Australian Equities

Australia All Cap

September 2024 | Investor Update

We are pleased to share the TAMIM All Cap Fund’s monthly report following the conclusion of September 2024.

The fund delivered a strong performance, rising +6.97% (net of fees) during the month, compared to a +5.09% gain in the Small Ords and a +2.36% increase in the ASX300.

Year-to-date (CYTD), the fund is up +22.68% (net of fees), significantly outpacing the ASX300, which has risen +11.51%.

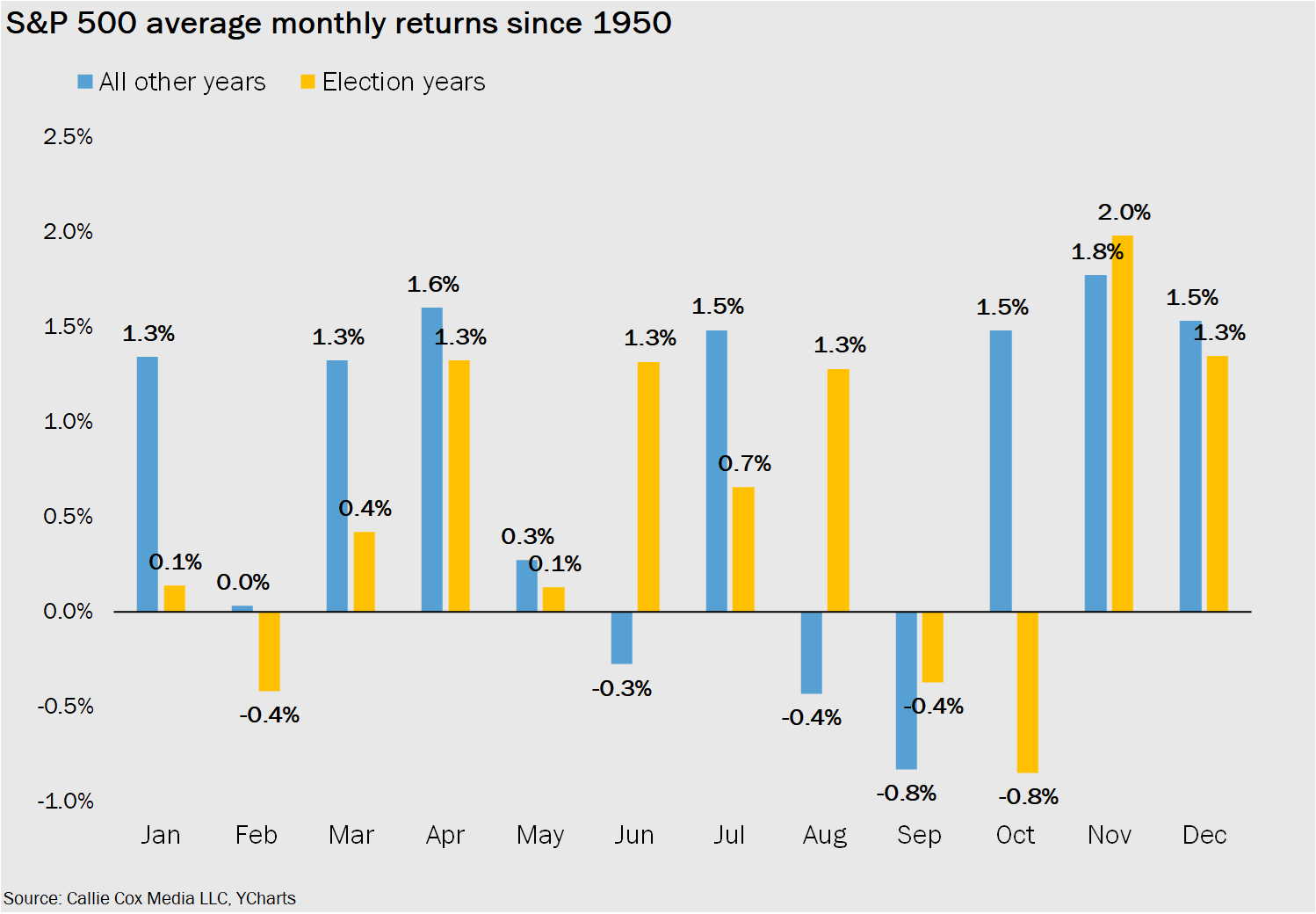

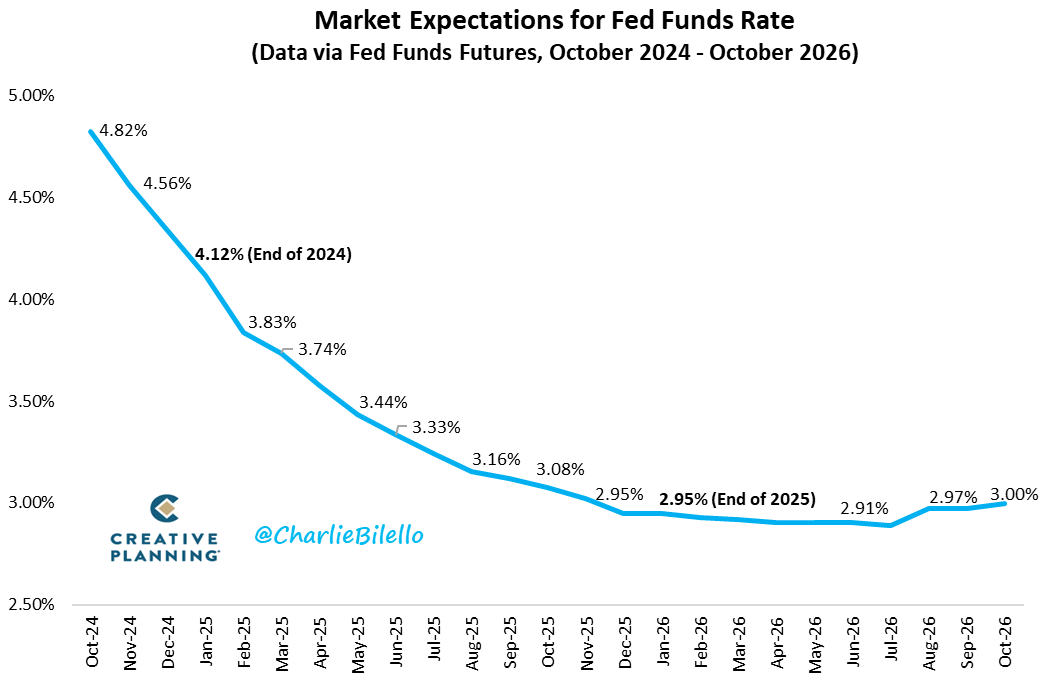

September is historically known as the most challenging month for equity market returns, but this year, it proved to be a positive outlier. The primary driver behind this robust market performance was the U.S. Federal Reserve’s decision to cut interest rates by 50 basis points, with indications of further reductions in the next six months.

We have consistently emphasised that rate cuts tend to be a strong catalyst for stock market performance, particularly for small and mid-cap stocks. This was evident in September as smaller companies outperformed, while large caps lagged. We anticipate this trend to persist in the months ahead.

Additionally, positive sentiment was bolstered by the Chinese authorities’ announcement of significant stimulus measures aimed at revitalising their economy and boosting consumer spending. As China is a key economic partner for Australia, this has promising implications for our economy.

As we have noted throughout this year, we believe we are in the early stages of a new bull market—driven by AI innovation and investment—that, based on historical patterns, could extend for the next 5 to 10 years. Our portfolio is strategically positioned to capture growth opportunities and undervalued stocks within the small and mid-cap segment.

As we enter the final quarter of the year, we anticipate some volatility in October due to geopolitical tensions in the Middle East and uncertainty surrounding the upcoming U.S. elections. However, once this uncertainty subsides and the election results are clear in early November, we expect the market to rally into the year-end and beyond.

Further details on portfolio updates for the month can be found in the portfolio section of this report. We look forward to sharing more insights in our next monthly update in November.

Sincerely yours,

Ron Shamgar and the TAMIM Team

Fund Performance

Portfolio Highlights

Humm Group Limited (ASX: HUM) a diversified financial services company, offers products ranging from buy-now-pay-later (BNPL) services to commercial leasing. Despite a challenging fiscal year, Humm reported a normalised cash profit of $60.6 million, reflecting a 19% decrease from the prior year. This drop was largely influenced by a weaker first half of the year, impacted by rising interest rates, economic uncertainty and increased competition in the BNPL sector.

However, there were several positive developments in the second half of the year, which signal well for Humm’s future prospects. The company experienced a 16% improvement in normalised cash profit compared to the first half. Additionally, net interest income grew by 5% in the second half, demonstrating a measure of stability amid rising interest rates. Humm’s net interest margin also held steady at 5.5%, showcasing the company’s ability to manage its margins even as the broader economic environment remained challenging.

Another key highlight for Humm was its ability to reduce operating expenses by 20%, achieving cost savings of $13.6 million in the second half compared to the first. This reduction in costs significantly improved the company’s cost-to-income ratio, which fell from 64% in the first half to 53% in the second half. The company’s ability to implement significant cost-saving measures underscores its commitment to operational efficiency and its focus on driving profitability despite market headwinds.

Humm’s consumer business also showed signs of improvement, with normalised cash profit after tax increasing from $6.5 million in the first half to $11.8 million in the second half. This turnaround was largely driven by the company’s efforts to rebuild and refocus its consumer division around customer needs and preferences. Humm is now concentrating on further improvements in its consumer business, with an eye on delivering sustainable, long-term growth.

Looking ahead, Humm remains focused on expanding its commercial portfolio, which has continued to demonstrate strong growth potential. The company is exploring opportunities to enter new regions and sectors, positioning itself for further expansion. A new funding program with Moelis Australia (MAF) for commercial receivables is also expected to increase the company’s capacity for capital-light growth, a key strategic priority moving forward.

At a current market cap of $400 million, Humm could potentially deliver a $70 million profit in FY25, with the possibility of a sector re-rating on the horizon, should the RBA opt for interest rate cuts early next year, the stock may experience significant upward momentum. Humm could present an intriguing opportunity for investors who are willing to look beyond its recent challenges and focus on its long-term growth potential.

Praemium Limited (ASX: PPS) a provider of investment platforms and portfolio administration services, has been making waves in the financial technology sector. The company delivered solid financial results for the year, with EBITDA reaching $21.5 million. This represents a notable improvement on market expectations, driven by a particularly strong second-half performance. EBITDA increased by 42%, rising from $9 million in the first half to $12.5 million in the second half. This uptick in profitability reflects Praemium’s ability to control expenses while capitalising on strong revenue growth.

In fact, Praemium’s revenue for the second half grew by 15%, reaching $84.9 million, an indication of the company’s robust market position and price increases. This growth was underpinned by Praemium’s investment in capability, resilience, and IT security during the first half, which laid the groundwork for its subsequent financial success. Praemium’s scalable business model has positioned it well within the industry, with $57.4 billion in assets under administration, reflecting the company’s broad reach and strong standing in the financial services space.

One of the key strategic moves that has contributed to Praemium’s growth was the acquisition of the OneView business from Iress (IRE), a decision that has proven to be both strategic and revenue boosting. The acquisition enhanced Praemium’s revenue and EBITDA, further solidifying its position as a key player in the sector. The company’s ability to integrate the new business seamlessly while maintaining strong financial discipline is a testament to its management team’s expertise.

Looking ahead, Praemium’s growth prospects appear strong. The company has identified a gap in the market for next-generation IDPs (Investment Data Platforms), which it is poised to address with its new offerings. This product innovation is expected to drive further revenue growth and expand Praemium’s customer base to address the non custodial market for high net worth investors. Additionally, the company has remained committed to disciplined capital management, evidenced by its 1-cent dividend declaration and its ongoing on-market share buyback program. Praemium’s net cash position of $44 million provides the company with ample financial flexibility to pursue further growth opportunities.

Praemium’s management team is optimistic about the company’s future, with our estimate projecting EBITDA of $28 million for FY25. With the company trading at an EBITDA multiple of 8.5x, it remains an attractive option for investors seeking exposure to the financial technology sector and dividend income. Praemium’s combination of strong revenue growth, operational efficiency, and product innovation makes it a compelling investment opportunity in a consolidating sector.

Australian Clinical Labs Limited (ASX: ACL) a leading provider of pathology services in Australia, reported solid financial results for the fiscal year. Despite a significant 59% decline in COVID-19-related revenue, ACL managed to deliver flat total revenue of $696.4 million, a testament to the company’s ability to maintain stability in its core business operations.

ACL’s underlying EBIT came in at $62.6 million, in line with the company’s FY24 guidance. However, the second half of the year was particularly strong for ACL, with underlying EBIT improving to $39.1 million, representing an 11% margin. This is a significant improvement compared to the first half, where underlying EBIT was $23.4 million, with a margin of 7%. The company’s ability to drive margin expansion in the second half of the year reflects the success of its cost control measures and its focus on operational efficiency.

ACL has carried this positive momentum into FY25, with strong growth already evident in the early months of the fiscal year. In July, ACL reported revenue per working day growth of 7.6%, alongside volume growth of 5.9%. The company’s FY25 EBIT guidance of $65-$72 million suggests that ACL is well-positioned to continue delivering strong financial performance in the coming year.

The clinical sector, in which ACL operates, has benefitted from improving general practitioner attendance volumes and a focus on cost controls, which has enhanced profitability across the board. Furthermore, recent mergers and acquisitions in the radiology sector have bolstered investor sentiment to healthcare stocks. For example, IDX’s acquisition of CAJ at 10x EBITDA and HLS’s sale of Lumus at 15x EBITDA have highlighted the value within the sector. In contrast, ACL is currently trading at a single-digit EBITDA multiple, making it a relatively undervalued player in the healthcare space.

ACL also benefits from a strong balance sheet, with a healthy cash position that provides the company with the financial flexibility to pursue growth opportunities and return capital to shareholders. The company’s dividend yield remains attractive, offering investors a steady income stream alongside the potential for capital appreciation.

One recent development that has positively impacted ACL’s stock performance is the exit of Crescent, the company’s largest shareholder, which sold its 30% holding. This move has removed a significant stock overhang and improved liquidity, making ACL more accessible to a broader range of institutional investors. Additionally, the company is now well-positioned for potential inclusion in market indices, which could further enhance its stock’s visibility and attractiveness.

Looking ahead, ACL appears poised for a re-rating, particularly if it continues to deliver strong financial results in FY25 where we estimate it is highly likely to upgrade guidance at the AGM or first half result. The company’s competitive positioning, strong balance sheet, and improving market conditions make it an appealing option for investors seeking exposure to the healthcare sector.

PointsBet (ASX: PBH) is a leading global operator in the online sports betting and iGaming space, with a strong foothold in both the Australian and Canadian markets.

The company’s proprietary technology, including its "Odds Factory" platform, has positioned it as a key player in regulated markets, delivering innovative sports betting solutions. PointsBet has demonstrated strong revenue growth and improving profitability, exemplified by its scalable, cloud-based wagering platform that offers advanced sports and racing wagering products, along with iGaming and advanced deposit wagering on racing.

A recent significant development for PointsBet was the sale of its U.S. business to Fanatics for US$225 million. This transaction was completed after an intensive and competitive process, culminating in the return of AUD $442.4 million to shareholders, equivalent to A$1.39 per share. The sale marked a pivotal restructuring phase for PointsBet, with the company retaining ownership of its core technology. This proprietary tech remains a key asset as PointsBet focuses on expanding its Australian market share and growing its Canadian operations.

The technology provides market leading in-play and same game parlay products and the cash out features used in all of the company’s markets but is particularly powerful in the North American live betting market.

Furthermore, the company is particularly optimistic about Canada, a market offering more favourable economics than the U.S., with lower taxes and capital requirements. PointsBet believes they are in the early stages of the Canadian Business complementing its more mature Australian business, as well as providing an opportunity to leverage attractive features that aren’t available in the Australian market such as iGaming, and online live betting

PointsBet delivered impressive FY24 results. In Australia, the company’s operating earnings rocketed to $26.8 million, a remarkable increase from just $0.1 million the previous year. Revenue growth in Australia was equally as impressive, climbing 10% and outperforming the broader market, with racing and sports betting driving this momentum. PointsBet also took significant steps in consumer protection, integrating a national self-exclusion register and prohibiting credit card deposits.

PointsBet showed further improvement in the Canadian market. Revenue grew 87% and the company’s operating loss narrowed to $19.7 million from $35.8 million the prior year. The Ontario market, in particular, has seen strong growth, contributing to the company's growing market share. Management are forecasting Canada to breakeven by FY25 year end. At a group level, revenue rose 17% to $245.5 million, while the overall operating loss was reduced by $47.2 million to $1.8 million.

PointsBet closed the year with a strong balance sheet, holding $28.1 million in corporate cash and $19.3 million in net assets, positioning it well for future growth.

Looking ahead, PointsBet remains bullish on its prospects in both Australia and Canada. The Canadian market, especially Ontario, offers significant growth potential, with further expansion anticipated in Alberta and British Columbia. In Australia, the company expects continued revenue growth, supported by ongoing product enhancements and customer loyalty. The company expects FY25 revenue to be between $280-$290 million and normalised operating earnings projected between $11-$16 million and is on track to cash flow breakeven, highlighting its strong growth trajectory.

PointsBet presents as an attractive takeover opportunity due to its strong market position, proprietary technology, and trajectory toward profitability. Its established presence in the regulated markets of Australia and Canada, coupled with its continued projection to scale makes it a prospect for both industry incumbents and new entrants.

The recent sale of its U.S. business has provided PointsBet with significant liquidity, while retaining ownership of key assets ensures it remains competitive in high-growth markets. This proprietary tech is a crucial differentiator, enabling advanced betting products that cater to both traditional and in-play wagering—an area of increasing consumer demand.

As PointsBet transitions to sustainable profitability with improved operating earnings and strong revenue growth, its attractiveness to potential acquirers grows. The sports betting industry has been marked by significant mergers and acquisitions. Emerging challengers, such as Betr, or even crypto and online gaming operators like Stake, may view PointsBet as a critical asset to expand their product offerings and strengthen their competitive positions. Watch this space.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Reference Index: | ASX 300 |

| Number of Securities: | 20-50 |

| Single Security Limit: | 10% (typically 5%) |

| Investable Universe: | ASX (focus on ASX300 ex20) |

| Market Capitalisation: | Any |

| Leverage: | No |

| Portfolio Turnover: | < 25% p.a. |

| Cash Level: | 0% - 100% (typically 5 - 30%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of RBA Cash Rate + 2.5% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3 - 5 years + |

| Distributions: | Annual |

Invest via TAMIM Fund

Invest via IMA

The TAMIM Australia All Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.