Healthia (HLA.ASX)

Authors: Ron Shamgar

Most of Healthia’s clinics have remained essential services, which saw them continue operations throughout lockdowns. The lockdowns would’ve caused many people to delay visits to a lot of Healthia’s clinics; we can see there being a huge backlog of people waiting for restrictions to ease to go to one of Healthia’s broad range of health services.

Acquisitions

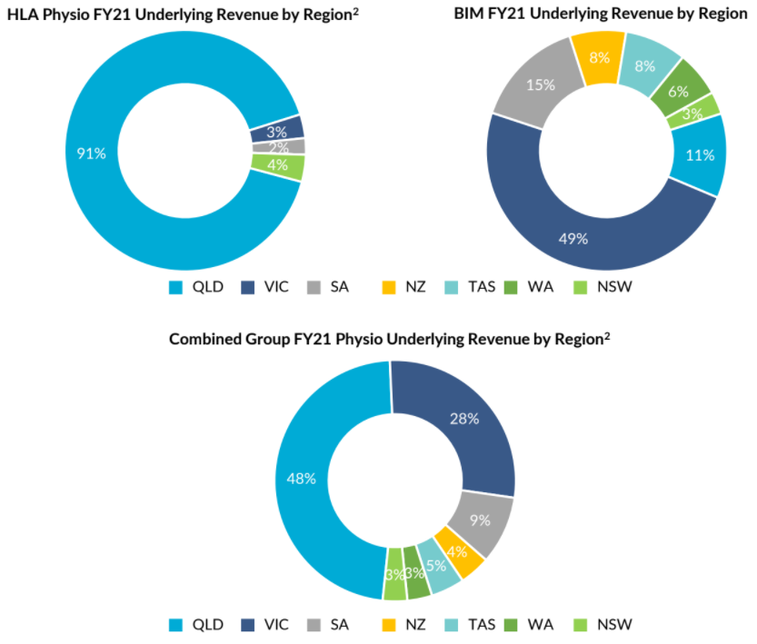

As mentioned, HLA has been undertaking an aggressive acquisition strategy to grow the business. They have been rolling up clinics throughout Australia which have all been earnings accretive. Their most recent acquisition of BIM, for a consideration of $88m, was a transformative one. Simply, it gave HLA a presence in new markets; BIM had a presence in New Zealand and Western Australia. BIM will add 64 clinics to the group and generated $12.3m of EBITDA, increasing the group EBITDA by approximately 57%. The acquisition is earnings accretive and was bought for circa 7x EV/EBITDA.

Valuation + Outlook

We recently saw 1300 Smiles, which ran a similar strategy to HLA except with dental clinics, get taken over by Abano Healthcare for approximately 15.5x EV/EBITDA. At below 8x EV/EBITDA, we see significant upside in HLA and the potential for multiple expansions on the back of their aggressive acquisition strategy. Heading into a post-covid world, we expect to see a backlog of people that will be booking appointments at HLA’s clinics. We like businesses like HLA that have good earnings visibility, their clinics typically have around 85% client retention and are pretty essential services. Buying a quality business like HLA on the back of a transformative acquisition at below 8x EV/EBITDA looks cheap heading into the country reopening.

We can see HLA trading at $3+.

People Infrastructure (PPE.ASX)

Reopening Tailwind

PPE was well placed heading into the lockdowns given the diversity of their clients, low client concentration and the critical nature of many of the services that their clients provide. While construction has mostly continued through lockdowns, it hasn’t been at full capacity and, as a result of labour shortages and lack of overseas workers, human capital is in high demand. When you combine these factors with easing restrictions, demand for PPE’s services could lift considerably. With healthcare making up a huge chunk of PPE’s EBITDA we can also see the pent up demand for elective surgeries being a huge driver of PPE’s business when restrictions ease. As well as this, there are huge fiscal stimulus plans in play where a lot of the money will go towards infrastructure development, another tailwind for PPE.

Acquisitions

PPE has a strong pipeline of acquisitions and is well funded to pursue them with $50-70m of available funding through debt and free cash; given their strong funding the strategy is non-dilutive to shareholders. Their past acquisitions have been earnings accretive and have expanded the industries PPE operates in. Their most recent acquisitions, Techforce Personnel and Vision Surveys, increased earnings per share by 19% and the combined deal was done on a valuation of circa 3.7x pro forma EBITDA. Their acquisition strategy opens up new regions for PPE to capitalise on and creates a much bigger addressable market for the group, as seen by their move into the healthcare recruitment space.