An update from our asset allocation models.

One of the most important decisions is how to allocate your money across different asset classes – property, bonds, equities, or cash. This is because a combination of these assets will be less volatile than simply holding equities, and the returns, although lower, will be safer and reduce the chances of a nasty surprise to your pension pot.

Summer in the Northern hemisphere often brings with it dull markets – the “sell in May and go away” expression is routinely trotted out for a good reason! Fewer investors at work, fewer company announcements and a long break for politicians, makes for a lack of news flow.

In the absence of news, markets tend to drift lower. Will it be the same this year?

We first wrote on asset allocation four months ago and thought it was time to revisit the landscape using our asset allocation models.

Our conclusions then were:

Equities – overweight especially Value

Bonds – underweight especially net debtor countries such as Australia, Turkey, Spain

Property – residential is overpriced and liable to be taxed by governments keen to spend more of your money. Be careful of yield hunting.

How did we do?

We did ok and you would have made money following the recommendation.

Most European equity markets have drifted a little over the last month, after a strong few months, but the US has continued upwards, as has Japan and a number of Emerging markets like China. We have held a strong Value bias in equities for a few months now and have been wrong in this regard.

Growth styles, and the ‘sexy six’ have performed exceptionally well. We aren’t changing our view on this and still recommend a Value tilt in an overweight equities position.

Our Tactical Asset Allocation model continues to like equities overall, and still prefers them to Bonds.

Other asset classes to consider currently are:

Overweight Equities

- Prefer Value style, with dividends and high free cashflow yield

- Prefer Financials, Cheap Tech, Telecoms

Underweight Advanced Economy Government bonds.

Equal weight Emerging Market bonds (China, Asian & Middle East issuers) but avoid South Africa & Brazil

Underweight commodities especially oil

Underweight residential property (including Australian banks). Prefer industrial and retail in Asia

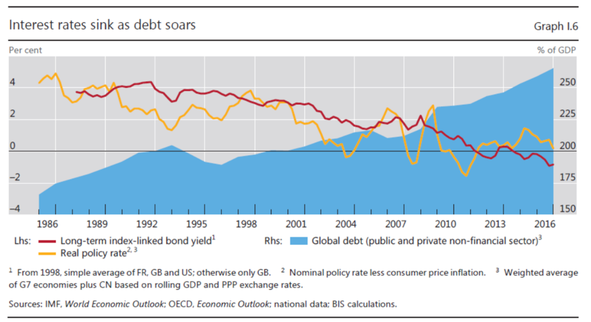

Given the inexorable rise in debt (see the chart above) over the last decade, and the decline in interest payable on it, as a consequence of central bank intervention in fixed income markets, the question you have to ask yourself with bonds is: – “Why should I lend money to governments at 2-3% when there is so much debt already outstanding?”

We wouldn’t! We might at 6%.

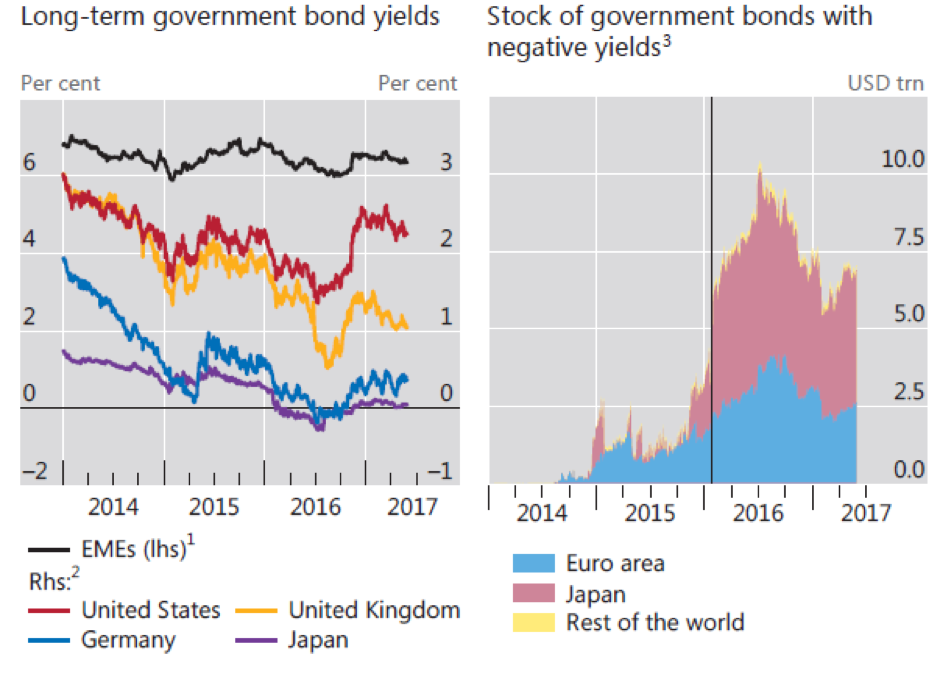

Looking at the charts below it appears to us that the only value in bond markets is to be found in certain emerging market bonds. These are bonds issued by net creditor emerging market countries and they still offer returns of 5-6% (LH Scale on left chart) which is a reasonable return. Avoid bonds with negative yields and those issued by governments which are heavily indebted already. (Right Hand chart)

Inflation hurts bonds more than equities where companies can, usually, pass on cost price increases and whose asset values rise in line with inflation.

Near term risks and what to watch

Purchasing Managers Indices – widely followed data as an indication of near term economic activity – have recently showed slowing activity. If this continues over the Summer this may see medium and long term interest rates move down and bond prices move up.

After a good first half of the year we may well see some pause or setback in equities, but they continue to be the preferred major asset class for now, given that we are currently in a broad synchronised global upswing in global economic activity.

Within equities, across the regions we continue to prefer Europe which is exhibiting its best growth since the financial crisis in 2008. Emerging markets are also now looking attractive both in terms of valuation and price action. The USA is the market where we continue to struggle to find value in stocks. The rally there has been very narrow there in the top hot tech stocks – Apple, Facebook, Google, Amazon – when you strip those out – the US market advance has not been widespread.

From the chart above you can see that Value stock returns have fallen relative to Growth stocks.

Value stocks have been disappointing for sure this year but we continue to believe that the focus on just a few big stocks in major indices has been excessive. Meanwhile some very good companies such as Daimler, Glaxo SmithKline, China Mobile, Legal & General, JP Morgan, Itochu are on modest PE ratings and with dividend yields in excess of 4%, will find favour.

The market may be a voting machine in the short run, but it’s a weighing machine in the long run. Now is the time to favour companies paying sustainable dividends, with asset backing. Now is the time to ensure your portfolio is set to take advantage of these coming market changes!