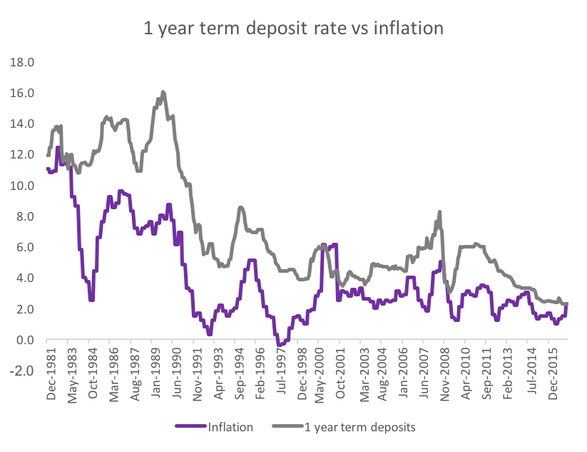

The chart below shows the real rate rates of return on term deposits since December 1981.

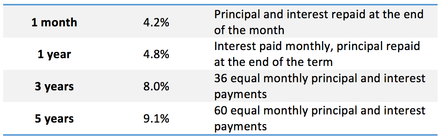

But fortunately, there has never been more choice for Australian’s looking for a better fixed income return. With a moderate increase in risk investors can earn significantly greater returns. The banks have been doing this for years it is high time that retail investors get a chance to invest in similar assets. The chart below shows the rates that banks have charging on various types of loans since 1981.

A few things stand out. Mortgages and small business loan rates have been coming down since April 1995 and we all know why. Disruptors such as Aussie Home Loans and RAMS forced the banks to start pricing fairly.

But, personal loans are basically at the same place as they were 20 years ago. This is during a period when default rates have been low and the economy has been strong.

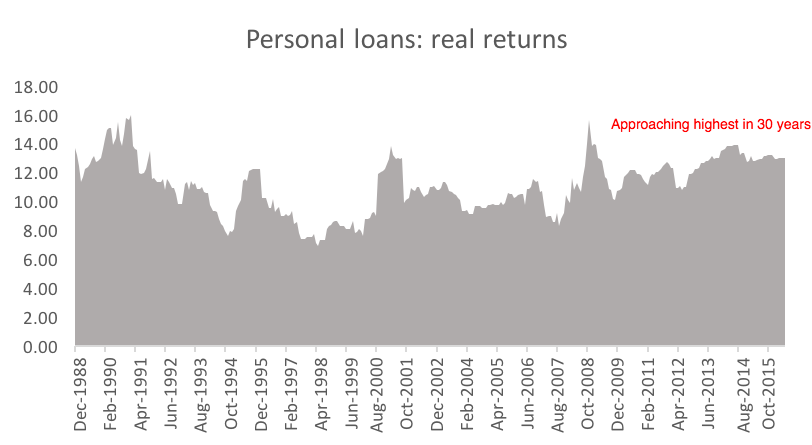

But the story is more interesting when we look at real returns to the banks on personal loans.

Real rates have actually gone up over the last 20 years. This is in the context of a generally stronger economic conditions and low default rates.

So let’s draw all this together. Term deposits are at historically low returns. More importantly, real returns on term deposits have come down consistently for the last 20 years, in some cases hardly keeping pace with inflation.

In contrast, the real return on personal loans has been increasing giving the banks exceptional returns for the risk.

Peer-to-peer lending

Until recently, access to the personal loan asset class was limited to banks and credit unions. Peer-to-peer lending gives retail investors the opportunity, for the first time to access this asset class.

In the USA and the UK, peer-to-peer lending has become very mainstream with over $20 billion dollars lent in 2016.

In a nutshell, peer-to-peer lenders match people looking to borrow money with people who have money to lend. Most peer-to-peer lenders have chosen to focus consumer credit and small business loans. Small loans like this allow greater diversification and lenders benefit from substantial data available to the peer-to-peer platforms which allow them to make informed credit decisions.

Leading peer-to-peer lenders, like RateSetter and Society One, target the top tiers of creditworthy borrowers. They compete against the banks (not payday lenders) for borrowers. Rates offered to borrowers are often lower than what that borrower would pay to a bank as peer-to-peer platforms operate more efferently than banks and pass on costs savings to borrowers and lenders.

There are two peer-to-peer models that have developed, one from the USA and the other from the UK.