|

Why SaaS Business Models Are Attractive

|

Author: Adam Wolf

|

Key Financial Metrics | K2F

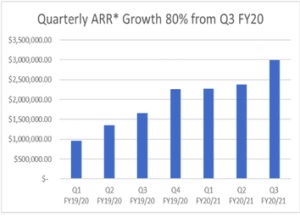

K2F’s annual recurring revenue sits at just under $3m with their total contract value over $9m. After the completion of a $7.25m placement in April, K2F now has $8.75m cash plus $1.5m in receivables with no debt. Their market cap is currently sitting just north of $42m.

ESG As A Thematic

The shift to ESG practices has become a thematic the world over. We now see a greater emphasis on companies having a plan for sustainability as well as taking responsibility for their societal impacts. As a result, we have seen institutional investors allocate more money towards companies that are more sustainable and have better ESG credentials. On the flip side, this drains capital from companies that are perceived to have poor sustainability and negative impacts on the environment such as oil and coal producers. K2F offers investors an opportunity to benefit from the rise of ESG investing.

Recently we saw RIO Tinto blow up a 45,000 year old indigenous cave system which led to the firing of the CEO and a few other key executives. Losing their jobs due to ethical wrong doings is front of mind for many C-suite mining executives around the world and there is increasing pressure from stakeholders in mining companies to engage with their surrounding communities, disclose mineral resource information and to minimise their impact on the environment. K2Fly is looking to address and capitalise on these issues.

(As a side note, RIO recently entered into an agreement with K2F worth $720,000 to integrate K2Fly’s community and heritage software).

Over the past few years K2F has a built a well-rounded arsenal of ESG software solutions for mining companies to:

- Accurately report their mineral resources in compliance with their respective exchanges

- Enable geology teams to streamline and automate pit block outs, spatial data, logging, sampling, and assay results to better understand material grade and behaviour

- Help improve compliance and provide the visibility to reduce risks and support accurate disclosure as well as helping environmental, rehabilitation, community and mine management teams globally to improve relinquishment, tracking of closure and achieving rehabilitation targets

Manage their tenements in regard to cultural heritage and surrounding communities (i.e. avoiding a RIO repeat…)

K2F’s Strategy: Land and Expand

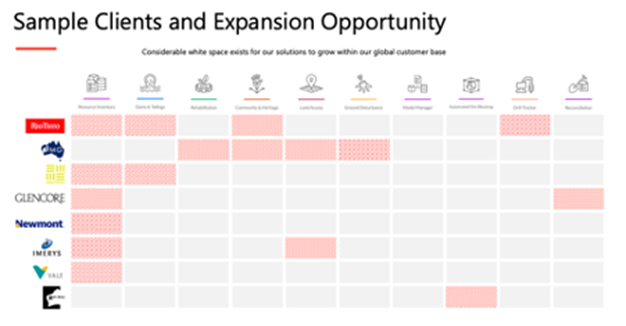

K2F have expanded their product offering for mining companies through acquisitions. This has been part of their strategy to “land and expand”, that is to leverage existing relationships with top tier miners to then cross sell their complementary solutions. K2F’s customers are comprised of high profile tier one clients, including 3/4 of the iron ore majors and 5/10 gold majors. Their solutions are used in 54 countries across 45 different commodities.

At the back end of last year, K2F’s solutions were endorsed by SAP, the biggest enterprise software company in the world. K2F is one of just twelve companies globally to be awarded the certification which is an amazing achievement given the size of K2F. SAP have relationships with 98/100 of the biggest mining companies and are now incentivised to sell K2F’s products. This provides K2F with a big runway to execute their “Land and Expand” strategy.

Recently, K2F acquired Decipher which was developed and operated by WesCEF, a subsidiary of Wesfarmers. Decipher offers award-winning cloud-based software-as-a-service monitoring and compliance solutions in tailings management and rehabilitation for mining industry customers. This has not only expanded K2F’s offering but also put Wesfarmers on K2F’s share registry as a substantial (10%) holder .

The sample below highlights the opportunity K2F has to cross sell their products to existing costumers. The grey boxes represent cross selling opportunities. This sample alone shows that only 20% of their products are being utilised. As K2F continues to develop new solutions and seek strategic acquisitions, this opportunity will only get bigger.

Outlook and Thesis

On the back of their endorsement by SAP, K2F can capitalise on the relationships that SAP has with the top tier mining companies and look to cross sell their solutions. The management team has experience across the mining and software industry and is led by CEO Brian Miller who co-founded AMT-Sybex, a software company providing services to the energy and utilities sector who were taken over for $150m+ AUD in 2014 (delivering tremendous shareholder value).

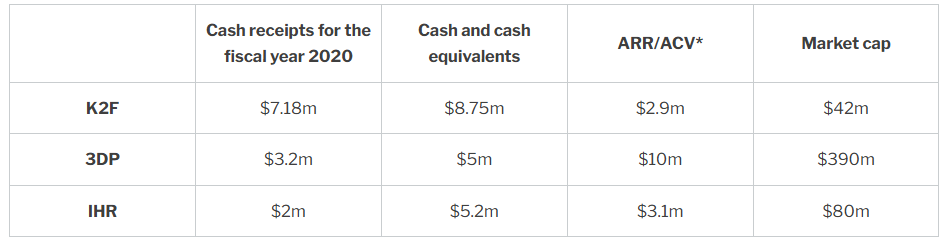

A comparison with geospatial data company Pointerra (3DP.ASX), which K2F is affiliated with through the integration of 3DP into their new acquisition Decipher, and cloud based software IntelliHR (IHR.ASX) is rather compelling and gives some food for thought on K2F’s current valuation. The table highlights how low a cash flow multiple K2F is trading at and what a cornerstone investor like Bevan Slattery can do to a company’s market cap (he took $2.5m positions in each of 3DP and IHR in 2020).

* Note: We used annual recurring revenue for K2F/IHR and annual contract value for 3DP

The thesis here is fairly simple, K2F is at the forefront in benefiting from a major shift in the mining industry whilst also having a positive impact on society, something that investors are beginning to value more and more. At a market capitalisation of just $42m with $9.25m in cash and receivables, K2F offers material upside as they look to add new solutions and use their existing relationships with miners as well as their partnership with SAP to cross sell their products and increase annual recurring revenue. In addition to this, there has also been a run up in commodity prices and a lot of talk about a “commodity super cycle”. This will only benefit K2F as more mines are brought to production, increasing the demand for mining services companies. K2F have provided strong updates to the market and are in advanced talks over further contract agreements. They are cashed up and can use the money for further acquisitions that could expand their product offerings as well as develop their own solutions tailored to the feedback of current customers. We also expect K2F to begin looking for products to offer to the oil and gas sector which will increase their addressable market significantly.

Disclaimer: K2F is personally owned by the author of this piece. It is not owned in any TAMIM portfolios.