Listed Property

Investor Updates

July 2024 | Investor Update

Dear Investor,

The TAMIM Listed Property unit class delivered a +4.80% return for the month of July 2024. For comparison the A-EIT index was +6.78% while the G-REIT index was +8.74%

Australian Listed REIT Portfolio (AUD)

We saw the portfolio come back roaring in July after a dismal 2Q24, where the portfolio delivered 7.12% for the month. The ASX 200 REIT Index was up 6.78% for the month, delivering a solid return but still underperformed the GPR 200 REIT Index which delivered 8.74%. The A-REIT market (+17.70%) has however still outperformed the global REIT market (+7.85%) and the ASX 200 (+8.59%) on a YTD basis. The ASX 200 which delivered 4.19% in July was left behind by the A-REIT market, outperforming the ASX 200 by 2.64%.

The spur in performance was driven by CPI data released during the month which rose 0.84% q/q in 2Q24 and was notably below the consensus market expectation of 1.00%. This changed the market speculating of possible rate hikes to curb inflation over the next few months. The monthly inflation reading for June 2024 was release on 31 July 2024 and read 3.8%, down from the 4.0% in the previous month. The slowdown in inflation was driven by easing prices for transport (from lower fuel costs), healthcare, recreation and culture and education. The next monthly inflation reading will be released on 28 August 2024 and expectation is for it to be slightly lower than the current reading.

The diversified REITs in the A-REIT market specifically rebounded during the month and returned +12.6%, followed by the retail sector (+11.1%), the office sector (+8.3%) and the industrial sector (+1.1%). The industrial sector is mainly driven by what GMG does and it delivered +1.0% for July. Just to keep in mind that even though GMG was only slightly positive for the month and underperformed the A-REIT market in July it has delivered 72.7% over the past 12 months.

The best performing stock in the portfolio was Waypoint REIT (WPR) which delivered 16.28%. There was a steady increase in the share price of WPR in July with its June 2024 valuations being released on 12 July and the market reacting favourably to a 1.4% increase in portfolio value and a 1.8% increase in NTA (Net Tangible Assets). The second-best performer was LLC (+16.08%) and then GPT (+15.29%), with no specific news other than a REIT rally on supporting CPI prints in the US and Australia. 9 stocks in the portfolio out of the 24 returned in excess of 10% for the month which showed the significant move of the A-REIT market. The next 8 best performing stocks in the portfolio also delivered greater than 7% for the month and only 2 stocks delivered negative returns

The RBA is in a slightly awkward position with volatile inflation data in recent times and wide-ranging market speculation of their next move. The next meeting will be held in early August, and they are expected to keep the cash rate constant at 4.35%. The rate has now been kept constant for the last 5 meetings held by the RBA and although inflation came down in the last month it is still above the RBA’s target range of 2-3%. The global narrative for interest rates for the past few months has been “higher for longer” but some regions and countries have started cutting rates while other such as the US is expected to start cutting even as soon as September. This does not seem to be on the cards in Australia at the moment.

There seems to be substantial uncertainty about the economic outlook in Australia, evidenced by slow GDP growth, an uptick in jobless rates and consistent pressure on many businesses. Globally the pressure from higher interest rates is weighing down on economies and both individuals as well as companies are really feeling stretched. Central banks have many considerations to keep in mind with rate decisions and will always try to avoid a recession but will need to ensure that inflation is under control and within their target ranges.

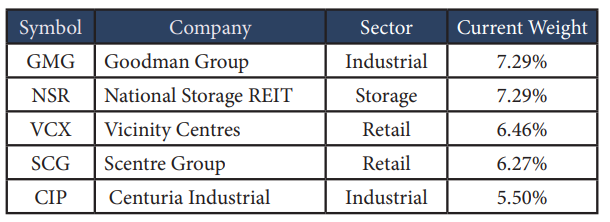

The current Australian portfolio component consists of 24 stocks. Below are the top 5 holdings:

Reitway Global Property Portfolio (USD)

The portfolio delivered a solid +6.50% for the month compared to the GPR 250 REIT Index which delivered +6.32%. This has brought the YTD performance of the global portfolio to 0.54%, or in essence flat. The last three months have all seen positive returns and in total is up over 11% over this period. The asset class has at last gained some traction after central banks started raising interest rates globally to combat escalating inflation in back in 2022. There is a sense of some interest rate relief on the cards where some regions and countries have already started cutting rates and the United States’ Federal Reserve possibly expected to cut interest rates in September this year.

The annual inflation rate in the US for June was released on 11 July and come down by 0.3% to 3.0%, beating the consensus estimate by 0.1% and REIT investors found it a positive reading. This was the third straight month of the rate falling and the lowest it has been since June 2023. Energy costs rose at a slower pace (1% vs 3.7%), due to gasoline (-2.5% vs 2.2%) and fuel oil (0.8% vs 3.6%) while utility gas service (3.7% vs 0.2%) accelerated. A plethora of positive data points supporting the decline in the inflation rate led to the decrease and even surprise to some. The inflation rate is still above the Fed’s target over the long term of 2%. PCE (Personal Consumption Expenditure) which is what the US Federal Reserve uses as a gauge of the economy’s health remained unchanged in June as the data was release in July.

In many ways there were not a lot of regions around the globe that did not contribute to the monthly returns of the portfolio, but the best performing region in the portfolio was Spain where our specific exposure to the Tower sector name of Cellnex Telecoms delivered 6.98%. The second-best performing region was Germany with specific exposure to the Residential sector contributing positively to the performance of the fund. Although the names in these regions were not in the top handful of performers for the month, they are regions where we have hand picked these names and has thus contributed significantly in these smaller regions.

The worst performing region where the portfolio had exposure was France and in specific UnibailRodamco-Westfiled (URW) which has been under pressure from significant cost overruns for its most important development project currently underway. We have in fact exited this position on the news.

The Industrial sector have been the standout sector in July. We saw a rebound in these names from some negative sentiment over recent times based on strong results. Global giant Prologis (+12.23) had a great month as well as Terreno Realty (+15.60%), which constitute almost 10% of our portfolio. Together with them, the Cold Storage sub-sector of Industrial delivered strong returns (COLD +17.03%) which make up 2.16% of our portfolio. This was on the back of speculation of an IPO of another giant Cold Storage REIT to be listed, Lineage (LINE). The portfolio has been hurt by the underweight exposure to the Office sector, but we still believe the medium to long term forecasts for growth in the sector is not warranting any additional exposure at the moment.

Uniti Group (+31.51%), a communications infrastructure specialist, was the best performing stock in the portfolio and the returns generated came from a recovery in the stock name from being hit down significantly due to a deal with an old associate Windstream which the market did not appreciate. There seems to be unjustified dislike of the business which is trading far below consensus valuations. We will continue to monitor the company and will make decisions in the interest of our clients. The second-best performing stock was Americold (+17.03%) and have been discussed above already. In third was SBA Communications which forms part of the Towers sector which has delivered excellent results on the back of optimism over possible interest rate cuts due to their higher-than-average debt levels compared to other sectors. Fund positioning remains roughly the same (quality, value, structural trend riders, and blend between offensive and defensive), with a slight uptick in risk appetite due to continuing optimism growing in markets awaiting rate cut announcements with the possibility of September seeing the first cut.

Fund positioning remains roughly the same (quality, value, structural trend riders, and blend between offensive and defensive), with a slight uptick in risk appetite due to continuing optimism growing in markets awaiting rate cut announcements with the possibility of September seeing the first cut.

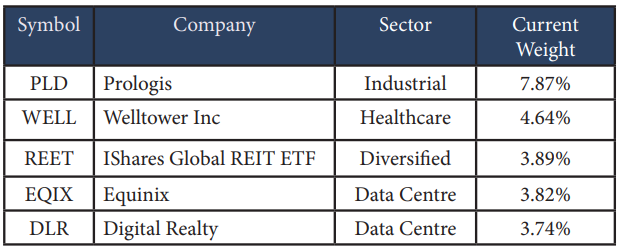

The Tamim global property portion invested in the Reitway Global Property Portfolio currently consists of 44 stocks. Below are the top 5 holdings:

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Listed property & property related securities |

| Number of securities: | 40-50 |

| Single security limit: | 10% |

| Region limit: | 70% |

| Sector limit: | 70% |

| Investable universe: | Listed property & property related securities |

| Market capitalisation: | N/A |

| Derivatives: | Yes – special instances & hedging |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-20%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 0.98% p.a. |

| Admin & Expense Recovery: | Up to 0.25% |

| Performance Fee: | Nil |

| Hurdle: | N/A |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly (with 30 day notice) |

| Distribution: | Quarterly |

| Investment Horizon: | 3-5+ years |