Australian Equities

Australia All Cap

August 2024 | Investor Update

We provide this monthly report to you following conclusion of the month of August 2024.

The TAMIM All Cap Fund was down -3.87% (net of fees) during the month, versus the Small Ords down -2.02% and the ASX300 up 0.44%.

CYTD the fund is up +14.69% net of fees versus the ASX300 up +8.94%.

The month of August was an uphill battle for the Fund. The month began with global markets selling off aggressively on the back of a partial unwinding of the yen carry trade. Global markets sold off between -5% and up to -20% in Japan in just a matter of 2-3 days. The Fund is not immune from general market volatility and so we spent the rest of the month peddling hard to regain those early month losses.

Market sentiment eventually recovered and the focus was back to fundamentals and the August reporting period. Share price directions were now driven by each company’s individual results performance and the corresponding market reaction to it.

Overall the majority of our holdings performed to expectations or exceeded them. Those that disappointed and where the original investment thesis was broken, we exited. There were some cases where our thesis was not broken but the market aggressively sold the stocks down due to certain aspects of the results or the outlook disappointing the market. In those cases, we took time to reassess our position and in some cases reduced our exposure. Unfortunately a combination of market volatility in early August and some late month disappointing results, ended up with the fund being down for the month, although this was after a very strong CYTD performance so far.

The good news is that as we go to print in mid September, the Fund is performing strongly. We will have to see whether that continues until the end of the month, but rest assured we continue to actively manage the portfolio.

We have uncovered some exciting growth companies to add to the portfolio that tick most of the boxes we look for such as founder led, strong profitable growth, cashed up balance sheets and industry leading positions. Some of these companies are utilising AI applications to drive strong sales growth and disrupt competitors.

We discuss some of these in our portfolio update section and also some of the laggards that we still believe present good upside in the next 3-6 months.

As we look forward into the near term, we are still of the view that rate cuts in the US will drive strong investor sentiment towards small/mid caps. In addition, once the uncertainty of the US presidential elections is resolved in early November, we believe the market will rally into the year end and into 2025 and beyond.

We provide a brief commentary on portfolio updates during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in October.

Sincerely yours,

Ron Shamgar and the TAMIM Team

Fund Performance

Portfolio Highlights

EML Payments (ASX: EML) FY24 results brought much-needed optimism to investors- although that wasn’t readily seen from the share price reaction post the results. The standout figure was an underlying EBITDA increase of 34%, reaching $57.1 million, at the higher end of guidance. Revenues rose 18% to $217.3 million, fueled by a 6% bump in customer revenue. This growth was particularly evident in EML’s General Purpose Reloadable (GPR) and Digital Payments segments.

This performance is largely due to EML’s focus on cost optimisation and its success in securing new business toward the end of FY24. Notably, the company’s regulatory remediation in the UK has been completed, removing growth cap restrictions, which now allows EML to expand in this key market.

All three of EML’s major segments—Gifting & Incentive, General Purpose Reloadable (GPR), and Digital Payments—performed well in FY24 although were skewed to the 1H, showcasing the company’s ability to diversify its revenue streams.

• Gifting & Incentive: Gross Debit Volume (GDV) increased by 5% to $1.8 billion, with revenue rising 9% to $81.5 million, driven by the success of corporate incentive programs.

• General Purpose Reloadable (GPR): A core business area for EML, the GPR segment saw a 3% rise in GDV to $7.8 billion, and customer revenue grew by 7%. This was largely due to strong demand in the government and human capital sectors.

• Digital Payments: Recorded a 19% increase in GDV, reaching $236.8 billion. This was supported by EML’s Sentenial business, which has now been fully divested in early September and removes a loss making and non core division from the group.

The sale of Sentenial, including its Nuapay business, to GoCardless for €32.75 million (~AUD $53.4 million) has been a transformative move for EML. This transaction allowed the company to shift from a net debt position of $48 million to a net cash position of approximately $5 million post FY24 balance date. There is an additional earnout kicker for EML if Sentenial delivers better growth than expected next 12 months. This improved liquidity provides EML with the flexibility to focus on its core operations and invest in new growth areas. Additionally, the company now has access to a $70 million debt facility, giving it further financial headroom for future initiatives.

Under the leadership of CEO Ron Hynes, EML’s “EML 2.0” strategy focuses on three core areas:

1. Reinvigorating Growth: EML is doubling down on organic growth, enhancing its sales and go-to-market strategies to expand its customer base, particularly in the UK, where growth restrictions have been lifted.

2. Product-Led Innovation: The company is aligning its product roadmap with evolving customer needs, leveraging data analytics and artificial intelligence to offer more innovative payment solutions.

3. Uplifting Organisational Capabilities: EML is streamlining its operations and bringing in new talent to ensure its growth strategy is executed effectively. Key hires in sales and other critical areas are expected in the near future.

While EML’s outlook is generally positive, challenges remain, especially in North America, where customer churn has impacted performance in the shopping mall gift card division. This churn is attributed to the financial difficulties of certain customers. However, EML is rebuilding its sales pipeline and improving customer retention strategies to mitigate these challenges.

Looking ahead, EML’s guidance for FY25 estimates underlying EBITDA between $54 million and $60 million which compares well versus the $49 million EBITDA for FY24 excluding PCSIL contribution. The company will focus on cost optimisation, responsible growth, and technology investments as part of its long-term strategy. EML is expected to provide a more comprehensive medium-term strategy at its November 2024 AGM, giving investors more insights into its future financial and operational metrics. We believe this will be a key catalyst for the trajectory of the stock in the short term.

With regulatory challenges behind it, a revitalised leadership team, and a strengthened balance sheet, EML is well-positioned to take advantage of the growing global payments market. Trading on an undemanding 4.8x EV/EBITDA, we believe a takeover of EML in the near term is likely. We will reassess our position in EML post their AGM strategy update and outlook.

Closed Loop Group (ASX: CLG) is a leading provider of circular economy solutions, focused on collecting, reusing, and recycling a variety of products and materials like print consumables, IT products, cosmetics, batteries, and soft plastics, and then remanufacturing, repurposing, or recycling them to avoid landfill.

CLG operates across four key geographical regions - North America, Europe, Australia, and South Africa. The company has over 380 staff and more than 300,000 collection sites globally. A key part of their strategy has been the acquisition of ISP Tech Services 16 months ago, which has been a "game changer" for the business.

CLG delivered a strong headline financial results in FY24, exceeding their revenue and EBITDA guidance. Total revenue was $219 million, up 59% year-over-year, while EBITDA grew 85% to $45 million. The company's debt position was a key area of focus. Net debt increased by $16 million in the half, despite good EBITDA, due to a $12.5 million working capital outflow in the second half.

This was partly driven by the timing of inventory payments related to the ISP acquisition, as well as a $7.5 million deferred consideration payment. Management aims for a 75% cash conversion rate, with plans to invest in working capital to support growth.

Regarding debt refinancing, the company is in discussions with its existing lender and has signed an engagement letter with a potential syndicated facility. They expect to announce a new debt facility around the time of the AGM in late November, with the potential to reduce interest rates by up to 3%. The company is also considering reducing the cash balance and borrowing amount as part of the refinancing.

On the packaging segment, there were some challenges, with earnings lower year-over-year, particularly in the second half. Management acknowledged small fixes needed, especially in the Australian packaging business, which relies on outsourced manufacturing. They attributed this to customer shifts leading to a shortage of packaging materials, requiring the acquisition of additional customers. One-off adjustments and the loss of a packaging customer due to insolvency also impacted the packaging space. However, the company has put management fixes in place, including changes to address the challenges.

The FY25 earnings outlook was also a concern as the company was unable to provide clear guidance. Management explained that it is still early in the new financial year, and they want to avoid over-promising and under-delivering. They remain confident in the growth opportunities, both organically and through potential acquisitions, but acknowledged the need to provide more clarity as the year progresses.

The potential divestment of the packaging business was also discussed, as it was suggested that this could improve the stock's multiple and allow the company to focus on its core resource recovery strategy. While the packaging business has faced some challenges, management noted that it is still a good cash generator and provides the company with flexibility in capital management. They are open to exploring opportunities for the packaging business, but it remains an integral part of the group's operations for now.

Another key challenge is customer concentration, with the company's top customers currently accounting for a significant portion of revenue. Management aims to reduce this concentration to around 50% within the next year through diversifying the customer base.

Looking ahead, CLG has an ambitious growth strategy focused on several key initiatives:

1. Expanding the HP certified refurbishment solution globally, including into Europe and the Middle East.

2. Growing the multi-vendor take-back program in Europe and adding printer refurbishment capabilities.

3. Increasing engagement with tier one packaging customers in Australia, South Africa, and Europe.

4. Reducing customer concentration in the IT asset disposition (ITAD) business.

5. Investing in additional soft plastic recycling facilities across Australia.

The company also plans to explore acquisition opportunities, both within its existing business units and to expand its service offerings. Management is confident these initiatives can drive substantial revenue and earnings growth over the next 3-5 years. We will reassess our position post the AGM guidance and debt refinance update. If CLG delivers strong cashflow in 1H FY25 then the stock will re rate back to 30+ cents.

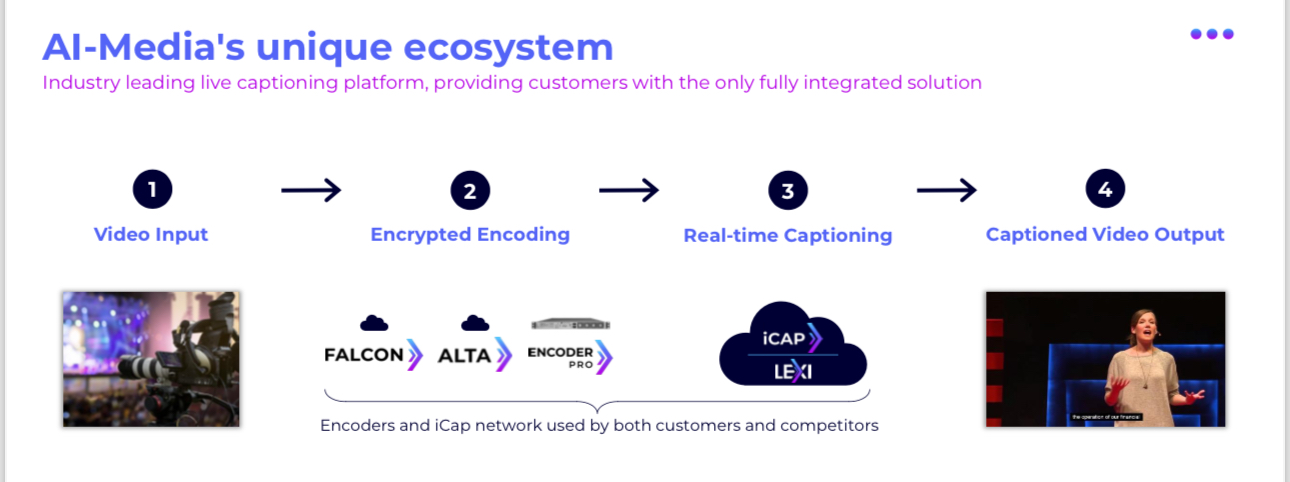

AI Media (ASX: AIM) is transitioning from a services-based business to a technology-focused business, with a core focus on AI-powered language services. Their key product is Lexi, an AI-powered captioning and transcription solution that is integrated into customers' workflows through the company's EEG encoder devices and icap network.

The company has achieved strong product-market fit, particularly in the US broadcast market, and is now looking to replicate that success internationally and expand into new sectors like government and enterprise.

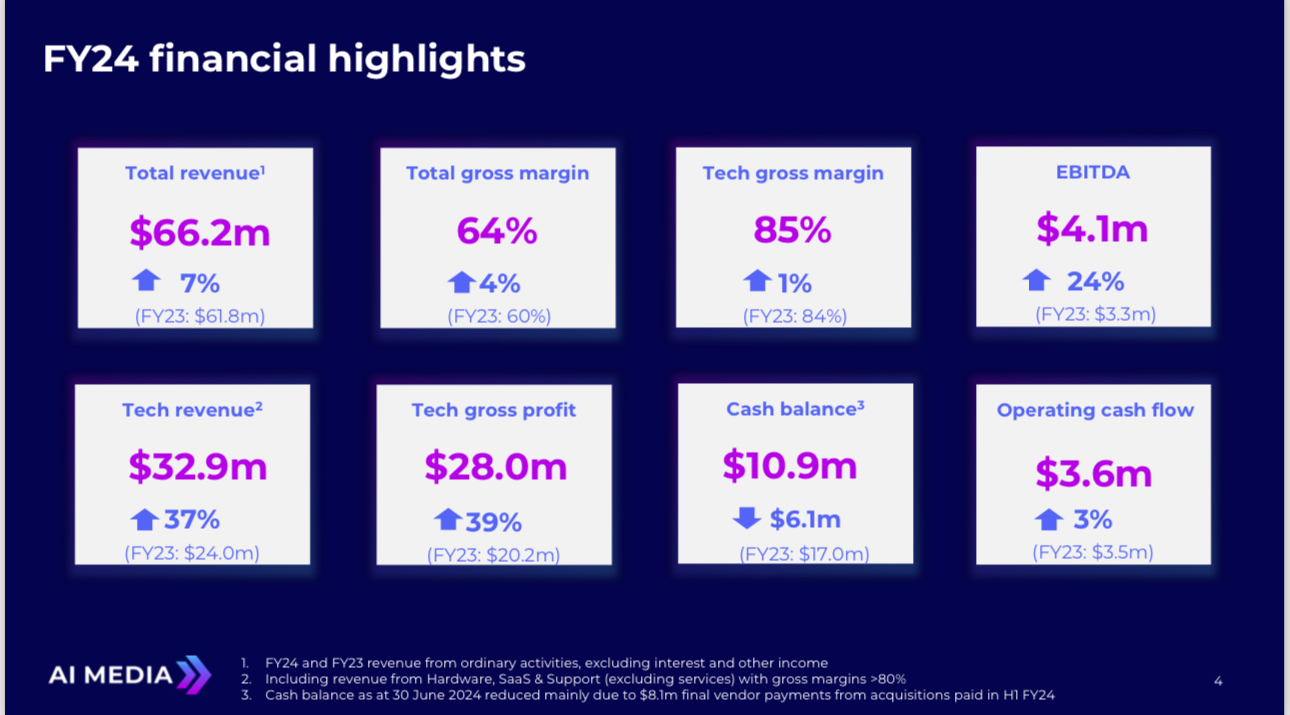

The company reported FY24 revenue of $66.2 million, up 7% year-over-year. The group revenue growth was masked by the gradually declining low margin (44%) services revenue being replaced by high margin (85%) and strong growth tech revenue. Gross group margins improved to 64%, driven by 85% gross margins on the technology business. Technology revenue grew 37% and technology gross profit grew 39%.

The company is cash flow positive and has a clean balance sheet with $11 million in cash. AIM spent $8 million on R&D during the year and conservatively capitalised only $500k. The current high amortisation is from acquisition accounting and is non cash - hence masking the true profitability of the business.

The company is targeting 80% technology revenue by December 2025, up from the current 50% level. Management have an aspirational 5-year target of $150 million in revenue and $60 million in EBITDA, driven by geographic expansion, sector diversification, and new product launches. Key focus areas include growing the icap network, launching new AI-powered products like audio description and voice, and continuing to transition the services business.

The company is open to strategic acquisitions that complement their existing technology and customer base. Replicating the successful US acquisition of EEG in other regions would be highly desirable.

AI Media is one of the few ASX exposures to AI. The stock ticks all the boxes we look for in a company - global leader in its industry, strategic asset through its embedded encoders, high growth in revenue and profits, strong balance sheet with $11m net cash, and more importantly a high energy and passionate Founder/MD, who is the largest shareholder with 16% and more recently has been buying shares on market.

On a medium term view we think the stock is worth around 90 cents. If the company can continue growing its technology revenue at 35% pa, we believe the market will start pricing it on its trajectory to the aspirational 5 year target ($150m revenue/$60m cash EBITDA) within a couple of years from today. At that point, we believe a $5.00+ valuation is possible (10x bagger).

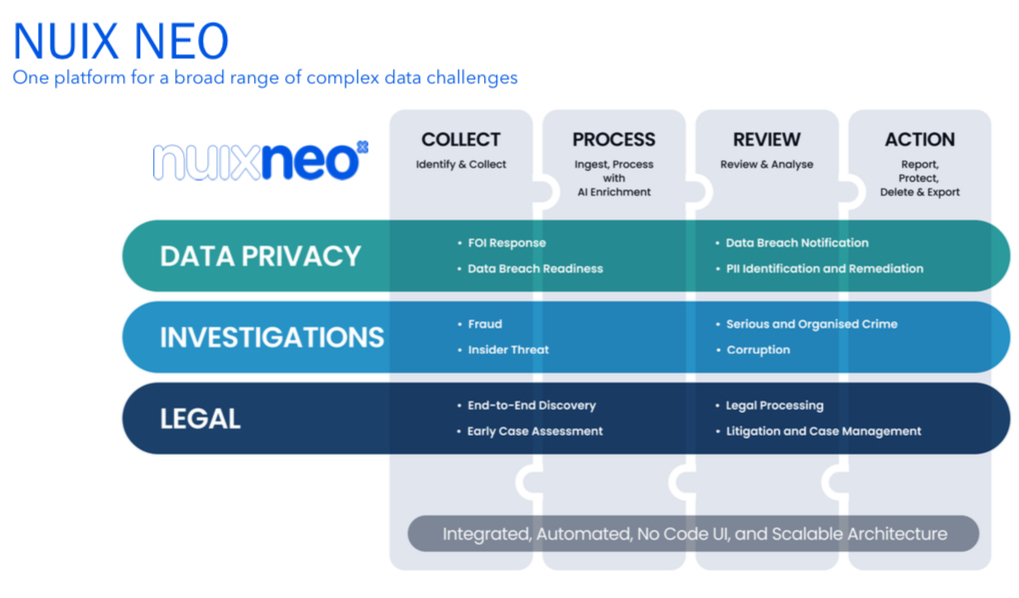

Nuix Ltd (ASX: NXL) is an Australian software company that provides intelligence software solutions to a global customer base. The company's core business model is centered around its Nuix Neo platform, which serves as the foundation for its key offerings in data privacy, forensic investigations, and legal processing and review.

At the heart of Nuix's platform is its world-leading data processing engines, which are increasingly enhanced with the company's proprietary AI technology. This unified platform approach allows Nuix to deliver streamlined, intelligent solutions to address common use cases for its customers. The acquisition of Rampiva last year has further bolstered Nuix's automation and orchestration capabilities, driving greater efficiency for clients.

Nuix products can be complex and difficult to understand but the following graphic does a good job of highlighting the 3 key products:

Nuix operates in a truly global market, with 85% of its annual contract value (ACV) generated outside of Australia. The company serves a high-quality customer base of 1,000 clients with over 400 staff worldwide, with 75% of customers having been with Nuix for more than five years. This depth and breadth of offering and footprint positions Nuix well to drive future growth.

In the financial year just ended (FY 2024), Nuix delivered impressive results that exceeded its strategic objectives. The company reported a 14% increase in ACV, reaching $211.5 million, with 95% of ACV coming from recurring subscription revenue. This strong ACV growth was driven in part by the successful launch and adoption of the Nuix Neo platform, which accounted for 45% of the ACV increase.

Nuix's revenue also saw robust growth, rising 20.9% to $220.6 million, outpacing the company's strategic target of 10% constant currency growth. This revenue performance was underpinned by continued momentum in net dollar retention, which increased by a further 3.7 percentage points to 112.9%.

Importantly, Nuix was able to achieve significant operational leverage, with underlying EBITDA increasing by 38.7% to $64.4 million and statutory EBITDA rising by 60.2% to $55.9 million. This strong profitability translated into a marked improvement in cash flow, with Nuix generating positive underlying cash flow of $24.7 million and overall positive cash flow of $11.9 million, a significant turnaround from the prior year.

Looking ahead to FY2025, Nuix has set ambitious but achievable targets. The company is aiming for around 15% ACV growth, while also expecting to grow revenue faster than operating costs, despite planned increases in R&D investment. This investment will be focused on further enhancing the capabilities of the Nuix Neo platform and its core solutions, broadening their appeal and usefulness to a wider customer base.

Nuix also has a $30 million debt facility available, which it may utilise for potential M&A or partnership opportunities to accelerate its growth strategy. The company's strong cash position and improved profitability provide a solid foundation for these strategic initiatives.

Overall, Nuix's FY 2024 results demonstrate the success of the company's transformation and the growing traction of its Nuix Neo platform. With a clear roadmap for continued innovation and a focus on driving operational efficiency, Nuix appears well-positioned to capitalise on the significant opportunities ahead and deliver sustained growth in the years to come.

Nuix NEO AI solutions have the potential to grow revenue 2-3 times over the next 5-10 years with significant profit margin expansion. With double digit revenue growth and high EBITDA margins, we believe NXL fits the bill for a Rule of 40+ software company. These type of global companies trade on 7-10x sales. We can see NXL being valued at $10.00+ over the next 2-3 years.

Bravura Solutions Limited (ASX: BVS) Bravura Solutions reported an impressive return to profitability following significant transformation efforts. The company achieved gross revenue of $250.4 million, marginally surpassing FY23, with operating earnings reaching $25.8 million eclipsing the prior period by $26.1 million. The growth was driven by a substantial reduction in operating expenses, which fell 10% to $231 million. The strategic cost-cutting measures included a reduction in headcount and reorganisation of occupancy requirements. As a result, Bravura posted an adjusted net profit after tax of $8.8 million, marking a $31.9 million improvement from the previous year.

Bravura’s FY24 performance reflects the success of its recent restructuring, which has restored the company to a positive cash operating earnings. The company is in a strong net cash position with $90 million as of June 30 2024, with a net cash inflow of $14.2 million and an additional $56 million of cash payment due in FY25 we discuss further below. Despite the success, Bravura has opted not to declare a dividend in FY24 but with a view to paying dividends in FY25.

Looking ahead, Bravura aims to further strengthen its financial position by targeting cash operating earnings of $28 million to $32 million in FY25.

Earlier in the month the company announced a proposed capital return as part of its capital management strategy. The return of up to $75.3 million has been further enhanced by an additional $20 million on-market buyback of up to 10% of the company. The strategy will be funded by existing cash reserves and proceeds from its recent agreement with Fidelity International.

This agreement with Fidelity International, includes granting them a perpetual, non-exclusive licence to use and develop the Sonata software platform. The deal includes a £29 million payment ($56 million AUD), with £24 million due upon software delivery in August 2024 and the balance in early 2025. While Bravura retains intellectual property rights, the move is designed to streamline Bravura’s operations.

We believe that while it may have a minor revenue impact in FY26, there will be minimal effect on profitability. While Bravura’s transformation continues, the company is moving into its next phase of sustainable growth with some large potential new logo wins being tendered and prospect of further work in the U.K. market with existing clients. In addition Continued cost reduction initiatives and a focus on maintaining a strong balance sheet remain at the forefront of the company’s future plans.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Reference Index: | ASX 300 |

| Number of Securities: | 20-50 |

| Single Security Limit: | 10% (typically 5%) |

| Investable Universe: | ASX (focus on ASX300 ex20) |

| Market Capitalisation: | Any |

| Leverage: | No |

| Portfolio Turnover: | < 25% p.a. |

| Cash Level: | 0% - 100% (typically 5 - 30%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of RBA Cash Rate + 2.5% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3 - 5 years + |

| Distributions: | Annual |

Invest via TAMIM Fund

Invest via IMA

The TAMIM Australia All Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.