Global Equities

Global Mobility

Investor updates

August 2024 | Investor Update

Dear Investor,

For the month of August, the Mobility portfolio was down -7.23%, while the Kensho Smart Mobility ETF (HAIL) was down -4.02%. We are seeing typical pre-election volatility across the market and notably Technology, exacerbated by a generally fragile market structure (highlighted by the concentration risk we delved into in prior updates, along with the stretched USDJPY carry trade). Yet, in the background, liquidity injections have begun to increase and the all-important Federal Reserve is about to begin a rate-cutting regime — which has already led to a weakening of the USD, and should help spur a cycle of purchases that require financing (e.g., auto, housing) as interest rates move lower. Superimposed against this market backdrop is an accelerating Technology picture — most notably, Artificial Intelligence (AI) — where opportunities abound. We continue to believe this Technological cycle will dwarf the Internet, Mobile, and other preceding technological revolutions — and we are already beginning to see hints of this with step-function advancements in robotics, self-driving vehicles, and the automation of many white-collar tasks (further details in position commentary below). Overall, this forced systematic selling in a generally seasonally weak period (August-October) has created a plethora of opportunities in areas we are focused on. And as uncertainty around macro events — notably, the Fed and BoJ decisions in September — begins to lift over the coming ~month or so, we expect volatility will likely come back down and money will flow back into risk assets.

Further, as rates come down, we believe the relative broadening of the market is likely just beginning and would re-highlight the study showing how the equal-weighted index tends to outperform over time (pending start date) — particularly in the context of the overly stretched concentration stats from June/July (i.e., index concentration near all-time highs, correlation near all-time lows, % of stocks outperforming index near all-time lows). Overall, it appears to be an opportune time to continue to evaluate and add high quality companies down the market cap spectrum and cross various industries exposed to the next wave (Phase 2) of the AI investment cycle and its respective derivatives. Our view remains that the heavily concentrated (mega-cap) indices are in the process of peaking (likely a multi-month “event”), with money just beginning to rotate into some of the ~bottoming areas like the auto/industrial/consumer supply chains.

We’ve utilised the volatility to purchase some attractive quality businesses, as well as scale generally smaller/mid-cap names in bottoming areas — notably, the electrification, AI/automation, and re-industrialisation supply chains. Our most recent focus areas invest-wise are on phase 2 of the AI infrastructure build-out — notably around networking within and between data centers, where there are key bottlenecks holding back compute. We also continue to own well-positioned analog semiconductor companies that are key enablers to everything from connectivity, to electrification, to automation, along with some semiconductor capital equipment companies that are key to both pushing forward the leading edge and reshoring critical supply chains. While these cyclical areas are ~bottoming, many (notably the auto supply chain) have been rangebound bouncing along the bottom due to the restrictive rate environment. As we begin the rate-cutting regime, the public government spending side is attempting a hand-off to the private lending side to spur the next wave of growth. We have utilised these seemingly attractive entry points to build positions for the turn, as the underlying secular trends — from electrification and AI/automation, to reshoring and reindustrialisation — remain firmly in place as geopolitical necessities. We are incredibly excited about the opportunity set that lies ahead given where we are within this technological innovation wave, and what must happen on the global landscape front.

Sincerely yours,

Ryan Mahon and the TAMIM Team

Fund Performance

Portfolio Highlights

MACOM Technology Solutions (MTSI) is a leading semiconductor company that designs and manufactures high-performance analog RF, microwave, millimeter wave, and photonic semiconductor products. Their components are critical enablers in various high-growth markets, including data centers, telecommunications infrastructure, aerospace and defense, and industrial applications. In the context of AI/automation and electrification supply chains, MACOM’s products play a crucial role in enabling high-speed data transmission, signal processing, and wireless communications. Their semiconductor solutions are used in 5G infrastructure, data center interconnects, and radar systems, which are fundamental to the development of AI and automation technologies. MACOM’s power amplifiers, switches, and other RF components contribute to the advancement of electric vehicle technologies and smart grid systems. Additionally, their high-performance analog and mixed-signal ICs are essential for precision control and sensing in robotics applications. By providing these critical components, MACOM supports the ongoing trends in AI, electrification, automation, and robotics across multiple industries, positioning itself as a key player in the semiconductor ecosystem supporting these transformative technologies.

As of early September, MTSI was trading ~20% off of its recent high -- one of the victims of the recent volatility. MTSI is particularly well positioned as we move into the next phase of the AI infrastructure buildout -- with a focus on resolving the bottlenecks around networking to help improve the compute throughput. MTSI is focused on the high-speed optical interconnects within data centers, which will be part of the solution to continuing to improve the price/performance equation that helps enable the next step function improvement in AI models. Further, MTSI is a key both a key supplier into the Defense industry and a key enabler of reshoring with their domestic US fabrication facilities -- both of which have secular drivers from geopolitical instability and reshoring in the West.

Alphabet Inc. (GOOGL), the parent company of Google, is a global technology leader that operates across various digital sectors. In the context of AI and automation supply chains, Alphabet plays a crucial role through its advanced AI research, cloud computing services, and hardware development. Google Cloud offers AI and machine learning tools that help businesses optimise their supply chains, including demand forecasting, inventory management, and logistics optimisation. The company’s DeepMind division is at the forefront of AI research, developing technologies that can be applied to automate complex supply chain decisions. Alphabet’s hardware initiatives, such as quantum computing and custom AI chips, contribute to the underlying infrastructure needed for advanced AI and automation systems. Additionally, via businesses like Waymo (autonomous vehicles) and Wing (drone delivery), Alphabet is directly influencing the future of automated transportation and logistics. By providing both the software tools and hardware innovations necessary for AI-driven automation, Alphabet is positioning itself as a key player in shaping the future of intelligent supply chain management and logistics operations.

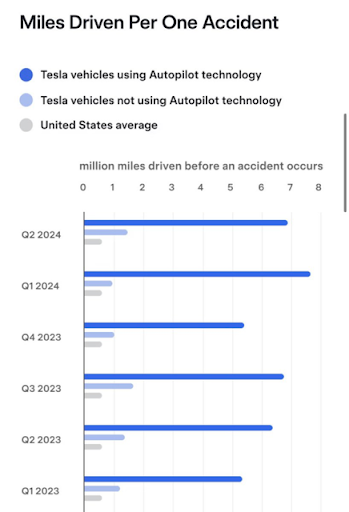

As of early September, GOOGL was trading ~20% off its recent high -- another victim of the volatility and forced systematic unwinds. GOOGL is a key player within the AI sphere as they are one of the main players who is vertically integrated across cloud infrastructure, leading edge AI technologies (algorithms and chips), and potential applications (from Search, to Waymo). Of note, the progress on the Waymo side in the last few months has been impressive. They surpassed 100K paid trips per week, revealed a powerful safety report (much safer than human driver), and expanded their services and partnership with Uber in two new cities (Atlanta and Austin). Overall, the progress on this front -- notably robotaxis -- has gone primarily under the radar, but we believe that will change in the coming 12 months.

Tesla (TSLA) is a pioneering electric vehicle, clean energy, and automation company that has revolutionised the automotive industry through its innovative approach to manufacturing and holistic vision of the electrification, automation, and robotics spheres. The company designs, develops, manufactures, and sells high-performance electric vehicles, solar panels, energy storage systems, and robotics. In the electrification supply chain, Tesla has vertically integrated many aspects of production, including battery cell manufacturing, to reduce costs and ensure supply (a similar approach as Apple in smartphones). For automation and robotics, Tesla heavily utilises advanced manufacturing techniques in its factories, employing sophisticated robots for tasks across the end-to-end process. The company’s commitment to automation extends beyond manufacturing to its vehicles, with Tesla a leader in developing autonomous driving technology (with a vision-first approach). Tesla now has over 5 millions vehicles on the road. These vehicles are essentially robots on wheels, gathering data. And, when they are ready, they can basically flip a switch and overnight these cars can become partial or full self driving. Additionally, Tesla is expanding into humanoid robotics with its Optimus project, further solidifying its position in the robotics supply chain. Through these initiatives, Tesla has positioned itself as a central player in the intersection of electrification, automation, and robotics, driving innovation across multiple industries.

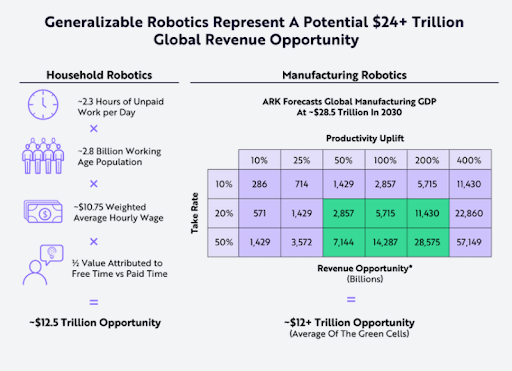

Only BYD in East, and Tesla in the West have cost structures that we believe will be competitive in this “new world” order. As we’ve laid out historically, we continue to think the majority of the other OEMs in the space will likely head toward zero -- similar to what happened with internal combustion engine OEMs in the early 20th century. The legacy auto OEMs will also end up being displaced over time as well -- as electric technology is simply superior to internal combustion and continues to improve. We are already seeing this with Ford recognising how far behind they are, and VW is potentially forced to shutter German factories due to under-utilisation. Further, both Tesla and BYD continue to separate themselves from the pack by now beginning to really lean into the software/AI side of their respective businesses -- which will ultimately power their autonomous driving experiences and the surrounding ecosystem. The recent progress on the self-driving front has been notable -- across both Tesla vehicles (see step functions improvements in chart below), as well as what’s coming on the humanoid robot front (Elon’s latest robot views) which is a massive multi-trillion dollar opportunity (second chart below estimates).

Fund Facts

Investment Parameters

| Management Style: | Active - Long/Short |

| Investments: | Equities (Long/Short) |

| Reference Index: | S&P Kensho Smart Transportation Index |

| Number of Securities: | 45-70 |

| Investable Universe: | MSCI (‘mobility’ universe) |

| Market Capitalisation: | US$ 500m-10bn |

| Cash Level: | 0-100% (typically <10%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.50% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate + 2.50% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.35% / -0.35% |

| Applications/Redemptions: | Monthly |

| Investment Horizon: | 5+ years |