Australian Equities

Australia Small Cap Income

Investor updates

Below you will find this month’s commentary and portfolio update for TAMIM Australia Small Cap unit class.

May 2024 | Investor Update

We provide this monthly report to you following conclusion of the month of May 2024.

The TAMIM Small Cap Fund was down -0.35% (net of fees) during the month, versus the Small Ords down -0.05% and the ASX300 up +0.85%.

Over the last 12 months the fund is up +21.0% net of fees versus the Small ords up +10.9%.

We are continuing to identify undervalued opportunities for the Fund from both emerging growth companies that are highly profitable, or unloved turnaround stories that are not yet fully appreciated by the market. We continue to see the overall small to mid cap part of the market as considerably undervalued.

As we have flagged previously this year, we believe the latter part of the calendar year is well poistioned to deliver better returns to the overall market and in particular the small end as investors begin to see inflation come off (In the US for example, CPI excluding shelter is low versus the headline figure) and rate cut expectations increase. If our assessment is correct then our portfolio holdings should see a significant re-rating as we saw towards the end of last year.

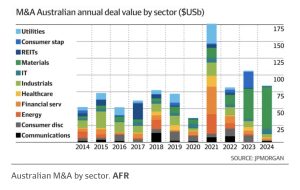

We also expect M&A activity to pickup and accelerate through the year with 2024 already seeing activity but mostly driven by the recent BHP/Anglo bid. History shows M&A activity rebounds strongly following the type of drop off we have seen in the last 2 years.

We provide a brief commentary on portfolio holdings results during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in July.

Sincerely yours,

Ron Shamgar and the TAMIM Team.

Fund Performance

Portfolio Highlights

Southern Cross Engineering (ASX: SXE) is an electrical contractor servicing the Commercial and Mining sectors but more recently a fast growing exposure to data centers and Renewable energy projects. During May SXE announced a string of good news including:

- SCEE Electrical awarded by Synergy the Balance of Plant works for the Collie Battery Energy Storage System with a Contract value of circa $160m

- This was the largest initial award by value in group history

- The acquisition of MDE group, a Sydney-based electrical and communications specialist, for an enterprise value of up to $10.55m

- MDE enables expansion of east coast offering for the group with a growing data centre project pipeline containing significant communications elements

- Forecasting EBIT contribution from MDE of at least $5m for FY25 and beyond

- Following announcement of acquisition of MDE Group, SCEE Group anticipates FY25 EBITDA of at least $53m (2nd upgrade for the year)

- Management is confident this growth is sustainable with expectations of further earnings growth in FY26 and beyond

We built a position in SXE at $1.10 and we believe the company strong balance sheet of $50m net cash provides further upside from M&A opportunities and contract wins. SXE is a picks and shovel play on the AI and Renewable energy thematic. We think the stock is worth $1.90+ and pays a 5% ff dividend.

IPD Group (ASX: IPG) provided FY24 earnings guidance during the month. Ebitda of $39m versus $27.7m last year and Ebit of $34m versus $23.4m last year. The guidance was within market expectations. FY24 has been a transformative year for IPG with the completion of two strategic acquisitions, EX Engineering and CMI Operations. Having expanded their EV infrastructure team, the company is capitalising on the growth in the market by securing a number of major projects during the year, including the electrification of Australia’s largest bus depot, and further data center wins.

Similar to Southern Cross (SXE), IPG is a dual - pick and shovels - play on both Australia’s transition to electric vehicles, the renewable energy transition and the accelerated growth in data center construction due to AI demand. Trading on 10x forward EV/Ebitda multiple and a 3% ff dividend yield the stock offers further value over time.

COSOL (ASX: COS) is a global Asset Management technology-enabled solution provider that optimises operations in asset intensive industries such as natural resources, energy and water utilities, public infrastructure and defence. We initiated a position in COS a year and half ago having followed the previous success and track record of the board and largest shareholders.

During the month COS won significant contract wins including with Qbuild. Under the contract, COSOL will deliver managed services and an infrastructure refresh of QBuild’s Hitachi Ellipse enterprise asset management system. The initial term of the QBuild contract is three years with a value of approximately $10 million. There are two extension options of one year each that, if exercised, would have a combined

additional value of approximately $5.2m if both 1 year extensions are exercised.

COS also finalised the acquisition of asset management consultancy Core Asset Co for $6.1m. Management anticipates that Core Asset will contribute approximately $6m in revenue and approximately $1.6m in EBITDA in FY25. Overall we see COS generating $130m revenue and $23m Ebitda in FY25. This places the stock on a net profit multiple of 16x and dividend yield of 2.9% ff. As per the founders previous success, we envisage the business to be acquired by a larger player over time.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Australian Equities |

| Investment Universe: | Australian Small Cap |

| Reference Index: | ASX Small Ords |

| Number of Securities: | 20-40 (10-20 Value, 10-20 Growth) |

| Single Security Limit: | +/-5% |

| Market Capitalisation: | Small Cap |

| Leverage: | No |

| Portfolio Turnover: | <50% p.a. |

| Cash Level (typical): | 0-100% (0-50%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate + 2.50% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Distributions: | Semi-annual |

| Applications/Redemptions: | Monthly |

| Redemptions: | Monthly with 30 days' notice |

| Investment Horizon: | 3 - 5 years + |

Invest via TAMIM Fund

Request additional details by using the form or if you're ready to invest select the apply now button.

Invest via IMA

The TAMIM Australia Small Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.