Australian Equities

Australia All Cap

February 2025 | Investor Update

Dear Investor,

We provide this monthly report to you following conclusion of the month of February 2025.

The TAMIM All Cap Fund was down -4.71% (net of fees) during the month, versus the Small Ords down -2.80% and the ASX300 down -3.79%.

February reporting season was one of the more volatile periods we have seen in the last 20 years. Sharp moves in response to earnings results were commonplace, with investors reacting swiftly to any sign of weakness. A miss to consensus was punished – with -20% or -30% share price swings – a common theme.

Unfortunately a combination of volatile markets and getting a handful of positions wrong – contributed to a very disappointing month for the fund.

In cases where a company has fundamentally disappointed we acted swiftly and exited the position. In some cases we took the opportunity to add to a position where we felt the market has undeservingly sold the stock.

Overall we are now quite pleased with the portfolio composition, having exited underperforming positions and added new positions that we believe are providing significant upside this year. We discuss some of these in the report with more disclosure to come in the next few months.

Over the last few weeks (since mid February) the markets here and in the US are officially in correction territory (-10% drawdown). A combination of uncertainty surrounding the new Trump administration Tariff policy and investors concerns about a possible slowdown and risk of a US recession, has seen the market selloff quite aggressively.

In fact the last few weeks since February 19th highs, has seen the quickest -10% drawdown since the COVID crash of March 2020. So should investors be concerned, or is this just another healthy correction in what is a structural long term bull market? We believe the latter holds true and we explain why further below.

The so called Trump 2.0 administration has been given a mandate to fix the US government budget deficits and the unsustainable debt spiral that’s been building over the last few years. This time around, The Trump 2.0 version – is less focused about short term market reactions – and has surrounded himself with a savvy group of policy makers to help fix the US economy and drive sustainable growth.

This is visible with the appointment of the new Secretary of the Treasury – Scott Bessent – who has a very clear plan to reduce government spending and regulations partly through the efforts of Elon Musk and DOGE, and by doing so balance the budget and reduce the long term borrowing costs of the US government (10 years bond yield). For those unaware, Scott Bessent is a legendary Hedge fund manager who understands markets and economics incredibly well.

The best analogy we can think of is the equivalent to Warren Buffett coming to work for us as an equity analyst.

These measures in combination with Tariffs and incentives will bring back investments and manufacturing on shore to the US and support domestic employment. The key focus is to shift unproductive federal government employment into the more productive private sector labour market without putting pressure on labour costs. At the same time tax cuts and a reduction in bond yields will spur domestic spending and stimulate growth.

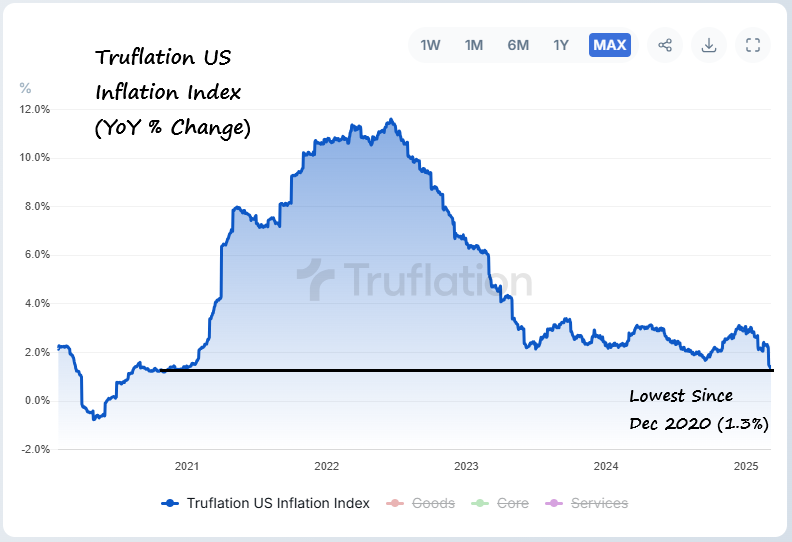

We see these measures as very logical and with true inflation sitting at under 1.5% (Truflation) we believe the Federal reserve will be forced to reduce rates at a faster pace than market expectations. Lower rates and a growing economy following a period of adjustment – should lead to a market rally later this year and into 2026.

In the short term these actions or the so called “Detox Period” will have some economic pain and the market is currently pricing that in. The uncertainty of how much economic pain is required is what causing the current market volatility.

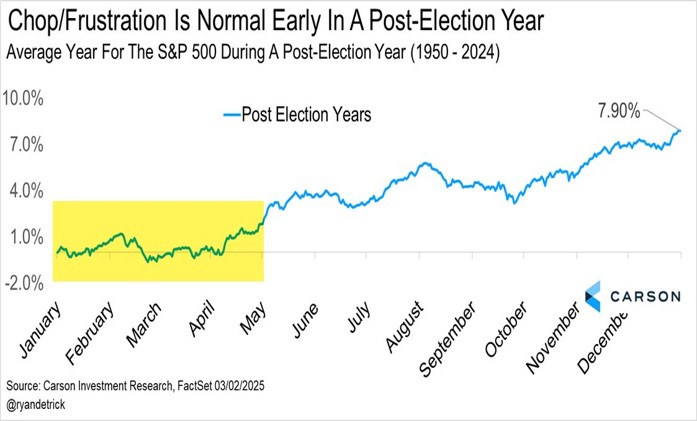

There are some other historical measures to consider in the context of a long term perspective. Historically the first year of a new president tends to see markets volatile in the first half of the year as new policies create uncertainty. We are seeing this play out with the Trump 2.0 tariffs. This so called first year seasonality is normal on a historical perspective.

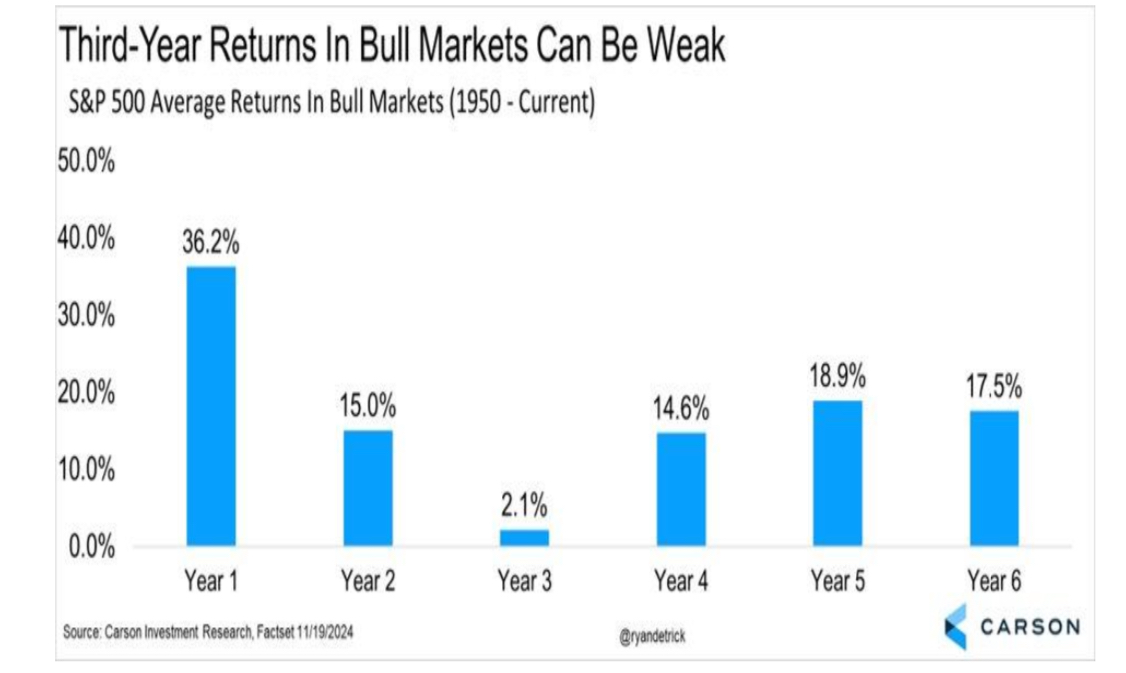

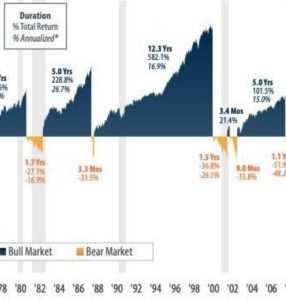

In conjunction, we are currently in the third year of this current bull market and these tend to be the weakest years of an average bull market that is at least 6 years long in average tenure. Investors must remember that the first 2 years tend to be quite strong from a returns perspective and we have seen this play out in 2023 and 2024. The good news is that years 4-6 are back to strong annual returns, so not long to go.

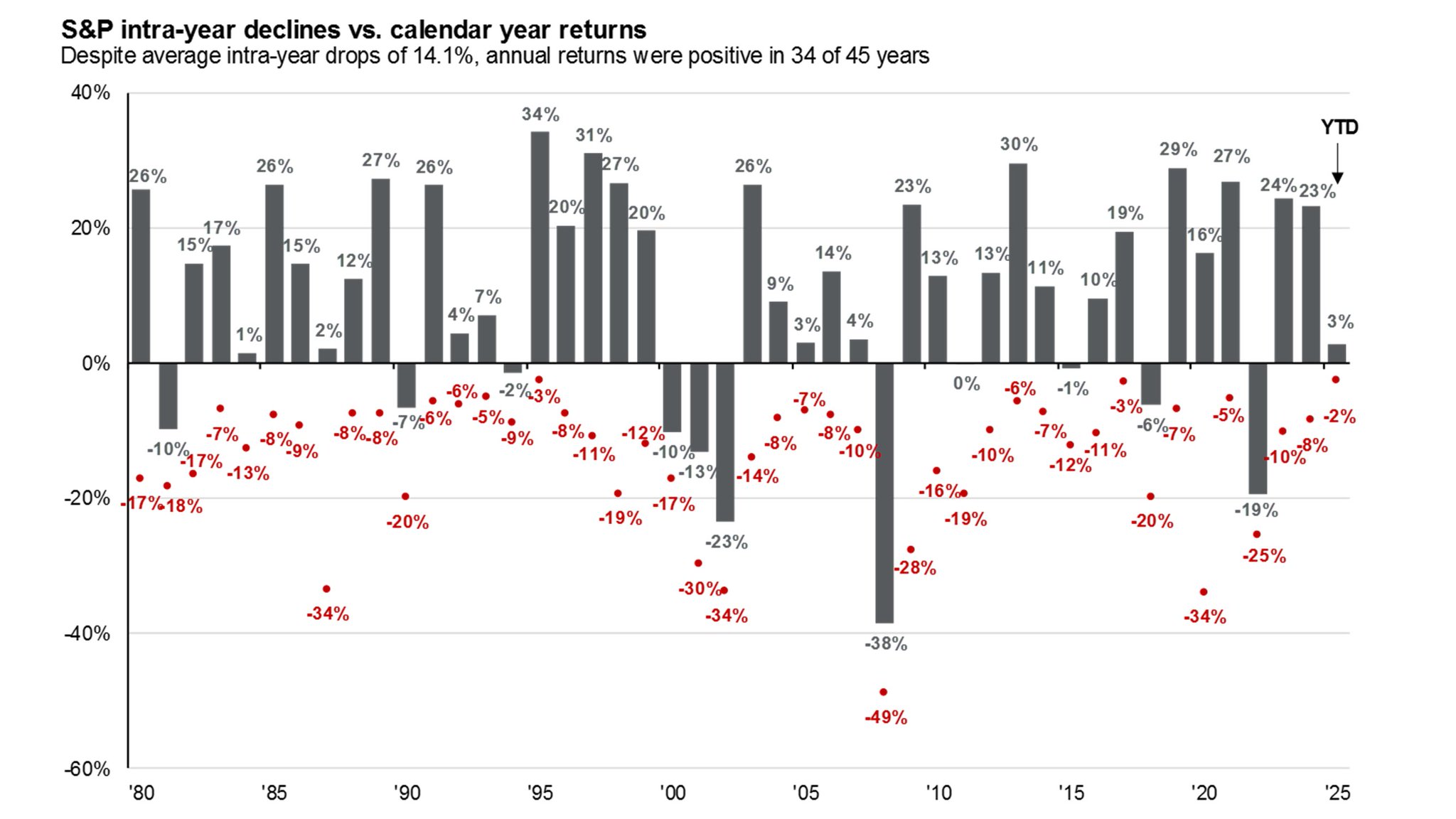

Since this bull market began just over 2 years ago, we have consistently said that every bull market tends to have between 2-3 drawdowns per annum, with each drawdown can be up to -14% on average. As can be seen below the average yearly drawdown is -14% regardless of the full year return. In other words – the price of admission for equity market returns – is volatility.

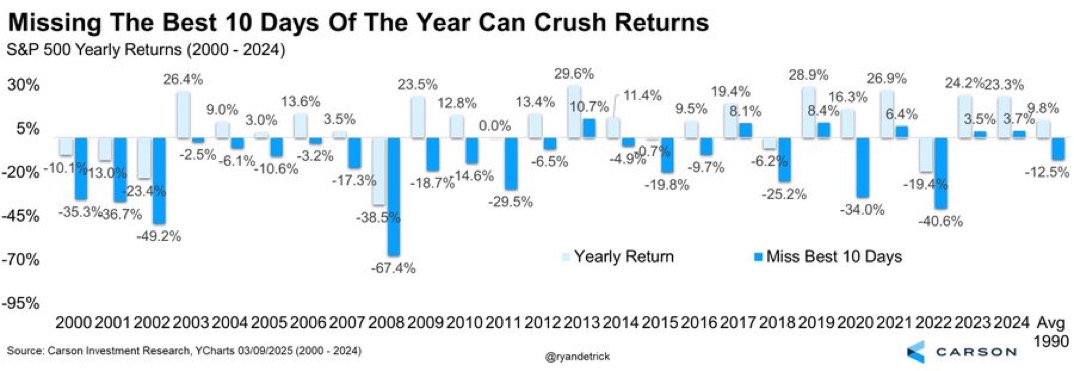

When markets are in a drawdown there is always a reason and each time the reason seems real and creates uncertainty. The current risk of Tariffs is no difference to when Silicon Valley bank collapsed in March 2023 or the Yen carry trade unwind in August 2024 or many other occasions. Trying to time these drawdowns is futile and can be quite detrimental to long term returns. For example, missing the best 10 days each year can be very costly over time.

So what should investors do from here? As always and over the last 6 years we have shown that each of these market drawdowns and corrections have proven to be a great buying opportunity. With all the volatility of the last 6 years, the Fund has proven to consistently deliver strong returns over the long term. Every time there is a correction we have always encouraged investors to take advantage of these opportunities and deploy funds into the market. Now is no different.

We view the current correction as a healthy pullback in what is a structurally long term mega bull market that will be driven by a healthier US economy, lower interest rates, and innovation led growth as a result of the AI technology revolution. We believe the current period is similar to the early 1990s Dotcom mega bull market that lasted for 12 years. That period was very profitable for patient investors.

Finally we provide a brief commentary on portfolio updates from reporting season during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in April.

Sincerely yours,

Ron Shamgar and the TAMIM Team.

Fund Performance

Portfolio Highlights

EML Payments (ASX: EML) has demonstrated significant financial recovery and strategic repositioning in the first half of FY25, signaling a promising turnaround for the payment solutions provider.

The company reported a robust financial performance, with revenue increasing 15% to $115.1 million and underlying EBITDA surging 50% to $33.4 million. Notably, EML transitioned from a net loss of $4.7 million in the previous corresponding period to a net profit of $9.5 million, marking a substantial improvement in profitability.

Key financial highlights include a 6% growth in customer revenue and a 49% increase in interest revenue, driven by higher bond returns and improved treasury management. The company's cash balance stands at $50.6 million, with a net improvement of $7.5 million in the half bringing the balance sheet to a net cash position.

EML's strategic "2.0" transformation is centered on three critical pillars: establishing a global operating model, reviving the revenue engine, and deploying a single technology platform. The leadership has already made significant strides, including restructuring the organisational approach, expanding the business development team, and initiating Project Arlo - a technology platform expected to streamline operations and provide cost efficiencies.

The company's geographic segments show varied performance. Europe demonstrated strong growth with a 30% revenue increase, while the Asia-Pacific segment saw steady 6% customer revenue growth. The North American segment faced challenges, with revenue declining 7%, highlighting the need for strategic focus.

Looking forward, EML has set ambitious targets. The company aims to build its sales pipeline to $65 million by FY25 year-end, with a calendar year goal of $90 million. Management is particularly excited about exploring new verticals, believing these offer more promising growth opportunities than entering entirely new markets.

The leadership, led by Executive Chair Anthony Hynes, appears fully committed to the company's transformation. Whilst emphasising a "one EML" culture focused on operational efficiency, innovation, and accountability. Anthony is a successful founder we believe the market will back.

Financial guidance remains unchanged, with the company maintaining its forecast of $54-60 million in underlying EBITDA for FY25. Following the result the Executive chair acquired $3 million of shares on market highlighting his conviction in the outlook. EML is in the early stages of its new growth phase and we believe the stock will re rate overtime as management executes. At an EV/EBITDA of 6x we see good upside from here with a high likelihood of takeover appeal.

Healius (ASX: HLS) is Australia’s 2nd largest pathology provider undergoing a critical transformation phase in its pathology division, with current challenges masking substantial long-term value creation opportunities. The first-half 2025 results highlight a strategic pivot aimed at improving operational efficiency and margin performance.

Currently, the pathology division struggles with compressed EBIT margins, hovering around 1%, significantly below the market benchmark of 7-10%. This is across a revenue base of close to $1.3 Billion.

The company's 1H FY25 7% revenue growth, driven by a 5% volume increase and a 45% surge in genomic diagnostics, demonstrates underlying market strength. Strategic investments are focused on workforce optimisation, collection center productivity, and specialist revenue stream development.

Margin compression stems from deliberate investments in labor cost restructuring, collection center staffing improvements, call center technology implementation, and pathologist remuneration realignment. Despite these short-term pressures, the company sees significant upside potential.

Operational efficiency gains are equally promising. The company has already reduced collection center closures by 50% and is investing $20 million in technology, targeting productivity gains of 15-20%. The pending Imaging division sale for $965 million provides additional strategic flexibility, with net proceeds exceeding $800 million and the potential for a special dividend over $300 million with $160 million of franking credits available to distribute. The March investor day will be crucial in providing detailed insights into the transformation roadmap.

Our thesis is simple, post imaging sale which is imminent and payment of debt, the company will have $450m of net cash. The current market cap is $950m. We believe a $350m+ fully franked dividend will be paid. This implies an EV for the remaining pathology business of circa $350-$450 million.

Under the right management we believe a pathology business generating such revenue should be yielding EBIT margins of 8-10%. This implies $100m of potential earnings upside. It is not clear whether the current management is up to the task. Hence we are confident that such a strategic asset will be acquired post capital return. A renewed merger offer with Australian Clinicsl Labs (ACL) makes strategic sense with material synergies. Either way we feel there’s 40% upside to the current valuation in the near term.

SuperLoop (ASX: SLC) delivered an exceptional first half of FY25, showcasing significant growth across critical business metrics. CEO Paul Tyler emphasised the company's progress in its three-year double-down strategy, with total customers surging 63% to over 664,000 and income rising 31% to $258 million.

The company's performance was marked by a substantial increase in NBN market share, growing over 50% to 6.3%, and the successful migration of 130,000 Origin broadband customers. Underlying EBITDA expanded 66% to $38 million, while the net loss after tax narrowed to $7.8 million.

Segment performance revealed nuanced growth strategies. The consumer segment added 37,000 new customers with a 43% revenue increase, while the wholesale segment saw a 52% revenue boost driven by Origin and new customers like AGL. The business segment experienced flat revenue due to ongoing price erosion in corporate data products.

Strategic initiatives included the announced acquisition of Uecomm, which will add 2,000 kilometers of metropolitan fiber, continued focus on high-speed internet plans, investments in AI and automation technologies, and maintenance of a low-cost operating model.

SLC exhibited financial discipline, with gross margin increasing to $88 million, operating expenses up 12.4%, strong cash flow generation, and a negligible debt position. The company confidently reaffirmed its FY25 guidance of underlying EBITDA between $83-$88 million and capital expenditure of $28-$30 million.

Management's strategic focus remains centered on cost leadership, organic growth, disciplined M&A opportunities, and expanding the smart communities division. The company has developed promising AI use cases, including an AI chatbot (Teddy) with impressive customer satisfaction rates. The wholesale segment shows potential for future growth, with management expressing optimism about white-label offerings and market opportunities.

SLC is focussed on M&A with a potential of a meaningful deal in the short term. We see this a material catalyst. In the meantime the 2H has started well with new NBN subs reaccelerating. The Origin contract will continue to drive strong growth for the group with some risk of a potential guidance upgrade later this year.

Bravura Solutions (ASX: BVS) reported robust financial performance for the first half of fiscal year 2025, showcasing significant improvements in its operational and financial metrics. Group CEO Andrew Russell highlighted the company's successful execution of its "energised build and grow" strategy, demonstrating renewed focus on client solutions and operational efficiency.

-

- Financial Highlights:

- Revenue: $127.5 million (0.4% increase from previous period)

- EBITDA: $23.8 million (up $15.9 million)

- Cash EBITDA: $20 million (up $20.3 million)

- Net Profit: $11.3 million (up $13 million)

- Closing Cash Balance: $151.8 million

The company announced a comprehensive capital return strategy, including:

-

- A special dividend of $40 million (8.9 cents per share)

- First-half dividend of $7.2 million (1.6 cents per share)

- Total cash distribution to shareholders of 26.8 cents per share in FY25

Bravura is concentrating on four key strategic pillars:

-

- EMEA and APAC market expansion

- Delivering client-focused technology solutions

- Positioning for growth with existing clients

- Building a high-quality technology business

The company has upgraded its full-year guidance, now forecasting:

-

- Revenue: $248 million to $252 million

- EBITDA: $46 million to $49 million

- Cash EBITDA: $38 million to $41 million

Notably, the company is seeing promising developments in its APAC digital advice proposition, which is gaining market traction and driving increased project work. Management emphasised ongoing efforts to reduce software customisation, improve engineering capabilities, and maintain a flexible cost base.

Management highlighted the company's approach to cost management, noting that most expenses can be flexibly adjusted based on project opportunities. The team is particularly focused on improving engineering efficiency, with recent efforts showing reduced code defects and more streamlined development processes.

While the company remains cautious about immediate large-scale investments in emerging technologies like AI, they are actively exploring potential integration and partnership opportunities that could benefit their clients.

Looking ahead, Bravura appears well-positioned for continued growth. The leadership team believes they are rebuilding market confidence through consistent delivery and strategic alignment with clients. The company expects to see further improvements in financial performance in FY26, driven by revenue growth opportunities and ongoing operational efficiencies.

Tyro Payments (ASX: TYR) has solidified its position as a leading fintech player. Tyro’s financial turnaround has been remarkable. The first half of FY25 marked its most profitable period to date. Since its IPO, Tyro has achieved an 18% compound annual growth in gross profit, rising from $68 million to $112 million, alongside 12x EBITDA growth, reaching $33 million. The company has also transitioned from an $11 million loss to a $10.5 million profit. These results highlight a well-executed strategy centered on disciplined cost management and targeted expansion into high-growth sectors.

The healthcare sector is a key growth engine for Tyro. With Australia’s healthcare payments market expected to reach $100 billion annually, Tyro processes $7 billion, capturing a 7% market share. The company has outpaced industry growth with a 24% compound annual growth rate in healthcare transactions. Tyro’s edge lies in its omni-channel capabilities, seamlessly integrating online and in-person payment solutions. The company’s proprietary technology connects with over 120 payment providers, including private health insurers and Medicare.

In key healthcare segments, Tyro has established a strong presence, holding a 30% market share in general practitioners, 2% in allied health, and 1% in dental. These figures highlight a significant growth opportunity, particularly in underpenetrated sectors such as allied health and dental.

Tyro is entering a new, high-potential vertical with a total addressable market of $5-10 billion. In collaboration with a market leader holding over 50% market share, the company aims to automate manual processes and enhance merchant value. This initiative is expected to generate $2-3 billion in transaction value over three years, with a gross profit potential of approximately $39 million and a target market penetration of 30-40%.

Tyro’s banking division is another significant growth opportunity. Currently contributing 7% of gross profit, the company aims to increase this to 20% through its partnership with Constantinople, an Australian fintech platform. The banking expansion strategy includes transaction accounts, cash flow lending solutions, term deposits, and the potential to settle $44 billion in processed payments through Tyro bank accounts.

With $155 million in cash and a robust balance sheet, Tyro is exploring capital management strategies, including potential share buybacks, subject to APRA approval. The company is also evaluating strategic acquisitions to enhance its technological infrastructure and market reach. One compelling opportunity is the acquisition of Smartpay (SMP). By processing SMP transactions on its in-house switch instead of through Cuscal, Tyro could unlock significant cost synergies, potentially adding $40 million in EBITDA.

CEO John David has outlined a clear roadmap focused on further penetration in the healthcare sector, expansion into new industry verticals, leveraging macroeconomic recovery in hospitality and retail, and advancing banking services to drive long-term revenue growth. With a combination of organic growth initiatives and potential strategic acquisitions, Tyro is well-positioned to capitalise on evolving market dynamics.

Trading at 5.3x EBITDA, Tyro appears significantly undervalued, with considerable upside potential. Given its previous takeover bids at $1.50+ per share in 2022, it remains an attractive acquisition target.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Reference Index: | ASX 300 |

| Number of Securities: | 20-50 |

| Single Security Limit: | 10% (typically 5%) |

| Investable Universe: | ASX (focus on ASX300 ex20) |

| Market Capitalisation: | Any |

| Leverage: | No |

| Portfolio Turnover: | < 25% p.a. |

| Cash Level: | 0% - 100% (typically 5 - 30%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of RBA Cash Rate + 2.5% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3 - 5 years + |

| Distributions: | Annual |