Global Equities

Global High Conviction

Investor Updates

Below you will find this month’s commentary and portfolio update for the Global High Conviction unit class of the TAMIM Fund.

October 2024 | Investor Update

The TAMIM Global High Conviction unit class was up +2.10% for the month of October 2024, this was in comparison to the index return of +3.81%. The strategy has generated a return of +25.56% over the past 12 months.

Don’t do something – just sit there.

Rather than pontificate on the US election results we thought we’d more closely examine the prospects for China and the HK stock market post the stimulus packages. Regardless of which side takes the White House and the House of Representatives and the Senate, it’s pretty clear that China will have to find its own solutions to declining growth rates and bad debts.

First though, a couple of observations of the ‘bleeding obvious’ variety. 1. Diversification is more essential than ever to avoid increasingly large market swings between growth value, small, large, and various sector rotations. We can’t see market volatility remaining at the low levels of recent years. 2. Currently consumer cyclicals (especially car companies and luxury goods companies) are being smashed. As are any companies that seemingly disappoint on results or guidance – ASML (not owned), US healthcare stocks, and at times the Mag 7 as in early August. This likely continues reverberating through the markets. Who knows which is next? 3. Getting the last bit of inflation out is not worth it – interest costs in USA and UK on government debt stock are already larger than defence spending. This means that inflation hedges will benefit and equities with good balance sheets which pay dividends are ideal. 4. A concentrated market such as we have now is not healthy. Favour non Mag 7!

Back to China – Australia is burdened by its apparent reliance on Chinese growth and policy. The markets are not being logical in their thinking regarding a stimulus package. Any stimulus is always likely to be a ‘sighting shot’, and need follow up. The fact that there was one at all is quite positive for China and thus Australia and certainly Australian investor sentiment.

Hong Kong is becoming investable and as a laggard will offer protection in the event of a dash to liquidity.

The sharp spike in the Chinese Stock Markets in late September caught a lot of people by surprise and triggered the usual round of self-serving advice focusing on the need to ‘stimulate’ the economy – followed by the (equally usual) round of disappointment. We said at the time that we saw this as a potential dip to be bought, not a rally to be chased, so with a near textbook rally, retracement and consolidation appearing, the ball in now in the Asset Allocators’ court. In our view we think both that they should and that they will start to pay attention.

The key thing is that, up until now, the Chinese Government has paid little heed to the Chinese Capital Markets. We think that this is about to change. And THAT is the real story.

Is China now a dip to be bought? Is Australia about to see a change of perspective on Chinese growth?

This suggests to us that the views on China will remain ‘uncertain’ in the near term – with traders dominating and the supposed long term narrative shifting to support the short term technicals. Should the market form a more stable ‘bottom’, we suspect that the asset allocation might start to shift, perhaps in the New Year. But, more important we suspect will be the role of the Chinese authorities and the domestic markets as the ‘New Buyer’.

It’s not about me. Or you. Or the stock market (yet).

The Western commentators are all talking about how the stimulus is ‘risking disappointment’, but this is to once again believe that that the Chinese authorities care about us, or what we think. Or indeed, the Chinese Stock Market. As we noted in ‘Not a Bazooka’ this is not a western-style policy response because the Chinese do not have a western-style mindset. Nor, for that matter, a western-style problem. As such, they will pay no attention to the ‘advice’ from western economists and commentators. Far from bailing out those that supply too much – be they property developers or manufacturers of excess goods – they are taking, perhaps ironically, an Austrian approach to the economics, one of creative destruction.

As the old saying goes (and to steal from my friend Louis at Gavekal in his recent note) “the tragedy of Asia is that Japan is a profoundly socialist country on which capitalism was imposed, while China is a profoundly capitalist country on which socialism was imposed. But each will naturally drift back to its natural state.”

As we look and listen to the policies being imposed on the west by the Globalist governments it begins to feel that it is now they who are finding themselves having Socialism imposed, just as China is reverting to its ‘natural state’.

Capital Markets; the missing piece for China

Which brings us to the role of the stock market and capital markets in general. In the US these are central, while in China they are nowhere, indeed, they are the missing piece of the jigsaw. We believe that this latest round of so-called stimulus in China is actually all about building ‘proper’ capital markets, with the key point that they are as much about the ‘saver’ as the ‘borrower’. Because of this, we think that we need to go beyond thinking about China as a trade and start thinking about it as a long term investment.

The Stock Market is central to US culture as the Billionaire Class that run the country would quite literally not exist without it. China, not so much.

The stock market is extremely important in the US, it is, quite literally, the foundation of the wealth of the richest people in the country – and thus by extension those that run it. Without it, they would be ‘merely’ rich industrialists and the centi-millionaire CEO class merely well compensated managers. It’s the wonders of options and stock based compensation that have delivered us the ‘top’ end of the wealth distribution. (As well as Private Equity, but that is a whole different post).

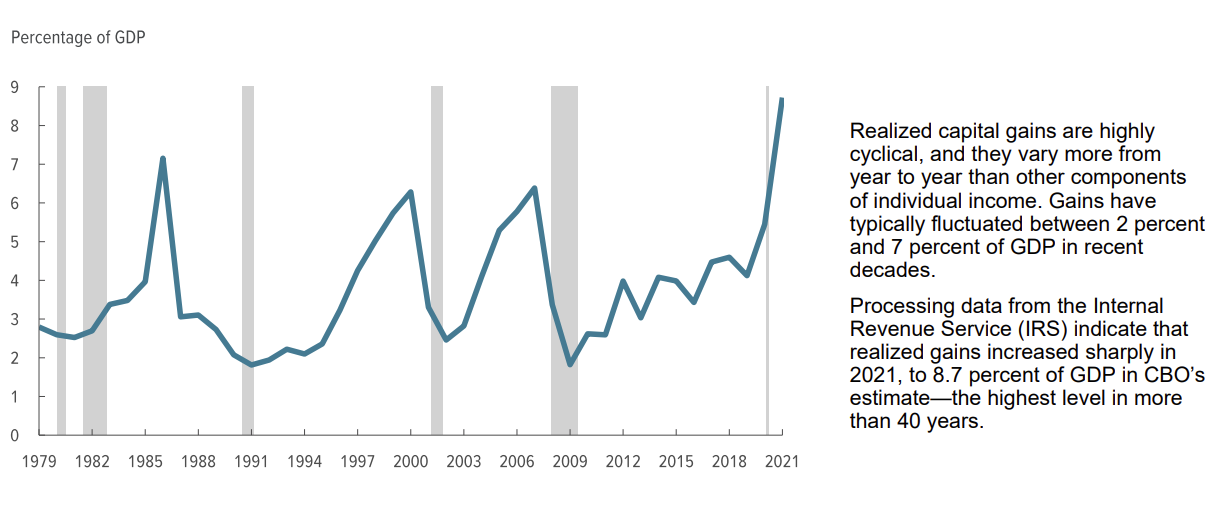

Meanwhile, the long term investments of much of middle class America are also heavily tied into the US stock market making for a powerful wealth effect, while financial services, including the financial media that talk about China, also view Wall Street as the centre of the world. And finally the US Stock market is important for the US Government finances as it benefits from the Capital Gains Tax received – which is an often overlooked reason why the Bond markets are correlating with equities – lower equities means lower taxes, which means more debt issuance.

Capital Gains Taxes an important source of US tax receipts

None of this is (currently) true in China. The Chinese population currently have less than 5% of their wealth in the stock market and the people that run the country are self evidently not the billionaires. The Government is not dependent on capital gains taxes, nor is the market used much for raising investment capital. Currently most investment is funded from internal cash or bank lending. Perhaps most importantly for our argument, there is not yet a proper savings and investment system that can recycle domestic saving into domestic investment and it is this missing piece that we think the l test initiatives are actually focused upon.

What is wrong with the Chart is not that the Chinese own too much property, but that they have too much cash and they do not (yet) participate in Capital Markets

The chart, from Allianz via Reuters, highlights the current dominance of property in the Chinese household balance sheets and while this sort of chart is often used on hyperbolic YouTube channels to show how badly the economy will be affected by a ‘property crash’, in our view it actually misses the point, not once but twice. First, there has not been a property crash – there has been a bursting of a speculative bubble by property developers. Second, high levels of property assets is a function of houses that are lived in – China has close to 100% ownership of housing and as a ‘store of value’. The real takeaway from the chart is the trillions of RMb held in cash.

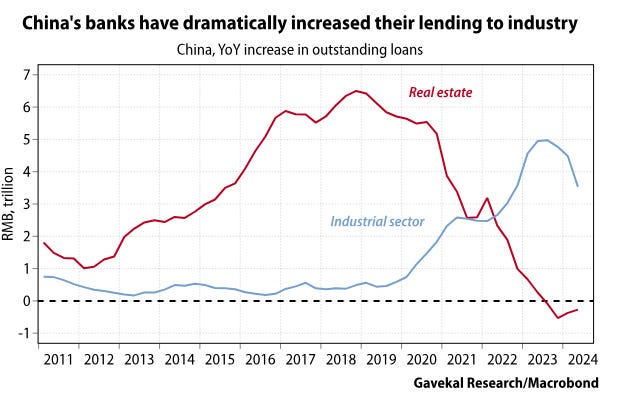

To take these points a bit further. As we have previously noted, the collapse of the Chinese property developers (not the property market itself) post 2021 was a deliberate policy in China that western ‘investors’ (speculators) didn’t understand, since in their mental model, the investors are always bailed out. When Xi reminded us all of the concept of Common Prosperity and the fact that “Houses are for living in, not speculation”, Chinese banks took note and as the Chart from Gavekal shows, there was a quite deliberate switch in Bank Lending. From Real Estate to the Industrial Sector.

It was around this time of course that US Covid stimulus cheques were being pumped into Robin Hood accounts and Wall Street Bets were pushing effectively bankrupt companies like Gamestop up fortyfold. Meanwhile, as the Magnificent 7 MegaCap tech stocks and crypto first swooned and then soared, bank lending in China poured into the industrial sector, ultimately delivering the new Chips from Huawei, the new EVs from BYD and Xiaomi and innovations across the board in AI, robotics and automation, intelligent manufacturing and low-altitude aviation. No need for IPOs (or NFTs), Chinese investment capital was sourced domestically from cash and the banks.

Chinese economic growth has been fuelled by cap-ex funded by cash, not equity

Meanwhile, Chinese listed companies currently have around Rmb18trn ($2.5trn) in cash, while almost half the stock market are State Owned Enterprises. GS calculated that a 10% increase in dividends would deliver $32bn to the government – a more reliable source of revenue than trying to tax capital gains.

However the point is not just about raising capital, or even about allocating it efficiently – where arguably capital markets are more efficient than banks – but about providing the assets on the other side of the balance sheet to savers and investors. Filling in the missing piece of the economic structure.

As noted, because the people who run China are (quite clearly) not the billionaire donor class, they also think and behave differently and have no desire to ‘stimulate the economy’ to ensure excess supply clears at a higher price, essentially bailing out producers by encouraging consumers to go into debt. Indeed, it is the very opposite. The latest moves, in our view are really about providing sufficient liquidity for the property market to clear at lower prices – while at the same time effectively delivering more social housing.

Meanwhile, we believe that these latest moves are also about building a savings and investment system for long term social provision. China undoubtedly wants a set of ‘capital markets with Chinese characteristics’ which means that in the same way he said houses are for living in not speculation, stocks are for long term growth not speculation and thus likely to focus on cash flow, quality and income, rather like the old UK market in fact – before Gordon Brown and the Treasury got involved.

This latest ‘stimulus’ looks to us therefore to be the start of a long term story that is building. If as we believe the so called weak hands have moved to strong hands (see the note we wrote back this time last year ) then long term investors should definitely start to get involved ahead of what we suspect will be the asset allocators starting to move in the New Year.

Fund Performance

Portfolio Highlights

Taiwan Semiconductor Manufacturing Co (TPE.2300)

TSMC is the world’s largest semiconductor manufacturer. The company pioneered the “fabless” production model, where customers outsource chip production to a specialised manufacturer and instead focus on designing and marketing products. This means producers focus primarily on what they do best (creating great products) while TSMC is left to refine the intricate process of chip manufacturing. Today, TSMC semiconductor market share exceeds 60%. More impressively, the company boasts a near monopoly on advanced chip production used for high-performance computing, defence applications and machine learning.

Because of TSMC’s strategic and geopolitical importance, Western nations have increasingly encouraged the company to build foundries domestically. The business received US$6.6 billion in funding and up to US$5 billion in loans from the CHIPS and Science Act to support the construction of three foundries in Arizona. The first foundry began wafer production in April, with “highly satisfactory” results with a “very good yield”. TSMC has also announced plans for a foundry in Germany. We expect governments to continue subsidising TSMC’s growth ambitions to secure domestic chip supply and reshore manufacturing. The TSMC share price has increased 77% this year, shrugging off concerns of a broader slump in chip demand. We expect orders will recover over the medium term and therefore underwrite the next leg of growth for the business.

Schlumberger NV (NYSE.SLB)

SLB is a global technology company that provides equipment and services to the energy sector. At its core, the business focuses on oil and gas projects, from evaluating reservoir feasibility to new well construction and production systems for transporting hydrocarbons. Producers employ SLB because they are world leaders in optimising operations and performance, which translates into higher output and returns on investment.

During the month SLB announced its third-quarter results, with revenue and pre-tax earnings increasing 10% and 13% respectively over the same corresponding period. While the core oil and gas divisions continue to perform, it was promising to see the emerging digital solutions segment continue to gain traction, with revenue up 7% in the last quarter and 25% year over year.

Equally exciting is the company’s growing sustainability efforts, which should expand as oil and gas majors look to curb emissions. For over three decades SLB has been modelling and commercializing carbon capture technologies for clients. More recently, the business has agreed to a partnership with the French Atomic Energy and Alternative Energies Commission for producing clean hydrogen. The investment, called Genvia, aims to build the most effective and cost-efficient electrolyser in “hard-to-abate industrial settings”.

HCA Healthcare Inc (NYSE.HCA)

HCA is one of the largest healthcare providers in the United States. The business owns a portfolio of hospitals, surgery centres, emergency facilities and rehabilitation clinics in 20 states, with a small presence also in the UK.

In October, HCA announced its third quarter results where revenue increased 7.9% to US$17.5 billion. Earnings jumped 13.4%, primarily due to productivity improvements and a reduced reliance on contract labour. HCA has invested significantly in artificial intelligence tools to reduce labour costs, with new scheduling models helping hospital managers better allocate workforce resources. Chief executive Sam Hazen believes the company is at an “inflection point”, with investments in AI driving better clinical outcomes better than 2019 levels in addition to further margin improvement.

Healthcare broadly is a sector we are attracted to due to its defensive characteristics. Few patients forego care, while inflation is largely passed onto end payers (governments and/or health insurers). Moreover, HCA is somewhat shielded from competition given the sizable cost and land requirements of new hospitals, particularly in urban areas. HCA also compliments our liking for companies exposed to changing demographics. Data from the US Population Reference Bureau estimates that by 2050, the number of Americans over 65 will increase by 47% to 82 million people.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Global Equities |

| Number of securities: | 80-110 |

| Single security limit: | +/- 5% relative to Investable Universe |

| Country/Sector limit: | +/- 10% relative to Investable Universe |

| Market capitalisation: | US$2+bn |

| Derivatives: | No |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-10%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust available to wholesale or sophisticated investors |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.00% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Fee Cap: | 2% of total FUM |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3-5+ years |

| Distributions: | Annual |

Invest via TAMIM Fund

Request additional details by using the form or if your ready to invest select the apply now button.

Invest via IMA

The TAMIM Global High Conviction strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.