Japan went through an historic boom that peaked in the late 1980s and early 1990s. Asset prices rose at an incredible pace, with the price of land absolutely rampant, increasing by as much as 5,000 per cent between 1956 and 1986. So distorted were land prices that land constituted a phenomenal 65% of Japan’s national wealth (compared to just 2.5% for the United Kingdom at the time), and Tokyo real estate sold for as much as US$139,000 per square foot–nearly 350 times the equivalent in Manhattan.

In hindsight the comparisons seem ludicrous (similar to other bubble periods), and eventually the market came to realise this as well. Property prices began to stagnate and then fall, and the Nikkei 225 (an index of Japan’s largest 225 stocks) fell by more than half its 1989 peak of 38,957 within just three years. Such was the incredible boom and bust of this period that the Japanese stock market continued to fall until the Global Financial Crisis, which kept the Nikkei 225 in the doldrums for several more years.

Since that time, however, contrarians who put aside the nearly two decades of declines have been richly rewarded. The Nikkei 225 has rallied nearly four-fold in the last decade, outpacing a number of the major global indices, including the ASX. The question now is, is there more to come?

Challenges of the Past

Early Signs of Progress

Valuations Remain Attractive

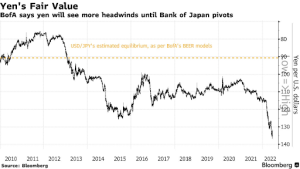

What’s more, the Japanese government is one of the few around the world that is actively encouraging a higher level of inflation. While this might seem strange to those of us struggling with high rates of inflation in Australia, Japan has struggled to generate much inflation for quite some time, which has concerned the country’s leaders due to the high level of government debt. As a result, the Bank of Japan is likely to tolerate much greater inflation before increasing interest rates–creating a more supportive environment for equity values. Even if interest rates do increase somewhat, it’s likely to have a much more muted impact compared to other developed nations given the public companies’ low valuations and cash-rich (largely debt-free) balance sheets.The nation’s currency, the Japanese yen, also looks attractively valued. It recently plumbed to a 24-year low against the U.S. Dollar, causing Bloomberg to call it “the most structurally undervalued” of the major world currencies. Bank of America also sees the Yen as undervalued, as you can see from the chart below. This significantly lowers the “currency risk” for Australian investors (the risk that an investor would lose money on the exchange rate, with the Japanese Yen declining against the Australian Dollar), and even increases the chances that the exchange rate may provide additional returns for investors (if the Japanese Yen were to appreciate).

Buffett Sees Value

Diversification with a Difference

However, times are changing in Japan, and there are many high-quality businesses with cash-rich balance sheets ripe for corporate improvement. The country is a leader in many industries, including automotive production and semiconductors, and many stocks in these industries do not receive the same publicity (and therefore valuations) as their North American or other international peers. Advantest Corp (TYO: 6857), for example, is a leading manufacturer of semiconductor equipment that has performed well yet remains valued substantially below its international peers, while Tokyo Gas (TYO: 9531) trades at a meagre 4.5 times earnings and remains a key part of Japan’s energy future.With cheap valuations, a depressed currency, and corporate change all moving in the right direction, following Buffett into Japan might be a great opportunity to boost your portfolio’s returns.

_________________________________________________________________________________________________________________

Disclaimer: Advantest Corp (TYO: 6857) and Tokyo Gas (TYO: 9531) are currently held in the TAMIM Portfolios.