Listed Property

Investor Updates

November 2024 | Investor Update

Dear Investor,

The TAMIM Listed Property unit class delivered a 1.44% return for the month of November 2024. For comparison the A-REIT index was 2.48% while the G-REIT index was 3.20%.

Australian Listed REIT Portfolio (AUD)

The A-REIT market got back on the horse after dropping in October, delivering 2.48% for the month of November. It underperformed the ASX 200 for the month, which delivered 3.79%. The November performance of the A-REIT market has now brought the YTD total return to 26.00%. The ASX 200 has only delivered 15.07% YTD and the GPR 250 REIT Index (a global REIT index) only 15.65% in AUD. The A-REIT market is heavily influenced by Goodman Group (GMG) with roughly a third of the index weight, and it has delivered 48.64% YTD. The Tamim portfolio delivered 2.21% for the month of November, slightly underperforming the A-REIT market.

There was solid performance from all sectors across the board. The best performing sector was Residential (+4.8%), Industrial (+3.3%), Retail (+2.3%) and Diversified (+1.6%). Only the Storage sector was slightly down for the month, -0.4%. Some of the large-cap names provided quarterly updates in November. Some highlights include the following. GPT: Logistics metrics over the quarter was consistent; Office occupancy was slightly down; Retail will be one to watch with sales growth slowing. GMG: Data Centres remain the focus as we have also seen in the global space; The global power bank was flat at 5GW although secured power lifted marginally to 2.6MW. Like-for-like NPI growth was robust at 4.9%. SCG: Occupancy was very healthy at 99.4%; Releasing spreads improved to 2.7%in Q3.

HMC was again the best performing holding for the month of November delivering 21.24%. HMC continued its performance from October. This stems mainly from the global digital infrastructure platform comprising the global DigiCo Infrastructure REIT HMC Capital intended to list. It did so on 21 November and was very well received. The enterprise value of the newly listed REIT is AUD4.3b of Data Centres is Australia and the US. Lendlease was the second-best performing REIT for the month with 5.60% but had no significant news. SCG was third best with 4.84%, providing an operating update with solid operational metrics and improving leasing spreads. The underperformers for the month were Cromwell Property Trust (-8.41%) and Eureka Group Holdings (-7.09%).

THE RBA kept the cash rate constant at its meeting held on 5 November 2024, as expected. The Cash rate has now been 4.35% since November 2023, which was also the 8th straight meeting. The central bank made comments around headline inflation that has significantly declined and is expected to remain lower for a while, but also that the underlying inflation remained too high. The upside risks seem to have outweighed the option of cutting rates and the RBA is aiming to stay sufficiently restrictive until it is confident that inflation is moving sustainably towards the target range.

The monthly Consumer Price Index (CPI) in Australia increased by 2.1% year-on-year in October 2024, holding steady for the second consecutive month but falling short of market forecasts of 2.3%. This reading is still the lowest it has been since July 2021, prevailing within the target range of 2-3% for the third consecutive month. Electricity prices saw another record decrease (-35.6% vs -24.1% in September), and automotive fuel continued to decline (-11.5% vs -14%). Prices for food (+3.3%), alcohol and tobacco (+6.0%), health (+3.9%) and education (+6.3%) however all rose.

We saw steady economic data released during the month. The jobless rate for October stood at 4.1%, steady for the third consecutive month and matching market estimates. The number of unemployed individuals increased by 8,300 to a three-month high of 625,800. The Westpac-Melbourne Institute Consumer Sentiment Index of Australia hit a 2.5 year high, rising 5.3% to 94.6 points in November. The outlook and the economy and finances finally has turned to an optimistic tune. Still, the index has now held below 100 for nearly three years, indicating pessimists continue to outnumber optimists.

The overall A-REIT market outlook is slightly positive, with some market participants and analysts expecting a 10-15% return in 2025. The Industrial and Retail sectors have returned positive returns for 2024 and is expected to continue to deliver, while Office and Diversified REITs have struggled. Australia’s strong economic institutions and policies provide a solid foundation for long-term stability and growth. However, the economy is likely to face short-term challenges, as tighter monetary policies are expected to remain in place for some time.

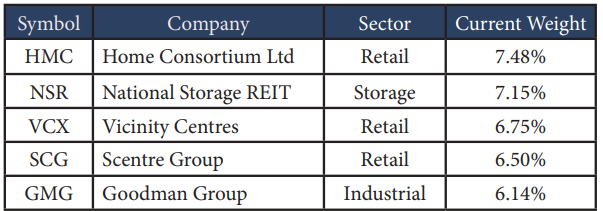

The current Australian portfolio component consists of 24 stocks. Below are the top 5 holdings:

Reitway Global Property Portfolio (USD)

The portfolio returned to positive monthly returns after October, with +2.56% for November 2024. The benchmark (GPR 250 REIT Index) slightly outperformed the portfolio with 2.64%. On a YTD basis the portfolio has now delivered 5.92% in USD. The year of the elections are almost over, and the US elections specifically is also now a done deal. Trump has most certainly had an impact on the markets, and we expect a little more volatility in the near future until we receive more clarity on policies and tariffs to be implemented. We have also seen the market take a new liking in tech stocks such as Tesla with the Elon-effect weighing in on investor decisions.

Uniti Group (UNIT) was the best performing stock in the portfolio for the month of November, delivering 16.57%. UNIT is on the recovery path after an announcement earlier in the year that they will enter a transformational merger with Windstream which should be closed by the second half of 2025. UNIT also presented at the Nareit conference, and the market took some positives from the delivery by President and Chief Executive Officer, Kenny Gunderman. Macerich was the second best performing holding during the month based on momentum from strong leasing activity and balance sheet strengthening from efforts which should lower leverage.

Regional Malls were the best performing sector in the portfolio, delivering a portfolio return of 10.10%. Macerich (MAC) delivered 14.42% and Simon Property Group (SPG) delivered 8.56%, largely contributing to the performance of the sector. Malls have come onto Santa’s “Nice list” and the sector seems to be poised to take advantage of market conditions. Operating results of the sector exceeded expectations as occupancy surprised to the upside. Foot-traffic at “A” malls is up 4% YoY and is marginally above pre-Covid levels. We see the sector attractively prices on a relative basis with solid tenant demand.

On the 7th of November the US Federal Reserve cut interest rate by 0.25%, as expected. The rate is now 4.75% after the 0.50% reduction the previous month. The expectation on the street is that there will be another 0.25% reduction at its December meeting. The Fed reiterated that they would continue to carefully assess incoming data, the evolving outlook, and the balance of risks when considering additional adjustments to borrowing costs. On the 14th of November Chair Powell said in a meeting that the Fed is not in a “hurry” to cut rates, based on their assessment of the economy and the inflation data.

The US PCE prices rose by 2.3% year-on-year in October as the data was received on 27 November 2024. This was in line with expectation but higher than the previous month’s reading of 2.1%. The labour market in the US remains robust and it seems now that the Fed will adopt a more gradual rate cut approach with optimism that inflation is subsidising.

The best performing region was the US with 3.85% for the month, followed by Australia with 2.37%. The worst performing regions were Japan with -4.08% and Singapore with -3.89%. We have seen the east struggle the whole year and the US has been the dominant region. The US economy has proven very resilient and probably only Australian REITs have been able to keep up with the it.

For many of the sectors in the REIT market there seems to be a slight tilt to the positive after what seems to have been the worst of the rate hiking cycle(s) now behind us. In general, REITs outperform general equities post the hiking cycle but there is a new expected norm of rates being “higher for longer”. Most central banks have now started cutting rates and inflation readings are generally well within target bands, but there is still a significant amount of cuts to come and also a lot of uncertainty with global markets still wary of the impact of the Russia-Ukraine war, the impact of new leaders on global relations, inflation that could possibly lift its head again and unknown events such as those we have seen in recent times. How this will play out exactly is still to be seen, but as a global REIT market investor we are more positive for 2025.

Fund positioning remains roughly the same (quality, value, structural trend riders, and blend between offensive and defensive). The REIT market now has an increased appetite for risk in an easing cycle starting to unfold with global central banks starting their rate cutting cycles.

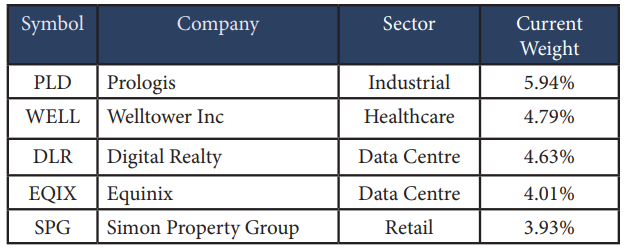

The Tamim global property portion invested in the Reitway Global Property Portfolio currently consists of 50 stocks. Below are the top 5 holdings:

We believe real estate fundamentals are still sound and remain steadfast in our belief that the asset class can post meaningful returns relative to stocks and bonds, even against a slower growth, higher inflation backdrop.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Listed property & property related securities |

| Number of securities: | 40-50 |

| Single security limit: | 10% |

| Region limit: | 70% |

| Sector limit: | 70% |

| Investable universe: | Listed property & property related securities |

| Market capitalisation: | N/A |

| Derivatives: | Yes – special instances & hedging |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-20%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 0.98% p.a. |

| Admin & Expense Recovery: | Up to 0.25% |

| Performance Fee: | Nil |

| Hurdle: | N/A |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly (with 30 day notice) |

| Distribution: | Quarterly |

| Investment Horizon: | 3-5+ years |