Australian Equities

Australia Small Cap Income

Investor updates

Below you will find this month’s commentary and portfolio update for TAMIM Australia Small Cap unit class.

August 2025 | Investor Update

Dear Investor,

We provide this monthly report to you following conclusion of the month of August 2025.

The TAMIM Small Cap Income Fund was up +6.99% (net of fees) during the month, versus the Small Ords up +8.41%.

August saw equity markets continue to rally on the back of a positive but volatile reporting period for the ASX. Overall the Fund holdings experienced very positive results for most stocks. We have uncovered some new opportunities and exited a couple of underperforming ones. We feel the Fund is positioned extremely well over the next 6-12 months.

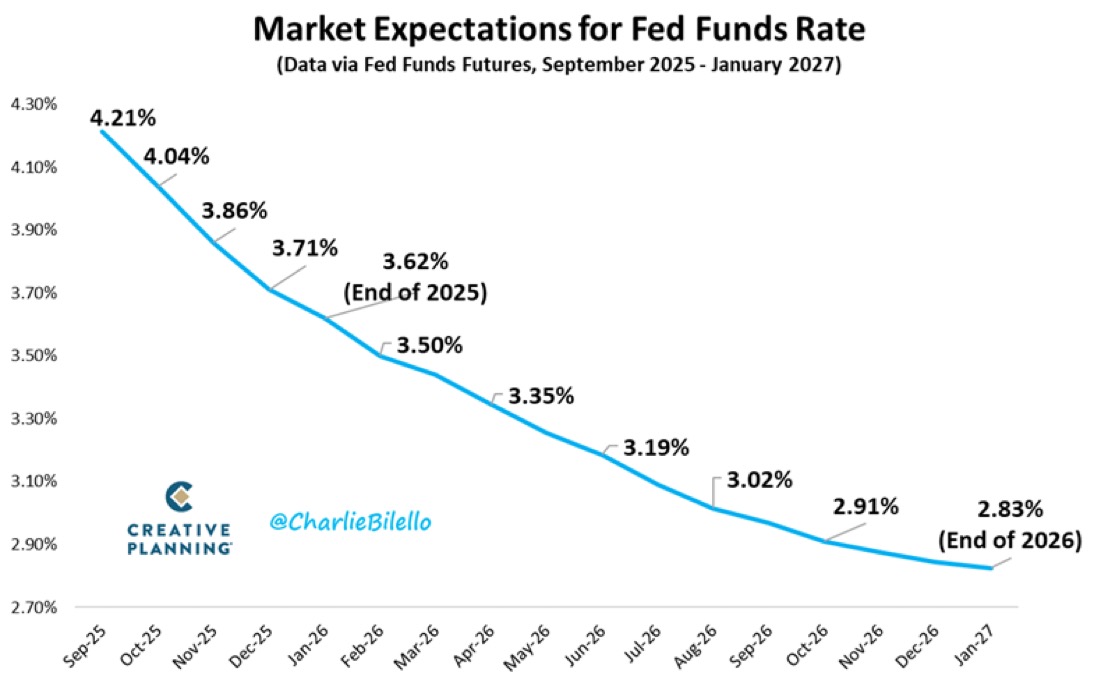

The market is increasingly positioning for rate cuts both in Australia and the US on the back of lower than expected inflation prints. The US bond market is now pricing in 3 rate cuts by year-end and 3 more cuts in 2026. That would bring the Fed Funds Rate down to 2.83%.

More importantly and as we have been highlighting for the last 12 months, small and mid caps are leading this rally and playing catchup to their larger peers. This catchup still has significant runway to go.

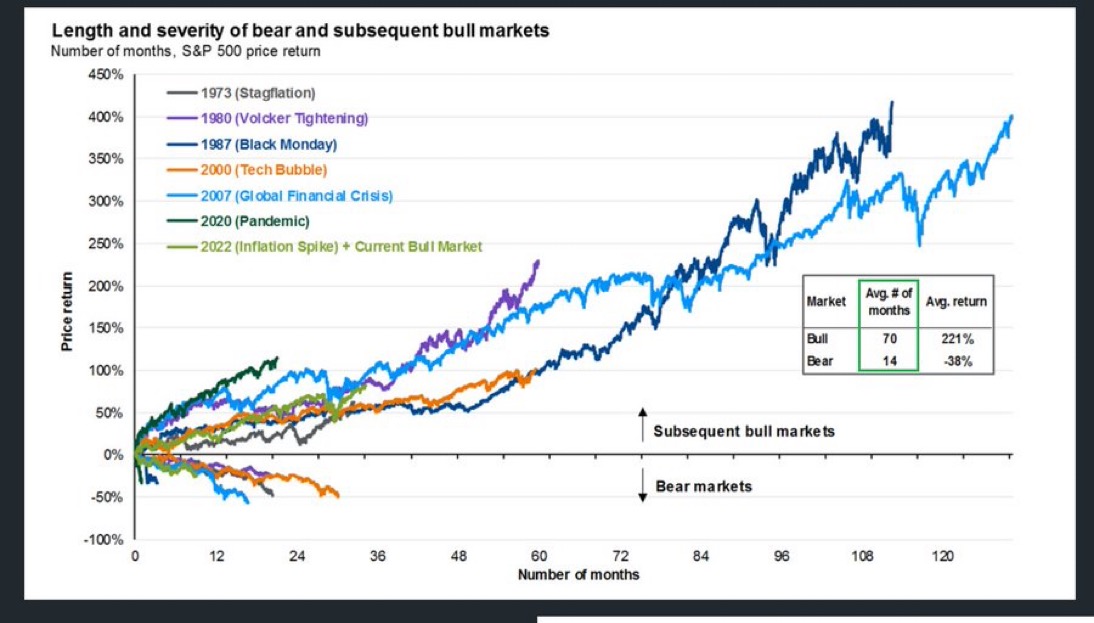

Finally this bull market turns 3 yrs old soon. As we’ve noted many times, this is still a rather young bull market and history would say there is likely many more years left. The past 50 yrs had 5 bulls get past their second birthday and the average was 8 yrs. The shortest was 5 yrs. We believe this bull market driven by AI thematic will be longer than average.

Investors should keep in mind that after several months of positive returns, it is always inevitable a possible market pullback may arise. We see any market pullback as a good opportunity to top up for the medium to long term.

Finally we provide a brief commentary on portfolio updates during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in October.

Sincerely yours,

Ron Shamgar and the TAMIM Team.

Sincerely yours,

Ron Shamgar and the TAMIM Team.

Fund Performance

Portfolio Highlights

Apiam Animal Health (ASX: AHX) has announced its FY25 results and strategic updates. Highlights include:

-

- Revenue increased by 1.4% to $207.6 million

- EBITDA grew by 5.2% to $25.8 million

- NPAT decreased by 83.1% to $0.8 million

- Final FY25 dividend of 1.0 cent per share

- New Interim Managing Director, Bruce Dixon, appointed on 5 June 2025

- Strategic Reset Program initiated to improve operations and shareholder returns

- Divestment of underperforming businesses, including a $4.5 million impairment loss

During the month the company received a Non-binding indicative proposal from Adamantem Capital to acquire Apiam at $0.88 per share and entered a process deed and exclusive Due Diligence. The bid values AHX at 10x EBITDA. Greencross is highly likely. We began buying AHX at 28 cents almost 2 years ago and more recently at 45-50 cents.

Servcorp (ASX: SRV) has reported its full year results for the period ending 30 June 2025. Highlights include:

-

- Underlying NPBIT: $69.1 million, up 23% on FY2024

- Underlying free cash: $84.9 million, up 17% on FY2024

- Operating revenue: $352.1 million, up 11% on FY2024

- Statutory net profit before tax: $62.6 million, up 46% on FY2024

- Statutory net profit after tax: $53.1 million, up 36% on FY2024

- EPS: 53.8 cents, up 35% from FY2024

- NTA: $2.17 per share, up 22% on 30 June 2024

- Final dividend: 14.0 cents per share, 10% franked; Total dividends for FY2025: 28.0 cents, up 12% on FY2024

- Expected dividends for FY2026: not below 30.0 cents per share

Having bought SRV under $3.00 almost 2 years ago, it was pleasing to see the stock re rate to over $7.00 recently. Including dividends, the total return so far has been 170%. We continue to see upside but have also taken profit above $7.00.

Pioneer Credit (ASX: PNC) has released its FY25 results. Highlights include:

-

- Net Profit after Taxation: $10.5 million, beating guidance by 17%

- Cash collections: $142.2 million (FY24: $140.5 million)

- EBITDA: $94.0 million (FY24: $88.7 million)

- PDP assets increased by $20 million Net assets up 37% to $60.6 million

- $34.3 million undrawn facilities avalable

- Preferred partner of the big four banks in Australia with Westpac beginning to sell PDPs to PNC.

- FY26 guidance includes a Statutory Net Profit after Taxation target of >$18 million for LTI vesting

Trading on 7x PE for FY26 and expectation of a potential dividend thru the year, we expect the stock to continue re rating to fair value of 80 cents.

Edu Holdings (ASX: EDU) is an education provider focusing on healthcare, education, and community services through two businesses: Australian Learning Group (ALG) and Ikon Institute. The company primarily serves international students with a strong pathway to employment and potential permanent residency.

In the first half of the year, EDU experienced significant growth, with revenue increasing 114% to $36 million and achieving a net profit of $6.3 million, compared to breaking even in the previous period. The higher education segment (Ikon) is the primary growth driver, with 5,300 total students, 4,800 being international.

Despite regulatory uncertainties around international student caps, the company remains optimistic about market conditions. Growth strategies include expanding course offerings, developing new programs in technology fields, and potentially pursuing acquisitions in the higher education sector.

EDU introduced its first dividend of 1 cent per share and sees continued potential in organic and inorganic expansion. Directors continue to buy shares on market and the buyback has been activated. We estimate for every $1 of revenue growth in FY26, at least 30% will drop to the NPAT bottom line.

ClearView Wealth (ASX: CVW) has long been a quiet achiever in the life insurance space. A modest market cap ($360 million), a reasonable share of the retail life market (~3.9%), and a history of being lumped in with other legacy life insurance businesses. But here’s the thing: ClearView is no longer a legacy business.

FY25 marked the company’s complete exit from wealth management and the successful rollout of its new cloud-based insurance platform. That’s a big deal. It signals a new phase for ClearView, one defined not by restructuring, but by scaling.

While many insurers continue to wrestle with ancient systems and slow customer onboarding, ClearView is now a digitally native player. Faster quote times, lower servicing costs, and customisable product design. That’s a material advantage in a world where insurance needs are becoming more personalised and where margin pressure is real.

Despite a tough start to the year, ClearView’s second-half results were surprisingly strong, delivering:

-

- $22.5 million in 2H25 life insurance underlying NPAT (up 12% YoY)

- In-force premiums up 10% to $412.9 million

- ClearChoice product premiums at $112 million since launch

- Embedded value up 5% to $524.4 million (82c per share ex-franking)

- Operating leverage across all major lines

Yes, full-year NPAT was down 5% to $37.7 million, but that only tells half the story. The real shift is operational: customer acquisition costs have stabilised, lapse rates have improved, and claims experience has returned to more predictable patterns. This is the kind of platform a business can grow from. In many ways, FY25 was about turning the ship. FY26 is where we expect it to pick up speed.

Now let’s talk capital management, a topic close to every value investor’s heart.

ClearView has already repurchased 11.4 million shares on-market as part of its FY25 buyback program. That’s about 4.5% of issued capital. The company has flagged its intention to continue, with a potential $20 million buyback capacity in the next 12 months.

Why is this important?

Because in a stock trading on a forward P/E of 7.8x FY26 EPS guidance, buying back shares is an accretive use of capital, particularly when the underlying NPAT is expected to rise 40%. It also suggests that the board sees the shares as materially undervalued.

We estimate the stock is trading at a large discount to embedded value, with no credit given for digital transformation, potential dividends in FY26, or optionality around strategic buyers.

ClearView’s FY26 guidance is, we believe, impressive:

-

- Gross premium income: $435–$440 million

- Life insurance underlying impact: $47–$52 million

- Group underlying NPAT: $42–$47 million

- EPS: 6.8–7.3 cents (implied P/E of ~7.8x at current price)

In our view, this guidance is both credible and conservative.

Why?

- Embedded value supports the earnings base, with higher lapse rates normalising and claims well within long-term expectations.

- ClearChoice is gaining traction, providing better cross-sell opportunities and a fresher brand in adviser channels.

- Digital systems reduce cost-to-serve, helping margins expand even without top-line blowouts.

And crucially: the business is no longer distracted by non-core operations.

Let’s dig deeper into the tech angle. This isn’t just window dressing. ClearView has spent the better part of two years replatforming its core insurance operations to the cloud and now that’s complete.

Benefits include:

-

- Faster policy issuance and servicing

- Lower unit costs on a per-policy basis

- Simpler product innovation cycles

- Real-time data tracking across claims and underwriting

This enables ClearView to compete with insurtechs on speed and digital delivery, while still offering the scale and trust of a licensed life insurer. For financial advisers and brokers, that’s an attractive combo, particularly as regulatory scrutiny intensifies.

In many ways, the company now looks like a platform-enabled compounder. That’s not something you could say even 18 months ago.

One of the more subtle features we look for in a business is “founder mentality” even when the founder isn’t in the building.

ClearView has long been run by a pragmatic, capital-disciplined management team. FY25 only reinforced that image. Rather than chasing growth at any cost, they opted for:

-

- Operational simplicity

- Scalable systems

- Shareholder return via buybacks

- Clear guidance and delivery

These are the hallmarks of a management team that acts like owners. As small cap investors, we’re always hunting for this mindset particularly in financial services, where discipline can slip.

We’ve said it before, and we’ll say it again: ClearView remains a takeover target.

Why?

-

- Clean balance sheet (net cash)

- Fully migrated digital systems

- Scalable retail life platform

- Trading at EV/EBITDA levels that private equity would typically salivate over

We also note that 80% of Australia’s life market is controlled by a handful of large players, many of whom struggle with legacy infrastructure. Acquiring ClearView would instantly plug a modern retail life engine into a broader financial services machine.

Add in potential offshore interest (particularly from Asia) and the story becomes compelling. We’re happy holding for the earnings growth alone — but optionality is there.

Of course, no investment is without risk. With ClearView, the primary ones are:

- Claims volatility, as always, one-off spikes can impact quarterly earnings.

- Tech migration challenges, although largely complete, any post-migration bugs could cause adviser friction.

- Distribution risks, heavy reliance on IFA channels could be impacted by regulatory changes or sentiment shifts.

- Investor perception, many still treat CVW as a “legacy insurer” and haven’t re-rated the digital potential yet.

That said, we believe the risks are increasingly asymmetric, tilted in favour of upside surprises in margins, earnings, and capital returns.

At the current share price (~56 cents), ClearView trades on:

-

- 7.8x FY26 P/E

- EV/EBITDA ~6x

- Price to embedded value ~0.7x (ex franking)

For a digitally modern, cashflow-generative, buyback-running insurer with 40% forecast earnings growth, this is cheap.

In fact, it’s hard to find peers with:

-

- Cloud-based platforms already live

- Strong guidance and historical delivery

- Buyback in place

- High gross margins and low debt

Our internal valuation model suggests a target range of 80–90 cents, excluding any optionality from a potential take-over.

ClearView Wealth is no longer the clunky, underperforming life insurer of old. It has evolved into a digitally enabled, capital-efficient platform business with buyback support, earnings momentum, and the optionality of strategic interest. We believe CVW is at an inflection point. With earnings guidance of up to $52 million, a lean balance sheet, and a shareholder-friendly capital allocation approach, we see material upside from here. In a market starved of quality, low multiple growth — ClearView might just live up to its name.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Australian Equities |

| Investment Universe: | Australian Small Cap |

| Reference Index: | ASX Small Ords |

| Number of Securities: | 20-40 (10-20 Value, 10-20 Growth) |

| Single Security Limit: | +/-5% |

| Market Capitalisation: | Small Cap |

| Leverage: | No |

| Portfolio Turnover: | <50% p.a. |

| Cash Level (typical): | 0-100% (0-50%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate + 2.50% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Distributions: | Semi-annual |

| Applications/Redemptions: | Monthly |

| Redemptions: | Monthly with 30 days' notice |

| Investment Horizon: | 3 - 5 years + |

Invest via TAMIM Fund

Request additional details by using the form or if you're ready to invest select the apply now button.

Invest via IMA

The TAMIM Australia Small Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.