Global Equities

Global Tech and Innovation

-3.40%

Total Return Since Inception (net of fees) as at 28 February 2025

$0.9521

NAV Unit Price as at 28 February 2025

22 August 2024

Inception

APIR Code

CTS9212AU

Invest into the High Growth and rapidly expanding Global Technology Sector

Our Global Tech and Innovation Fund is designed to capitalise on the best of this thriving sector. The fund is heavily weighted towards leading technology companies, which have seen significant growth. Notable giants such as Nvidia, Apple, Microsoft, Amazon, Alphabet (Google), and SMCI have experienced substantial increases in their market values, driving the exceptional performance of the NASDAQ.

The Global Tech and Innovation Fund is more than an investment; it is an opportunity to be part of the technological revolution that is transforming industries and creating new paradigms of growth and development.

About the Global Tech and Innovation Fund

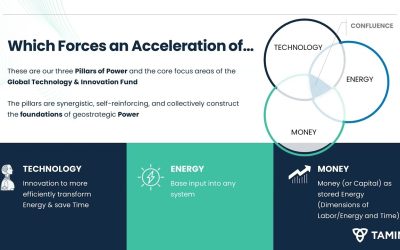

- Target companies with “multiple ways to win” at the intersection of Technology, Energy, and Money.

- Focus on companies contributing to or benefiting from industry evolutions, e.g., semiconductors.

- Seek overlooked or misunderstood opportunities, including small caps and developing countries.

- Diversified international shares, for exposure to unique market segments and global companies.

- Flexible investment mandate capable of transitioning to cash when needed.

- Risk-aware and long-term approach to global investing.

- Focused portfolio featuring innovative and attractive global companies.

While we cannot outline every potential risk, detailed information is available in the relevant information memorandums and additional information booklets.

The Portfolio Manager: Ryan Mahon

Fund Performance

Reports & Factsheet

Reports

| Monthly Report | |

|

|

Factsheet

Discover further details about the fund's investment strategy, the investment team, and the investment process.

Investment Philosophy and Process

Learn about the fund investment philosophy and process.

Resources

| Webinar Videos | Webinar Snippets | |

|

|

|

|

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Global Equities |

| Investable universe: | Nasdaq Composite |

| Number of securities: | 40-50 |

| Derivatives: | Yes |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-20%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust available to wholesale or sophisticated investors |

| Minimum Investment: | $150,000 |

| Management Fee: | 1.50% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate +2.5% or 4% |

| Entry/Exit Fee: | 5% exit fee is payable on an exit from the investment in the unit class prior to the first year anniversary of the investors initial issue of units. |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 5+ years |

| Distributions: | Annual |

Investor Profile

The TAMIM Global Tech and Innovation Portfolio suits investors who:

1.

2.

3.

4.

Insights

TAMIM Global Tech and Innovation – Portfolio Highlights – Top picks for 2025

Are mid-cap opportunities the key to AI’s future? TAMIM targets critical bottlenecks in memory and networking, focusing on optimising connections within and between data centers. Ryan Mahon highlights the companies best positioned to capitalise on...

Earnings Report Summary – NASDAQ: GOOG

In this video, Ryan Mahon, TAMIM's Global Tech and Innovation Portfolio Manager, breaks down Alphabet’s impressive Q3 earnings and the cutting-edge tech innovations driving its growth. From revenue surges to AI advancements like Gemini and Waymo’s...

Earnings Report Summary – NASDAQ: META

In this video, Ryan Mahon, TAMIM's Global Tech and Innovation Portfolio Manager, delves into Meta's impressive Q3 earnings and the technological advancements propelling its growth. Learn about the company's AI initiatives, including the Meta AI...

Earnings Report Summary – NASDAQ: TSLA

In this video, Ryan Mahon, TAMIM's Global Tech and Innovation Portfolio Manager, delves into Tesla's impressive Q3 earnings and the technological advancements propelling its growth. Learn about the company's strategic focus on autonomous driving...

TAMIM Global Tech and Innovation – Pillars of Power

Governments serve as the driving force, utilising three key aspects as pillars of power with leadership in these pillars defining the winners of the new global order. What are the pillars of power and why are they the focus sectors for our Global...

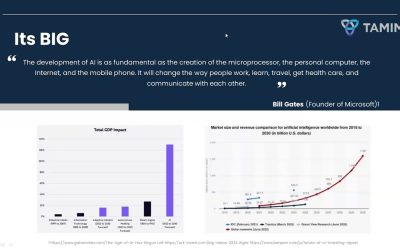

TAMIM Global Tech and Innovation – Just how big is the tech industry?

We evaluate just how big the tech sector is and the exponential rate it is growing. Is there still time to capitalise on this opportunity? Disc: All investing entails risk - please read disclaimer on our website for more details -...

Watch a recording of Webinar hosted in July 2024.

Invest Now

If you are ready to invest in TAMIM Fund: Global Tech and Innovation, click on the link below.

Wholesale Investors Only.

Invest via TAMIM Fund

Invest via IMA

The TAMIM Global Tech and Innovation strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.