Australian Equities

Australia Small Cap Income

Investor updates

Below you will find this month’s commentary and portfolio update for TAMIM Australia Small Cap unit class.

April 2024 | Investor Update

We provide this monthly report to you following conclusion of the month of April 2024.

The TAMIM Small Cap Fund was down -1.84% (net of fees) during the month, versus the Small Ords down -3.06% and the ASX300 down -2.92%. The fund is up +13.61% over the last 12 months.

April saw equities take a breather after a very strong run up in March. We see these market pull backs as very healthy in the short term, allowing recent market gains to have time to consolidate for a few months before the next move higher, which we expect in the second half of the year. We are glad to have once again outperformed the market.

The US economy continued to be strong with a good earnings quarter and the jobs market continuing to show resilience. This naturally flowed to slightly higher than expected inflation figures in March which in turn changed rate cut expectations to potentially no cuts this year. To put this into context – versus how the market would have reacted last year (aggressive selloff) – the pullback has

been measured and small.

This signals to us that investors are no longer focused as much on inflation and interest rates as they were last year. This is a positive sign for equities in the medium term, as markets move on fundamentals rather than general sentiment. We also believe there will be no more rate hikes both in the US and here in Australia. The US has inflation well under control and in Australia mortgages are highly rate sensitive and have a much larger impact on consumer spending and hence economic activity in the short term.

We believe that rate cuts are unlikely this year which we see as a positive in general. In the next few months market attention is likely to turn to the US elections which promise to be wildly entertaining to watch. At the moment Trump is the favourite to win, and historically he’s been good for the US economy and hence markets.

We provide a brief commentary on portfolio holdings results during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in June.

Sincerely yours,

Ron Shamgar and the TAMIM Team

Fund Performance

Portfolio Highlights

Pacific Smiles (ASX: PSQ) announced a signed scheme of arrangement with National Dental Care (NDC) for a cash bid at $1.90 with an additional 5 cents of franking credit from a 12 cents dividend included in the price. The bid is superior to the Genesis $1.75 offer back in March. Shortly after, Genesis converted their Call Swap arrangement for their 19.90% holding in PSQ to physical shares.

We now await on Genesis to see whether they match the offer, bid higher, or just take their 35%+ gain in 6 months and move on. NDC is a much larger operator than the Current Genesis dental operations and so they are able to extract much larger set of synergies from acquiring PSQ. So far this has been a tremendous investment for us since we bought around $1.05 late last year.

Source: TAMIM CVW Company Analysis

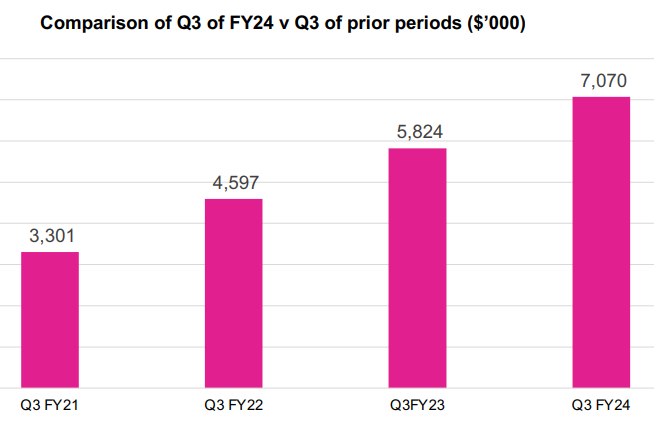

Clearview (ASX: CVW) provided a third quarter update as part of a conference presentation. Q3 is seasonally slower for sales given impact of holiday period (Jan and Feb), regardless sales were up 21% to $7.1m – cycling 27% growth in the pcp. Industry appears to now have reset on firmer footing for growth with ClearView’s market share is increasing in a growing market and the strategy delivering a simplified business focused on life insurance. Wealth management exit well progressed (expected to be completed in 1H FY25).

Additionally during the month Suncorp (SUN) divested their NZ life insurance business for $410m (NZD). We examined the deal and If you applied the same multiples to CVW, you would get the following:

- Price to NPAT: $0.92 per CVW share

- Price / In Force Premium: $0.675 per CVW share

- Price / Net Assets: $1.00 per CVW share

Servcorp (ASX: SRV) is a leading provider of Executive Serviced and Virtual Offices, Coworking, and IT, Communications, and Secretarial Services. The company was founded in 1978 and is still led to this day by Alf Moufarrige. Servcorp began as a solution to the overhead costs of traditional office setups. Since then, it has expanded globally, pioneering concepts like the Virtual Office in 1980 and boasting a presence in 129 locations across 40 cities in 20 countries. With a commitment to supporting businesses’ growth and success, Servcorp offers premium locations, state-of-the-art facilities, cutting-edge technology, and dedicated support teams.

In a highly competitive market, one rival readers will likely be familiar with for all the wrong reasons is global player WeWork. Founded in 2010 by Adam Neumann and Miguel McKelvey, WeWork initially thrived by offering shared workspaces tailored to freelancers, startups, and companies seeking flexible office solutions. Its innovative business model, fueled by low-interest rates, saw rapid growth, achieving unicorn status with a valuation exceeding US$1 billion by 2014. However, intensified scrutiny ahead of its planned IPO in 2019 exposed concerns over leadership, spending habits, and governance, prompting Neumann’s resignation and a postponement of the IPO.

SoftBank Group’s subsequent bailout and restructuring efforts failed to reverse the company’s fortunes, exacerbated by the COVID-19 pandemic’s impact on office space demand.

Despite a strategic pivot towards catering to larger corporate clients, WeWork’s market capitalisation plummeted post-IPO, accompanied by substantial net losses. With its sustainability questioned amid a changing real estate landscape and macroeconomic challenges, WeWork faces an uphill battle to regain investor trust and viability in an environment of excess supply, diminished demand, and heightened competition.

Since then, the outed CEO, Neumann, has attempted to buy back the business making a bid of over US $500 million and making a Bunnings style offer to beat any other deal by 10%. It now appears that attempted repurchase has failed with a bankruptcy court judge approving a deal whereby WeWork’s creditors take control of the reorganised entity and invest fresh capital. The longevity of Servcorp, experienced management and responsible cost control give us confidence that the business will not suffer the same fate as WeWork.

The longevity of Servcorp, experienced management and responsible cost control give us confidence that the business will not suffer the same fate as WeWork.

Servcorp is in the process of restructuring its operations in the Middle-East.

The company recently updated the market with details regarding the establishment of a new holding company for the region. Securing a regional headquarters licence from the Saudi Ministry of Investment marks a milestone, granting Servcorp full support for its international initiatives through its Saudi entity.

This progress aligns with Servcorp’s strategy for a planned listing of its Middle East and European operations in 2025. With Servcorp retaining a 55% stake in the new entity, profit targets for 2024 are on track, supported by the construction of four new locations to meet demand. The potential listing promises value enhancement for shareholders, leveraging strong growth market multiples in Saudi Arabia.

Servcorp reported their first half results in February with total revenue growing by 8.5% to $157 million.

The company stated that the effective execution of Servcorp’s business model, centredaround delivering prestigious experiences and tailored workspace solutions to meet each client’s specific needs, not only propelled revenue growth but also facilitated steady improvements in client satisfaction and retention, resulting in heightened business efficiency and reduced business development costs. This was a key driver in the 31% increase in earnings per share for the first half to 20.2 cents.

Servcorp is supported by a strong cash position with $95 million in cash on hand as of 31 December 2023. Furthermore, it has consistently returned capital to shareholders paying a dividend of $0.12 per share in each of the previous 6 months with a dividend yield of 5.71% at the time of writing.

The company reaffirmed its FY24 guidance despite the highly competitive market. Servcorp expects an additional 7 new operations to commence in FY24 which supports the forecast underlying net profit before tax between $50 million and $55 million with the expectation to produce at least $70 million in free cash flow.

Servcorp epitomises the essence of a “boring” yet robust business model that stands the test of time.

The company’s global footprint highlights its strong geographical diversity and resilience in navigating diverse market landscapes. As the company continues to deliver premium solutions tailored to meet the evolving needs of businesses worldwide, its virtual office tailwinds position it for sustained growth and success. Moreover, Servcorp’s dedication to returning capital to shareholders, underscored by consistent dividend payments and a strong financial position, reinforces investor confidence in its long-term sustainability.

Amidst the market headlines and high multiples of flashy technology like AI, Servcorp’s steadfast performance and prudent management instil confidence in a company that can navigate challenges and deliver value to stakeholders, making it a compelling investment proposition for steady, dependable enterprises.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Australian Equities |

| Investment Universe: | Australian Small Cap |

| Reference Index: | ASX Small Ords |

| Number of Securities: | 20-40 (10-20 Value, 10-20 Growth) |

| Single Security Limit: | +/-5% |

| Market Capitalisation: | Small Cap |

| Leverage: | No |

| Portfolio Turnover: | <50% p.a. |

| Cash Level (typical): | 0-100% (0-50%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate + 2.50% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Distributions: | Semi-annual |

| Applications/Redemptions: | Monthly |

| Redemptions: | Monthly with 30 days' notice |

| Investment Horizon: | 3 - 5 years + |

Invest via TAMIM Fund

Request additional details by using the form or if you're ready to invest select the apply now button.

Invest via IMA

The TAMIM Australia Small Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.