From March 2020 to mid-2021, Australian investors were treated to an impressive rally of almost 60% following the market’s COVID-lows.

So far, 2022 has proved far less generous with the S&P/ASX All Ords falling by as much as 15% since peaking in August last year.

However, last week felt like 2020 all over again – not just because the virus is ramping back up with talks of returning to mask mandates and the like, but because of all the green in the market. The ASX recorded its strongest week in four months, led by the banks, miners and tech stocks.

The question now is whether we’ve seen the bottom of the market, or is this just a bear market rally with further pain ahead?

No one knows for certain what lies ahead, but there are a number of factors that might just provide us with a clue of what’s to come. So, here are some things to look for that might signal that fear has peaked and the market has bottomed.

Peaking interest rates

Historically, markets don’t tend to bottom until interest rates stop rising and central banks adopt more dovish monetary policy.

At its July meeting, the RBA lifted the cash rate for the third consecutive month. It now sits at 1.35% after rising from an all-time low of 0.1%. The RBA meets again on Tuesday and another rise is widely expected.

The RBA has said that further steps to normalise monetary conditions in Australia would be taken over the months ahead. They believe that the current rate remains too low, particularly considering that inflation remains unacceptably high and the unemployment rate is at fifty year lows.

If inflation does moderate and interest rates are increased only modestly, the market may soon recover. But if inflation remains high, the RBA may have to keep raising rates (making a recession possibly unavoidable) and the sharemarket will remain volatile.

Based on current RBA predictions, the cash rate is expected to reach a peak of around 2.5%, with inflation expected to reach around 7% by the end of year and not fall until early in 2023.

The market is forward looking and has priced this information in already. The risk lies in whether inflation continues to increase unabated or if the RBA makes a policy error by hiking rates too high despite inflation pressures having abated. This leads us to our next point.

Market capitulation & extreme fear

One sign that the bottom is near would be market capitulation – the point at which extreme fear enters the market and investors give up on trying to recapture lost gains from falling stock prices. At this point markets tend bottom out and subsequently recover once there is no longer fear.

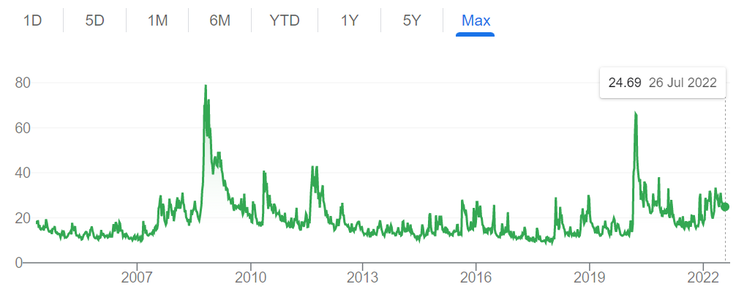

This can be seen by a spike in the VIX or “fear index”, which measures the expected volatility of the US stock market over the coming thirty days. When the market capitulates there will be a corresponding spike in the VIX.

Decline in company earnings

The current reporting season will be important to watch to get an idea of how companies are coping in this inflationary and rising rate environment.

See: What to expect this August reporting season?

Earnings expectations remain high but do seem to be pulling back, possibly to do with a recent pullback in commodity prices. That said, cost pressures, labour shortages, rising interest rates and supply chain constraints also remain threats.

It’s also the start of the US reporting period, yet most companies won’t report until next week. Despite cost pressures and supply chain issues there are early signs that companies are performing better than expected, although earning growth is below longer term averages.

Keeping a close eye on company results will tell whether they are managing in this more challenging environment or if it is carrying over to hit the bottom line, which would suggest further share price declines are in store.

But rather than trying to pick the bottom, it may be better to recognise that the market could still see some volatility in the months ahead. While share prices are starting to look attractive, a strategy of not picking the bottom but rather of using weakness to average into an investment over a number of months may be the way to go.

As we have previously said: Keep it simple. Keep it disciplined. Keep it rational.