Finding unique opportunities in Japan is a thematic we have been enthusiastic about consistently over the years. Japanese balance sheets have historically been less than optimal, with many companies holding excessive cash reserves instead of returning capital to shareholders. However, we anticipate a shift in this trend, making the market increasingly attractive.  Japan’s reputation for high-quality hardware production is evolving as companies invest more in digital transformation and artificial intelligence (AI). Despite its lag in software development, Japan is now embracing the digital economy, spurred by government incentives and a strategic pivot towards balanced growth in hardware and software. This change, coupled with favourable valuations and a stable economic environment, underscores the significant investment potential within the Japanese market.

Japan’s reputation for high-quality hardware production is evolving as companies invest more in digital transformation and artificial intelligence (AI). Despite its lag in software development, Japan is now embracing the digital economy, spurred by government incentives and a strategic pivot towards balanced growth in hardware and software. This change, coupled with favourable valuations and a stable economic environment, underscores the significant investment potential within the Japanese market.

Japan and the Digital Economy

Japan has long been renowned for its exceptional production of high-quality hardware, establishing itself as a global leader in sectors such as consumer electronics, automotive manufacturing, and precision machinery. Household names like Sony Group Corporation (TYO: 6758), renowned for its cutting-edge electronics and entertainment systems; Toyota Motor Corporation (TYO: 7203), a pioneer in automotive innovation and hybrid technology; and Canon Inc (TYO: 7751), a leader in imaging and optical products, epitomise Japan’s engineering prowess. This expertise in hardware has been underpinned by a meticulous approach to engineering and a culture of relentless pursuit of perfection. However, despite these strengths, Japan’s digital economy has struggled with the integration and development of quality software. This lag is partly due to historical focus and investments predominantly channelled towards hardware innovation, coupled with a conservative corporate culture that has been slower to embrace agile software development methodologies and disruptive technologies. There are signs that this dynamic is beginning to shift, presenting new investment opportunities. With increasing recognition of the importance of software in driving future growth, Japanese companies are now investing more heavily in digital transformation initiatives and software development. The government is also actively promoting the digitisation of industries through policies and incentives designed to spur innovation. This pivot towards a more balanced emphasis on both hardware and software is expected to yield significant advancements in the digital economy.

The Japanese Market

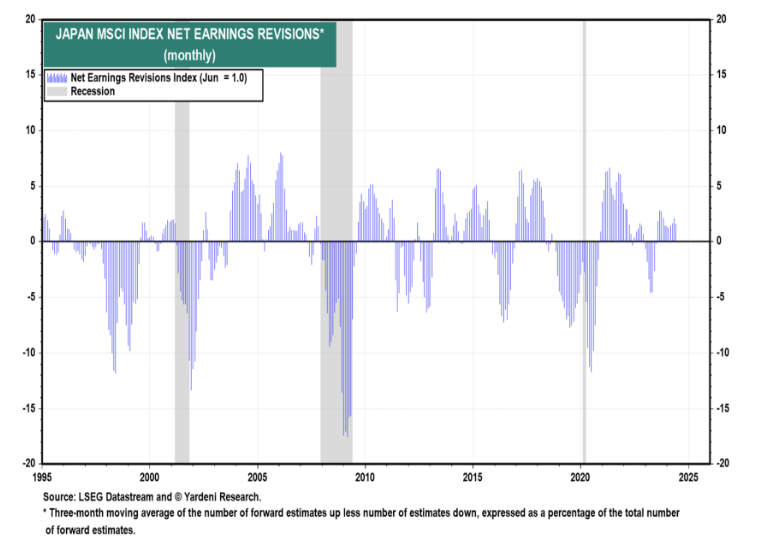

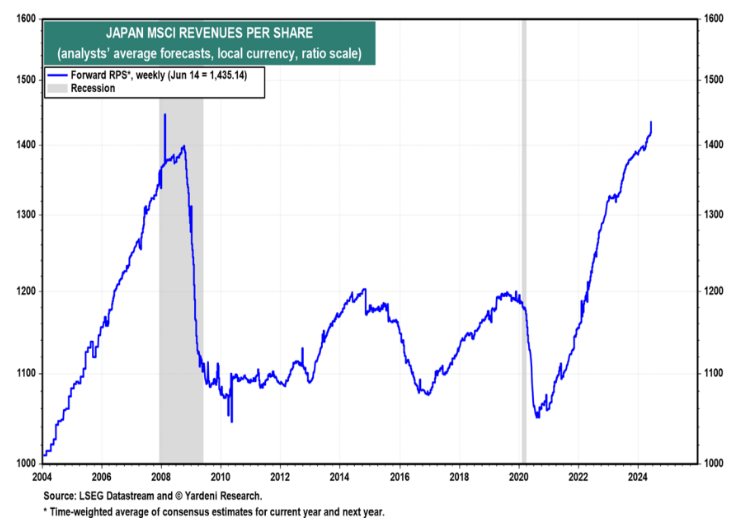

In our view the Japanese share market generally remains attractive. Valuations in Japan appear cheaper when compared to the United States, with lower price-to-earnings ratios signalling a potential for value investment. Business conditions are favourable, buoyed by strong industrial output and a stable economic environment. Furthermore, corporate earnings revisions in Japan have generally been on an upward trajectory, reflecting improving profitability and operational efficiencies among Japanese company’s.

The Opportunity

As a result of the recent pull back, the TAMIM Global High Conviction team has revisited a number of Japanese businesses. One of these investments is Advantest Corporation (TSE:6857). Advantest stands out as an attractive investment opportunity within Japan, particularly for those seeking exposure to the “picks and shovels” play in the burgeoning fields of AI and semiconductors. Advantest has established itself as a global leader in semiconductor and component test systems, manufacturing automatic test and measurement equipment used in the design and production of semiconductors for applications including 5G communications, the Internet of Things (IoT), autonomous vehicles, high-performance computing (HPC), including AI and machine learning, and more. The company’s comprehensive product portfolio includes SoC test systems, memory test systems, and system-level test solutions, which are critical for the development and production of advanced semiconductor devices. Advantest’s strategic positioning in the semiconductor industry is further bolstered by its commitment to innovation and technological advancement. The recent launch of the DC Scale XHC32 power supply, designed to meet the rising power requirements for AI and HPC devices, exemplifies its forward-thinking approach. Additionally, the company’s global footprint, with operations across the Americas, Asia, and Europe, ensures a broad market reach and diversified revenue streams Over the long term Advantest has performed very well with a strong return for shareholders. The recent share price pullback is one we see as an opportunity to capitalise upon.

The TAMIM Takeaway

We continue to believe that the Japanese market offers a unique and compelling investment. As the country continues to bridge the gap in its digital economy, the integration of superior software capabilities with its world-class hardware production could unlock significant growth potential, making it a market to watch closely for both traditional and software-focused investments. We continue to believe that now is an opportune time to consider investing in Japan, leveraging the anticipated corporate reforms and technological advancements that promise to drive long-term profitability and growth. ____________________________________________________________________________________________________________________________ Disclaimer: Canon Inc (TYO: 7751) and Advantest Corporation (TSE: 6857) are currently held in TAMIM Portfolios.