Aptiv (APTV.NYSE)

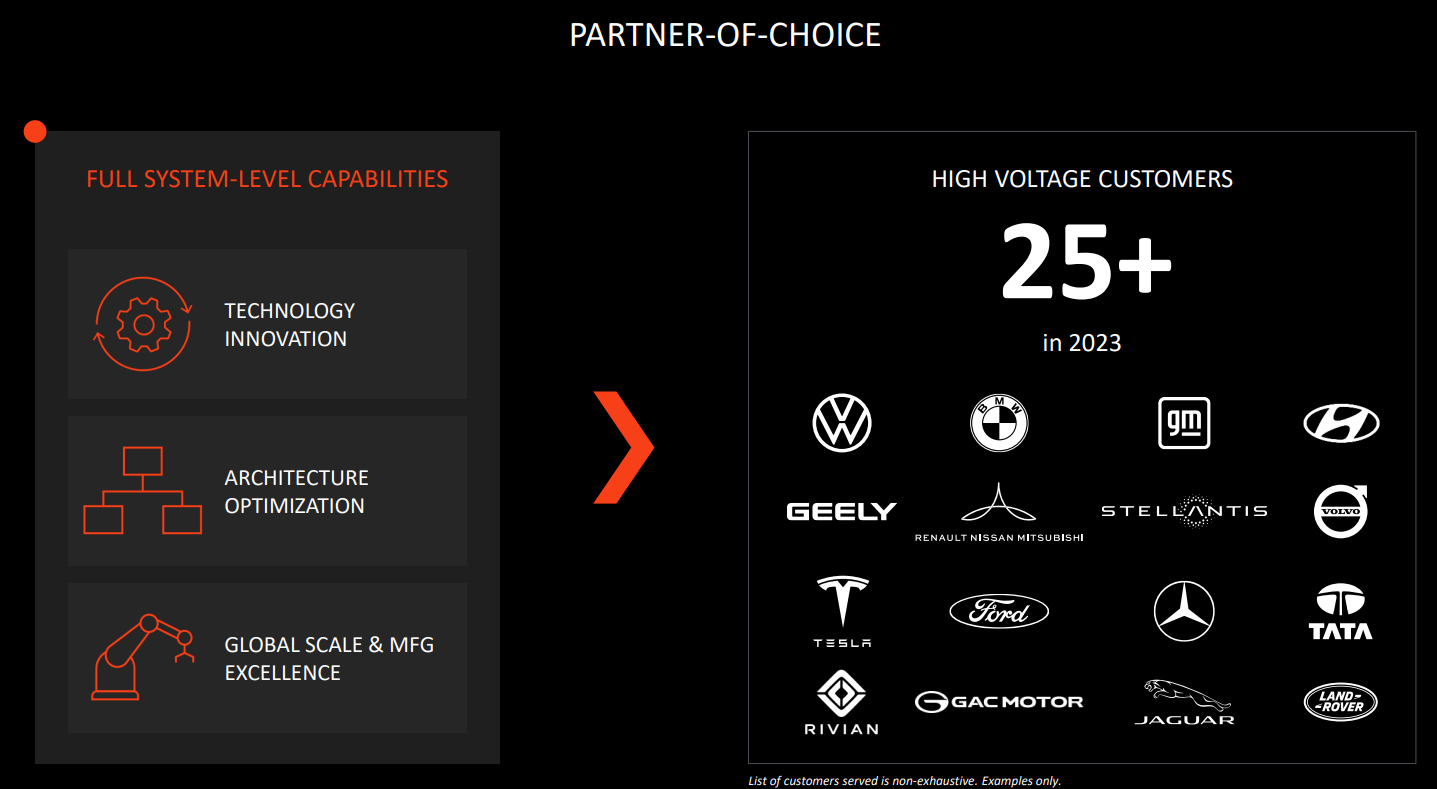

Aptiv manufactures, and sells vehicle components internationally. The company provides electrical and electronic tech products as well as safety technology solutions to the automotive and commercial vehicle markets through two main segments, the first being signal and power solutions and the second being advanced safety and user experience. Key positioning in high demand and rapidly growing industries such as autonomous driving, E-mobility, and smart vehicle architecture are likely to set Aptiv up well for the foreseeable future. Their signal and power solutions are aiming to capitalise on the need for high voltage subparts for electric vehicles.

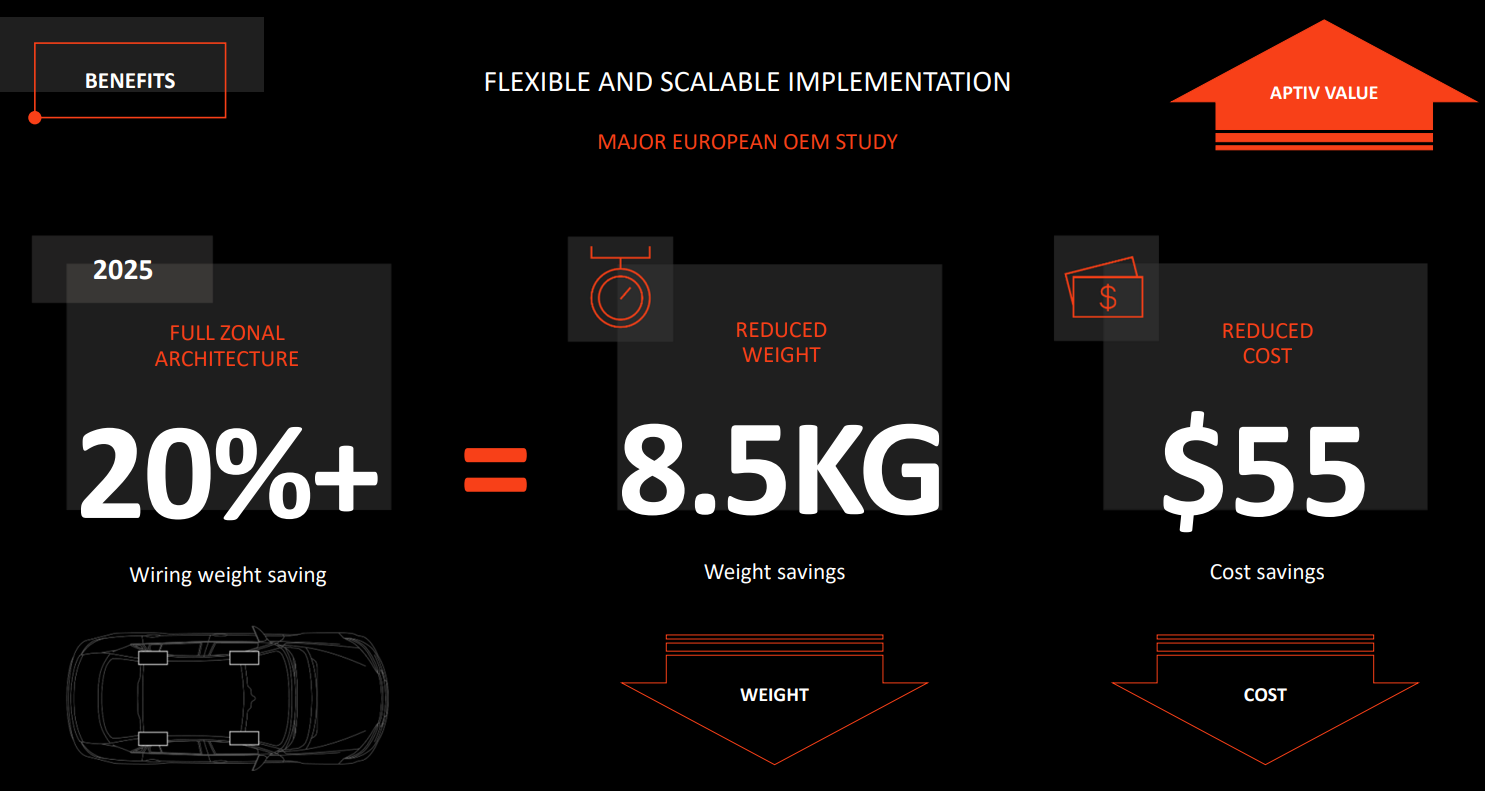

Aptiv manufactures, and sells vehicle components internationally. The company provides electrical and electronic tech products as well as safety technology solutions to the automotive and commercial vehicle markets through two main segments, the first being signal and power solutions and the second being advanced safety and user experience. Key positioning in high demand and rapidly growing industries such as autonomous driving, E-mobility, and smart vehicle architecture are likely to set Aptiv up well for the foreseeable future. Their signal and power solutions are aiming to capitalise on the need for high voltage subparts for electric vehicles.Aptiv solutions optimise electric vehicle architecture, making intelligent design trade-offs that reduce cost, weight and mass. This allows for faster democratization of technologies that reduce CO2 emissions and reduce traffic accidents and fatalities.

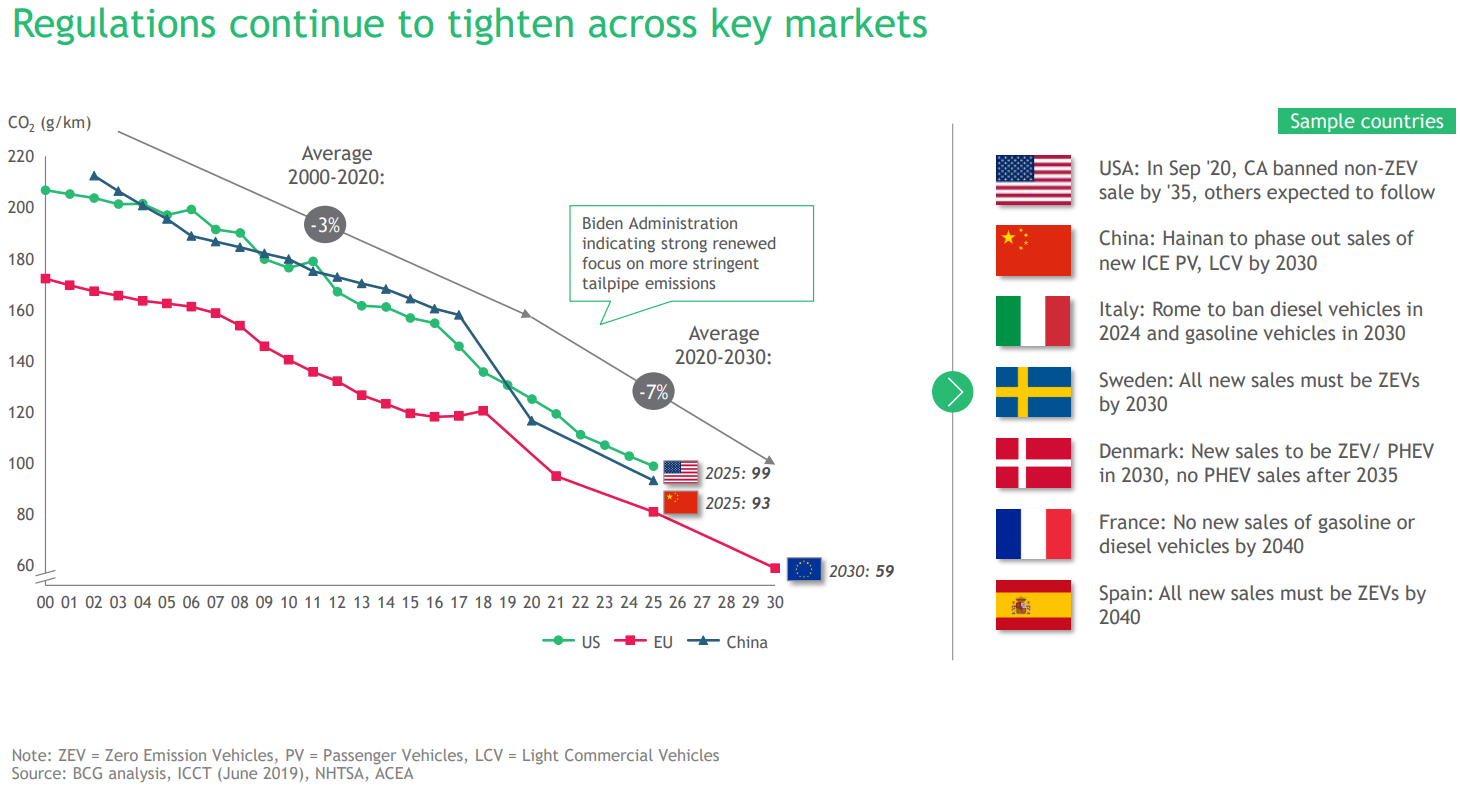

Government mandates are accelerating electric vehicle demand

We are seeing countries around the world, especially in Europe, begin to tighten various mandates on carbon emissions. Many are trying to do so before 2030. This is a huge backdrop for electric vehicles and other carbon friendly thematics such as uranium, carbon credits, hydrogen, solar/wind energy and the like. While they aren’t manufacturing electric vehicles themselves, Aptiv’s solutions are critical for the viability of electric vehicles, Aptiv are integral in reducing carbon emissions but they aren’t getting the same credit for it, especially compared to their customers.

High voltage

Electric vehicles are being adopted rapidly worldwide but it is still in its infancy and there are still some pressing inefficiencies that need to be addressed. Unlike an internal combustible engine (ICE), an electric vehicle needs to be charged which can be time consuming depending on which charger you are using. On top of this, they are somewhat limited in their range, a real issue until appropriate charging infrastructure is rolled out or ranges improve. Consumers are demanding faster charging cycles, which means higher voltages and currents. Higher voltages and current brings greater reliability and performance requirements, which increase vehicle range as well.

Increasing the voltage level from 400V to 800V represents the most efficient way to optimize performance. By doubling the voltage, considerably more power can be transmitted in the same time with the same current, which can lead to up to half of the charging time compared to a 400V system. When scaling up the electrical vehicles to 800V, the requirements of all sub-components change. All parts in the e-drive motor´s construction must be adapted and entire mechanical sub-systems need to be electrified, creating a huge opportunity for companies that produce these subparts to capitalise on. Aptiv estimate that the requirement for high voltage equipment in an electric car is 1.5-2.0x higher than a traditional ICE car. Aptiv have positioned themselves to be a key player in the electrification ecosystem and will benefit from the increased demand for high voltage subparts. Aptiv currently provide high voltage cabling, high voltage connectors, internal battery connections, charging cable sets and inlets, power distribution boxes and battery disconnect units.

Electric vehicles require a lot more wiring and denser materials compared to an ICE. this increases the weight of the vehicle and is one of the reasons electric vehicles are more expensive. As mentioned, government mandates are currently fueling the rise in electric vehicle adoption but, in order for them to be rolled out at a mass scale, the price needs to come down.

Hyundai Partnership

Aptiv has formed a partnership with Hyundai Motor (005380.KRX), a joint venture (they have both dedicated $2bn to this JV) whose objective is to develop a robot taxi platform. The first model should be ready before year end with a new version in 2022. Hyundai Motor Group and Aptiv will each have a fifty percent ownership stake in the JV, valued at a total of US $4bn. Aptiv will contribute its autonomous driving technology, intellectual property, and approximately 700 employees focused on the development of scalable autonomous driving solutions. Hailing a ride from your smartphone is no longer new. Google’s (GOOGL.NASDAQ, owned) Waymo have been operating a fully driverless service in Phoenix for a while now. The JV’s goal is to make riding in an electric/hybrid vehicle driven by a computer system commercially viable in Las Vegas. For once, what happens in Vegas doesn’t need to stay in Vegas.

Connectivity

The technology content of vehicles has continued to rise as a result of infotainment systems, greater safety, and convenience. In order for autonomous vehicles to be fully operational, the vast majority of roadside infrastructure will also need to be connected. This involves traffic lights, sensors, cameras, road maintenance etc all communicating with each other. This will enable cars to safely travel at higher speeds, preemptively reduce their speed when necessary as well as aid in the efficient flow of traffic, preventing traffic jams. Autonomous vehicles may be widespread before this point but this will be required to maximise their benefits and efficiency. As a result of the increased amount of data, there is an increasing demand for solutions that enhance connectivity. Aptiv are developing vehicle to vehicle (V2V) and Vehicle to infrastructure (V2I) communication technologies which enable vehicles to detect and signal danger, reducing collisions and improving safety. Aptiv’s solutions will maintain connectivity to an increasing number of devices both inside and out of vehicles utilising connectivity solutions such as over the air (OTA) technology that enables vehicles to receive software updates remotely and collect market relevant data from other connected vehicles.

Investment Thesis

The past year has been a tough one for Aptiv. Widespread chip shortages and fractured supply chains are having a huge impact on electric vehicle production in general. The decline in EV production has definitely slowed down Aptiv’s growth but the thesis for broader increased EV production remains strong and, once these shortages normalise, Aptiv should have a huge pipeline of sales ahead of them. Interestingly, Aptiv tick every box in terms of the pillars we are looking at in our Global Mobility portfolio (electrification, autonomy and connectivity/sharing). Aptiv present as an opportunity to gain exposure to all three thematics in this $10tn mobility revolution and yet they aren’t one of the names you think of when talking about electric or autonomous vehicles. The management team are well aligned with shareholders and have done an exceptional job at creating shareholder value.

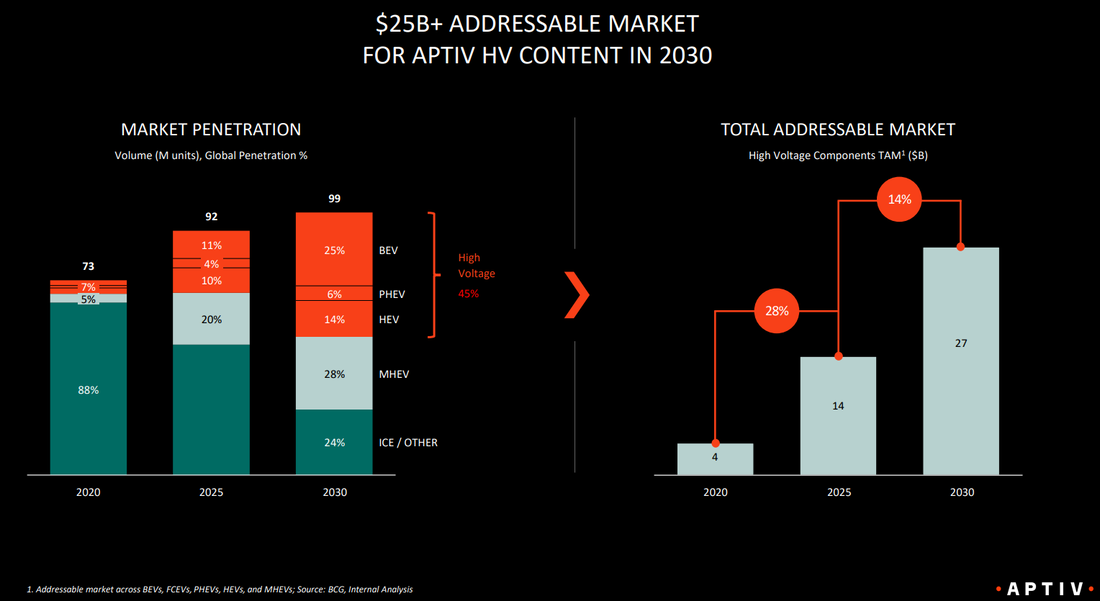

Electric and autonomous vehicles still have a long way to go to reach full functionality and efficiency in order to replace ICEs (and drivers themselves). Aptiv’s solutions are helping electric vehicles become more affordable and more convenient to use. Aptiv has already established a dominant position in the high voltage subpart market and, if they can capture the customers they are targeting by 2023 (most of whom are already customers), they will have a big chunk of that particular $25bn addressable market.

Aptiv have a strong position in the ecosystem enabling the electric/autonomous vehicle industry and we can see them being a market leader in their segments. In doing this they will be an integral piece of the $10tn revolution we are looking to exploit. All being equal, in a more mature industry this could mean a much larger market cap for Aptiv (currently $43bn).

Innovation In Motion: Electrification, Aptiv, June 2021

Aptiv Investor Outreach, Aptiv, April 2021