Listed Property

Investor Updates

September 2024 | Investor Update

Dear Investor,

The TAMIM Listed Property unit class delivered a +2.18% return for the month of September 2024. For comparison the A-REIT index was +6.48% while the G-REIT index was +0.46%.

Australian Listed REIT Portfolio (AUD)

A-REITs was (again) “hot property”, delivering 6.48% for the month. This was more than double what the ASX 200 delivered for the month. The main driver was the industrial sector through Goodman Group (GMG) which makes up a significant (~36%) part of the A-REIT market. Globally, REITs were +0.46% up in AUD for the month. The GPR 250 Australia was 3.56% up for the month and are all the components of the GPR 250 REIT Index but does not contain GMG. A-REITs have been a decent asset class to have exposure to in 2024, with only one month of negative returns and the last 6 months all delivering positive returns.

The September performance by the A-REIT market was supported by te semi-surprise 0.50% rate cut by the US Federal Reserve. Australian rate cuts are anticipated to follow that of the US but generally with at least a quarter delay. NAB is Australia’s third biggest home loan lender and they now expect the RBA to start cutting rated in February 2025. This has been moved earlier from the previous expectation of May 2025. This expectation is now in line with that of ANZ and Westpac. There has now not been an interest rate cut in Australia since the last rate hike in November 2023 and the RBA again kept its rate constant at 4.35% during the September meeting. The stance of the RBA is that inflation is still too high and that it will not return to the 2 to 3% target until 2026.

The industrial sector (+10.5%) was again the standout sector with its contribution to the monthly returns. This will probably be the case for as long as GMG is such a large component of the market. It has regularly featured as one of the top performers over the last 18 months but has also been the worst here and there. The sectors that followed industrial on a positive note was the Diversified sector (+5.4%), the Storage sector (+5.4%), the Office sector (+5.0%) and the Retail sector (+2.6%). The Residential sector was the worst performer at -3.3%.

Making a roaring comeback from the price dip of previous month or two, GMG delivered an impressive 10.75% for the month. There were no material news flows for the month in the stock name and the consensus rating is that the stock is in the “SELL” territory for the next 12 months. On a 1 year rolling period perspective GMG has delivered 74.2%, quite remarkable for a AUD7.3bn REIT and the largest REIT in the A-REIT market. GMG is one of a very few A-REITs that have delivered positive earnings growth across FY23/24 and has been the clear favourite of investors in this specific sector. Some analysts are expecting a sustained EPS growth rate of >10% which exceeds the average sector 3-year EPS CAGR of 8.5% through to FY27. The monthly inflation data for August 2024 was release on 25 September and was 2.7%, down from the 3.5% in August and the fourth straight

drop from the high point of 4.0% in May. This data point was below the consensus expectation of 2.8% and was the lowest figure since August 2021. The inflation numbers are now withing the RBA’s target range for the first time in three years, but it is still at the high end of the range. The impact of the Energy Bill Relief Fund rebate continues, and we also saw electricity prices falling the most on record (-17.9% vs -5.1% in July). Automotive fuel dropped for the first time in 13 months, and we also saw a drop in communication costs. The next monthly inflation data will be released on 30 October.

Growth has slowed and while inflation is retreating from its peak, it remains elevated as demand/supply imbalances persists particularly in sectors like rents en new dwellings. The IMF expects a modest economic recovery in 2025, pushing growth from 1.2% for 2024 to 2.1% in 2025. Australia’s robust economic institutions and policy frameworks can be further enhanced to underpin stability and foster growth in the long term. The economy will however face some cyclical challenges with tighter monetary policies expected to continue for a while still.

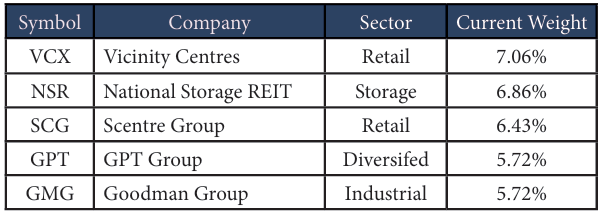

The current Australian portfolio component consists of 24 stocks. Below are the top 5 holdings:

Reitway Global Property Portfolio (USD)

For the fifth month in a row the portfolio has delivered a positive return, coming in with 2.90% for September. It has now delivered 21.18% over the last five months, coinciding with central banks around the world starting rate cuts and the lead up to these cuts. The fund slightly beat the benchmark (GPR 250 REIT Index) which delivered 2.72% for the month. On a year-to-date basis the portfolio has now delivered 9.50% up to the end of the third quarter.

The big news for the month was that the United States’ Federal Reserve Bank has at last cut rates. The even bigger news was that they cut the rate by 50bps on 18 September at their rates announcement meeting. This was also the first rate cut by the Fed in 4 years and took some of the market participants by surprise where a more conservative 25bps cut was anticipated. With this meeting the Fed also released new economic forecasts and policymakers are pencilling in another 50bps of easing by the end of the year, consisting of 2 x 25bps cuts. Looking into next year, there is another 100bps reduction expected over the year and a final 50bps reduction in 2026.

Some interesting changes were made to expected economic indicators for the next few years. PCE inflation was revised lower for 2024 to 2.3% (vs 2.6% in the June prediction) and the 2025 projection was revised down to 2.1% (vs the previous 2.3% projection). The unemployment rate is seen to be higher at 4.4% vs the previous 4.0% predicted. GDP growth for 2024 is seen slightly down at 2.0% (vs the previous 2.1%) but the forecast for 2025 was kept at 2.0%.

The best regions in the portfolio for the month was Australia (+6.25%) and Germany (+5.84%). The largest component of the portfolio is the US, and it delivered 3.30%. Our specific exposure to regional malls in Australia through Scentre Group (+8.49%) and our German residential exposure to Vonovia (+5.84%) contributed to these regions delivering solid returns. There was no region that delivered a negative return for the month in the portfolio, but the worst performing region was Japan (+0.11%). We are underweight Japan by a considerable margin and that aided in the slight outperformance of the portfolio for the month.

From a sector perspective we saw our speciality exposure delivering the greatest return. Speciality is made up of sub-sectors such as Data Centres, Towers and Communication Infrastructure (Fibre). We specifically gained from the holdings in the US but also gained from our exposure to Spanish Tower REITs. Data centres have been an excellent performer over the last 2 years, up over 70% on the back of continued strong demand and robust leasing deals being signed. Capital is flooding into the sector to support massive construction projects. There seems to be a fair runway left for the sector into 2025.

The worst performing sector which the portfolio had exposure to was the Office sector (-2.74%). We have subsequently exposed of the specific holding contributing to the negative returns. We also loss out from our exposure to Manufactured housing which brought in a negative return of -1.22% for the month. We do not have significant exposure to either of these sectors and the negative contribution to the performance was minimal. The office sector has been on a bit of a recovery path in the last few months but has come from significant lows with an uncertain outlook and where bad properties are being pitched by sellers as good land plays.

The best performing stock in the portfolio was Uniti Group, an internally managed real estate investment trust engaged in the acquisition and construction of mission critical communications infrastructure and a leading provider of fiber and other wireless solutions for the communications industry. At the beginning of the month, they announced a new 20-year contract award with a large hyperscaler in Alabama which was a big deal in the industry. Uniti also announced the pricing of the Windstream refinancing transaction close to the end month and the market reacted positively to the news. They have been making a considerable effort to address the market and announced numerous presentations such as presenting at the Deutsche Bank 32nd Annual Leverage Financed Conference and the RBC Capital Markets 2024 Global Communications Infrastructure conference. These presentations seem to be a ploy by them to be open and provide clear communication to their investors, which was in the opinion of some not always been the case.

Lineage (LINE) was the worst performing holding in the portfolio for the month, down 6.13%. This is a new listing (Listed 25 July 2024) which we entered at the back end of August and currently hold just over 2% in the portfolio. LINE is the world’s largest global temperature-controlled warehouse REIT with a network of over 480 strategically located facilities and has a market cap of $19.2bn. IT’s IPO was the largest REIT IPO in history and the proceeds were used to repay debt. It is an acquisition focused REIT, and the IPO aided its leverage metrics which in turn allows for a greater runway of bolton acquisitions before common equity issuances are needed as a funding source. They extract significant synergies from acquisitions and has made significant investment in technology in recent years to help grow their business.

Fund positioning remains roughly the same (quality, value, structural trend riders, and blend between offensive and defensive). The REIT market now has an increased appetite for risk in an easing cycle starting to unfold with global central banks starting their rate cutting cycles.

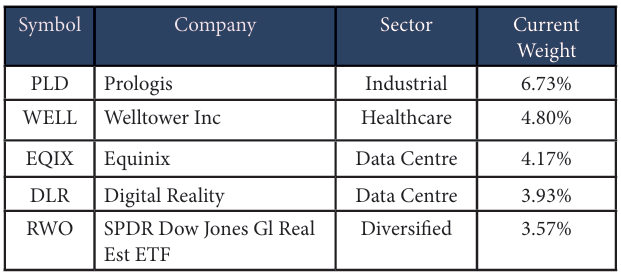

The Tamim global property portion invested in the Reitway Global Property Portfolio currently consists of 46 stocks. Below are the top 5 holdings:

We believe real estate fundamentals are still sound and remain steadfast in our belief that the asset class can post meaningful returns relative to stocks and bonds, even against a slower growth, higher inflation backdrop.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Listed property & property related securities |

| Number of securities: | 40-50 |

| Single security limit: | 10% |

| Region limit: | 70% |

| Sector limit: | 70% |

| Investable universe: | Listed property & property related securities |

| Market capitalisation: | N/A |

| Derivatives: | Yes – special instances & hedging |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-20%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 0.98% p.a. |

| Admin & Expense Recovery: | Up to 0.25% |

| Performance Fee: | Nil |

| Hurdle: | N/A |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly (with 30 day notice) |

| Distribution: | Quarterly |

| Investment Horizon: | 3-5+ years |