Listed Property

Investor Updates

October 2024 | Investor Update

Dear Investor,

The TAMIM Listed Property unit class delivered a -1.07% return for the month of October 2024. For comparison the A-REIT index was -2.52% while the G-REIT index was 0.72%.

Australian Listed REIT Portfolio (AUD)

We saw the A-REIT market take a backward step from a good run for the first time in 6 months after delivering 26.12% YTD up to the end of September. The A-REIT market was down -2.52% for October, only the second negative monthly return for 2024. The Tamim portfolio was also down for the month with -1.42% but did manage to beat the A-REIT market. The ASX 200 outperformed the A-REIT market for the month as well, delivering a negative return of -1.31%.

The A-REIT market took a dip across the board with all sectors being down for the month. The best performing sectors were the Industrial sector (-1.0%), followed by the diversified sector (-3.1%) and then the Retail sector (-3.6%). GMG drove the Industrial sector performance by only being down 0.95% for the month. The worst performing sectors were the Office sector (-5.4%) followed by the Residential sector (-4.2%). The market was somewhat muted from the overhang of specifically the US elections and the possible impact of policy changes on global markets. It was always going to be a tightly contested election with both the Republicans and the Democrats having a respectable chance of pulling it through.

Economic data received during the month was a mixed bag and included, household spending slowing to +1.7% y/y in August 2024 after a +2.4% increase y/y in July 2024; employment increased by 64k m/m (+0.4%) in September 2024 beating expectations; and 3Q24 trimmed mean CPI came in at 3.5% y/y, broadly in line with market and RBA expectations. The market is still expecting the first RBA rate cut in February 2025, but there is increasing probability that this might be pushed out to as far as July 2025. HMC was the best performing holding for the month of October delivering 24.03%. On 24 October it announced key initiatives to establish a global digital infrastructure platform comprising the global DigiCo Infrastructure REIT intended to be listed on the ASX alongside a new institutional Unlisted Fund.

HMC agreed to acquire 100% of Global Switch Australia for $1.937bn, a highly strategic 26 MW colocation data centre in Sydney CBD. The market reacted to the news and pushed up the stock price on the day and up to the end of the month. There were no other holdings performing specifically well, with negative returns for the month for all other holdings. The underperformers for the month were BWP Trust (-8.00%) and Cromwell Property Trust (-7.65%), with no material news coming out for either of them during October.

The monthly inflation data for September 2024 was released on 30 October and was 2.1%, down from the 2.7% reading in August and the fifth straight drop from the high point of 4.0% in May. This is now the second month in a row where the reading is within the RBA’s target range of 2-3% and is largely attributable to the ongoing impact of the Energy Bill Relief Fund rebate. Electricity prices dropped significantly by -24.1% vs -17.9% in August. This adds to the positive side of the argument for the RBA to contemplate decreasing interest rates but the expectation for the next meeting in early November is still to keep rates constant.

Australia has been one of the better performing regions over the short to medium term. On a year to-date basis it has delivered 10.3% in USD, only beaten by the US which delivered 11.7%. Most other regions are still in the negative on a year-to-date basis. Including the global REIT run in November and December 2023 and thus looking at a 12-month rolling return, Australia has outperformed all other regions. The global 12-month REIT market return in USD was 28.7%. There is thus some speculation of downside risk to the A-REIT market where a pull back is possibly expected from the economic backdrop and interest rates being kept constant compared to other regions globally.

Economic growth has slowed, and while inflation is easing from its peak, it remains high due to ongoing supply and demand imbalances, especially in areas like rents for new housing. The IMF predicts a modest recovery in 2025, with growth increasing from 1.2% in 2024 to 2.1% in 2025. Australia’s strong economic institutions and policies provide a solid foundation for long-term stability and growth. However, the economy is likely to face short-term challenges, as tighter monetary policies are expected to remain in place for some time.

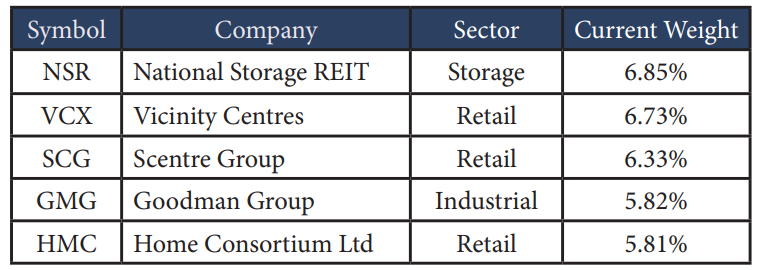

The current Australian portfolio component consists of 24 stocks. Below are the top 5 holdings:

Reitway Global Property Portfolio (USD)

The portfolio returned a negative result for the first time in six months with -5.69% for October. The benchmark (GPR 250 REIT Index) outperformed the portfolio although it was also down -4.91%. The month was dominated by the anticipation of the elections in the United States and the Global REIT market took a dip with some possible policy changes anticipated to negatively affect REIT returns. There was building speculation that Trump would achieve the desired result and that he and Elon Musk are aligned with objectives of amongst others growth in the US and the market seemed to follow the securities in these sectors which could gain most with Trump getting back into the hot seat.

Another force driving the REIT market down was the US 10 Year which picked itself up from 3.80% at the start of the month and continued to climb to 4.28% at the end of the month. This 12.6% increase could possibly be ascribed to uncertainty in the market, but many factors play a role. In general, the 10 Year would rise if there were a falling demand for this asset, which would mean that investors are preferring more risky assets based on the economic landscape. Thus, as investors started rotating to this riskier asset classes such as Technology, the 10-year yield was pushed up and REITs took a knock, finding it harder to compete with this lower risk asset at higher yields.

The global REIT market saw no individual area or country delivering a positive return for the month. Three of the main regions in Canada, Spain and the United Kingdom were all down around the 12% mark for the month. Canada was driven down by specifically the Apartment constituents; Spain by the Diversified constituent and the UK was hit across the board. The US was the most resilient region as could possibly be expected by its size and diversity in sectors, only being down -3.47% for the month. 2 Sectors to highlight in the US that did take some pain was the Industrial sector (-10.02%) and the Self-Storage sector (-9.67%).

The best performing holdings in the portfolio was Digital Realty (DLR +10.13%), Welltower (WELL +5.35%) and Macerich (MAC +5.17%). DLR is a Data Centre REIT and released its 3Q24 results on 24 October which the market reacted very favourably to, pushing its share price up for the day by 10.8%. The REIT inked roughly 190MW of new leases during the quarter, which upon commencement will generate more than $520m in annualised GAAP rent. The bulk of these lease was for hyperscalers and that should be a stable and significant source of rental going forward. Another highlight to mention was their cash re-leasing spreads which increased 15%. There is arguably no better sector than Data Centres in the REIT world now when you look at long term growth opportunities. Welltower and US Healthcare as a sector had a strong month and was an outstanding sector across the REIT universe, delivering +2.69% for October.

The worst performing stocks was the Canadian apartment names in Boardwalk REIT (BEI -18.06%) and Canadian Apartments (CAR -16.65%). This sector in Canada took a knock from news coming out that the Canadian government is planning to pause population growth by implementing a new immigration plan. The new plan includes controlled targets for temporary residents, specifically international students and foreign workers, as well as permanent residents. Canada’s temporary population should decline by 445k people per year in 2025 and 2026 based on the new plan. This was obviously not positive for Apartments with a limitation placed on demand in the future.

Industrial was by far the worst performing sector (-10.02%) and this pulled down the index considerably due to its size (16.64%). UK Industrial was down -13.89%, US Industrial -9.99% and Singapore Industrial -8.52%. Rexford Industrial (REXR) was the worst individual name of the lot, down -14.75%. There has been a lot of news on this sector on oversupply coming onto the market that has served as an impediment for investors to support this sector. Prologis, the biggest REIT in the world and roughly 8.37% of the Index was down -10.56% for October.

The IMF projected a global growth rate of 3.2% for 2024-2025 in their World Economic Outlook report. The report also noted that the balance of risks is tilted to the downside, and that fiscal policy needs to be sustainable to rebuild fiscal buffers. Central banks have commenced with the interest rate cutting cycle. There was no interest rate decision for the US nor the BOE in October however, but the next one in early November is expected to be a 25bp cut by each. The ECB did cut interest rates by 25bps on 17 October and BoC cut rates on 23 October by 50bps. Interest rates generally have started moving in and towards the lower end of the various target ranges of central banks.

Fund positioning remains roughly the same (quality, value, structural trend riders, and blend between offensive and defensive). The REIT market now has an increased appetite for risk in an easing cycle starting to unfold with global central banks starting their rate cutting cycles.

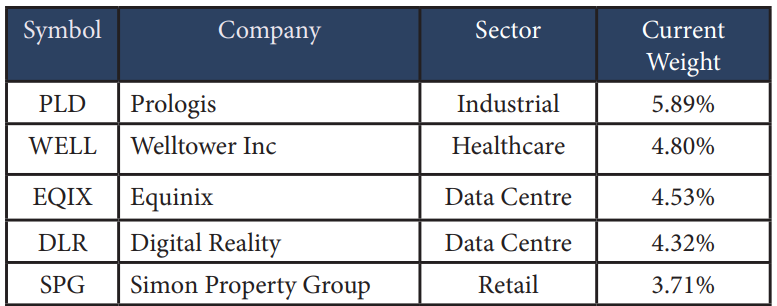

The Tamim global property portion invested in the Reitway Global Property Portfolio currently consists of 50 stocks. Below are the top 5 holdings:

We believe real estate fundamentals are still sound and remain steadfast in our belief that the asset class can post meaningful returns relative to stocks and bonds, even against a slower growth, higher inflation backdrop.

Fund Performance

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Listed property & property related securities |

| Number of securities: | 40-50 |

| Single security limit: | 10% |

| Region limit: | 70% |

| Sector limit: | 70% |

| Investable universe: | Listed property & property related securities |

| Market capitalisation: | N/A |

| Derivatives: | Yes – special instances & hedging |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-20%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 0.98% p.a. |

| Admin & Expense Recovery: | Up to 0.25% |

| Performance Fee: | Nil |

| Hurdle: | N/A |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly (with 30 day notice) |

| Distribution: | Quarterly |

| Investment Horizon: | 3-5+ years |