Australian Equities

Australia All Cap

July 2024 | Investor Update

Dear Investor,

We provide this monthly report to you following conclusion of the month of July 2024.

The TAMIM All Cap Fund was up +0.46% (net of fees) during the month, versus the Small Ords up +3.49% and the ASX300 up +4.13%.

CYTD the fund is up +19.31% net of fees versus the ASX300 up +8.46%.

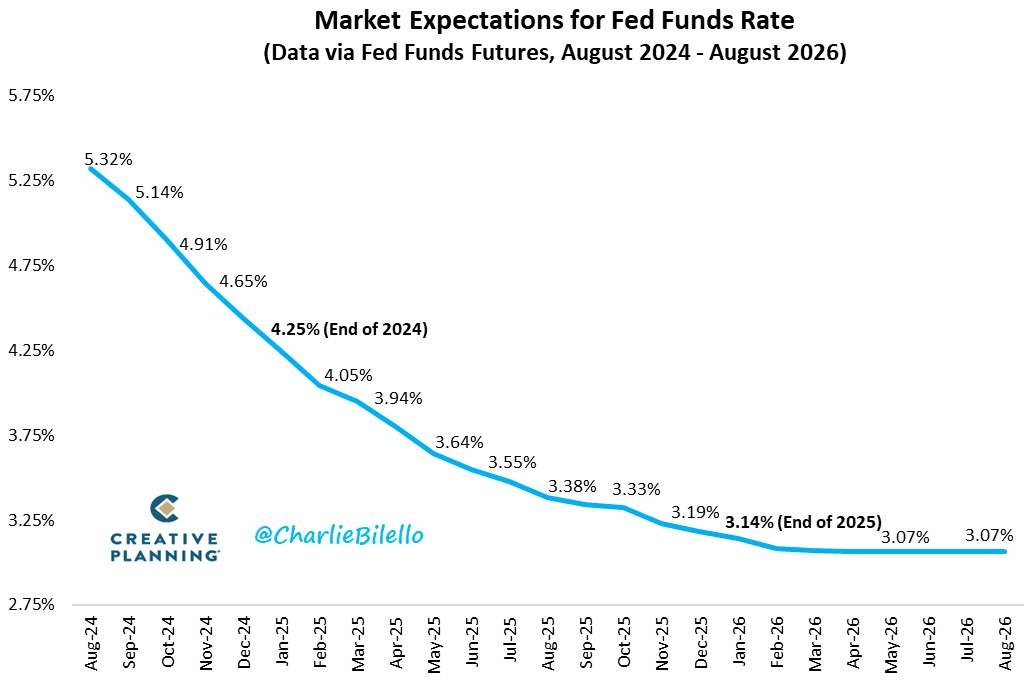

July saw equity markets rally on the back of a weaker than expected CPI report in the US and signaling from the Fed that rate cuts are now firmly on the table at the September meeting. The market is now expecting a 50bps rate cut in September followed by a 25bps rate cut for 6 consecutive Fed meetings. By mid next year the Fed fund rate is forecast to be 3.75-4.00%.

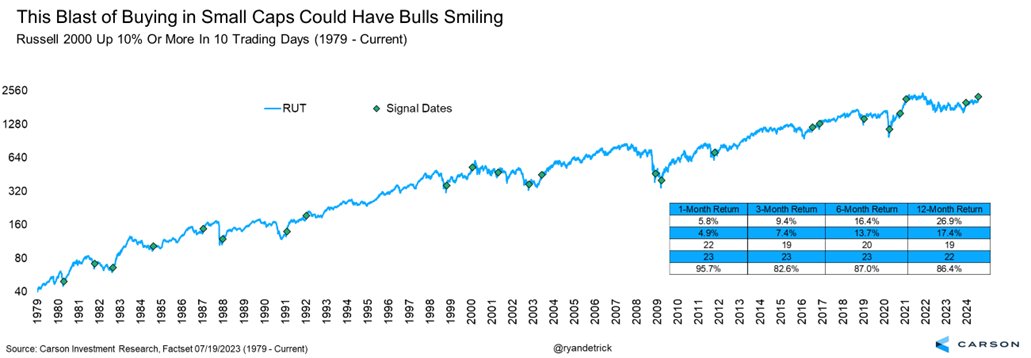

As we have foreshadowed for many months now, we expect mid and small cap companies to benefit from interest rate easing and this played out as the US small cap index, Russell 2000, was up more than 10% in 10 trading days. Since 1979 (when it started trading), this has happened only 23 other times. Future returns are quite strong, up nearly 27% a year later and higher 86% of the time.

Finally, as we head into the August reporting period, we expect this to be a strong catalyst period for our portfolio holdings and should determine the next leg up of returns in the short term and into next year. We believe many of our holdings have clear near term catalysts, and are significantly undervalued by the market, which in the past has been the reason why we have seen significant Takeover activity in the Fund.

We provide a brief commentary on portfolio updates during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in September.

Sincerely yours,

Ron Shamgar and the TAMIM Team

Fund Performance

Portfolio Highlights

Dropsuite (ASX: DSE) reported its Q2 FY24 update displaying an encouraging set of results.

The company showcased significant growth across several key performance indicators. We’ve previously written about how Dropsuite is approaching an inflection point and the company continues to focus on expanding its market presence and enhancing its product offerings. As a result, the Q2 numbers have yielded impressive outcomes, particularly in Annual Recurring Revenue (ARR), the number of paid users and churn rate.

One of the standout metrics from Dropsuite’s Q2 FY24 report is the remarkable growth in ARR.

The company reported an ARR of $39.92 million, representing a 31% year-over-year increase. This substantial growth confirms Dropsuite’s ability to attract and retain customers through its comprehensive suite of cloud-based backup and archiving solutions.

During Q2 FY24 the company brought its churn rate back down to below 3%, consistent with its historical performance. This follows on from an increase in the March quarter to just under 5%. Dropsuite previously reported that the increase was primarily due to increased competition on pricing especially in the Europe, Middle East, and Africa (EMEA) region.

Dropsuite has seen a significant increase in its paid user base. The number of paid users grew by a record 112k during the quarter to reach a total count of 1.35 million. This growth is indicative of the strong demand for Dropsuite’s solutions and the company’s ability to penetrate new markets. The expanding user base is a critical driver of Dropsuite’s recurring revenue model, providing a stable and predictable income stream.

Looking ahead if Q2 user growth can be maintained the company should be adding an incremental $12 million of ARR by June 2025. This will place DSE at $52 million ARR or 4x ARR multiple which is cheap. Similar type companies growing at this rate trade on 7-10x ARR.

Bravura Solutions (ASX: BVS) has announced a proposed return of capital to shareholders.

Contingent on receiving the necessary approvals from shareholders at the upcoming Annual General Meeting (AGM) and securing a favourable Class Ruling from the Australian Taxation Office (ATO) the company intends to distribute up to $75.3 million or 16.7 cents per share.

This decision follows a thorough review of Bravura’s capital management strategy, following on from the previous management’s decision to raise capital in March 2023 and the significant transformation executed during FY24. The board has determined that the business is overcapitalised and aims to return excess capital to its shareholders within three months of the AGM, pending the requisite approvals.

This follows on from the July market update where Bravura announced an upgrade to its FY24 financial guidance. The unaudited operating earnings guidance has been increased to approximately $25 million, up from the previously forecasted range of $18 million to $22 million. Additionally, Cash operating earnings guidance stands at around $10 million.

CEO, Andrew Russell attributed this upgrade to the successful execution of Bravura’s transformation strategy, which has stabilised the business and surpassed budget expectations.

We have previously discussed how we believe Bravura is a turnaround story and with the company’s proactive capital management and upgraded financial guidance position the business continues to show signs of this being the case.

We estimate BVS can exit FY25 with cash Ebitda margins of 20% which will place the stock on 7x cash Ebitda pre capital return. We think over time as management prove their ability to grow the top line, the stock will re rate to a growth multiple with 100%+ upside. We believe a dividend payout policy will be announced during FY25.

Superloop (ASX: SLC) provided a trading update during the month including Consumer segment customer numbers for the half-year ended 30 June 2024 and an update on the delivery of the contract to provide wholesale internet services to Origin Energy.

Origin has reached “go live” with Superloop. From July 2024, Superloop’s white label offering will underpin new sign-ups for Origin home broadband services. This milestone has been reached in under four months, with the speed of this achievement testament to the capability of the Superloop platform. The transition of the existing Origin customer base remains on track for completion in October 2024. This date is key to meeting FY25 guidance.

At the time of contract signing, SLC advised that the Origin broadband customer base was approximately 130,000 customers. Origin recently commented that their broadband customer base now exceeds 150,000 customers, which demonstrates Origin’s continuing growth in the category and further reinforces the growth outlook for Superloop’s white label offering. We estimate every incremental 100,000 origin signups adds $14 million of Ebitda to SLC.

SLC added a record new Consumer customers in 2H FY24. In 1H FY24, the Consumer segment delivered record organic growth, adding 34,100 net new customers. This momentum has increased in 2H FY24, with 45,720 net new customers. SLC has continued to perform very strongly in the high value segment of the residential broadband market, with high-speed plans (100Mbps or greater) now exceeding 50% of their base. We expect this trend to continue, driven by consumer demand for higher internet speeds, reliability and value.

Management also updated underlying EBITDA for FY24 is now expected to be at or above the top end of the $51-$53 million guidance range.

Superloop’s cost structure and efficient operating model provide a competitive advantage, and this continues to translate to earnings growth and strong cash generation.

FY24 cash capex remains on track for the $25-$27 million range previously guided. We expect acquisitions, confirmation of FY25 guidance and potential new white label deals to be short term catalysts.

AI-Media Technologies (ASX: AIM) offers a comprehensive suite of products, including LEXI, an AI-powered automatic captioning tool, various encoding tools for seamless caption delivery and the iCap network allowing integration of the process.

AI-Media’s acquisition of EEG Enterprises in May 2021 was a transformative move that significantly enhanced the company’s position in the captioning and video technology market. This strategic acquisition not only expanded AI-Media’s presence in North America but also added crucial technologies to its product suite, making it a fully vertically integrated player in the industry.

The integration of EEG’s technologies, including the LEXI automatic captioning solution and the iCap Cloud Network, allowed AI-Media to offer end-to-end solutions for captioning, transcription, and translation.

The iCap network, being the world’s largest and most secure captioning delivery network, processes over 9 million minutes of content monthly, giving AI-Media a significant competitive advantage. This vertical integration means AI-Media can now provide solutions at every stage of the captioning process, from encrypting source data to encoding, captioning, transcription, and translation.

The company’s solutions are trusted by world-leading broadcasters and organisations, including major sporting events and global media companies.

Historically, human captioners were essential, serving as intermediaries who repeated spoken content and trained the model to recognise specific voice prints.

However, outside of complex scenarios, advancements in AI technology have diminished the necessity for these intermediaries. Despite slow group revenue growth in recent years, Ai-Media’s technology sector has experienced rapid expansion. Not only is the tech side of the business growing, it is doing so at a significantly higher gross margin than that of the legacy services business. A crucial piece of Ai-Media’s strategy is the iCap network, which transitioned from a free model to a fee-based one, thereby increasing reinvestment and reinforcing its competitive edge. This move underscored the businesses competitive advantage as rivals continued using iCap, unable to develop similar infrastructure independently.

Ai-Media’s iCap network not only sustains its dominance but also facilitates the upselling of its advanced ASR technology, including Lexi.

US broadcasters with existing encoding hardware/software are easily transitioning to Lexi, demonstrating the seamless integration and appeal of Ai-Media’s offerings. While the shift in technology is internally disrupting Ai-Media’s service revenue, it is having the same impact on competitors. The issue for Ai-Media’s competitors is that it doesn’t have the iCap advantage. With ambitions to expand iCap’s dominance globally and upsell Lexi services, Ai-Media’s strategy presents a promising area for investors to watch.

The potential for global network expansion coupled with impressive automatic speech recognition (ASR) capabilities positions Ai-Media as a noteworthy player in the broadcast technology market.

Ai-Media is due to report the full year 2024 results in August.

In its most recent update for the first half in February, AI-Media reported strong financial results. The company’s revenue increased by 10% to $37.2 million compared to the prior corresponding period. While not a huge jump overall, the technology side of the business grew revenue by 38%, driven by the growth in Lexi. The higher margin growth in technology revenue led to a 16% increase in gross profit to $20.5 million, with group gross margin increasing to 63%. This flowed through to improved operating earnings. The companies saw a 39% increase in operating earnings compared to the prior period to $1.9 million.

AI-Media’s cash position remained strong, with $11.7 million in cash and no debt as of December 31, 2023. The company also reported positive operating cash flow of $3.6 million for the period.

The company’s strategic focus on expanding its technology offerings and improving operational efficiency positions it well for its continued transition towards profitability.

As AI continues to revolutionise industries, AI-Media exemplifies how embracing technological disruption can lead to significant competitive advantages.

The strategic integration of AI-powered tools like LEXI and the iCap Cloud Network has not only elevated their service offerings but also fortified their market position. By focusing on technological advancements and operational efficiency, AI-Media has successfully transitioned from a reliance on legacy services to becoming a leading innovator in the broadcast technology market.

With an ever growing technology segment and improving operating earnings, the company is well positioned to move toward break-even profitability in the future. With its strong cash position, Ai-Media is well-equipped to continue expanding its global network and enhancing its ASR capabilities.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Reference Index: | ASX 300 |

| Number of Securities: | 20-50 |

| Single Security Limit: | 10% (typically 5%) |

| Investable Universe: | ASX (focus on ASX300 ex20) |

| Market Capitalisation: | Any |

| Leverage: | No |

| Portfolio Turnover: | < 25% p.a. |

| Cash Level: | 0% - 100% (typically 5 - 30%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of RBA Cash Rate + 2.5% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3 - 5 years + |

| Distributions: | Annual |

Invest via TAMIM Fund

Invest via IMA

The TAMIM Australia All Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.