Diversification: Can You Have Too Much?13/7/2023 Diversification is no secret, it’s a well-known part of investing. “Don’t put all your eggs in one basket” is a common phrase that we learn at a young age, and something that most people put into action, at least to some degree–usually after we make a big mistake, or see one made by a partner, friend, or family member.

Diversification is important. It’s a hedge against our inevitable mistakes and an uncertain future, and protects us against losing too much money–an amount that would impact our lifestyle, undo years of hard work and savings, or in the case of professional investors, cost us our job. But, how much is enough? And can you have too much of a good thing?

Time and EffortRenowned investor Peter Lynch delivered a compounded return of more than 29% per year between 1977 and 1990 at Fidelity Investments. In his flagship Magellan Fund, Lynch typically held more than 1,000 stocks (and often as many as 1,400 different companies) in the portfolio.

The average investor, though, likely only has the capacity to properly monitor up to 30 individual companies–especially if they have a day job that isn’t investing, children or other family members to care for, or any other hobbies or life challenges to occupy their time. The average investor also doesn’t have the same level of access to company management, nor a team of analysts, a Bloomberg terminal, institutional research reports, and IPO prospectus materials. It’s also worth noting that Lynch retired at the sprightly age of 46, such was the toll of his investing career.

DiversificationWarren Buffett, on the other hand, is famous for his concentrated investing style that has generated incredible returns for Berkshire Hathaway shareholders over decades. Investors almost immediately associate Buffett’s name with the likes of Wells Fargo, Coca-Cola, American Express, and nowadays, Bank of America and Apple. Buffett has been quoted as saying: “Diversification is protection against ignorance. It makes little sense if you know what you are doing.” As well as being the most sophisticated and talented of investors, Buffett has a clear reason for his concentrated strategy. He wants to always allocate new funds to his best idea, and his best idea is usually something that he already owns (a lot of!). Although this is outdated given the bank’s subsequently-aired scandals, Berkshire’s vice-chairman Charlie Munger described this strategy succinctly: “Our best idea is Wells Fargo. And we would compare every stock that we’re looking at to Wells Fargo. If it’s not better than Wells Fargo, why not just buy more Wells Fargo?”

Cutting Flowers and Watering WeedsThe mantra of diversification often causes investors to sell their winners and add to their losers–a process Lynch described as “cutting the flowers and watering the weeds.” This is often counter to a successful investing process. It’s well-known that a portion of investments won’t be successful and in fact, an investor who picks 6 winners out of every 10 will usually be richly rewarded. This is because the gains from some stocks will be so large over time that they will significantly outweigh the losses or mediocre returns for the others.

The success of these great performers will cause them to become an outsized portion of the portfolio at times, and diversification encourages people to sell. On the other side, poorly performing stocks will become so small that investors will be encouraged to add to these positions. As Frank E. Block wrote in “The Elements of Portfolio Construction” all the way back in 1969: “more often than not, both moves turn out to be mistakes.” Taken to the extreme, one good investment in Amazon in 1997 has turned Bill Miller from Miller Value Partners into a billionaire (he also credits his more recent Bitcoin purchases).

Overlapping ExposureBeginner, time-pressed and less passionate investors often look to exchange-traded funds (ETFs) for a simple, low-cost way to invest with adequate diversification. There has been an explosion in the number of ETFs available over the last decade, providing investors with exposure to different geographies, sectors, themes, and company sizes. Unfortunately, the fine print often outlines something different than one would expect, and there can often be significant overlap between products. For example, according to data from ETF.com, 321 ETFs held shares in ExxonMobil as of mid-2023.

Adding an additional ETF to a portfolio may not provide any additional diversification benefit. Even with individual shares, an investor might think they are gaining diversification by increasing the number of companies. While this is true to a certain extent, if they are within the same industry or have other overlapping features (e.g., macroeconomic risks), the extra benefit may be minimal.

Your Personal Balance SheetOne aspect that doesn’t get much attention but is worth remembering is the size of an investment relative to your overall net worth. While a stock may represent 10% of your share portfolio, it may only represent 5% (or even much less) of your total assets–particularly given the value of the family home for most homeowners in Australia. Thinking about it in this way may significantly change how comfortable you are with the size of a particular position.

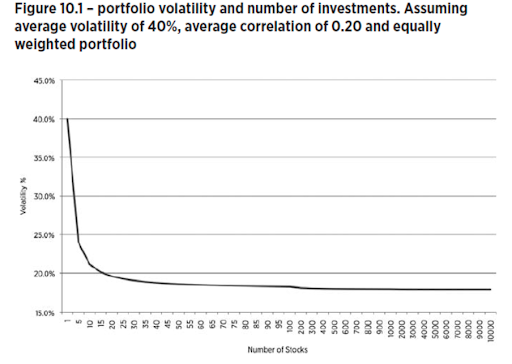

The Big Question: How Many Stocks?While the numbers may vary slightly, the theory in financial courses is remarkably consistent. Diversification provides enormous benefits starting from your initial investment until you build out a portfolio of at least 5, and preferably 10, (lowly-correlated) investments. The benefits of diversification begin to decline substantially after 15 stocks, and even more after 30.

Portfolio Volatility vs. Number of InvestmentsSource: Multi-Asset Investing: A guide to modern portfolio management. Lustig, 2013.

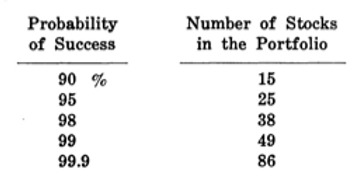

These guidelines relate to both “volatility” and “risk”, which some investment professionals use interchangeably (a topic for another day). Block’s article described it as a “probability of success.” Probability of Success vs. Number of InvestmentsSource: Frank Block, 1969, The Elements of Portfolio Construction, Financial Analysts

What’s the Answer?The best reason for greater portfolio concentration is higher returns. Truly special companies are rarer than you might expect and focusing on your best ideas is one of the best ways to achieve long-term investing success–particularly if you let these ideas flourish and don’t trim them prematurely. As the ever-quotable Buffett said: “Diversification may preserve wealth, but concentration builds wealth.”

Yet the future is an uncertain place. The unexpected can happen at any time, as we’ve seen in recent times from the pandemic, the outbreak of war in Ukraine, and the rapid change in interest rates and inflation.Concentration can have a dramatic impact if things go the wrong way. Ruane Cunniff & Goldfarb Inc.’s Sequoia Fund tarnished an incredible long-term track record by allocating up to 15% to the infamous Valeant Pharmaceuticals, damaging their reputation and causing conflict inside the firm. This personal impact is often the most under-appreciated factor. While there’s no doubt that greater concentration can produce better returns (if executed well), it can still take its toll. Joel Greenblatt delivered a phenomenal 50% annualised return between 1985 and 1994 at Gotham Capital using a portfolio that generally held 6-8 investments. He acknowledged, however, that it often kept him up at night. As described above, Peter Lynch retired at just 46. Ultimately, the best level of diversification will be what you’re comfortable with and allows you to make smart investment decisions that keep you invested, to reap the benefits that long-term share ownership can bring. |

Diversification: Can You Have Too Much?

Diversification: Can You Have Too Much?

Written by