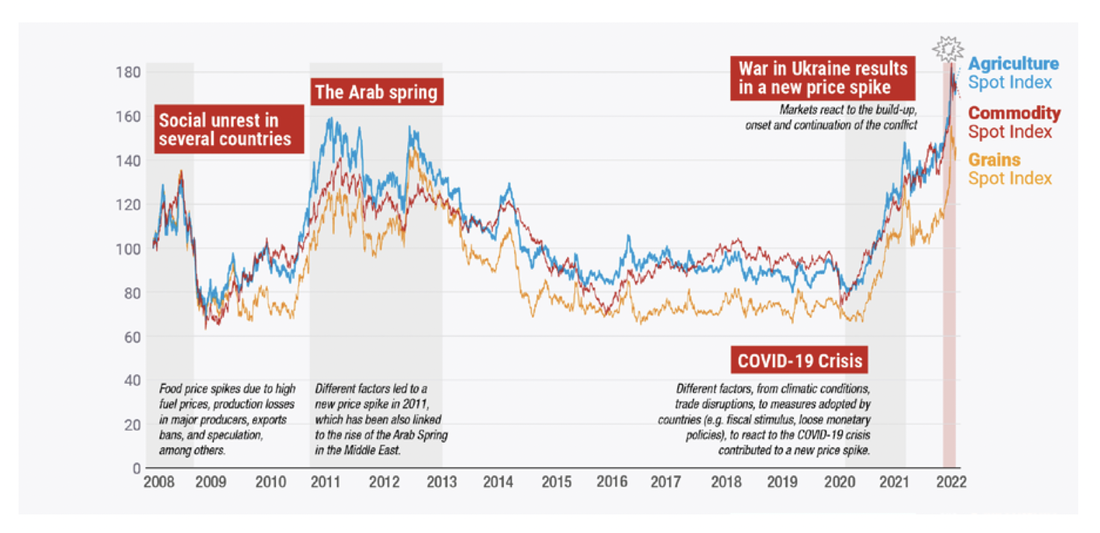

The Food and Agriculture Organization of the United Nations (FAO) Food Price Index – a global benchmark for food prices – is up 22.8% above the same corresponding month in 2021 due to a global agriculture supply shortage.

But you don’t need us to tell you that. A short stroll through the local fresh food section will give you a fair indication of the havoc. $12 lettuces. $17 green beans. $10 for a punnet of strawberries!

Supply had been also been impacted by an unusual combination of weather events. La Niña reduced yields in the Southern Hemisphere leading to drier conditions. Flooding in China impacted rice harvests while heat waves in India limited wheat output. Add in pandemic-induced shipping bottlenecks in addition to labour constraints and the scene was set for a global supply shortage and thus more expensive food.

Then Russia invaded Ukraine, making a bad situation worse.

Is the food shortage turning a corner?

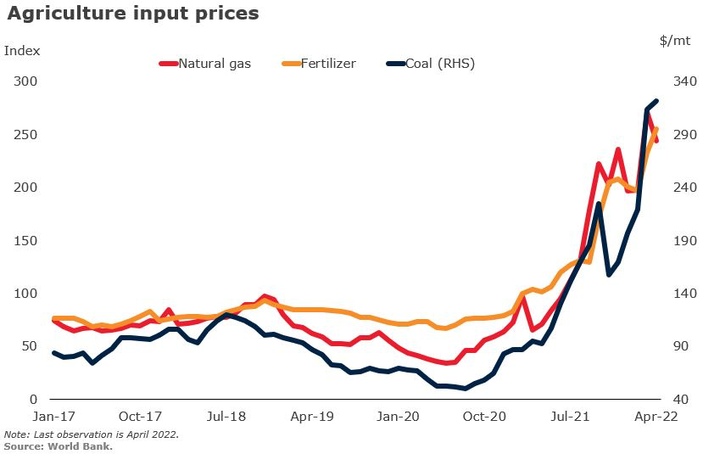

The positive news is that prices look to be turning a corner. In May the FAO Food Price Index fell, albeit modestly, for the second consecutive month. Prices for fertiliser are off 30% while shipping rates and energy prices are also beginning to cool down. Certain food commodity prices, like fish and meat, remain elevated. But overall the old adage – the cure for higher prices is higher prices – is starting to take effect.

On Friday Russia withdrew from Snake Island, reopening shipping lanes for grain exports out of Ukraine. While only a small concession, this will put downwards pressure on wheat and other commodity prices.

Markets are also beginning to price a correction. The BetaShares Global Agriculture Companies ETF (FOOD.ASX) has fallen 18% in the past three months. Moreover, most futures curves are in backwardation (when the future price is lower than the current price), implying that abnormal food prices should revert over time.

Interestingly, this hasn’t quelled investor interest. Salmon producer Tassal Group (TGR.ASX) received a takeover bid last week. Fortescue Metals (FMG.ASX) founder Andrew Forrest also purchased a 17.4% stake in cattle and beef producer Australian Agricultural Company (AAC.ASX).

Agriculture is a cyclical industry, prone to peaks and troughs. It’s hard to imagine conditions getting any worse, but that doesn’t mean they won’t persist. Despite energy prices moderating, it will take time for decreases to flow through. Moreover, future-proofing supply chains will be a longer-term project given it takes two to five years to develop new fertiliser plants and oil refineries. Reducing dependency on Russia will also be no easy (or cheap) task. While markets are pricing in falling agriculture prices, it’s likely they will remain above historical levels for the time being.