Global Equities

Global High Conviction

Investor Updates

Below you will find this month’s commentary and portfolio update for the Global High Conviction unit class of the TAMIM Fund.

June 2024 | Investor Update

Dear Investor,

The TAMIM Global High Conviction unit class was up -0.37% for the month of June 2024, this was in comparison to the index return of +1.61%. The strategy has generated areturn of +18.67% over the past 12 months.

Is ‘political risk’ just the excuse they need?

Global equity markets rose again. Whatever happened to ‘sell in May and go away”?! Looking more closely it doesn’t seem a healthy market; nor one based on an improving economic backdrop. The concentration of the US market is now far greater than it was in the dotcom era. 10 stocks continue to dominate. Their balance sheets are indisputably strong with many holding net cash. Thus, their managements’ ability to buy back shares, increase dividends and fund capital expenditure is unquestioned. It’s just that ‘trees don’t grow to the sky’; something can go wrong and sentiment regarding momentum can shift. They might make bad capital allocation decisions such as the one Apple made in its search for a car? Lina Khan at the FTC might be successful in reining in some of the oligopolistic practices? Most probably the sheer gap in performance and valuation will cause a reversal?

Momentum based strategies and the cap weighted indices are now very driven by the momentum factor, can have rapid reversals.

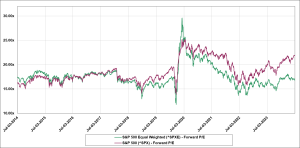

However, Growth style indices outperformed Value by over 4.5% in June alone; over 5% in the 2nd quarter. Thus the forward estimate of P/E between the equal and cap weighted S&P 500 over the last 10 years is at a record high. A lot is being discounted in these Growth stocks. See the chart below.

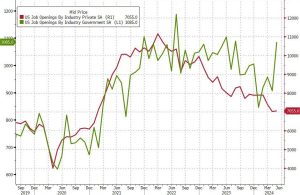

In the real economy ‘Bidenomics’ is increasing debt, debt service costs, and hasn’t raised productivity (yet?). Job creation is strong according to some surveys but even these show the private sector struggling to create jobs. It is these jobs that would drive the economy sustainably forward. We wrote about the confusing and confused nature of economic statistics in May.

Our guess is that central banks would love to cut rates and while inflation is too stubborn for them to do so on a rational basis, the comments from the ECB, the BoE and the Fed regarding political risk have made us wonder whether a change in political hue at the forthcoming elections will enable them to state that this “political risk” is sufficient for them to act, regardless of the inflation consequences?

Any lowering of interest rates will surely improve the outlook for these stock market laggards which now comprise about 490 stocks in the S&P 500. They’re cheaper and many are just as likely to maintain profitably as the top 10.

A change in the US Presidency will also likely mean fewer regulations, incentives to the private sector to invest, and a return to optimism in the export energy sector. We believe we are well positioned for this with holdings in Valero, Exxon, Cheniere Energy among others. Our stance on the US power grid and the need for re-investment remains constructive.

We remain fully invested and prefer to take active risk in misunderstood companies such as Ebara, Kurita Water, AMADA, and Shin-Etsu Chemical in Japan.

During the quarter we made a few trades to refresh the portfolios and maintain active risk at a prudent level. Schlumberger was a new purchase. A global company listed on the NYSE, it engages in the provision of technology for the energy industry worldwide. The company operates through four divisions: Digital & Integration, Reservoir Performance, Well Construction, and Production Systems. The company provides field development and hydrocarbon production, carbon management, and integration of adjacent energy systems; reservoir interpretation and data processing services for exploration data; and well construction and production improvement services and products. In other words, it is the leader in finding, proving up, and managing the stuff in the ground and oceans, which when extracted, and/or linked to the grid, improves the quality of life and the environment. It trades on a forward P/E of about 14x earnings.

Sincerely yours,

Robert Swift and the TAMIM Team

Fund Performance

Portfolio Highlights

Evercore Inc (NYSE.EVR)

Evercore is the world’s largest independent investment bank. Unlike competitors who typically offer a universal banking platform that includes trading, lending and investing, Evercore focuses purely on advising organisations. This positions the company and its employees as trusted partners without the potential conflicts of interest that arise with larger peers. Despite its size today, Evercore never intended to become a global company. It was founded three decades ago with the humble ambition of creating a small but high-quality advisory shop without the rough-and-tumble culture of Wall Street. The firm was deliberately not named after its founders, nor did they reserve any special ownership or legal structure. A uniform and transparent compensation system renumerated the whole firm rather than each department or business unit paying themselves from their respective P&L. This instilled a culture of collaboration and comradery rather than an “eat what you kill” mindset. The unique culture has enabled Evercore to attract and retain high-quality talent that drives organic within the business. The company has 142 senior managing directors with a median productivity of US$18 million per year. While investment banking remains a cyclical industry leveraged to corporate activity, Evercore has built earnings redundancy by expanding its advisory coverage across new sectors and geographies. Over the past decade, revenue has increased 12% annually. Moreover, the business has an exceptional track record of rewarding shareholders, returning US$2.6 billion to equity holders since 2018 and increasing the dividend each year since 2008.

Sprouts Farmers Market Inc (NASDAQ.SFM)

Sprouts Supermarkets is an American fresh-food supermarket retailer. The company offers a wide selection of fresh, organic, vegan, dairy-free, gluten-free and whole foods rarely available at mainstream supermarkets. We first wrote about Sprouts in September 2023, highlighting that we believed the market had underappreciated the store rollout trajectory and the stickiness of its customer base. Since then, the company has continued to beat internal and analyst expectations regarding the pace of new stores, revenue and earnings. Despite the weakening economy, customers have continued to frequent Sprouts with same-store sales increasing by 4% and total sales rising by 9%. The superior value proposition (Sprouts is regularly cited as being cheaper than close competitor Whole Foods) has shielded the business – and its consumers, from economic headwinds. The health-conscious consumer is also likely to be of middle or high-socioeconomic demographic and therefore relatively less immune to cost of living pressures. The average Sprouts shopper is 46 years old, has an income of US$121,000 per year and is likely to be college-educated. Sprouts is a classic case of a market caught up in short-term macro headwinds rather than seeing the long-term fundamental growth story. The ~122% increase in the share price means the earnings ratio now reflects a growth company rather than a nascent, low-margin retailer. While we would not expect the same share price gains to be repeated, the company remains well-positioned to capitalise on a growing and profitable grocery niche.

CNOOC Ltd (HK.0883)

China National Offshore Oil Corporation (CNOOC) is one of the world’s largest oil and gas companies. The business derives around 70% of its production from China with the remainder sourced from assets in the Americas, Asia and Africa. CNOOC’s assets are competitive on the cost curve with an average cost of ~US$28/BOE (barrel of oil equivalent) compared to a current oil price of ~US$78. It’s well established that in the next five years, we will reach peak oil demand as electric vehicle adoption accelerates. However, the steepness of the decline is still uncertain, and given the lack of substitutes for fueling trucks, planes, and ships in addition to producing plastics, there is a fair chance that oil demand will remain resilient until commercial alternatives are developed and widely available. Moreover, new supply is only becoming increasingly difficult to first gain approval, and then scale to be competitive, particularly in developed nations. This bodes well for CNOOC as a low-cost producer with a growing production profile. Traditional energy companies have faced significant valuation headwinds in recent years as the rise of sustainable (or ESG) prevented pension managers and institutions from deploying capital into the sector. Chinese companies such as CNOOC have also battled concerns over the economy and ownership structures. While these headwinds remain to varying degrees, the underlying business performance of CNOOC has grabbed the market’s attention. The company has diligently expanded production and reserves while also retaining tight control. Since 2018, earnings have increased 134% despite gyrations in the underlying oil price There’s also been a broader trend in the energy market to “get big or get out”, with larger rivals taking over smaller peers to amalgamate resources and cash flows. This has given the market a yardstick to value other public energy companies leading to multiple rerating. Even after the CNOOC share price has doubled, the business trades on a dividend yield above 5% and a mid-high single-digit earnings multiple.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Global Equities |

| Number of securities: | 80-110 |

| Single security limit: | +/- 5% relative to Investable Universe |

| Country/Sector limit: | +/- 10% relative to Investable Universe |

| Market capitalisation: | US$2+bn |

| Derivatives: | No |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-10%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust available to wholesale or sophisticated investors |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.00% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Fee Cap: | 2% of total FUM |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3-5+ years |

| Distributions: | Annual |

Invest via TAMIM Fund

Request additional details by using the form or if your ready to invest select the apply now button.

Invest via IMA

The TAMIM Global High Conviction strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.