Money3 (MNY.ASX)

Authors: Ron Shamgar

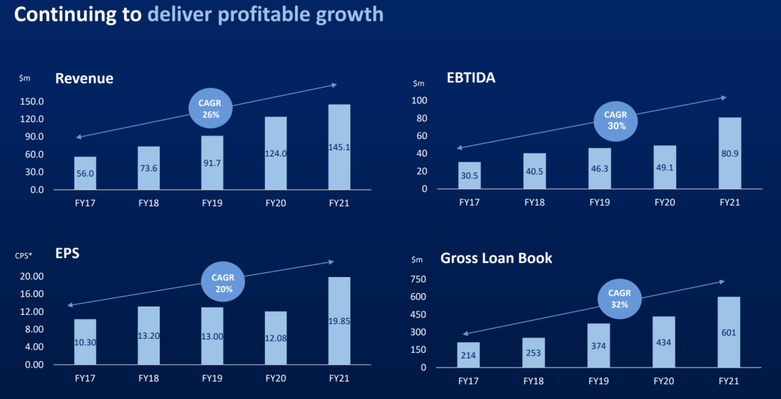

MNY recently executed a transformational $250m funding deal with Credit Suisse. The deal will both lower their cost of capital and allow them to expand into new car financing; given the higher value of new cars this should accelerate their loan book growth. The new facility will increase margins and allow MNY to pursue their growth strategy in the auto finance market.

Acquisitions

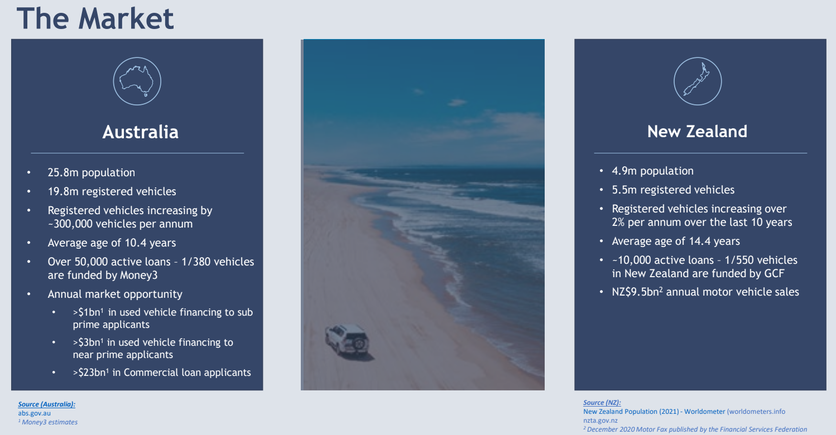

MNY has also been active when it comes to M&A activity. They acquired New Zealand company Go Car Finance in 2019, giving them a presence in the NZ auto finance market. Go Car now has a loan book of AU$158m, increasing over 300% since MNY acquired them. Their NZ presence opens up the opportunity for MNY to grow their loan book above $1bn and, with the cheap funding behind them, MNY should continue to scale this segment. More recently, they took over Automotive Financial Services (AFS) who have a $52m loan book and are projected to do around $2.5m NPAT in FY22.

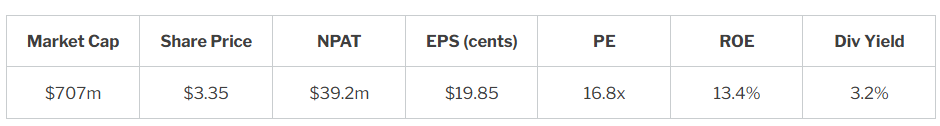

MNY has been a post covid winner and, with second hand car prices at highs, they are benefiting from increased value of their loans. MNY has a clear path to grow their loan book on the back of their new loan facility, which will see them expand their new car lending, and the Go Car Finance acquisition ,which has given them a position in the NZ market. There have been issues with vehicle supply shortage, slowing loan origination, but that will normalise as the world returns to normal. MNY has been able to acquire struggling competitors that don’t have the same access to funding that Money3 has. We can see MNY achieving a loan book of $1bn by FY24. We estimate that this will yield approximately $80m in NPAT which would put MNY on a forward PE multiple of around 8x, all while they continue to distribute strong dividends. We can see MNY being worth double their current share price if they achieve that $80m of NPAT by FY24.

Last week we saw Money3’s peers Plenti (PLT.ASX) and MoneyMe (MME.ASX) provide strong updates and they have both seen good growth in loan originations. We expect MNY to do the same, their upcoming annual general meeting on November 16th could be a catalyst as they provide an update on their outlook for FY22. We expect them to do over $50m of NPAT in FY22 which would put them at a PE of around 14x.

Resimac Group Limited (RMC.ASX)

Resimac Group is a residential mortgage lender and multi-channel distribution business specialising in Prime and Specialist lending. RMC operates in targeted market segments and asset classes in both Australia and New Zealand. As a non-bank financial institution, they have developed a high quality lending portfolio, loan servicing capability, and funding platform predominantly through organic growth.

Resimac is a quality business that has mostly slipped under the radar. They are attacking a huge market and are achieving huge growth in their loan book with AUM (assets under management) now at $15bn. Resimac are currently investing heavily in their digital capabilities to develop a customer centric organisation that is data-driven, powered by a modern digital platform providing cost-effective, scalable and rapid growth.

Resimac has benefited from the consumer shift away from traditional lenders. In a post-Royal Commission world consumers are better informed and have started to favour alternatives in finance solutions, the recent rise of fintechs is a testament to that. Resimac has a number of competitive advantages over their traditional bank competitors; by offering superior service, systems and approval procedures they have established themselves as one of the biggest non bank lenders in Australia. Simply, Resimac has the quickest loan settlement turnaround time.

Resimac has been diversifying into asset finance under the newly acquired Resimac Asset Finance brand. RMC will look to leverage their existing digital expertise in scaling their asset finance business. Given the growth in their home loan portfolio, the asset finance business should be highly accretive to Resimac’s AUM.

The key drivers of Resimac’s earnings are their AUM and their net interest margin (NIM). Resimac has benefited from a lower cost of funding which has led to a huge increase in earnings. Their funding comes from issuing residential mortgage backed securities (RMBS). The older bonds were issued at a higher rate and, as they mature, the new bonds they will be issuing will be at a lower rate. Their NIM was 207bps in FY21, up from 190 in FY20. Resimac will have very favourable funding costs for FY22. Looking to their AUM, they grew their home loan book by 11% in FY21. If they continue to deliver a superior service, growth in NZ as well as their diversification into asset finance, their earnings power is huge.

In current market conditions Resimac has seen multiple tailwinds that have accelerated their business. Resimac posted a 37% return on equity in FY21, an almost unheard of result for a company trading at less than 10x earnings. Looking ahead, we see Resimac continuing to benefit from low cost of funding in the short term. Resimac have a tiny portion of the Australian lending market and there is plenty of room to grow AUM in both home loans and asset finance. Resimac should also see their NIM remain above 200bps for HY22. Considering growth in their loan books and a strong NIM, Resmac should be trading at closer to 6x earnings in FY22.

In their most recent presentation, Resimac said they are targeting $8bn in annual settlements by FY24 for the home loan segment. They are also targeting $1bn in annual settlements by FY24 for the asset finance business. These targets would see Resimac achieve strong growth in their originations and, at a PE of less than 8x, there is huge upside for multiple expansion.