Last week’s release of the June Consumer Price Index (CPI) told the market what it already knew: everything is more expensive. Headline inflation came in at 6.1%, the highest recording since the introduction of the GST in 2000. Trimmed inflation, which removes big price swings, hit 4.9%. The headline number was below economist expectations of 6.3%, but the underlying was above the expected 4.7%.

The major causes are well known but not easily fixed. Labour shortages have been exacerbated by two years of limited migration. Ongoing logistic constraints won’t be fully resolved until China ditches its zero tolerance to COVID-19 or Russia halts its invasion of Ukraine. Soaring commodity prices and abnormal weather are impacting input costs, which are subsequently passed on to consumers

Subsequently, fruit and Vegetables are up 7.3%. New housing for owner-occupiers increased by 5.4%. Small and large household appliances were up 7.1% and 5.7% respectively. Even the temporary six-month excise cut of 22 cents at the bowser couldn’t alleviate fuel pressures, increasing for the eighth consecutive quarter.

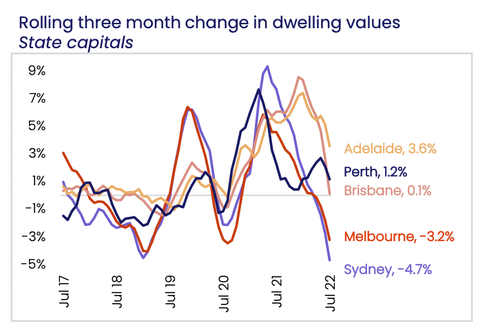

The weekly budget isn’t the only line item feeling the heat. Most superannuation account balances fell in the 2022 financial year, with just three MySuper products achieving positive returns. House prices are also beginning to roll over. Melbourne and Sydney are already contracting. Other capital cities are experiencing slowing growth.

US Fed alleviates market uncertainty

The CPI release wasn’t the only big economic news last week. The US Federal Reserve increased rates by 75 basis points last Thursday night to bring its benchmark rate to 2.25% – 2.50%. The Central bank has now raised rates by 225 basis points in just four months, demonstrating its commitment to bring down inflation. Again, the number was in line with economic forecasts. But what really caught markets attention was Chairman Jerome Powell’s shift in rhetoric.

He acknowledged current monetary policy is now at a neutral rate, i.e. neither stimulatory nor contractionary. Some further tightening will be required, citing prior Fed forecasts of 3.25% to 3.50% as an estimate, but also stating that the policy would be decided on a “meeting by meeting basis”.

Why is this important? Powell is giving certainty to the markets. The rapid increases are in the rear view mirror and the Fed will be more deliberate with its cash rate moves. Subsequently, the Nasdaq rallied +4.26% and the S&P/500 added +2.62%. Powell also toed the line that a recession is avoidable while acknowledging some pain will need to be felt:

|

“We need a period of growth below potential in order to create some slack so the supply side can catch up. We also think that there will be in all likelihood some softening in the labour market conditions, and these are things that we expect and we think are necessary to get inflation on a path back down to 2%”

|

Powell’s words rang true just 24 hours later when the US recorded its second consecutive quarterly decline in GDP growth and entered a technical recession.

The Fed faces a delicate balancing act. The more it wants to guarantee inflation is squashed, the further it will need to push the economy into a downturn. Fortunately, the economy is entering the recession from a position of strength with a strong US dollar and unemployment at just 3.6%.

The RBA blinks

With domestic inflation data and the Fed’s latest decision, it was time for the Reserve Bank of Australia (RBA) to step up. On Tuesday, Governor Philip Lowe announced a third consecutive 50 basis point increase, taking the cash rate to 1.85%. Just three months ago the cash rate was 0.10%. Similarly, none of this was very surprising. But like the Fed, there was a shift in attitude from the RBA.

Powell’s comments on reaching neutrality afforded Lowe the opportunity to slow the pace and severity of rate increases. And he took it with both hands. In the RBA’s monetary policy statement, the addition of two new lines demonstrates a more measured approach to future increases:

|

“The Board places a high priority on the return of inflation to the 2–3 per cent range over time, while keeping the economy on an even keel”.

“The Board expects to take further steps in the process of normalising monetary conditions over the months ahead, but it is not on a pre-set path”.

|

Most will interpret Lowe’s words as dovish. The RBA indirectly acknowledged the pain households and businesses are facing evident in the June CPI and highlighted it will balance both the economic and inflation considerations.

But what it implicitly says is that the economy is not as strong as once thought. The RBA downgraded its economic growth forecasts and also forecasted unemployment would rise. There was also no mention of the speech Deputy Governor Michele Bullock delivered just two weeks ago, that the vast majority of households can cope with 300 basis points worth of increases.

There is also a lot of scepticism around the RBA’s forecasts. Inflation is expected to peak at 7.75% before returning to 4% in 2023 and 3% in 2024. But we know inflation usually takes months if not years to flow through as fixed contracts roll over and businesses reset prices. After it backtracked on its own forecast that rates wouldn’t rise until 2024, how can one be sure the RBA has got it right this time?

To make sure households are able to cope with elevated inflation and rate rises, the RBA will be more measured and likely move in 25 basis point increments going forward. It could even pause towards the end of the year to evaluate how households are coping. This news will likely be a much needed reprieve for mortgage and asset owners. But it also signals that, should inflation linger for longer than expected, Australia will almost certainly experience an economic downturn as the RBA is forced to extinguish inflation.