Australian Equities

Australia All Cap

Below you will find this months commentary and portfolio update for TAMIM Australia All Cap unit class.

April 2024 | Investor Update

Dear Investor,

We provide this monthly report to you following conclusion of the month of April 2024.

The TAMIM All Cap Fund was down -2.18% (net of fees) during the month, versus the Small Ords down -3.06% and the ASX300 own -2.92%. CYTD the fund is up +12.49%.

April saw equities take a breather after a very strong run up in March. We see these market pull backs as very healthy in the short term, allowing recent market gains to have time to consolidate for a few months before the next move higher, which we expect in the second half of the year. We are glad to have once again outperformed the market.

The US economy continued to be strong with a good earnings quarter and the jobs market continuing to show resilience. This naturally flowed to slightly higher than expected inflation figures in March which in turn changed rate cut expectations to potentially no cuts this year. To put this into context – versus how the market would have reacted last year (aggressive selloff) – the pullback has been measured and small.

This signals to us that investors are no longer focused as much on inflation and interest rates as they were last year. This is a positive sign for equities in the medium term, as markets move on fundamentals rather than general sentiment. We also believe there will be no more rate hikes both in the US and here in Australia. The US has inflation well under control and in Australia mortgages are highly rate sensitive and have a much larger impact on consumer spending and hence economic activity in the short term.

We believe that rate cuts are unlikely this year which we see as a positive in general. In the next few months market attention is likely to turn to the US elections which promise to be wildly entertaining to watch. At the moment Trump is the favourite to win, and historically he’s been good for the US economy and hence markets.

We provide a brief commentary on portfolio holdings results during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in June.

Sincerely yours,

Ron Shamgar and the TAMIM Team

Fund Performance

Portfolio Highlights

EML Payments (ASX: EML) announced they have resolved the final regulatory matter with the UK regulator (FCA). The FCA has been satisfied with the better regulatory controls for the PFS UK subsidiary and has removed the self imposed growth caps on new programs going forward. This was a major update as EML is now free from all regulatory matters for the first time since May 2021.

This means EML management is now fully focussed on growing the business and improving margins rather than dealing with regulators. At the same time EML's largest holder, Alta Fox, exited their investment and stepped down from the board. EML is now a $380m market cap business with $45m of net cash (post Sentenial sale settlement) and is expected to generate $60m of Ebitda in FY25 and $30m of free cashflow. That places the stock on 5.5x and we believe either the stock will re rate at least 50% in the next 6-9 months or otherwise it will be acquired for 10-12x EBITDA.

Pacific Smiles (ASX: PSQ) announced a signed scheme of arrangement with National Dental Care (NDC) for a cash bid at $1.90 with an additional 5 cents of franking credit from a 12 cents dividend included in the price. The bid is superior to the Genesis $1.75 offer back in March. Shortly after, Genesis converted their Call Swap arrangement for their 19.90% holding in PSQ to physical shares.

We now await on Genesis to see whether they match the offer, bid higher, or just take their 35%+ gain in 6 months and move on. NDC is a much larger operator than the Current Genesis dental operations and so they are able to extract much larger set of synergies from acquiring PSQ. So far this has been a tremendous investment for us since we bought around $1.05 late last year.

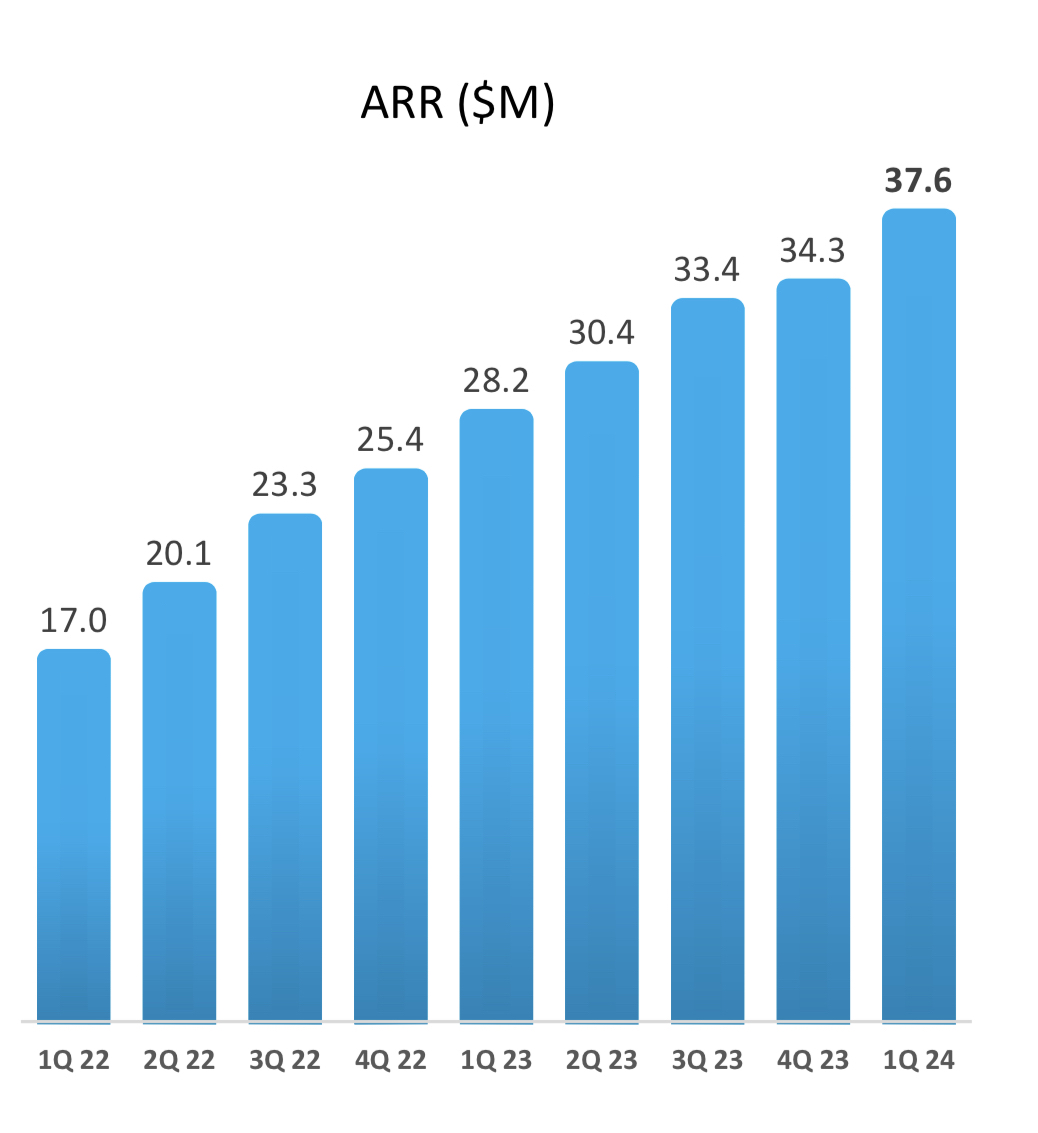

Source: Dropsuite Investor Presentation Q1 2024

Dropsuite (ASX: DSE) provided a first quarter update to CY2024with the following highlights:

- Annual Recurring Revenue (ARR) of $37.6m, up 33% on the Previous Corresponding Period

- ARR increased 9% on prior quarter (QoQ) with assistance from depreciating AUD:USD (up 7% on a constant currency basis).

- Q1 FY24 operating cashflow of $0.39m.

- Monthly ARPU of $2.53 up 10% on PCP (up 8% on a constant currency basis).

- Product gross margin of 69%, in line with previous quarters.

- Onboarded 40 new direct and 220 indirect transacting partners.

- Total users increased 22% vs PCP to 1.24 million.

- DSE continues to invest in research and development and go-to-market functions to drive sustainable and scalable growth.

- DSE remains well-funded with $24.9m cash as at 31 March 2024.

With the stock trading on an undemanding 4.5x EV/ARR and profitable we see the multiple contracting further as the year progresses. We think once ARR scales to $50m (sometimes in CY2025) the company will attract inbound interest by a larger player.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Reference Index: | ASX 300 |

| Number of Securities: | 20-50 |

| Single Security Limit: | 10% (typically 5%) |

| Investable Universe: | ASX (focus on ASX300 ex20) |

| Market Capitalisation: | Any |

| Leverage: | No |

| Portfolio Turnover: | < 25% p.a. |

| Cash Level: | 0% - 100% (typically 5 - 30%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of RBA Cash Rate + 2.5% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3 - 5 years + |

| Distributions: | Annual |

Invest via TAMIM Fund

Request additional details by using the form or if you're ready to invest select the apply now button.

Invest via IMA

The TAMIM Australia All Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.