Listed Property

Investor Updates

Below you will find this month’s commentary and portfolio update for TAMIM Listed Property unit class.

May 2024 | Investor Update

Dear Investor,

The TAMIM Listed Property unit class delivered a +1.03% return for the month of May 2024. For comparison the A-REIT index was +1.94% while the G-REIT index was +1.39%.

Australian Listed REIT Portfolio (AUD)

The A-REIT market for the month of May stabilised after the hit it took in April and delivered 1.94%. The portfolio was also up 1.29% for the month. Of the 1.94% market return, Goodman Group contributed roughly 1.68% due to its size and the performance it provided for the month of 5.8%. The A-REIT market outperformed the ASX 200. Global REITs outperformed the Australian REIT market in May delivering 3.3% in USD.

The Industrial sector seems to be a great source of continuing performance, being the best performing sector for the month with 5.6%. The second-best sector was Retail, delivering 0.2% and then the Diversified sector down -0.6%.

Many of the large-cap A_REIT names delivered their quarterly updates in May. Some of the highlights saw Goodman’s non-DC portfolio delivering greater than expected rent growth (4.9%) and showed occupancy of 98%. This despite the global logistics sector showing a slow down mainly from oversupply. The retail sector showed sound operating metrics but are moderating from an elevated level. GPT can be highlighted in this sector with 5% sales growth mainly driven by its recovery in the Melbourne CBD.

HMC was the best performing REIT in the portfolio and the market delivering 12.32%. They announced the acquisition of Payton Capital, a Commercial Real Estate private credit manager. The consideration was $127.5m at an implied FY24 EBITDA multiple of ~6x. The transaction was funded by a fully underwritten institutional placement of $100m, a non-underwritten security purchase plan to raise up to $30m and the $50m on-market sell-down of HMC’s co-investment in HDN.

Goodman Group is absolutely dominating the A-REIT space and has no intention of looking at those left behind in its wake. From its quarterly update we saw their operating EPS growth guidance increase from 11% to 13%. Its impressive performance is driven by its data centre pipeline providing double digit operating EPS growth over the medium term. It has delivered 73.1% over the last 1year rolling period, the best in the A-REIT market.

The RBA kept the Cash Rate at 4.35% at its May meeting as was widely expected. Cost pressure might be easing from its highs recently, but the pace of moderation is slower than expected due to persistent service inflation. The April CPI indicator which was release in May increased by 3.6% in the year to April 2024, up from 3.5% in March but above the 3.4% forecast. This is the highest it has been since November 2023 and was driven by a faster rise in food and non-alcoholic beverage prices. Inflation is still outside the RBA’s target range of 2-3%.

Unemployment figures for April were released this month and rose to 4.1%, up from the previous month by 0.2% and 0.2% above the forecast of 3.9%. This is the highest the unemployment rate has been since January 2024. The number of unemployed individuals rose by 30 thousand to 604 thousand.

The Australian 10-year government bond yield was slightly down for the month of May. At the end of April, it stood at 4.416% and at the end of May it was at 4.399% after dipping to 4.19% during the month. The month end level is close to its three-week lows and followed the US treasury yields amid softer-than-expected US inflation figures.

If inflation data remains sticky and the RBA is unable to bring it down to its target levels the conclusion would be that rates would be kept higher for longer until inflation is under control. As with many other central banks, the next rate moves are all data dependent and every now and again the topic of another rise raises its head and markets react.

The current Australian portfolio component consists of 23 stocks. Below are the top 5 holdings:

Reitway Global Property Portfolio (USD)

Global REITs were up for the month by 3.30%, providing a nice bounce back from the -5.92% in April. The portfolio outperformed the Global REIT market and the benchmark with a return of 4.09% for May. The REIT market is still down for the year and the benchmark of the GPR 250 REIT Index is -4.50% year-to-date. We are seeing some positive sign for the property market to start clawing back some of the negative returns from market sentiment in a higher for longer interest rate environment, but it has been agonisingly slow in 2024.

The US annual CPI rate eased to an over 3-year low of 3.4% for April as it was announced in mid-May. This was 0.1% lower than the prior month and in line with the forecast. The annual PCE inflation rate remained steady in April at 2.7%, in line with expectations and the same as the previous month, after accelerating in March. The US Federal Reserve uses the PCE as their preferred data indicator of inflationary movements in the economy. The Federal Reserve seeks to achieve maximum employment and targets an inflation rate of 2% over the longer run. Looking at the global economy, we have now seen Switzerland cut rates, but we have also seen some rate hikes for several reasons such as Japan (First hike in 17 years) and a 500bps hike from Turkey.

When we look at global REITs and our benchmark, we see that it has been trading close to the current level since the beginning of the year after the “everything REIT” rally in November and December last year. In fairness, it has been volatile and monthly movements were as much as -5.92% down (April) and 3.12% up (March) but has come back to a fair range close to the level it has been at the beginning of the year. The US market in our opinion is waiting on stronger communication from the Federal Reserve that interest rates will be coming down in the near future. Thus far the wording has been mostly in line with “data dependent” and the new norm for interest rates being “higher for longer”.

In the portfolio, the best performing country to which we have exposure was Germany. We are invested in the residential sector and this sector has shown good growth in market rents recently. Underpinned by healthy demand fundamentals and the slowing pace of new construction, the sector has performed well over the last 12 months. The two main German Residential listed REITs are both up over 1 year, Vonovia +40.27% and LEG Immobilien 32.90%. That must however be put in context when interest rates and rent controls hit these names hard in middle 2022. From the middle of 2022, both are still down around 25% from that period.

The worst performing region was Japan, -3.33% down for the month. A lot of this has to do with the Japanese Yen. In late April, the Yen weakened to 160 against the green back, the highest it has been since the 1980’s. The Yen weakness can be attributed to the market expectations of a more hawkish Fed, as inflation remains stickier than expected. The BOJ is believed to remain dovish, with little clarity obtained from its last meeting and little details in its policy guidance. We have remained underweight Japan compared to the benchmark.

The top performing holding in the portfolio was Americold (COLD), +21.39% for the month. COLD provides cold storage supply chain infrastructure to various market participants through an integrated network of value adding facilities and services. The REIT reported on 10 May on its 1st quarter earnings and the $0.37 1Q AFFO print was $0.09 higher than market expectations. Management also raised the midpoint of its FY AFFO outlook by $0.05 to $1.42 owing to a higher same store NOI guide. There was significant headway made by COLD on developments. The market has reacted positively to this, and the company continues to deliver on set targets.

The worst performing holding for the month was Uniti Group (UNIT), down -45.04% for the month. UNIT specialises in digital infrastructure, encompassing fibre optic networks, communication platforms, residential internet and voice services. The stock fell early in May after the announcements of a merger with Windstream, subsequently to de-REIT and to eliminate the dividend. This, together with their earnings call saw the stock plummet on the 3rd of May after reported EPS missed expectations. The announcement impacts REIT/dividend investors in the way that they will have to sell out. This creates a good buying opportunity again. We still see value to be unlocked by the stock and it to recover based on its underlying fundamentals. AI demand will also be driving demand for its offering as more homes get converted from copper to fibre connections.

The Health Care sector was the best the top of the picks for the month, delivering 10.98%. We own both Welltower (WELL +9.48%) and Ventas (VTR +13.51%). From the recent earnings calls for the REITs in this sector, the mood has shifted to an overall positive. NOI growth expectations on average are expected to be 20% in 2024 and 14% in 2025. We have seen a solid trajectory of occupancy and rent growth to begin the year and expenses are also moving in the right direction.

Since the beginning of 2022 when the 10-year Treasury yield was 1.5%, the FTSE Nareit All Equity REIT Index has tumbled 26%. Looking at the same period, the S&P 500 Index has gained 11%. The underperformance of REITs in higher interest rate environments is not unexpected, but the magnitude has been somewhat surprising.

Fund positioning remains roughly the same (quality, value, structural trend riders, and blend between offensive and defensive), with a slight uptick in risk appetite due to continuing optimism growing in markets awaiting rate cut announcements.

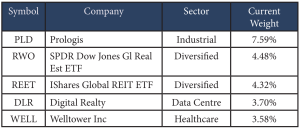

The Tamim global property portion invested in the Reitway Global Property Portfolio currently consists of 45 stocks. Below are the top 5 holdings:

We believe real estate fundamentals are still sound and remain steadfast in our belief that the asset class can post meaningful returns relative to stocks and bonds, even against a slower growth, higher inflation backdrop.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Listed property & property related securities |

| Number of securities: | 40-50 |

| Single security limit: | 10% |

| Region limit: | 70% |

| Sector limit: | 70% |

| Investable universe: | Listed property & property related securities |

| Market capitalisation: | N/A |

| Derivatives: | Yes – special instances & hedging |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-20%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 0.98% p.a. |

| Admin & Expense Recovery: | Up to 0.25% |

| Performance Fee: | Nil |

| Hurdle: | N/A |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly (with 30 day notice) |

| Distribution: | Quarterly |

| Investment Horizon: | 3-5+ years |