Listed Property

Investor Updates

Below you will find this month’s commentary and portfolio update for TAMIM Listed Property unit class.

April 2024 | Investor Update

Dear Investor,

The TAMIM Listed Property unit class delivered a -5.62% return for the month of April 2024. For comparison the A-REIT index was -7.71% while the G-REIT index was -4.98%.

Australian Listed REIT Portfolio (AUD)

We saw the end of a good run of monthly positive returns from the Australian REIT market ended abruptly in April, with the ASX 200 REIT Index returning -7.71%. The portfolio return was in line with the A-REIT market with -7.77% for the month.

For the 5-month period from November 2023 to the end of March 2024, the ASX 200 REIT Index returned 44.51%, and it seemed inevitable that the good run required cooling off. Compared to the Australian REIT market, the ASX 200 delivered 18.65% over the same 5 months to the end of March 2024. The ASX 200 on a year-to-date basis to the end of April 2024 has delivered 2.24% and the ASX 200 REIT Index came in with 7.66% even after the fall in April. To put the A-REIT market April return in perspective, Global REITs were down -5.4% in USD.

By sector, Residential (-10.9%), Office (-10.0%), Storage (-10.0%) and Diversified (-9.8%) pulled down the market the most, accumulating to roughly a third of the Index weight. The best performing sector was Industrial, only down -6.4%, followed by Retail which was down -7.1%. The higher beta stocks and sectors were generally pulled down by slight moderation of expectations of rate cuts to follow in the near future.

BWP (-1.1%) was one of the best performing names in the portfolio after reaching a 90% acceptance of its offer to acquire Newmark Property REIT. Post incorporation of the Newmark earnings, BWP’s earnings are looking slightly better, they also have low gearing, defensive income (strong covenant) and lease structures (triple net, CPI-linked escalations) which is attractive in a higher for longer rate environment.

There was no RBA meeting in April. The RBA’s latest decision to maintain the cash rate at 4.35% in Australia aligns with the Reserve Bank’s overarching objective of facilitating a gradual reattainment of inflation within the 2–3% target range and bolstering the labour market towards full employment. Emphasising the paramount importance of restoring inflation to the desired level, the board underscored the necessity of preserving the labour market gains achieved thus far. Economic indicators suggest that the economy is on a trajectory largely in line with expectations, despite notable uncertainties, with risks perceived to be evenly distributed. The consensus forecast in May is to keep the cash rate unchanged but neither a decrease nor an increase have been ruled out.

The Consumer Price Index (CPI) rose by 3.5% in the year leading up to March 2024. This is a slight increase from the previous three months, where it was at 3.4%, which was the lowest since November 2021. The recent reading is above the expected 3.4%, marking the highest level in four months. The increase was mainly driven by higher prices in housing and transportation. Housing prices, including rents, new dwelling prices, and electricity, rose by 5.2% compared to 4.6% previously. Transportation costs also went up by 4.5% from 3.4%, largely due to higher automotive fuel prices. Additionally, education and health prices increased by 5.2% and 4.1% respectively. Food and alcohol prices continued to rise, but at a slower rate, while communication and clothing prices saw minor decreases. Excluding volatile items and travel, the CPI climbed by 4.1% in March, up from 3.9% in February. Overall, inflation in Australia remains above the Reserve Bank’s target range of 2-3%.

Unemployment figures for March was released this month and rose by 0.1% to 3.8%, up from the previous month, but was below the consensus expectation of 3.9%. Februarys 3.7% was at a five month low and even though a small increase was observed for March it is still showcasing a stronger labour market. The number of unemployed individuals rose by 20k to 570k individuals. Consumer sentiment numbers from the Westpac-Melbourne Institute Consumer Sentiment Index fell 2.4% to 82.4 point in April, down for the second consecutive month on the back of persistent inflation and high interest rates.

We find ourselves in uncertain waters as to when and how fast rate cuts will be initiated by the RBA as is the case with many countries and their central banks, claiming that decisions are all data dependent and occasionally even claiming hikes are not totally off the cards with sticky inflation readings coming out. Time will tell and although the Australian REIT market has had good returns compared to other global REIT markets in recent times, it should be a positive thing for the market in general if inflation does start coming back into the target range and rate cuts start being announced.

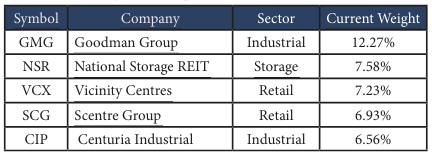

The current Australian portfolio component consists of 23 stocks. Below are the top 5 holdings:

Reitway Global Property Portfolio (USD)

The Portfolio was down -7.29% mainly driven by our out of benchmark selection stocks in Data Centres and Tower REITs and exposure to countries like Canada (-7.67%) and Australia (-9.14%). The Industrial sector in the US was hit hard with Prologis, the largest component of the benchmark (over 10%) and the largest REIT in the world, delivering -21.63%. Global REITS made its steady way down for the month until mid-month when it started picking its head up for the buildup to PCE data being release close to month end.

US CPI was announced on 10 April for the March 2024 YOY data and CPI came in at 3.5%, slightly above the 3.4% market expectation and the market reacted negatively. This is the 3rd straight month of CPI increases and is on top of the 3.2% increase in February. The US Core PCE Price Index, which is the Federal Reserve’s preferred gauge to measure inflation was also released on 26 April for the March 2024 YOY reading and rose by 2.8%. The figures came in above market forecasts of 2.6% but it is the lowest reading since March 2021.

It is now, according to some market participants at least, very possible that European central banks my cut rates before the US Federal Reserve. Such conclusion was drawn from a more dovish tone by European central banks and slightly softer-than-expected data received in April. This may be supportive to for instance German residential names which are included in the portfolio.

The industrial sector earnings releases saw a fair swing in momentum from being one of the standout sectors to one with softening tenant demand. Prologis, who reported their earnings on the 17th of April materially reduced their own 2024 forecasts for same-property NOI growth. Their explanation was tenants prioritising cost management and opting to better utilise the additional gross leasable area (GLA) secured during the post-pandemic boom for anticipated demand not materialising. This is also a reflection of a more subdued reality on the ground and is consistent with the slowdown in US GDP growth data observed.

Some action in the European market saw Shurgard Self Strorage (SHUR) expand its UK footprint by striking a recommended cash deal with one of its peers, Lok’nStore Group PLC worth around GBP 378m. The merger is expected to lead to some job cuts and the shareholders of Lok’nStore are set to receive GBP 11.10per share, which would mark a 2.3% premium to the targeted company’s all time high closing price of GBP 10.85 on January 2022. The merger will enable SHUR to increase its footprint in the Southeast and Manchester regions which it called “the two most attractive target markets outside of London”.

In the US, Apartment Income REIT Corp. (AIRC) is noted to be going private. In an all-cash transaction valued at $10bn, Blackstone Real Estate Partners X will take AIRC private in its largest ever apartment portfolio acquisition. The bidder will be acquiring all the outstanding AIRC shares for $ 39.12 per share, which also includes the assumption of debt.

According to Blackstone global investment manager, real estate values are bottoming which is driven by a healthier cost-of capital environment and lower supply growth. The ECB is the only one of the three major central banks in Europe that met in April and they held rates constant as expected. Despite this, it was still a volatile month for rates and credit spreads. The Bund, US Treasury and Gilt curves shifted upwards materially over the month with some slight bear steepening in each case. The UK 10year Gilt yield expanded by 42 bps, leading the UK real estate sector 2.8% lower. US Treasuries moved 48 bps during the month and impacted REIT sentiment in the market negatively. The US 10- year yield was sitting at 4.69% at month end.

Fund positioning remains roughly the same (quality, value, structural trend riders, and blend between offensive and defensive), with a slight uptick in risk appetite due to optimism growing in markets awaiting the first rate cut announcements.

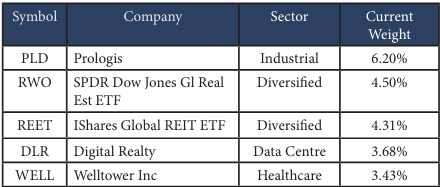

The Tamim global property portion invested in the Reitway Global Property Portfolio currently consists of 46 stocks. Below are the top 5 holdings:

We believe real estate fundamentals are still sound and remain steadfast in our belief that the asset class can post meaningful returns relative to stocks and bonds, even against a slower growth, higher inflation backdrop.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Listed property & property related securities |

| Number of securities: | 40-50 |

| Single security limit: | 10% |

| Region limit: | 70% |

| Sector limit: | 70% |

| Investable universe: | Listed property & property related securities |

| Market capitalisation: | N/A |

| Derivatives: | Yes – special instances & hedging |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-20%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 0.98% p.a. |

| Admin & Expense Recovery: | Up to 0.25% |

| Performance Fee: | Nil |

| Hurdle: | N/A |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly (with 30 day notice) |

| Distribution: | Quarterly |

| Investment Horizon: | 3-5+ years |