Australian Equities

Australia Small Cap Income

Investor updates

Below you will find this month’s commentary and portfolio update for TAMIM Australia Small Cap unit class.

September 2025 | Investor Update

Dear Investor,

We provide this monthly report to you following conclusion of the month of September 2025.

The TAMIM Small Cap Income Fund was up +2.84% (net of fees) during the month, versus the Small Ords up +3.44%. Year to date the Fund is up +19.17%.

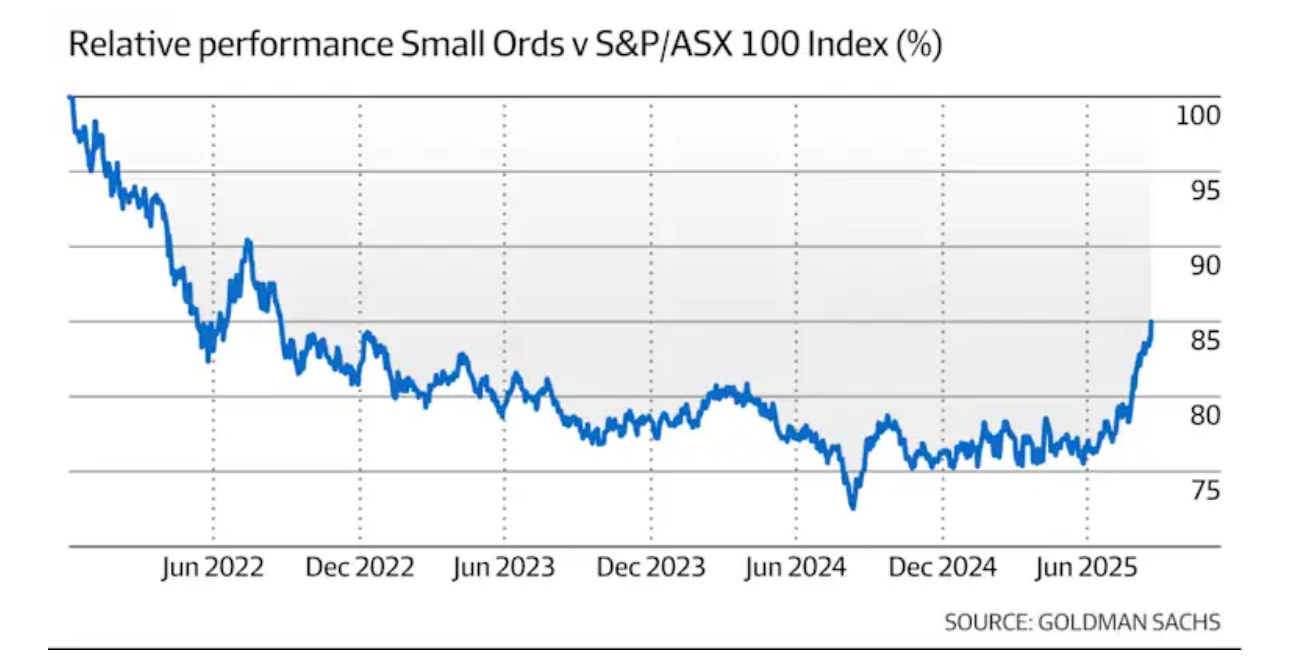

September saw the fund continue the streak of consecutive positive return months since March. Small/mid caps continue to play catchup and are outperforming large caps. We expect this trend to continue. The chart below highlights the relative underperformance of small caps vs large caps since 2022.

For small caps to catchup to their historical relative performance, there’s another +20% of upside to play out next 12 months.

We are currently in the midst of a generational bull market that began 3 years ago. As we enter the fourth year of this bull market there are plenty of reasons to see continued strength in markets but more importantly for small and mid caps to continue to outperform:

1. AI investment/innovation – is set to continue and drive significant economic growth next few years. We have already seen that play out in a very strong Q3 GDP growth in the US. The AI tech revolution has only just began and is resembling the early 1990s bull market driven by the internet which drove a 12 year mega bull market.

2. Interest rates – will continue their downtrend trajectory as central banks are no longer hampered by rising inflation and instead turn their focus on maintaining the jobs market and economic activity. We expect low rates to continue to provide tailwinds for smaller companies as these businesses are more sensitive to interest rate movements.

3. Small/mid caps – will continue to play catchup to large caps due to their 3 year underperformance. We are seeing a fierce catchup rally in this part of the market over the last couple of months. For small caps to truly catchup to their historical relative performance, there’s a further +20% upside to go at the very least. We expect this to play out during 2026.

4. Bull market 4th year – tends to be a strong performance year historically. The third year of a bull market tends to be choppy and we saw a near bear market after Liberation Day in April. The good news is once you can get past year three, year four of a bull market tends to be strong with an average return of +14.6%.

In saying all of the above, investors must remember that markets can’t continue going up in a straight line. The average bull market year sees at least 2-3 pullbacks of between -5% to -15%. In April we saw a -19% correction with a very quick SnapBack rally of +35% since the April lows to today. It is only inevitable that we will see a healthy pullback in the short term.

At the risk of sounding like a broken record – we remind investors that any market pullback should be considered as another good opportunity to deploy further funds into the market. As we head into October, historically this is the most volatile month of the year – so expect volatility and embrace it.

Finally we provide a brief commentary on portfolio updates during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in November.

Sincerely yours,

Ron Shamgar and the TAMIM Team.

Fund Performance

Portfolio Highlights

Symal Group Limited (ASX: SYL) has announced the acquisition of McFadyen Group, a Queensland-based water utilities contractor for $11 million and is forecasting annualised underlying EBITDA of $3 million in FY26. The deal is expected to be EPS accretive from the first year of ownership. Management also updated FY26 guidance for Normalised EBITDA to increased by $2 million to $117-$127 million. McFadyen founder and Managing Director, Ron McFadyen, will remain involved in the business.

SYL is a founder led contracting business servicing government and infrastructure clients across Australia with a majority focus on VIC. The company IPO was last year and the business ticks all the characteristics we look for with founder owning majority of the company, growing and profitable business, strong balance sheet in a net cash position, and an undemanding valuation of 10x PE versus a sector with peers trading on mid teens multiple.

We see the company continuing to win work in renewable projects and potential defence related work. Acquisitions are part of the strategy to expand into other states and sectors. We think the stock is on the cusp of a major re rate in the next few months towards our valuation of $3.00+.

Bravura (ASX: BVS) announced a positive upgrade for FY26, with revenue now projected at $265-275 million, up from $258.7 million, and cash EBITDA raised to $55-65 million from above $50 million. The revenue and cash Ebitda increase was driven by a combination of foreign exchange tailwind and $7 million in new professional services wins, primarily from EMEA wealth management, reflecting enhanced customer budget visibility, responsive pricing strategies, increased client efficiency spending, and regulatory upgrades. Professional services work is a good lead indicator for ARR growth.

Additionally, Bravura appointed Colin Greenhill as CEO, effective January 1, 2026. Greenhill, former CEO of SSP Worldwide (Constellation Software subsidiary), brings expertise in transforming businesses and driving customer-focused growth, positioning Bravura to capitalise on EMEA opportunities and pursue disciplined acquisitions. Colin is another Ex- Constellation software executive, and adds further pedigree to the company in improving cash Ebitda margins towards 30%. His entire LTI package is tied to cash Ebitda margins and share price performance - both measures that we focus the most as investors.

Emeco Holdings (ASX: EHL) has addressed press speculation during the month regarding potential control proposals. The company indicated it has received unsolicited interest from several potential acquirers with no binding proposals have been made at this time. A takeover bid could enable exit for 40% shareholder Black Diamond.

According to reports, Utah-based American Equipment Holdings, a major US overhead crane and hoist provider is leading takeover interest in EHL with other potential suitors include Saudi Arabia’s National Mining Company and Australia’s National Mining Services.

Emeco is currently valued at $611 million ($1.25) with strong cash flows providing rental equipment to clients in gold, iron ore, and coal industries. EHL reported FY25 net profit up 43% to $75.1 million and is trading at a discount to the $1.36 net tangible asset value. We initially bought EHL at 80 cents several months ago as we saw a good turnaround taking place and a focus on cash generation and improved margins. We also expect capital management next 12 months.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Australian Equities |

| Investment Universe: | Australian Small Cap |

| Reference Index: | ASX Small Ords |

| Number of Securities: | 20-40 (10-20 Value, 10-20 Growth) |

| Single Security Limit: | +/-5% |

| Market Capitalisation: | Small Cap |

| Leverage: | No |

| Portfolio Turnover: | <50% p.a. |

| Cash Level (typical): | 0-100% (0-50%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate + 2.50% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Distributions: | Semi-annual |

| Applications/Redemptions: | Monthly |

| Redemptions: | Monthly with 30 days' notice |

| Investment Horizon: | 3 - 5 years + |

Invest via TAMIM Fund

Request additional details by using the form or if you're ready to invest select the apply now button.

Invest via IMA

The TAMIM Australia Small Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.