, targeting mid-market enterprises. While FY25 results fell slightly short of their typical double-digit organic growth target last year, they're seeing momentum return, particularly in education and local government.

Key highlights include winning their first university client, expanding in higher education, and beginning cloud upgrades for local government customers. The company is heavily investing in AI, expecting seven AI releases next year that will drive productivity gains and potentially create new revenue streams.

The company's current pipeline is around $33 million, with almost half in education. They're targeting significant growth in TAFEs and universities, with FY26 expected to be a strong tender year and FY27 for winning larger universities. Their local government segment has 200 ERP customers out of 530 potential councils, with significant room for module expansion and cloud upgrades. The workforce solutions segment is their fastest-growing, with a focus on industries like hospitality, retail, and logistics. Trading on only 10x Cash EBITDA for FY27, we think the company is vulnerable to a takeover.

Tyro (ASX: TYR) reported a solid financial performance with 10.6% year-on-year growth and 4.5% gross profit increase to $220.1 million. The company is experiencing positive momentum across several key areas: banking, payments, and new verticals. Their banking platform saw a 43% increase in active accounts, with a new platform launched. The payments business showed a 5.3% growth, and the health segment continues to perform strongly with 15% TTV growth and higher margins.

The company is optimistic about future growth, targeting 4.5-9% gross profit growth in FY26 and improved EBITDA efficiency. They're focusing on strategic areas like pet insurance, automotive, and health payments, leveraging their unique market positioning. The macro environment is showing signs of improvement, and the company believes they're at an inflection point with potential to reach the top end of their guidance.

During the month the company announced several takeover approaches have been received. We believe it is highly likely the company will be acquired. Just like our investment in Smartpay (SMP) and the eventual takeover, we believe TYR is the most strategic acquiring business in Australia. Any takeover bid could see a bidding war emerge.

Apiam Animal Health (ASX: AHX) has announced its FY25 results and strategic updates. Highlights include:

-

- Revenue increased by 1.4% to $207.6 million

- EBITDA grew by 5.2% to $25.8 million

- NPAT decreased by 83.1% to $0.8 million

- Final FY25 dividend of 1.0 cent per share

- New Interim Managing Director, Bruce Dixon, appointed on 5 June 2025

- Strategic Reset Program initiated to improve operations and shareholder returns

- Divestment of underperforming businesses, including a $4.5 million impairment loss

During the month the company received a Non-binding indicative proposal from Adamantem Capital to acquire Apiam at $0.88 per share and entered a process deed and exclusive Due Diligence. The bid values AHX at 10x EBITDA. Greencross is highly likely. We began buying AHX at 28 cents almost 2 years ago and more recently at 45-50 cents.

Pioneer Credit (ASX: PNC) has released its FY25 results. Highlights include:

-

- Net Profit after Taxation: $10.5 million, beating guidance by 17%

- Cash collections: $142.2 million (FY24: $140.5 million)

- EBITDA: $94.0 million (FY24: $88.7 million)

- PDP assets increased by $20 million Net assets up 37% to $60.6 million

- $34.3 million undrawn facilities avalable

- Preferred partner of the big four banks in Australia with Westpac beginning to sell PDPs to PNC.

- FY26 guidance includes a Statutory Net Profit after Taxation target of >$18 million for LTI vesting

Trading on 7x PE for FY26 and expectation of a potential dividend thru the year, we expect the stock to continue re rating to fair value of 80 cents.

Edu Holdings (ASX: EDU) is an education provider focusing on healthcare, education, and community services through two businesses: Australian Learning Group (ALG) and Ikon Institute. The company primarily serves international students with a strong pathway to employment and potential permanent residency.

In the first half of the year, EDU experienced significant growth, with revenue increasing 114% to $36 million and achieving a net profit of $6.3 million, compared to breaking even in the previous period. The higher education segment (Ikon) is the primary growth driver, with 5,300 total students, 4,800 being international.

Despite regulatory uncertainties around international student caps, the company remains optimistic about market conditions. Growth strategies include expanding course offerings, developing new programs in technology fields, and potentially pursuing acquisitions in the higher education sector.

EDU introduced its first dividend of 1 cent per share and sees continued potential in organic and inorganic expansion. Directors continue to buy shares on market and the buyback has been activated. We estimate for every $1 of revenue growth in FY26, at least 30% will drop to the NPAT bottom line.

ClearView Wealth (ASX: CVW) has long been a quiet achiever in the life insurance space. A modest market cap ($360 million), a reasonable share of the retail life market (~3.9%), and a history of being lumped in with other legacy life insurance businesses. But here’s the thing: ClearView is no longer a legacy business.

FY25 marked the company’s complete exit from wealth management and the successful rollout of its new cloud-based insurance platform. That’s a big deal. It signals a new phase for ClearView, one defined not by restructuring, but by scaling.

While many insurers continue to wrestle with ancient systems and slow customer onboarding, ClearView is now a digitally native player. Faster quote times, lower servicing costs, and customisable product design. That’s a material advantage in a world where insurance needs are becoming more personalised and where margin pressure is real.

Despite a tough start to the year, ClearView’s second-half results were surprisingly strong, delivering:

-

- $22.5 million in 2H25 life insurance underlying NPAT (up 12% YoY)

- In-force premiums up 10% to $412.9 million

- ClearChoice product premiums at $112 million since launch

- Embedded value up 5% to $524.4 million (82c per share ex-franking)

- Operating leverage across all major lines

Yes, full-year NPAT was down 5% to $37.7 million, but that only tells half the story. The real shift is operational: customer acquisition costs have stabilised, lapse rates have improved, and claims experience has returned to more predictable patterns. This is the kind of platform a business can grow from. In many ways, FY25 was about turning the ship. FY26 is where we expect it to pick up speed.

Now let’s talk capital management, a topic close to every value investor’s heart.

ClearView has already repurchased 11.4 million shares on-market as part of its FY25 buyback program. That’s about 4.5% of issued capital. The company has flagged its intention to continue, with a potential $20 million buyback capacity in the next 12 months.

Why is this important?

Because in a stock trading on a forward P/E of 7.8x FY26 EPS guidance, buying back shares is an accretive use of capital, particularly when the underlying NPAT is expected to rise 40%. It also suggests that the board sees the shares as materially undervalued.

We estimate the stock is trading at a large discount to embedded value, with no credit given for digital transformation, potential dividends in FY26, or optionality around strategic buyers.

ClearView’s FY26 guidance is, we believe, impressive:

-

- Gross premium income: $435–$440 million

- Life insurance underlying impact: $47–$52 million

- Group underlying NPAT: $42–$47 million

- EPS: 6.8–7.3 cents (implied P/E of ~7.8x at current price)

In our view, this guidance is both credible and conservative.

Why?

- Embedded value supports the earnings base, with higher lapse rates normalising and claims well within long-term expectations.

- ClearChoice is gaining traction, providing better cross-sell opportunities and a fresher brand in adviser channels.

- Digital systems reduce cost-to-serve, helping margins expand even without top-line blowouts.

And crucially: the business is no longer distracted by non-core operations.

Let’s dig deeper into the tech angle. This isn’t just window dressing. ClearView has spent the better part of two years replatforming its core insurance operations to the cloud and now that’s complete.

Benefits include:

-

- Faster policy issuance and servicing

- Lower unit costs on a per-policy basis

- Simpler product innovation cycles

- Real-time data tracking across claims and underwriting

This enables ClearView to compete with insurtechs on speed and digital delivery, while still offering the scale and trust of a licensed life insurer. For financial advisers and brokers, that’s an attractive combo, particularly as regulatory scrutiny intensifies.

In many ways, the company now looks like a platform-enabled compounder. That’s not something you could say even 18 months ago.

One of the more subtle features we look for in a business is “founder mentality” even when the founder isn’t in the building.

ClearView has long been run by a pragmatic, capital-disciplined management team. FY25 only reinforced that image. Rather than chasing growth at any cost, they opted for:

-

- Operational simplicity

- Scalable systems

- Shareholder return via buybacks

- Clear guidance and delivery

These are the hallmarks of a management team that acts like owners. As small cap investors, we’re always hunting for this mindset particularly in financial services, where discipline can slip.

We’ve said it before, and we’ll say it again: ClearView remains a takeover target.

Why?

-

- Clean balance sheet (net cash)

- Fully migrated digital systems

- Scalable retail life platform

- Trading at EV/EBITDA levels that private equity would typically salivate over

We also note that 80% of Australia’s life market is controlled by a handful of large players, many of whom struggle with legacy infrastructure. Acquiring ClearView would instantly plug a modern retail life engine into a broader financial services machine.

Add in potential offshore interest (particularly from Asia) and the story becomes compelling. We’re happy holding for the earnings growth alone — but optionality is there.

Of course, no investment is without risk. With ClearView, the primary ones are:

- Claims volatility, as always, one-off spikes can impact quarterly earnings.

- Tech migration challenges, although largely complete, any post-migration bugs could cause adviser friction.

- Distribution risks, heavy reliance on IFA channels could be impacted by regulatory changes or sentiment shifts.

- Investor perception, many still treat CVW as a “legacy insurer” and haven’t re-rated the digital potential yet.

That said, we believe the risks are increasingly asymmetric, tilted in favour of upside surprises in margins, earnings, and capital returns.

At the current share price (~56 cents), ClearView trades on:

-

- 7.8x FY26 P/E

- EV/EBITDA ~6x

- Price to embedded value ~0.7x (ex franking)

For a digitally modern, cashflow-generative, buyback-running insurer with 40% forecast earnings growth, this is cheap.

In fact, it’s hard to find peers with:

-

- Cloud-based platforms already live

- Strong guidance and historical delivery

- Buyback in place

- High gross margins and low debt

Our internal valuation model suggests a target range of 80–90 cents, excluding any optionality from a potential take-over.

ClearView Wealth is no longer the clunky, underperforming life insurer of old. It has evolved into a digitally enabled, capital-efficient platform business with buyback support, earnings momentum, and the optionality of strategic interest. We believe CVW is at an inflection point. With earnings guidance of up to $52 million, a lean balance sheet, and a shareholder-friendly capital allocation approach, we see material upside from here. In a market starved of quality, low multiple growth — ClearView might just live up to its name.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Reference Index: | ASX 300 |

| Number of Securities: | 20-50 |

| Single Security Limit: | 10% (typically 5%) |

| Investable Universe: | ASX (focus on ASX300 ex20) |

| Market Capitalisation: | Any |

| Leverage: | No |

| Portfolio Turnover: | < 25% p.a. |

| Cash Level: | 0% - 100% (typically 5 - 30%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of RBA Cash Rate + 2.5% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3 - 5 years + |

| Distributions: | Annual |