Australian Equities

Australia All Cap

November 2024 | Investor Update

We are pleased to share the TAMIM All Cap Fund’s monthly report following the conclusion of November 2024.

The TAMIM All Cap Fund was up a very strong +6.86% (net of fees) during the month, versus the Small Ords up 1.32% and the ASX300 up 3.68%.

CYTD 2024 the fund is up +28.48% net of fees versus the ASX300 up 14.90% and on track for another exceptional year of returns following a very strong year in CY2023 (+31.5%).

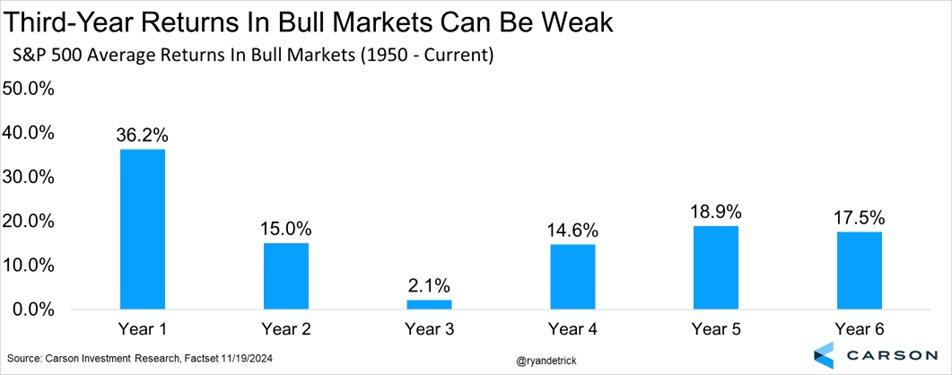

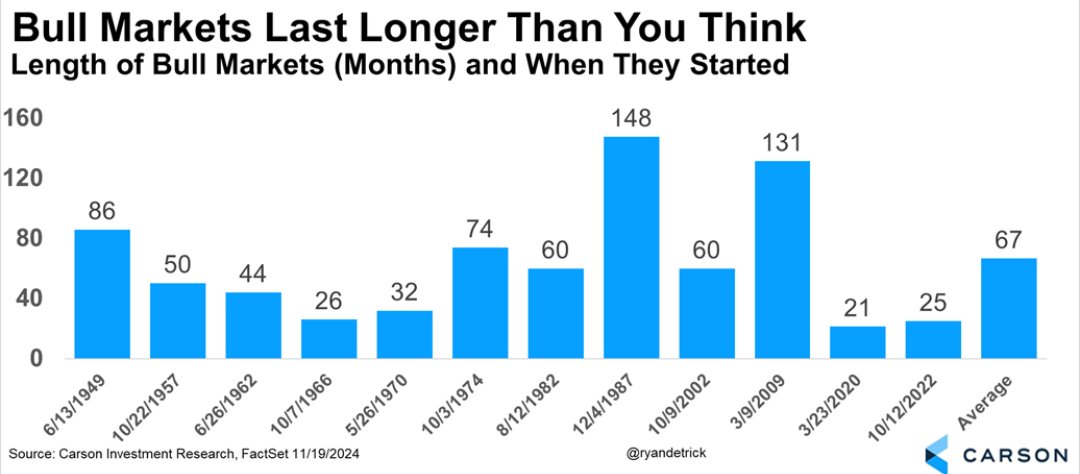

We are now 2 years into this current bull market which began early 2023, as we flagged at the time. Historically, bull markets that make it to their 2nd year anniversary tend to continue and last an average of 5.5 years. Every 20 years we have seen bull markets average up to 12 years in length and those were driven by tech/industrial revolutions. We believe the current AI advancements will deliver such a bull market in the years to come.

This bull market will also be aided by a market friendly new Trump administration whose main focus is to cut regulations, reduce taxes and end the current global conflicts in Ukraine/Russia and the Middle East. We see all of the above as extremely positive for reduced inflation, strong economic (GDP) growth driven by the private sector and lower interest rates. All of the above will drive a continued strong US economy and bouyant markets. The ASX will follow.

It’s important to keep in mind, that on average and during bull markets, we expect 2-3 pullbacks every year. These pull backs vary from 5-15% and are great buying opportunities. Those that recall the Silicon Valley bank crisis in March 2023, Middle East conflict in October 2023 and the yen carry trade margin call in early August 2024, would remember, that all were seen at the time as potential threats to the market – yet ended up being exactly what we flagged them to be at the time – great buying opportunities!

We urge investors as we have done so for the last 6 years, to take advantage of any market volatility next year and invest further into these great buying opportunities – we are certain will emerge over time.

We are quite excited about the portfolio holdings in the fund as we head into 2025 and see significant upside ahead – just as we flagged a year ago heading into 2024.

Finally, we expect markets to remain positive heading into Christmas with some key catalysts coming up in the new year during the January quarterly updates. We also expect any M&A brewing in the background, to be announced pre Christmas (similar to last year) as boards scramble to get deals signed off before Christmas. Hopefully, luck is on our side – once again.

We provide a brief commentary on portfolio updates during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in January.

We would also like to take this opportunity and wish our investors a very warm and safe festive holiday season and a happy new year. We are pleased to have delivered another exceptional year of strong market leading returns.

Sincerely yours,

Ron Shamgar and the TAMIM Team

Fund Performance

Portfolio Highlights

Close the loop group (ASX: CLG) received a non binding conditional takeover offer from Adamantem private equity for 27 cents cash. The offer includes a script rollover into the privatised group of up to 40% of the shares on issue. This equates to the current board ownership of the group and hence why we believe the board is recommending the offer if the scheme becomes binding following an exclusive 3 weeks due diligence period.

The next day following the offer, CLG held their AGM and provided a weak update on current trading headwinds in the US and a debt refinance term sheet in place. In addition the company announced the immediate resignation of the founder and MD and the stepping down of the current chairperson. The above and no FY25 provided guidance - all seemed a bit strange in the context of the current bid.

We got CLG badly wrong. Although the company ticked many of the boxes we look for in a company - profitable, founder led, high level of insider ownership, industry tailwinds - the reality is we held on for too long in the face of strong resistance from the market to re rate the stock.

The company seemed cheap on paper but in hindsight, management didn’t execute on converting profitability to free cash and paying down their debt. Going into the AGM we reduced our holding since the August results and when the bid was announced we promptly exited the position. Overall CLG was a flop and the experience was a classic lesson in position sizing we will take away from and look to improve in future.

EML Payments (ASX: EML) Last month we attended EML strategy day and met with management. EML outlined a clear and focused 2.0 strategy centered around three key pillars: nurturing and growing their existing core business, accelerating into new verticals, and expanding into new geographic markets. This strategy is underpinned by three strategic enablers: implementing a single global operating model, reviving their revenue engine, and building a new global technology platform.

On the core business, EML acknowledged they have a solid foundation with a presence in three of the world's largest and fastest growing payments markets - Europe, North America, and Australia. They process over $23 billion in GDV and have $2.1 billion in stored value float, providing a strong revenue base. The focus here will be on extracting more value from their existing 1,100 customer relationships through cross-selling and deepening partnerships.

To accelerate into new verticals, EML sees opportunities in areas like insurance disbursements, mobility/fleet, and travel where they believe complex payment flows remain underserved. They have a track record of identifying gaps in the market and building unique solutions, like their salary packaging and perks businesses. The plan is to take a structured and resourced approach to selling across all products and markets.

For geographic expansion, EML will be opportunistic, partnering with existing schemes, banks or infrastructure providers to enter new markets, rather than investing ahead of revenue. This capital-light approach allows them to follow the opportunities rather than trying to create new demand.

Enabling this strategy are three key initiatives. First, implementing a global operating model with centralised shared services and best practices, under new global COO Brian Lewis. Second, rebuilding their sales and revenue engine, led by new CRO Shabab Muhaddes, after years of underinvestment. And third, transitioning from three legacy technology stacks to a single global platform, at a cost of $12-15 million, which will drive significant operational efficiencies.

Financially, EML is targeting double-digit transaction revenue growth and a 35% EBITDA margin by FY2028. This equates to $95 million Ebitda, $60 million of free cashflow and 13 cents EPS. In the near-term, they have reaffirmed FY2025 EBITDA guidance of $54-60 million, with Q1 trading in line with expectations.

The company expects interest income to moderate over time as rates decline, but this will be offset by growth in the core business and operational efficiencies. They project a flat cost base over the medium-term, with 15-20 million in savings offsetting inflation and investment in sales/marketing.

Overall, EML is confident in their ability to execute on this plan, noting a renewed sense of urgency and focus within the organisation after a challenging period. The strategy is clear, the financial targets are ambitious but achievable, and the leadership team has the experience to deliver. If successful, it will transform EML from a good business to a great one, delivering sustainable double-digit growth and material margin expansion.

With a clear strategy in place, a sense of excitement within the company we haven’t seen for a few years, and green shoots of momentum in new sales, we believe EML 2.0 ticks all the boxes for a company that the market will gradually re rate and fall back in love with over time. In the meantime management has painted a takeover target on their back with their $95 million Ebitda forecast in 3 years versus their current EV of around $350 million. We think it’s highly likely a bid emerges next 6 months at $500-$600 million and shareholders will most likely accept.

Catapult (ASX: CAT) delivered another strong set of results in the first half of FY25, continuing the momentum from the previous year. The company's annualised contract value (ACV), a key leading indicator, grew 20% year-over-year to $96.8 million, driven by robust performance across both the P&H (performance & wearables) and T&C (tactics & coaching video) verticals.

The P&H vertical grew 22%, fueled by league-wide deals in soccer and continued growth in college sports. The T&C vertical experienced an 18% increase in ACV, with the company's new video solutions growing an impressive 42%. This video growth is becoming an increasingly significant portion of Catapult's total T&C ACV, more than doubling over the last two years.

Catapult's focus on cross-selling is paying off, with the average ACV per team increasing 11% year-over-year to over $23,600. The number of teams using products from multiple verticals grew by 80% in the past 12 months, demonstrating the company's ability to expand its footprint with existing customers.

The strong top-line growth is translating to significant profitability improvements. Catapult achieved a remarkable 75% incremental profit margin in the first half, well above its FY24 target of 30%. This, combined with disciplined cost management, drove a substantial increase in free cash flow to $4.8 million, surpassing the entire FY24 free cash flow.

Looking ahead, Catapult remains confident in its ability to capitalise on the growing $40 billion professional sports technology market. The company's strategy centers on delivering an integrated, value-driven platform that empowers teams to make better decisions. This is underpinned by a focus on landing new clients, expanding relationships through cross-selling, retaining customers at industry-leading rates, and driving operational efficiencies.

Catapult is targeting a contribution margin of 55% and a profit margin of 30% over time, putting it on a path to consistently achieve the "rule of 40" benchmark for top-performing SaaS companies. With a strengthened balance sheet and a clear strategic roadmap, the company is well-positioned to continue delivering profitable growth and generating strong returns for shareholders.

Gentrack (ASX: GTK) is a leading provider of mission-critical software solutions for the utilities and airport sectors. The company's business model is centered around delivering recurring revenue through a combination of software-as-a-service (SaaS) offerings and professional services.

In FY24, GTK reported total revenue of $213 million (ahead of their $200 million guidance), representing 25.5% year-over-year growth. This strong performance was driven by robust growth across the company's two main business segments - Utilities (G2) and Airports (Veovo).

The Utilities segment, which accounts for around two-thirds of total revenue, grew 23% in FY24 to $181 million. Excluding prior year one off insolvency revenues, growth was even more impressive at 51%. This included a 33% increase in recurring revenue to $121 million, as the company continued to expand its footprint with existing customers and win new logos. The non-recurring revenue (NRR) in Utilities more than doubled to $60 million, driven by a range of implementation projects and regulatory changes. We expect NRR to continue to grow as existing clients implement and upgrade their current solutions and new logo wins come on board.

The Veovo business, which provides airport management software, grew 25% year-over-year when excluding the impact of hardware sales (45% including hardware sales) to $32 million. This highlights the strong underlying demand for GTK's solutions in the digitising and automating the airport sector. Management is looking at M&A to bolster this division with other solutions it can cross sell to its tier 1 and tier 2 global airport clients including some of the worlds largest such as Dubai, Sydney and London airports.

Importantly, GTK has been able to drive significant operating leverage in its business model. Despite the rapid revenue growth, the company's headcount growth has been more moderate and non-linear, indicating improved productivity per employee. This, combined with the high-margin nature of the company's recurring revenue streams, has allowed GTK to expand its EBITDA margins.

In FY24, EBITDA came in at $23.6 million, at the low end of the guidance range. However, this included a significant one-time impact from the company's long-term incentive (LTI) schemes and UK payroll taxes, which accelerated due to the strong share price appreciation. Stripping out these LTI costs, the underlying EBITDA growth was an impressive 42% year-over-year to $41 million. With GTK expensing all their development costs compared to other listed software companies, this figure is even more impressive.

Looking ahead, GTK expects the LTI costs to moderate substantially in FY25 and FY26, which should help support further EBITDA margin expansion. The company is targeting EBITDA margins of 15-20% over the medium term, after expensing all development costs. Management avoided giving a specific FY25 guidance and instead choosing to wait for later in the year and assess the timing of new contacts wins before issuing more accurate guidance.

In terms of cash flow, GTK demonstrated strong execution, with a 35.6% increase in its closing cash balance to $66.7 million. This was after the company invested $12.9 million into its Amber Electric investment. Free cashflow was an impressive $30 million. Due to timing of payments, 2H cashflows are generally stronger than 1H.

A key pillar of GTK's strategy is its G2 software platform, which the company believes has a unique and highly capable set of features compared to competitors. The company is seeing increasing interest from its customer base in adopting the G2 stack, with nearly all new sales being G2-oriented.

Geographically, GTK sees continued strong demand in its core markets of Australia, New Zealand and the UK. The company is also making inroads in international markets like Asia and Europe (Saudi and Philippines new logo wins in FY24), though it acknowledged the longer sales cycles in these regions (12-36 months).

Overall, GTK's impressive FY24 results highlight the strength of its business model and the growing demand for its software solutions globally. The underlying fundamentals of the business appear strong, and the outlook for continued growth remains positive.

We first bought GTK in mid 2022 at $1.50 ($150 million cap) and have seen the company execute and grow to $13.00 ($1.3 billion cap) or more than 8x our initial investment. We believe the stock is now being more fully appreciated by investors as a highly profitable tech company with substantial growth tailwinds for the next decade. The energy transition is real and every utility company (Energy/Water) will need to upgrade their billing stack in the next few years.

Praemium Limited (ASX: PPS) is a leading platform provider in the Australian wealth management industry, currently servicing $60 billion in assets under administration and reporting on $280 billion. The company is focused on the high net worth segment, which represents a $3.2 trillion market opportunity in Australia. During the month PPS held its investor day.

The presentation highlighted several key trends and opportunities in the advice market. Post-Hayne, the number of financial advisors has declined by 45%, but demand for advice is growing, creating an "advice gap" that PPS aims to address. Comparisons to the UK market show Australian advisors have significant potential to increase their fee income by adopting more efficient practices.

Technology is seen as critical for advisors to grow their businesses and reduce the advice gap. PPS's core strengths in reporting and administration of sophisticated assets, including alternatives and non-custodial investments, position it well to serve the needs of high net worth clients and their advisors.

To capitalise on these opportunities, PPS has refreshed its operating model and executive team, with a focus on service excellence and advisor-led product development. The launch of the Spectrum platform is a key initiative, allowing advisors to manage all client investments through a single administration solution.

Spectrum leverages PPS's capabilities in areas like trading, execution, HIN administration and multi-currency support. It also provides advisors access to a broad range of investment solutions, including private markets and alternatives, which are in high demand.

The integration of the OneVue business is another key priority, with a structured approach to capturing synergies and ensuring a seamless transition for clients. PPS is also reviewing its superannuation strategy to improve the member and advisor experience.

Underpinning these initiatives is a strong focus on technology, with investments in infrastructure, security, automation and data/AI capabilities. The risk and governance function is also evolving to enable the business while providing appropriate oversight and assurance.

Overall, PPS is positioning itself as the platform of choice for high net worth investors and their advisors, leveraging its domain expertise, service excellence and technology capabilities to drive growth and innovation in the wealth management industry. The stock trades on 10x Ebitda, pays a 3% ff dividend and has 15% of its valuation in net cash. We see the platform sector as ripe for consolidation and due to the valuation discrepancy between PPS and HUB/NWL, we believe an eventual takeover offer is only a matter of time.

AI Media (ASX: AIM) provided an update at their AGM on their strategic transformation into a global technology leader focused on AI-powered language services. The core of AIM's business model is the Lexi platform, which leverages the company's network of 5,000 encoders installed in customer workflows to orchestrate diverse data inputs into AI engines. This automated workflow management is seen as AIM's key competitive advantage.

Financially, AIM is targeting 35% annual growth in tech revenue over the next 5 years, aiming to reach $150 million of revenues and $60 million in EBITDA by FY2029. This aggressive growth plan is underpinned by several factors:

1. Mainstream adoption of Lexi in the US live broadcast market, which has grown from 16% to 50% market share in 3 years. The installed encoder base has been critical to driving Lexi adoption.

2. Geographic expansion, particularly in Europe, where AIM has already made significant progress selling encoders and expanding the iCap network. Key partnerships with broadcasters like ITV have helped drive adoption. YTD encoder sales has already doubled the entire FY24 sale number.

3. New product innovations like Lexi Voice, which is expected to be a major revenue driver, addressing a $69 billion market for AI-powered voice and translation services. Estimated launch in April 2025.

To execute on this growth strategy, AIM plans to increase investments in product development and sales/marketing by $4 million in FY2025. The company will also focus on transitioning legacy services revenue to the higher-margin tech business, with a goal of 35% annual tech revenue growth. Reaffirmed Dec 2025 target of 80% of revenues from tech sales.

Operationally, AIM faces risks around automating complex workflows, maintaining quality and accuracy of AI-generated captions, and potential bottlenecks in encoder production and distribution. However, the company is addressing these through initiatives like resilient architecture design and exploring alternative encoder integration models.

Overall, the meeting outlined an ambitious growth plan for AIM, leveraging its unique technology platform and market position to drive rapid expansion in AI-powered language services. The company's focus on financial discipline, strategic investments, and operational excellence aims to deliver the targeted $60 million EBITDA by FY2029. We believe that even if AIM only delivers on half their target, the stock is still a multi bagger from here. In the meantime we expect further market exposure as more brokers initiate cover on the stock.

Superloop (ASX: SLC) held their AGM and we had the chance to meet the company with some key highlights including:

Financials and Outlook:

- The company had a very strong four-month period, adding 192,000 new subscribers across the group. This included the successful migration of 124,000 customers from the Origin acquisition.

- The company affirmed its guidance for over 50% EBITDA growth in FY25, with the Origin migration being a critical factor.

- The consumer division added 19,000 net new customers in the four-month period, with a disproportionate weighting towards the latter part of the period. Marketing spend increased due to production costs for new brand campaigns, but the company is focused on maintaining discipline and not chasing volumes at higher costs.

- The smart communities division saw significant progress, with 6,000 new lots contracted across 9 new customers. However, the earnings contribution from this division is not expected to be material until the second half of FY26, as there is typically an 8-24 month timeline from contract signing to homes being built and generating revenue.

Operational Initiatives:

- Automation and digitisation remain a key focus, with the company aiming to reduce sales costs as a percentage of revenue by a further 2-3 percentage points. Examples include the implementation of the Teddy AI chatbot, which has already reduced human agent interactions by 50%.

- The company sees opportunities in the enterprise connectivity market as customers transition from legacy MPLS networks to IP-based solutions. While there is price erosion in this segment, the company is focused on maintaining market share.

- The smart communities division secured a significant contract with major developer AV Jennings, highlighting the company's positioning as a third scaled player in the new developments market.

M&A and Capital Management:

- The company's net cash position continues to strengthen, providing flexibility for potential M&A opportunities. However, the company emphasises that M&A is not a strategy in itself, and it will only pursue acquisitions that are strategically and financially accretive.

- The Origin migration required some working capital support, but the company remains confident in its 80-90% underlying EBITDA to cash conversion ratio.

Overall, the company delivered a strong operational performance in the first four months of FY25. We believe in the absence of any M&A it is likely SLC will begin paying dividends. Any M&A should be very accretive and a catalyst for the stock to reach our valuation of $2.50+.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Reference Index: | ASX 300 |

| Number of Securities: | 20-50 |

| Single Security Limit: | 10% (typically 5%) |

| Investable Universe: | ASX (focus on ASX300 ex20) |

| Market Capitalisation: | Any |

| Leverage: | No |

| Portfolio Turnover: | < 25% p.a. |

| Cash Level: | 0% - 100% (typically 5 - 30%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of RBA Cash Rate + 2.5% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3 - 5 years + |

| Distributions: | Annual |

Invest via TAMIM Fund

Invest via IMA

The TAMIM Australia All Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.