Global Equities

Global High Conviction

Investor Updates

Below you will find this month’s commentary and portfolio update for the Global High Conviction unit class of the TAMIM Fund.

May 2024 | Investor Update

Dear Investor,

The TAMIM Global High Conviction unit class was up 1.42%% for the month of May 2024, this was in comparison to the index return of 2.00%. The strategy has generated areturn of 23.15% over the past 12 months.

June 2024 – Onwards and Upwards?

Equity markets were very healthy in May, nearly doubling the year-to-date returns in many cases. European equity markets managed to edge out the US. Europe benefitted from greater investors’ convictions that the ECB would be one of the first major central banks to cut interest rates. The good US equity market return was helped by the strong performance of tech stocks.

Asian equity markets were mixed in May, not helped by some stuttering in the performance of Japanese equities. This is not surprising after such a strong 12 month performance. We had trimmed slightly a few weeks back by selling Zozo and Itochu. We reinvested in Swire Group in Hong Kong, Tenet Healthcare, and Ebay in the USA for the global strategies. The Japanese economy showed some signs of slowing, and the Yen remained under downward pressure. China’s equity market also went quiet, consolidating after some strong gains in previous months.

| -1mth | -3mths | YTD | |

| US | 4.7% | 3.5% | 10.7% |

| NASDAQ | 6.9% | 4.0% | 11.5% |

| Europe ex UK | 5.2% | 5.7% | 8.1% |

| Japan | 1.3% | -0.7% | 7.0% |

| UK | 1.9% | 9.5% | 9.0% |

| Switzerland | 6.6% | 4.9% | 7.7% |

| Asia ex Japan | 1.6% | 5.4% | 5.3% |

| India | 0.7% | 3.9% | 9.3% |

| China | -0.6% | 2.4% | 3.8% |

| Brazil | -5.0% | -10.5% | -15.6% |

| Emerging markets | 0.6% | 3.5% | 3.4% |

| Global | 4.5% | 3.8% | 9.5% |

Source: Bloomberg, *MSCI

Equity sector performance

After last month’s profit taking, the tech sector had another good performance in May. Nvidia reported another excellent quarter’s performance, leading to a further sharp rise in share price. The energy sector went into reverse as the oil price slipped back, unwinding a quarter of recent gains. Consumer discretionary stocks are hurting, with consumers cutting back on large purchases due to the damage to their spending power from inflation.

Global equity sector returns for May in US$

|

Global Sectors |

-1mth |

-3mths |

-12mths |

|

Energy |

0.3% |

9.8% |

10.4% |

|

IT |

8.6% |

4.2% |

15.0% |

|

Consumer Staples |

2.8% |

4.0% |

5.0% |

|

Consumer Discretionary |

0.4% |

-3.7% |

2.0% |

|

Healthcare |

2.7% |

0.9% |

6.0% |

|

Banks |

5.5% |

11.7% |

15.6% |

Source: Bloomberg

We surmised a couple of months ago that the equity markets would just keep chugging along, and it would be best to stay invested.

Base effects on annual growth rates, inflation and earnings would start to turn positive, meaning that they will be moving in the right direction at least for a little while. Annual historic growth up, inflation down!

The one area that provides us with real concern is the real estate market especially the office market where large debts, falling rents and overbuilding have created the ingredients for severe markdowns. This is beginning to happen. We quote from a broker update – “Buyers of the AAA portion of a $308 million note backed by the mortgage on a building in midtown Manhattan got back less than three-quarters of their original investment after the loan was sold at a steep discount. It’s the first such loss of the post-crisis era, says Barclays. As for the five groups of lower ranking creditors? They got wiped out. Market watchers say the fact the pain is reaching all the way up to top-ranked holders, overwhelming safeguards put in place to ensure their full repayment, is a testament to how deeply distressed pockets of the US commercial real estate market have become.”

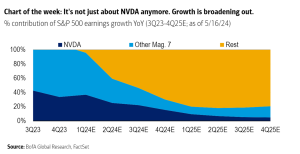

Countering this concern is a welcome broadening of the USA market. It was never healthy for 1 or even 5 or 7 stocks to be responsible for all the earnings growth and index performance and the chart below gives us encouragement that the other thousands of stocks are going to receive more attention from investors.

May saw some significant moves in holdings with International Paper +28%, Qualcomm + 23%, Teradyne, + 21%. Detractors were CVS -12%, Ebara -12% and Kajima -12%.

Sincerely yours,

Robert Swift and the TAMIM Team

Fund Performance

Portfolio Highlights

International Paper (NYSE.IP)

International Paper is a global packaging and pulp producer. The business designs and manufactures packaging used to facilitate the delivery of food, e-commerce, retail and personal care products. The business also produces raw materials used in various end goods such as diapers, paints and textiles. The International Paper share price has rallied strongly in recent weeks after the business announced the acquisition of London-based peer DS Smith. International Paper will issue shares to fund the transaction with existing shareholders owning two-thirds of the combined business and DS Smith shareholders holding one-third. The deal will add 235 mills and packaging plants and act as a springboard for International Paper to expand its European footprint. Management expects the business to be earnings per share accretive after one year and will exceed the cost of capital after year three. Beyond the numbers, the acquisition will bolster International Paper’s range of sustainable products. DS Smith has developed water and grease-free paper solutions to replace plastic food waste, recyclable shrink wrap and temperature-controlled corrugated packaging for grocery delivery. We like International Paper because it’s a company that meets “needs not wants”. Global packaging demand will continue to increase steadily over time and the company’s industrial base is seldom replicable by competitors or new entrants. Moreover, the business is making tangible strides towards reducing its carbon footprint and will be a key enabler in reducing landfill waste.

Teradyne (NASDAQ.TER)

Teradyne is a global leader in automated testing equipment and robotics. The testing divisions build systems used to test semiconductors, electronic systems, data storage and wireless products. Testing is a critical part of the production process and is conducted several times to ensure yields, safety and reliability. The robotics division produces arms and mobile robots that are used in manufacturing and logistics to improve efficiency and decrease production costs. Teradyne is placed at the intersection of two structural tailwinds: the bifurcation in critical supply chains and the need to improve global productivity. Nations are legislating domestic expertise and production of strategic technologies such as semiconductors and robotics. In the United States alone over US$2 trillion has been earmarked by the government to encourage companies to reshore their operations. Concurrently, sluggish productivity in the developed world means governments and corporations need to find new ways to generate returns and profits. Enter robotics, which is a viable solution for repetitive and high-precision tasks. Admittedly, the semiconductor industry is going through a cyclical lull due to tepid end-market demand and export restrictions on key technology. However, these headwinds will abate with time as smaller chips and artificial intelligence underpin the next wave of demand. Management forecast sales to increase 58% and earnings to more than double at the midpoint of 2026 guidance. We are confident shareholders will be the primary benefit of this growth given 87% of capital has been returned via buybacks or dividends since 2015.

Best Buy (NYSE.BBY)

Best Buy is the largest electronics retailer in North America. The company’s buying power enables it to offer a wide range of appliances, gaming, laptops and other electronics at competitive prices. Moreover, the company’s membership program encourages customer loyalty and repeat purchases through express shipping, exclusive prices and extended returns. During the month Best Buy reported its first-quarter results. Despite a 6.1% fall in comparable sales, earnings marginally increased for the first quarter owing to higher-margin membership services and lower store costs. Chief executive Corie Barry noted a challenging sales environment for electronics as households limit discretionary spending. High inflation, rising mortgage rates and low consumer confidence are expected to remain a headwind for the foreseeable future. While the weak economic backdrop is not ideal, Best Buy is well-positioned to capitalise. The business has a net cash balance sheet and a favourable inventory position to further entrench its domestic market share and support international expansion. Best Buy reconfirmed full-year earnings per share guidance of US$5.75 to US$6.20. Before the result, the share price traded below 12 times earnings and a ~5% yield. The share price has since rallied over 20% to close the valuation gap.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Global Equities |

| Number of securities: | 80-110 |

| Single security limit: | +/- 5% relative to Investable Universe |

| Country/Sector limit: | +/- 10% relative to Investable Universe |

| Market capitalisation: | US$2+bn |

| Derivatives: | No |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-10%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust available to wholesale or sophisticated investors |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.00% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Fee Cap: | 2% of total FUM |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3-5+ years |

| Distributions: | Annual |

Invest via TAMIM Fund

Request additional details by using the form or if your ready to invest select the apply now button.

Invest via IMA

The TAMIM Global High Conviction strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.