Global Equities

Global High Conviction

Investor Updates

Below you will find this month’s commentary and portfolio update for the Global High Conviction unit class of the TAMIM Fund.

August 2024 | Investor Update

The TAMIM Global High Conviction unit class was down -2.06% for the month of August 2024, this was in comparison to the index return of -1.21%. The strategy has generated a return of +18.18% over the past 12 months.

If you can keep your head when all around you are losing theirs?

Markets whipsawed but finished higher as the Fed statement from Jackson Hole essentially said, “keep taking the Hopium”. Hope it’s a soft landing, hope we can fund the fiscal deficit at the imminently lower rates, hope that inflation is going to behave even though we will cut rates into a booming asset market, and hope that we can keep these asset prices up with more monetary stimulus. Being logical doesn’t always pay off in a market where your positions can be swamped by other investors’ needs to liquidate and hedge especially when leverage is very high.

“We believe the policy makers’ Zeitgeist is still to worry about wealth effects or widespread asset price falls and that inflation remains of secondary importance. Consequently, interest rate cuts are now likely to be accelerated, and further rate rises in Australia and Japan unlikely. The ‘wealth effect’ on inflationary expectations will be used as justification. This strikes us as a sell-off in the froth but with unexpected consequences. As an example of the illogicality of thinking, the Yen / US$ cross rate is only up year to date by 2% and over 3 years the US$ has actually appreciated by over 25% against the Yen. To argue that the Japanese companies have lost competitive positioning due to an overvalued currency after an 8% rise, is unsound to put it mildly. What we do from here with portfolios is to re-run our stock selection models since relative prices and valuations will have moved to an abnormal extent and think about the macro-economic consequences if we get rapid rate cuts. We will most likely make more trades than normal.”

Due to the greater number of opportunities that arise in highly volatile markets we did indeed make more trades than usual.

Nvidia’s results kept investors calm, but little was revealed regarding the new Blackwell ‘killer’ product. We remain invested in other tech names but did luckily sell LAM Research before the tech market wobble in early August. Other trades we made were to invest in MGIC, MDU Resources, DWS, the German fund management company, F5 Tech and Japan Aviation Electronics. We sold Atkore, Covestro, LAM Research, Elevance and trimmed Sprouts Farmers Market after a price rise of 300% in the last 3 years.

Notable positive performance in August came from Best Buy, Advantest, Dick’s Sporting Goods and Teradyne all up over 13%. Detractors were Amada, Hillenbrand, Emerson and Valero.

In mitigation, we note that Intel, which has failed to re-invest adequately to stay ahead in the MPU field, is now teaming up with Japan’s National Institute of Advanced Industrial Science and Technology (AIST), to push harder and faster into Extreme Ultraviolet Lithography, or very narrow bandwidth (faster) processing chips. (EUV).

AIST, which operates under the Ministry of Economy, Trade and Industry, will run the facility, while Intel will provide expertise in chip manufacturing using EUV technology. This announcement came early in September. We do not own Intel. We draw a few conclusions from this.

Since the Japanese AIST operates under the Ministry of Economy Trade and Industry (MITI), a government ‘bureaucracy’, it shows that the Japanese government is skilled at helping private enterprise become more competitive by remaining on or at the cutting edge. Japanese technology is pretty good, and the USA does not monopolise the opportunity set (ASML in Europe is the leader in EUV but its share price got smacked in early September as the EU decided that export licences are required to export the technology to China). Japan and the US are going to cooperate strategically at a national level in technology which has clear implications for Chinese companies and the government; for European semi-conductor tech too, such as it is. If governments everywhere are going to become more involved in directing capital, regulating, and promoting “key industries” (they most certainly are) then why not choose to invest more in a country where that has been a successful playbook for over 40 years? MITI is an experienced government partner for private enterprise. We remain overweight Japanese sourced technology. Intel is presumably moving to an open platform to compete against TSMC as a foundry and presumably wishes to have some of the NVDA market adulation as a global provider of manufacturing to client specified design?

It’s time to hedge political risk. Regardless of which side wins the White House it’s very likely we’ll see more re-onshoring and ‘National Industrial Policy’. The Democrats will continue to subsidise ‘Green’ or Renewable Energy, and the Republicans will attempt to encourage organic/carbon-based fuels and reduce regulation. Our stance is to invest in the companies that will power the energy transmission regardless of its generation and to capitalise on the re-industrialisation theme. We have written about this and our holdings at length. At some point Industrial REITs in the USA especially in low tax states, will become attractive as the combination of demand for space and lower cap rates works through positively for NAV calculations.

Sincerely yours,

Robert Swift and the TAMIM Team

Fund Performance

Portfolio Highlights

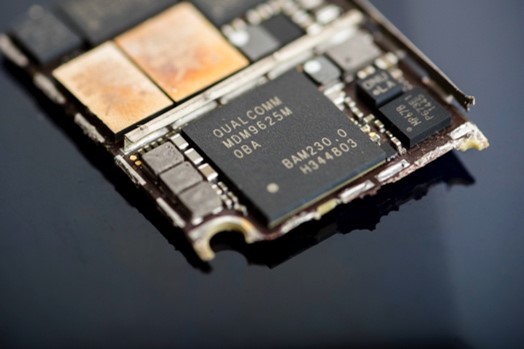

Qualcomm Incorporated (NASDAQ.QCOM)

Qualcomm, short for Quality Communications, is the global leader in mobile connectivity. The company’s hardware and systems are ubiquitous across both Android and Apple handsets with the technology enabling billions of users to call, text and stream every day.

“Hard” technology companies such as Qualcomm are our preferred exposure in the technology sector. The business possesses true intellectual competitive advantages that are difficult to replicate, even with the world’s leading engineers and abundant financial resources (as you’ll see below). The company remains a long-term holding for the fund a quiet winner in the tech arena.

The Mobile Era

Founded in 1985 by Irwin Jacobs and six co-founders, the business initially conducted communications research. Its first products were satellite phones for trucking companies, however the research team had greater ambitions. Qualcomm had patented a new cellular technology called code division multiple access (CDMA), allowing several users to simultaneously transmit data across the same frequency.

This was more efficient than the incumbent Time Division Multiple Access (TDMA) system, where users could only transmit data during a given time slot. Despite the incumbent technology being simpler, and in the initial years more reliable than CDMA, it was not suited to high-capacity communications. Over time cellular networks and handsets adopted the CDMA system entrenching Qualcomm as the standard for mobile connectivity.

Demand for the company’s modems – the small chip that enables a phone to connect to cellular towers – proliferated as mobile phone adoption grew. Handset manufacturers were eager to include the latest modems, and later semiconductors, in their products to capitalise on the emerging personal electronics market.

With the best communications hardware, Qualcomm became a cost of doing business. And while hardware sales were booming, Qualcomm had another equally lucrative profit engine. The company patented and subsequently licensed its intellectual property to competing modem and handset manufacturers, earning a royalty on every mobile device sold.

That intellectual property would continue to serve the company, providing the foundation for 3G, 4G and 5G mobile communications, and with it more patents and licensing deals.

Apple Takes A Bite

Qualcomm had built an unassailable lead in mobile. So much so that competitors, customers and regulators have been keen to dent the company’s market leadership. The fiercest battle has been with Apple, which has previously litigated Qualcomm for anti-competition practices and in 2017, began work on an in-house modem. Given Apple represents ~20% of Qualcomm’s revenue, this has been a dark cloud over the company. For several reasons, however, the Apple-Qualcomm rift is likely overblown.

After the processor, the modem is the most important component of a phone. Qualcomm’s chips are the best and have been battle-tested for decades across several platforms. From an iPhone user standpoint, there is limited functionality upside and tremendous downside should the components prove less robust than Qualcomm. More simply, users don’t mind who makes the modem, as long as it works.

Moreover, building modems is not a simple exercise, with Apple themselves acknowledging it’s “very difficult”. Apple has since extended supply agreements with Qualcomm until at least 2027. And even assuming Apple succeeds, we expect Qualcomm will have made strides to diversify away from handsets (and Apple) to new revenue streams.

The Future

Qualcomm recently announced that Microsoft Copilot personal computers, produced by several vendors including Dell, Acer, Lenovo, HP and Microsoft itself, would be exclusively powered by the company’s proprietary SnapdragonX system-on-chip.

Meta is already using Qualcomm chips for smart glasses and powering Llama2 – ChatGPT’s closest competitor. Snapdragon processors have been modified for automotive applications including facial recognition, cloud-connected content and digital chassis. The latter has a sizable runway for growth given cars have been a laggard in adopting consumer consumer-facing tech. In the latest quarter, automotive revenue increased 87% to US$811 million.

The future remains bright for Qualcomm, irrespective of if (or when) Apple produces its modems. The market has largely agreed with us, with the Qualcomm share price doubling over the past five years. Still, the business remains modestly valued on 20x earnings and a 2% dividend yield, despite several growth vectors and the rise of artificial intelligence applications.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Global Equities |

| Number of securities: | 80-110 |

| Single security limit: | +/- 5% relative to Investable Universe |

| Country/Sector limit: | +/- 10% relative to Investable Universe |

| Market capitalisation: | US$2+bn |

| Derivatives: | No |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-10%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust available to wholesale or sophisticated investors |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.00% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Fee Cap: | 2% of total FUM |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3-5+ years |

| Distributions: | Annual |

Invest via TAMIM Fund

Request additional details by using the form or if your ready to invest select the apply now button.

Invest via IMA

The TAMIM Global High Conviction strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.