Global Equities

Global High Conviction

Investor Updates

Below you will find this month’s commentary and portfolio update for the Global High Conviction unit class of the TAMIM Fund.

February 2025 | Investor Update

The TAMIM Global High Conviction unit class was down -1.46% for the month of February 2025. The strategy has generated a return of +16.60% over the past 12 months.

The World Turned Upside Down?

(a popular refrain originating in the 17th Century and used henceforth by those disliking change)

The new US administration’s mantra of “move fast and break things” appears to be working. Add in the German election result which portrays the country as it was before unification, and ‘it’s a whole new ball game.” Where on earth are we going?!

Knowing where to start analysing the investment opportunities and risk is virtually (in the true sense of the word) impossible. A good plan is to diversify. If you didn’t realise the market is beginning to be worried about momentum as an extended risk factor, then the fact that AT&T has outperformed NVIDIA over the 12 months to end February is a wake-up call. Be diversified.

It’s also becoming clear that the US Administration doesn’t care about pleasing the ‘legacy media’ or the ‘intellectual geopolitical heavyweights’ meeting in Davos, nor paying respects to what was done previously. Regardless of what you think and any ‘anchoring problems’ you may have as the last 20 years is swept away, as an investor you have to adapt. The market can remain irrational longer than you can remain solvent so to speak.

Our concerns and ponderings revolve around the following:

The Kalecki profit equation.

With DOGE aiming to take 2$ trillion out of US government spending of $6 trillion, the negative consequences of reduced demand, and thus profit, need to be compensated by changes in spending by other parts of the economy. One, some, or all of Private spending, Company spending (capital expenditure) or Foreign spending (current account balance) need to replace the loss of impetus from the reduction in the government contribution. It’s clear to us that private sector capital investment needs to rise in the US and may well do so. This will also help improve productivity. Maybe a $1 trillion increase would therefore more than compensate for the loss of government spending?

Interestingly share buybacks are running at about $1 trillion p.a. currently….this makes us think that if MAGA is achievable then a support for the market in the form of buybacks is replaced by a support for the economy in the form of private sector investment. Increased capex intentions have been flagged by technology companies, so we hope they follow through. We doubt any significant cuts will be an easy transition albeit a much needed one.

Our conclusion – if cuts in government spending are made and not replaced by something else of equal benefit to growth, then a US economy already weakened by debt, will weaken further. Rates will be cut and profitability reduced. The US$ will fall. Even the transition to private spending from government spending will cause equity volatility to rise as the certainty of buybacks is replaced by the uncertain pay off to increased investment. The MEGA 7 may not be so well placed with MAGA? Another reason to diversify.

Geopolitics – the speech in Munich at the Security Conference, by Vice-President Vance, to a range of dignitaries, laid bare the rift in thinking and the new priorities of the US compared with European expectations of more of the same. No punches were pulled on election interference, trade, freedom of speech and democratic values, and defence. Tariffs, and the demands made of The Ukraine to make peace are not conventional tactics post WW2. The conclusion – The US is quite prepared to revisit and abandon the post WW2 structures for which they perceive they pay and Europe free loads. Europe has already stated they will find money (they don’t have) to increase defence spending such they can stand toe to toe with the US and be independent. This is barely compatible with high levels of social security spending nor ESG principles which have seen listed military stocks shunned and inefficient power supplies hamper arms production. You can’t make weapons without digging stuff up and having reliable power. ESG will morph into something else as necessity and expediency prevails. ESG stocks will come under further pressure to change or be further de-rated. BP have already done a U-Turn. If European governments (aka Germany) find the money, materials, commodity, and organic sourced energy stocks seem pretty well placed to be rehabilitated.

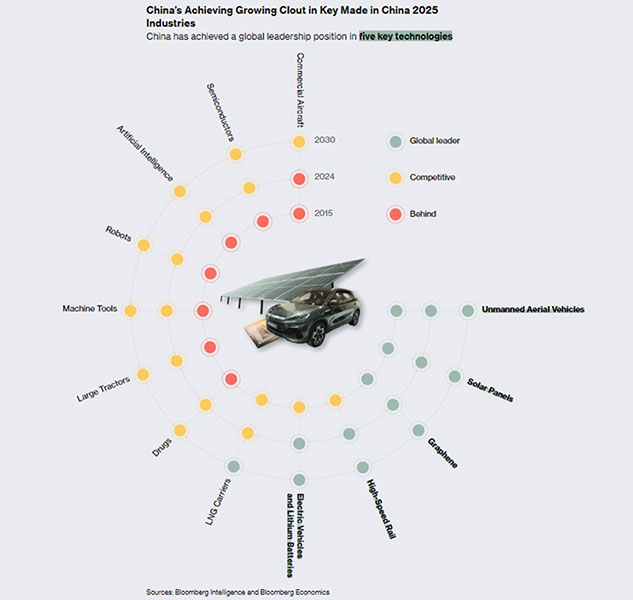

China next – toward a Mutually Agreed Dependency? Removing the ‘distraction’ of Russia, The Ukraine, and allegedly now Iran, will allow the US to focus on China. China is being isolated IF Russia and the USA cosy up. Strengthening ties with Japan further isolates China. On the other hand, China has quite capable industrial and technological skills and even advantages. See the chart below for an assessment of their capabilities and areas of global leadership.

Mutually Assured Destruction or MAD was the slogan used to describe the nuclear weapon stand-off between the USSR and the USA in the 1970s. MAD prevented the lunacy of war and allowed the West to outgrow the Communist Bloc and provide an enviable increase in the standard of living. (Pace the JD Vance comments about lost values in Europe). Mutually Agreed Dependency (MAD II) between China and the USA is this era’s opportunity for stability. Remove the tension created by intellectual capital theft, assume that usual spying and defence procurement will continue, and there is much to gain from freer trade and investment. It’s not going to happen quickly, and we assume (hope?) that the recently announced tariffs of 25% are a tool to promote negotiations. To a President who thinks of himself as a deal maker, every country problem is a deal to be done (and one to screw if possible). The best short-term opportunity? Japan, and perhaps Hong Kong. Virtually the first dignitary to meet Marco Rubio, the Secretary of State was Japan’s Foreign Minister Takeshi Iwaya. The two agreed to take the U.S.-Japan alliance to “new heights” and touted the importance of trilateral ties with South Korea and the Philippines. “We agreed to continue to work together to take the Japan-U.S. alliance to new heights and to work closely together to realise a free and open Indo-Pacific,” Iwaya said following the meeting. Iwaya, who a day earlier became the first top Japanese diplomat to attend a U.S. presidential inauguration, was visiting Washington for talks with officials in President Donald Trump’s new administration as Tokyo looks to lay the groundwork for a leaders’ summit with Prime Minister Shigeru Ishiba in the coming weeks.

Performance in February was poor as our positioning was negatively impacted by ‘events’. The Global Infrastructure holdings were hampered by the block trading sell-off of energy stocks as the fears of reduced data centre spending spread. Even at reduced levels of data centre demand, the US grid needs re-investment and the forthcoming March 25th release of the quadrennial report on US infrastructure by the American Society of Civil Engineers, is unlikely to see a grade above C.

Fund Performance

Portfolio Highlights

Danone S.A. (ENXTPA:BN)

Danone is a recent addition to the trust, representing a compelling example of our process of identifying undervalued businesses in out-of-favour sectors. While many investors overlook consumer staples in favour of short-term momentum trades, our approach is grounded in recognising long-term potential and strong fundamentals. This allows us to build diversified, resilient portfolios, avoiding overexposure to sentiment-driven investing.

Danone, the French multinational behind Activia yogurt and Evian water, ended 2024 on a strong note. The company reported like-for-like sales growth of 4.7% in Q4, surpassing market expectations of 4.2%, with growth driven primarily by volume increases (up 4.2%), and modest price contribution (+0.6%). Demand remains particularly strong in North America, especially within high-protein, coffee, and water product lines. This marked an acceleration from the previous quarter and reflected broad-based operational execution across its Essential Dairy & Plant-Based, Specialised Nutrition, and Waters divisions.

Full-year recurring net profit rose to €2.35 billion, ahead of consensus, while recurring operating income grew 2% to €3.56 billion, lifting operating margins to 13% from 12.6%. Despite a modest decline in reported sales to €27.37 billion (versus €27.62 billion in 2023), Danone demonstrated solid margin control and profitability. CEO Antoine de Saint-Affrique highlighted a renewed focus on value creation and disciplined capital allocation, noting the company has now returned to double-digit return on invested capital, a key marker of corporate health.

Currently trading at a forward P/E of 18.6 and offering a 3.0% dividend yield, Danone continues to be undervalued relative to its strategic positioning in health-conscious, functional nutrition segments. Its global reach, brand equity, and financial discipline offer a defensive yet growth-oriented profile, particularly attractive in today’s uncertain macroeconomic backdrop.

In our view, Danone showcases how our global equity knowledge and long-term approach allow us to identify opportunities in temporarily underappreciated companies. This helps us avoid the pitfalls of momentum-driven investing and positions clients to benefit from structural consumer shifts and operational turnarounds.

Evonik Industries AG (XTRA:EVK)

Evonik has been a longstanding holding in the trust and stands as a testament to our ability to identify quality businesses in cyclical sectors when they are trading below intrinsic value. The company has benefitted from being overlooked during previous market cycles, allowing us to invest when sentiment was weak but fundamentals were sound. This approach reflects our broader commitment to constructing diversified portfolios that are not reliant on momentum or short-term themes, but rather on strategic positioning and disciplined balance sheet management.

Evonik is a global leader in specialty chemicals, supplying critical inputs to high-value industries through its divisions in Specialty Additives, Nutrition & Care, Smart Materials, and Technology & Infrastructure. In FY2024, the company delivered a 25% year-on-year increase in adjusted EBITDA, with broad-based earnings growth across all segments. Particularly strong contributions came from animal nutrition, high-performance polymers, catalysts, and silica.

Management has executed well on operational priorities. The “Evonik Tailor Made” transformation program is streamlining the business, reducing management layers, and improving cost discipline. The firm is targeting €2.0–2.3 billion in adjusted EBITDA for FY2025, underpinned by further efficiencies, innovation-driven sales, and strong demand for its next-generation solutions in biosurfactants, battery materials, and circular economy applications.

Evonik’s free cash flow conversion remained strong at 42%, with €873 million in FCF generated in FY2024, allowing the company to maintain a stable dividend of €1.17 per share (yielding over 5%). The net financial debt leverage ratio fell to 1.5x, reinforcing the strength of its capital structure.

Despite these achievements, Evonik trades at a forward P/E of just 13.0 and a P/B of 1.1, suggesting a valuation disconnect relative to its innovation pipeline, ESG improvements, and operational delivery. Our continued holding of Evonik reflects our confidence in the firm’s strategic trajectory and our broader investment philosophy buying strong businesses during times of underappreciation to deliver long-term, risk-adjusted value for clients.

Qualcomm Inc. (NASDAQ:QCOM)

Qualcomm has been a long-term holding in the trust, exemplifying our approach of backing companies with strong fundamentals at times when sentiment around the sector is overly negative or narrowly focused. In a market often distracted by short-term headlines and momentum, our conviction lies in the enduring value of companies whose technology is mission-critical, balance sheets are healthy, and whose positioning aligns with transformative long-term trends.

Qualcomm is a global leader in wireless technology and semiconductor innovation, operating through three key segments: QCT (chipsets and platforms), QTL (licensing of IP), and QSI (strategic investments). Its product suite powers 5G connectivity, automotive infotainment and ADAS, AI at the edge, and the Internet of Things (IoT) sectors we expect to grow substantially over the coming decade.

The company recently posted strong financial results, with FY2024 revenue increasing to $40.7 billion and net income up 36% year-on-year to $10.6 billion. Operating margins remain robust, and free cash flow conversion is solid, with net debt reduced to just $272 million. Qualcomm continues to return capital to shareholders, recently announcing a 4.7% increase to its dividend (now yielding 2.15%) and maintaining a substantial buyback program.

Looking forward, Qualcomm is guiding to continued strength in its core mobile business, while gaining momentum in automotive and industrial segments. The company’s leadership in wireless patents and chip design, combined with its push into AI-on-device and low-power edge computing, positions it uniquely among semiconductor peers.

With a forward P/E of 13.5, Qualcomm remains undervalued given its earnings power, innovation pipeline, and global reach. Our continued holding reflects our belief that patient capital invested in out-of-favour but fundamentally strong technology names will outperform over time, especially as cyclical and structural trends converge across 5G, AI, mobility, and automation.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Global Equities |

| Number of securities: | 80-110 |

| Single security limit: | +/- 5% relative to Investable Universe |

| Country/Sector limit: | +/- 10% relative to Investable Universe |

| Market capitalisation: | US$2+bn |

| Derivatives: | No |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-10%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust available to wholesale or sophisticated investors |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.00% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Fee Cap: | 2% of total FUM |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3-5+ years |

| Distributions: | Annual |

Invest via TAMIM Fund

Request additional details by using the form or if your ready to invest select the apply now button.

Invest via IMA

The TAMIM Global High Conviction strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.