What is a recession and what does it mean for investors?6/7/2023 Fearing a recession is natural. Recessions are an economic reality. They typically start before anyone realises they’re happening and end before economists have enough data to know they’ve finished.

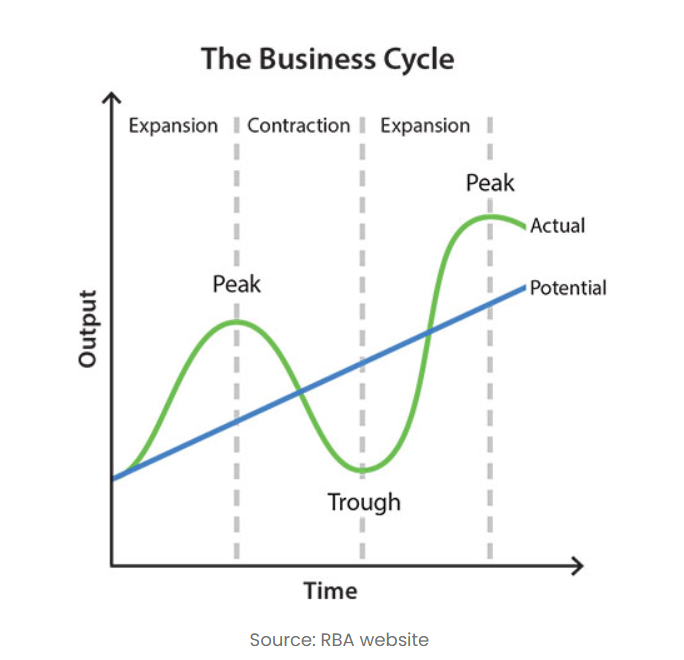

It’s understandable to worry considering the constant headlines dance between inflation, interest rates, the cost of living crisis and the mortgage cliff. For investors, a recession may seem daunting at first, but its actual impact can be less severe than the media suggests. We all hope that the Reserve Bank of Australia (RBA) can pull off a soft landing for our economy over the rest of 2023 and into 2024. But sometimes, it’s best to hope for the best and plan for the worst. In order to do so, we think it is crucial to understand the business cycle and get clear on the intricacies of recessions. The business cycleThe business cycle is made up of four phases broken down into expansion, peak, contraction and trough which looks at the growth and output of the economy. The output is considered real gross domestic product or GDP and is an inflation adjusted measure reflecting the value of all goods and services produced by an economy in a given year. While the phases are fairly self explanatory, expansion is when everything is booming, workers are being hired, wages are going up and households are purchasing more goods. This all ends at the peak before beginning a move into the contraction phase where employees are laid off and wage growth slows leading to less goods being purchased by households and a reduction in demand. The end of the contraction phase is the trough in economic activity.

So what exactly is a recession?There are many definitions of a recession depending on the data you utilise and where in the world you live. What is common between them is the changes in economic output and the labour market. One of the more common terms used is a ‘technical recession’.

A technical recession is defined as two consecutive quarters of negative growth in real GDP and is the common definition you’ll read about online or in the newspaper. Prior to the Covid-19 Pandemic Australia hadn’t seen a technical recession since the early 1990’s which is an unusually long time. There are some weaknesses in the technical definition, for example:

A recession definition with less focus on GDP is one that is based on unemployment numbers. The unemployment based rules are generally straightforward and take into account a predetermined increase in the unemployment rate. While simple in nature it again has some limitations, particularly around underemployment which looks at how well the labour force is being used within the economy and whether employees could be working additional hours.

What does this mean for investors?It can be a scary time when all headlines point to doom and gloom and there are plenty of reasons to exit the market. Thesis’ are tested and external noise can impact share prices even though the fundamentals of businesses may not be impacted in the long term.

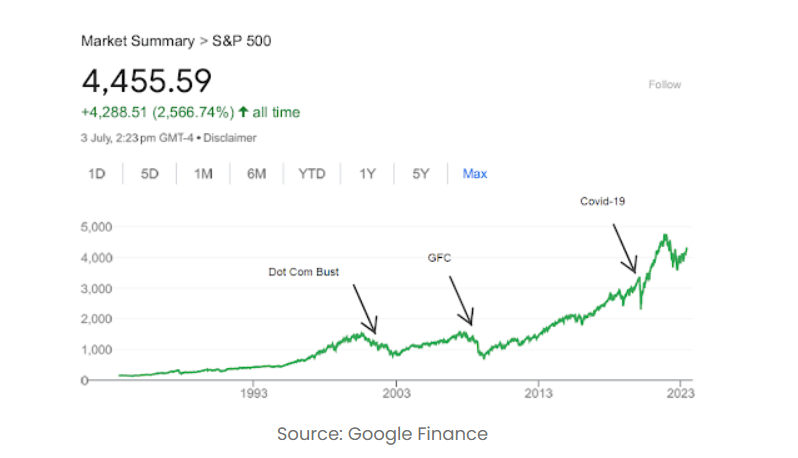

It’s important to take a step back and remember your investing goals.As a long term investor it’s paramount to remember that downturns and recessions don’t last forever and they can potentially provide terrific buying opportunities. It’s crucial to consider the reasons why you’re invested in an asset in the first place and a good point in time to review your conviction in a position. Taking a look at past performance of markets during and post significant downturns you can see that these drawdowns can bring opportunity to the right investment. While almost impossible to time the top and bottom of markets, a dollar cost average approach into high conviction well researched positions could lead to long term gains. From an index standpoint you can see from the below graph some of the larger drawdowns in the S&P 500 index and the subsequent performance. Had you exited during these periods you would have missed some incredible growth from that point on.

Not only growth but some of the world’s best businesses were developed during recessions.

Disney (NYSE: DIS) was launched in 1929 right before the great depression. The company navigated its way through four years of difficulty to produce its first feature film at the conclusion of the depression. It has since become a $165 billion dollar company. Netflix (NASDAQ: NFLX) was established in 1997 pre dotcom bust. It didn’t take long though before things turned south and they approached Blockbuster to purchase a large part of the business. They were laughed out of the room but ultimately had the last laugh as they became the streaming mega giant they are today leaving Blockbuster for dead. AirBnB (NASDAQ: ABNB) was created pre the GFC, born out of an idea to rent out air mattresses (the air in AirBnB) in the founders apartment floor so they could cover rent. The GFC hit and people began looking for more affordable accommodation options as well as a new way to make money. This created a new challenger for the hotel industry and the rest is history! So rather than running from the markets if a recession is on its way it may be an opportunity to discover the next big businesses of tomorrow. A little closer to home had investors left the market during the peak fear of the COVID-19 Recession they would have missed some significant share price appreciation. Since late March 2020 companies such as REA Group Limited (ASX: REA), Fortescue Metals Group (ASX: FMG), Telstra Group (ASX: TLS) and Xero (ASX: XRO) are just some of the many companies that have bounced back off their lows.  Of course, TAMIM portfolios have seen similar movements. We’ve spoken about Helloworld Travel (ASX: HLO), IPD Group (ASX: IPG) and Silk Laser Australia (ASX: SLA) recently – all these companies faced share declines through 2020-2022 as the world faced extraordinary economic challenges but have rebounded strongly as conditions improved. The following Morgan Housel quote is about markets but is also transferable to recessions: “Every past market crash looks like an opportunity, but every future market crash looks like a risk.”

The TAMIM TakeawayWhether we are about to enter a recession or not as investors it’s not a time to panic. Rather, take stock of what you are invested in and find businesses that you are confident will be prospering in the long term. A recession or significant downturn can sharpen your focus on those companies that have the characteristics to be long term winners and weed out the losers. The game doesn’t change but potential opportunities do arise in falling markets.

Disclaimer: Helloworld Travel (ASX: HLO), IPD Group (ASX: IPG) and Silk Laser Australia (ASX: SLA) are held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.

|

What is a recession and what does it mean for investors?

What is a recession and what does it mean for investors?

Written by