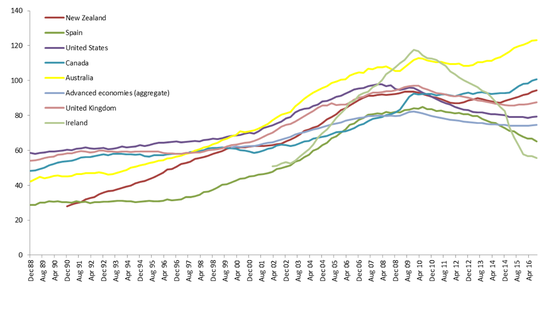

When one reads this paper and looks at the current economic environment in Australia, it is hard not to get nervous. Recently, the retail sector has seen a significant selloff and whilst many observers point the finger squarely at Amazon, we believe there might be more at play. As a case in point, the recent downgrades from the two largest car retailers in Australia (AP Eagers and Automotive Holdings Group) tell an interesting story. As far as I’m aware Amazon does not sell cars and yet sales on a national level are falling. What is causing this? Well, Australia has the second most indebted consumer in the world behind only Switzerland with respect to Household debt to GDP (chart below). The rise in household debt in this country has pushed the level above what was seen in places like Ireland and Spain prior to the Global Financial Crisis. Recent out of cycle interest rate hikes from the banks combined with record low wage growth has put significant pressure on this highly leveraged position.

High debt levels mean the consumer is highly sensitive to small changes like we have recently seen. As a consequence we have seen a fall in car sales on a national basis led by falls in Western Australia and Queensland. AP Eagers indicated that sales were impacted by a 5.9% fall in Queensland whilst Automotive Holdings stated that a 3% fall on the east coast had “reduced the capacity of east coast earnings to provide cover for WA”.

In addition to falling car sales we had construction data out for the first quarter of 2017 and we had the first signs of the residential construction boom slowing. The fall in residential construction for the quarter was 4.7% and was the largest such fall in over 15 years. The fall was driven by a 14% fall in Queensland and whilst this was potentially cyclone impacted, the increasingly oversupplied Brisbane apartment market appears to be having an impact. This fall in residential construction combined with sharply falling car sales ticks both of Leemer’s boxes and suggests Queensland may well be joining Western Australia in a recession.

Whilst problems are evident in Queensland and WA, it is probably too early to have the same concerns for NSW and Victoria but the overall economic outlook is slowing. So with that in mind how should one position portfolios? Well, for starters are a long list of companies and sectors to avoid. The three stand out to us as most vulnerable are:

- Anything consumer orientated. With record high household debt and record low wage growth, retail activity will remain subdued at best. Companies in this category include the likes of JB HIFI, Harvey Norman, Nick Scali and the above named car retailers.

- Anything finance related. High household debt makes consumers more vulnerable to both a slowing economy and interest rate changes. Whilst we do not expect the RBA to raise rates we note that increasing regulation and offshore funding markets could lead to further out of cycle hikes. Companies that are vulnerable here include Credit Corp, Pioneer Credit, Money 3, Flexigroup as well as the banks.

- Companies tied to residential construction. Ultimately residential construction will fall; it has fallen in WA and is starting to fall in Queensland. Companies exposed here include Adelaide Brighton, Mirvac, Leadlease and Finbar.

The question becomes where to hide. If we do have a recession, very few stocks will do well. In order to avoid cyclical weakness it is important to look for industries that are going through structural change. The three most obvious examples to us are:

- The technology sector. Technology is enabling companies and individuals to become more productive, to do more with less. Australia is home to a number of software companies that are world leading in particular niches. Examples of this include Altium, Gentrack, Hansen Technologies and Integrated Research. As these companies are global players they will benefit as well from a falling Australian dollar.

- Healthcare. Ageing populations globally leads to natural demand growth and thankfully Australia is home to a number of world leading companies such as CSL, ResMed, Ramsey and Cochlear. Again, these companies would all benefit from a falling Australian dollar.

- Truly counter cyclical companies. An example of which would be shareholder litigation companies such as IMF Bentham. In times of stress, fraud and misleading statements tend to be exposed.

The current consumer strike is sounding warning bells to us. The economies in Western Australia and Queensland appear to be in or heading for recession, it’s only NSW and Victoria (or more accurately Sydney and Melbourne) that are holding the economy up. Whilst we have no perfect insight in the future, we believe that now is the time to be selective with your investments.

DISCLAIMER: Guy’s portfolio currently includes the following stocks mentioned above: Altium (ALU.ASX), Gentrack (GTK.ASX), Hansen Technologies (HSN.ASX), Integrated Research (IRI.ASX), CSL (CSL.ASX), ResMed (RMD.ASX), IMF Bentham (IMF.ASX).