Listed Property

Investor Updates

August 2024 | Investor Update

Dear Investor,

The TAMIM Listed Property unit class delivered a +1.86% return for the month of August 2024. For comparison the A-REIT index was +0.07% while the G-REIT index was +2.50%.

Australian Listed REIT Portfolio (AUD)

Continuing the gains made in July, the portfolio delivered 2.50% for the month. The portfolio was almost 2% ahead of the A-REIT market for the month and performed in line with the GPR 250 REIT WORLD Index which delivered 2.55% in AUD. The Australian REIT market was in the middle of the pack compared to the rest of the world for monthly returns but has been one of the better performing regions based on the GPR 250 REIT constituents’ performance on a year-to-date basis.

Goodman Group (-4.80%) came off its highs and due to its significant weighting in the A-REIT market pulled down the market for the month of August. It arguably had to give back some of the gains made over the medium term, but the REIT still has strong fundamentals and expected annual earnings growth forecasts unmatched in the A-REIT market. Together with its expansion into data centres it is poised to deliver excellent returns for investors over the next few years.

The monthly inflation data for July 2024 was release on 28 August and was 3.5%, down from the 3.8% in June and the third straight drop from the high point of 4.0% in May. It was however above market consensus expectation of 3.4% but was also the lowest it has been since March 2024, reflective of the extended and expanded Energy Bill Relief Fund rebate. Housing prices, electricity costs and transport prices all contributed strongly to the inflation rate dropping during the month. Inflation remains outside the RBA’s target range of 2-3%.

The diversified REITs in the A-REIT market continued their solid run of performance, delivering 5.9% for the month. The next best sector was Retail REITs which delivered 3.3% followed by the Office sector which was up 2.8% for the month. Industrial REITs was the worst performing sector, delivering -4.7%, with the main component of the sector being GMG as discussed above.

From the August 2024 reporting period we can conclude that the range of updates points to a lot of volatility in the market. Management teams commented on capacity in their balance sheets (gearing and liquidity) and that the transaction market in their opinion was improving.

EGH (+19.63) was the best performing holding in the portfolio for the month after a good build-up to results that was released at the end of the month. There is strong demand for their offering which has led to occupancy levels of 98% over the year. Australia has a growing ageing population and seniors’ superannuation balances are low, playing right into the hands of EGH and what it can provide. They have also had a board refresh, and new CEO appointed which the market reacted to favourably. The second-best performing stock was CHC (+14.01%) based on a bullish tone during the guidance they provided during the month suggesting that the valuation cycle is at the trough and that transactions should start picking up again in FY25.

GMG was the standout negative contributor in the portfolio for the month, down -4.80%. It achieved strong OEPS growth of 14% in FY24 after initial guidance of 9%. Their FY25 guidance of OEPS growth of 9% was below that of the consensus forecast of 12%. The market is probably also not seeing much tangible evidence of Data Centre progress to satisfy lofty market expectations.

The RBA kept its rates constant at 4.35% during the August meeting. This was what the market was expecting and was the 6th straight month of keeping it constant. The board reiterated that they would rely on data and that there is still upside risk remaining that could impact future rate decisions to be made. The governor of the RBA, Michele Bullock, mentioned that they would not be hesitant to lift borrowing costs again should inflation flair up again and that the alternative of persistently high inflation would have far worse effects than a combative raise, in her opinion.

There is uncertainty in the economy and the outlook is unclear, evidenced by slow GDP growth, rising jobless rates, and mounting pressure on many businesses.

There is much expectation globally on central banks cutting rates with their next meetings, but the RBA governor is of the opinion it is premature for the country. According to Michele Bullock, they are aiming to balance reducing inflation within a reasonable period while still maintaining as many gains in the labour market as possible.

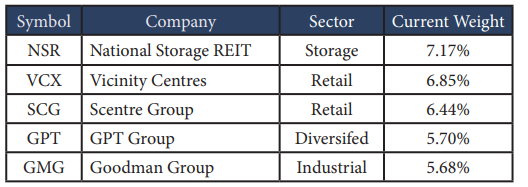

The current Australian portfolio component consists of 24 stocks. Below are the top 5 holdings:

Reitway Global Property Portfolio (USD)

The fund continued its good performance from the previous month by delivering 5.85% in August, slightly below the 6.50% delivered by the Index. This has now been the 4th straight month of positive returns for the fund and accumulates to over 17% for this period. It is thus fair to say that the market has started anticipating a return of the asset class back into favour on the back of global interest rate cuts being seriously on the cards.

The steady decrease in the annual inflation rate did not stop with the July inflation rate data that was released on 14 August. The rate was down 0.1% from 3.0% to 2.9% and was below the 3.0 consensus forecast. This was the 4th consecutive month of rate decreases and is now at the lowest it has been since March 2021. Inflation eased for shelter, transport, apparel and new vehicles. Food inflation was steady at 2.2%, but energy costs rose mainly due to gasoline rising. It seems to be no coincidence that as interest rates are coming down that the asset class is also picking up. PCE (Personal Consumption Expenditure) which is what the US Federal Reserve uses as a gauge of the economy’s health remained unchanged in July as the data was release in August.

The best performing holding in the portfolio for the month was Public Storage REIT which delivered +16.15%. It is the largest owner of storage assets in the US and is one of the largest REITs in the world by market cap, sitting at around $62bn. PSA has one of the best balance sheets of all REITs in general and the best one amongst its peers, with net debt-to-EBITDA sitting at 2.7X. It is arguably still underlevered but has taken significant steps in the past few years to take up leverage when at some point in the mid 2010’s it was close to zero. The sector has picked up over the last 3 months and PSA specifically might just have been included in an overall asset class rotation by many investors in the market, creating a good rally in its stock price.

We saw good returns for the month from VTR (+14.09%) and BEI (+13.57%). VTR has shown good prospects in growing its senior housing business and the “silver tsunami” of aging demographics has assisted senior housing operators to continue its recovery from the impact of the pandemic. VTR benefits from slowing supply coming online soon and the sector is defensive and recession resilient. Boardwalk is still benefiting from Western Canada driving solid earnings growth and has met elevated expectations in 2Q24. It again raised its guidance for the next quarter and the manager sees robust fundamentals across its portfolio supporting double-digit earnings growth through 2026. SPNOI growth was +14.2% in the second quarter and accelerated from the 13.5% in the first quarter of 2024.

The 2 cold storage names, COLD (-2.98%) and LINE (-2.96%) were the worst performing holdings in the portfolio and was in our opinion mainly due to the cooling revenue trends of the sector. LINE completed its ~$5bn IPO in July and this was the largest REIT IPO in history and the largest IPO globally since late 2023. The weakening consumer health will impact the sector more adversely than others and average economic occupancy is projected to decline 250-300 bps for both these names in 2024. The sector overall now screens attractively priced.

Global REITs as an asset class did very well in August and only one sector (Lodging and Resorts) delivered a slightly negative return for the month. The best performing sector was Self Storage (+12.75%) followed by Apartments (+8.91%), Health Care (+8.56%) and Regional Malls (+8.23%). Specific inclusions in the Speciality sector also added performance to the fund for the month through Cellnex Telecom (+11.03%) and Uniti Group (+13.54%).

On a regional basis there was no region in the red for the month, thus all contributing to positive returns. The best region in the portfolio was our exposure to Germany (+12.27%) through Vonovia, an apartment REIT. The second-best region was Singapore (+11.79%) through Capitaland Ascendas and then Canada (+10.50%), mainly derived from apartment exposure. The United States which forms the major part of the REIT universe and our portfolio delivered 6.05% for the month in our portfolio.

We are seeing a change in sentiment in the market for the asset class where the general feeling is that REITs will be benefitting from central banks decreasing interest rates after the tightening cycle. Some countries have already started their cutting cycles after bringing inflation under control and in the US specific there are wide talks of even a 50pbs cut by the Federal Reserve in September and a 1.25% cut before year end.

Fund positioning remains roughly the same (quality, value, structural trend riders, and blend between offensive and defensive), with a slight uptick in risk appetite due to continuing optimism growing in markets awaiting rate cut announcements with the possibility of September seeing the first cut in the United States.

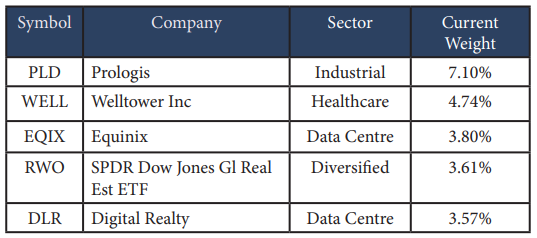

The Tamim global property portion invested in the Reitway Global Property Portfolio currently consists of 47 stocks. Below are the top 5 holdings:

We believe real estate fundamentals are still sound and remain steadfast in our belief that the asset class can post meaningful returns relative to stocks and bonds, even against a slower growth, higher inflation backdrop.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Listed property & property related securities |

| Number of securities: | 40-50 |

| Single security limit: | 10% |

| Region limit: | 70% |

| Sector limit: | 70% |

| Investable universe: | Listed property & property related securities |

| Market capitalisation: | N/A |

| Derivatives: | Yes – special instances & hedging |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-20%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 0.98% p.a. |

| Admin & Expense Recovery: | Up to 0.25% |

| Performance Fee: | Nil |

| Hurdle: | N/A |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly (with 30 day notice) |

| Distribution: | Quarterly |

| Investment Horizon: | 3-5+ years |