Australian Equities

Australia Small Cap Income

Investor updates

Below you will find this month’s commentary and portfolio update for TAMIM Australia Small Cap unit class.

June 2025 | Investor Update

Dear Investor,

We provide this monthly report to you following conclusion of the month of June 2025.

The TAMIM Small Cap Fund was up +3.08% (net of fees) during the month, versus the Small Ords up +0.85%.

The month of June carried over from May with another positive return. Both the US and Australia has seen easing inflation metrics during the month which have now set the RBA on an aggressive path to cut rates between 2-4 times this year and the US Fed for at least another 2 cuts and possibly more.

We continue to identify some exciting companies with strong growth prospects and have received several takeover offers for some of the holdings in the fund (SMP, JLG, HUM, SLH to name a few). We expect M&A to heat up even more during the second half of the year. In addition, the IPO gates have reopened and we are keeping an eye out for new opportunities.

We are expecting some very positive updates during July and August and are generally bullish on the outlook for markets going into Xmas and next year.

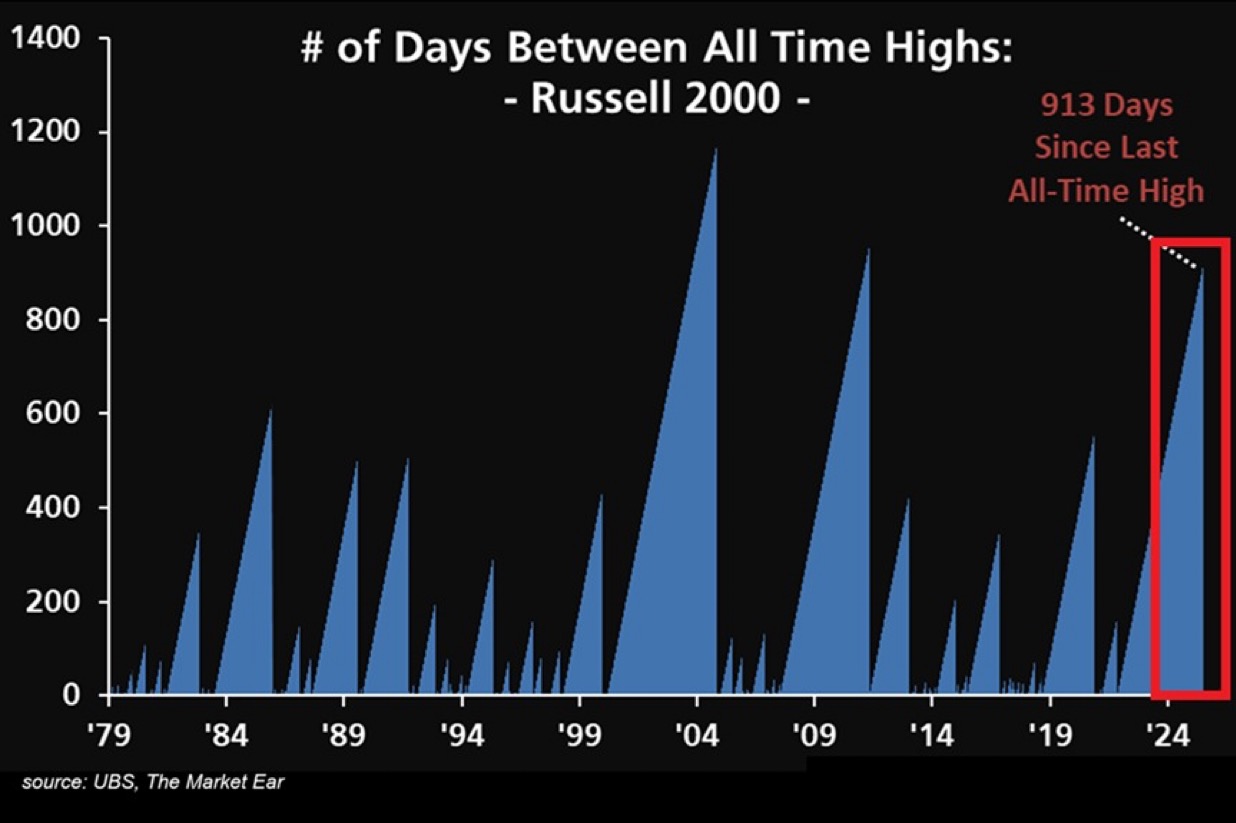

Small caps have continued to underperform large caps with the Russell 2000 index going 913 trading days without hitting an all-time high – the longest streak in 14 years. This also marks the 3rd-longest stretch in history. The index is currently trading ~10% below its November 2021 peak. While the Nasdaq 100 and S&P 500 have reached multiple record highs in 2025, small caps continue to lag.

Year-to-date, the Russell 2000 is flat, significantly underperforming the S&P 500 and Nasdaq, which are up 5.9% and 7.8%, respectively. All this means that there is considerable latent upside in small caps and with lower rates on the horizon – we believe this might just be the catalyst for a catchup rally next 6-12 months which will be reflected on ASX small cap companies.

Finally we provide a brief commentary on portfolio updates during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in August.

Sincerely yours,

Ron Shamgar and the TAMIM Team.

Fund Performance

Portfolio Highlights

Apiam Animal Health (ASX: AHX) announced that Dr. Chris Richards will step down as CEO and Managing Director after over nine years. Mr. Bruce Dixon (15% shareholder), a non-executive Director, has been appointed Interim Managing Director. Dixon brings extensive experience, having successfully led Healthscope (1997–2010) and Spotless Holding Ltd (2012–2015), and served as founder and Chair of Australian Venue Co until its 2024 sale. Chairman Andrew Vizard noted the leadership change aligns with Apiam’s focus on revenue growth and operational efficiencies during the transition.

We view this change as a critical step to restore value in the company. Following discussions with the company we see new leadership focus in improving clinic margins to 20%+ and reducing corporate overheads. We believe the company should improve EBITDA from $20m to $30m in 12-18 months. With a fragmented industry and two PE backed competitors (Vetpartners & Greencross), we see AHX as a takeover target at 10-12x EBITDA or $1.00+.

Motorcycle Holdings (ASX: MTO) has announced a significant acquisition of Peter Stevens and Harley Heaven, marking a transformative moment in the motorcycle retail industry. The deal, valued between $7-9 million, encompasses seven dealerships across four states and is set to reshape the company’s national presence.

CEO Matthew Wiesner outlined the strategic vision, highlighting the acquisition’s potential to increase MTO’s market share from 16% to approximately 20% of new bike sales. The transaction will expand the company’s geographical reach, particularly into South Australia and Western Australia, while preserving the acquired brands’ legacy.

Financially, the acquisition is expected to be EPS accretive in the first half of FY26, adding roughly 25% to MTO’s existing revenue and at least $4.5 million of PBT before further synergies. The company will retain approximately 200 staff members and integrate the businesses with minimal disruption. Notably, the purchase will be funded through existing cash reserves, with no goodwill premium paid. We estimate FY26 EPS of between 32-36 cents and our valuation is $4.00+.

Superloop (ASX: SLC) has upgraded its guidance for FY25:

-

-

- Underlying EBITDA for FY25 is expected to be at or above $91 million, exceeding the previous guidance range of $83-$88 million.

- This represents an increase of over 67% from FY24 underlying EBITDA.

- FY25 cash capex remains on track for the $28-$30 million range

-

Additionally the company is active in potential M&A discussions which we believe are a key catalyst and will be very accretive. We estimate FY26 EBITDA of $110 million which will represent over 20% organic growth at the very least. SLC is the fastest growing telco on the ASX and deserves a premium multiple. We see fair value closer to $4.00.

GTN Limited (ASX: GTN) provides traffic updates on the radio in return for selling radio ad slots. The company has provided an earnings update for FY25 and a proposed capital return of approximately A$44 million to shareholders. (A$0.23 per share)

Update includes:

-

-

- Expected Group revenue: $178 million to $182 million (compared to $184.2 million in FY24)

- Expected Adjusted EBITDA: $15.5 million to $17.5 million (compared to $22.3 million in FY24)

- Expected closing cash: $23 million to $25 million after dividends, debt repayment, and share buy-back

- New $35 million bank debt facility finalised in March 2025, remains undrawn

-

We first bought GTN around 52 cents as an activist shareholders made a partial bid for the company and indicated capital management initiatives in future. The update during the month was mixed. The capital return and future dividend payouts are positive but the earnings during the 2H have deteriorated considerably. We see the stock firming towards 70 cents going into the capital return ex date and we will reassess our position at the full year results.

EDU Holdings (ASX: EDU) is a tertiary education group operating two main segments: a vocational business targeting international students and a higher education business, Ikon Institute, serving both domestic and international students.

With campuses in Sydney, Melbourne, Brisbane, and Adelaide, EDU has over 5,000 students, primarily international, recruited through education agents. The company’s strategy involves developing courses in high-demand fields like early childhood education, community services, and healthcare, with a focus on employability and migration pathways.

EDU has experienced significant growth, particularly in its higher education segment, by offering three to four-year courses at around $17,000 per year. The business is expanding its offshore recruitment channels and considering strategic acquisitions to diversify its revenue streams and reduce regulatory risk.

At $50m market cap the company should have $15m of net cash, and generate $12m NPAT so is currently trading on 3x profit. We expect dividends to be paid soon and Directors have been recently buying. We believe the stock could double this year.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Australian Equities |

| Investment Universe: | Australian Small Cap |

| Reference Index: | ASX Small Ords |

| Number of Securities: | 20-40 (10-20 Value, 10-20 Growth) |

| Single Security Limit: | +/-5% |

| Market Capitalisation: | Small Cap |

| Leverage: | No |

| Portfolio Turnover: | <50% p.a. |

| Cash Level (typical): | 0-100% (0-50%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate + 2.50% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Distributions: | Semi-annual |

| Applications/Redemptions: | Monthly |

| Redemptions: | Monthly with 30 days' notice |

| Investment Horizon: | 3 - 5 years + |

Invest via TAMIM Fund

Request additional details by using the form or if you're ready to invest select the apply now button.

Invest via IMA

The TAMIM Australia Small Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.