Robert Swift & Roger McIntosh

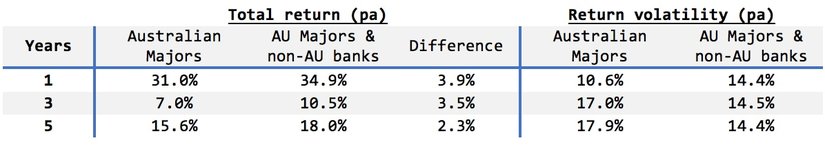

For Australian investors, the banking sector, particularly the four major banks, form a significant part of their investment strategy and exposure to Australian economic activity. However, only investing in Australian banks even with the franked dividend income, is definitely a suboptimal approach to investing.

Let’s compare Australian banks with global competitors in terms of valuation, capital sufficiency, and business positioning or resilience.

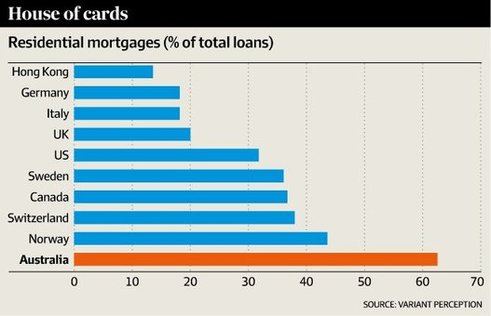

Australian banks have high dividend yields and low variability of EPS growth compared to global competitors. This would usually make them attractive. Although we like dividends as proof of cash flow, it appears to us that Australian banks are overdistributing earnings as dividends, and not sufficiently acknowledging the risk in their loan books. In other words, their EPS resilience is somewhat masked by ‘highly managed’ bad debt recognition.

In terms of capital sufficiency, the Australian banks are average. It appears to be a form of financial arbitrage to us that the Australian banks pay out franked dividends and then raise capital in the markets to meet regulatory capital ratios. If management wanted to avoid this ‘distribute capital and then raise capital’ merry go round they would cut the ordinary dividends and wouldn’t need to raise capital since the capital buffers would be built by retained earnings. However, there would be an outcry from investors desperate for dividend income. When companies are hooked on dividend amounts which they shouldn’t be paying, it strikes us as risky.

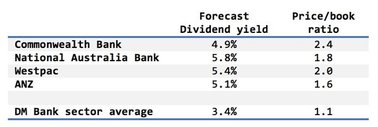

Price/book ratios may be a better guide to valuation given the latitude which all banks have in their EPS reports? In the table below we show the Australian banks look expensive on this measure compared to other developed market banks.

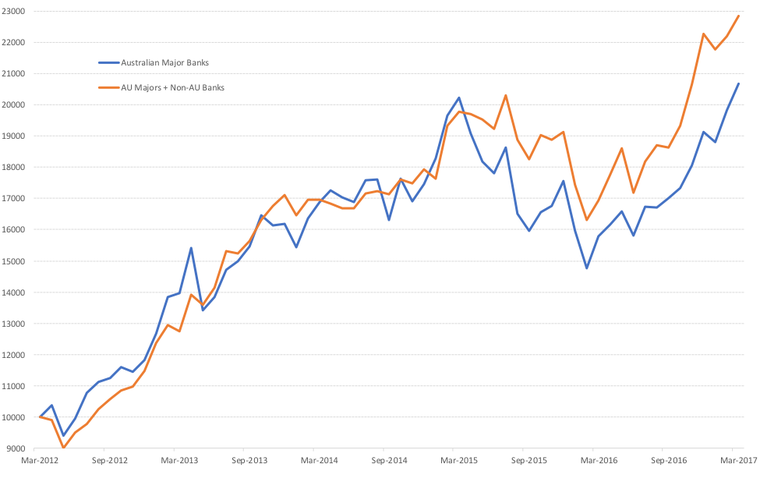

Australian banks tend to copy and follow each other’s business strategies and this is clearly shown in the very high correlation of the bank’s total returns with each, not offering investors a reasonable level of asset diversification. They rushed into expensive wealth management platforms and ‘fund management’ (multi-manager offerings) and all now appear to be exiting simultaneously? They all rushed into mortgage lending in NSW, Victoria and Queensland and are now being told by APRA, their regulator, to ‘cool it’. Further, to increased limits around mortgage lending, the regulator has now indicated they are reviewing further changes to the risk weightings the banks use (for details on this, please see The Lazy Dog blog post). None have cracked Asia; none have cracked investment banking as have the USA majors.

You can see the result of this ‘tack and cover’ strategy in the table below. This compares the price behaviour of the Australian banks to each other where a figure near 1 means they are al the same and a figure of -1 means they are all different.

Correlation figures of 0.8 or higher show very close similarity in asset returns. Investing in Australian banks is essentially investing in one big bank. This is not ideal for your portfolio.