Global Equities

Global Mobility

Investor updates

July 2024 | Investor Update

Dear Investor,

For the month of July, the Mobility portfolio was up 0.82%, while the Kensho Smart Mobility ETF (HAIL) was up 3.89%. The month for the market overall was incredibly volatile – with the Nasdaq down 0.75% and the Semiconductor index (PHLX) down -4.37% – driven by a confluence of macro events combined with a fragile market structure (highlighted by the concentration risk we delved into in last month’s update) and relatively illiquid summer trading. On the macro event front, the combination of the Republican convention and the Trump assassination attempt led to a steepening of the yield curve and a general outperformance of small caps over large caps, which caught many offside. The geopolitical volatility took another turn after Biden dropped out of the Presidential race, and endorsed his Vice President – Kamala Harris – which led to a reversal of some of the ‘Trump’ trades. On the FX front, we saw the Federal Reserve hint at its first rate cut in September while the Bank of Japan slightly raised rates, which drove (the start) of an unwind of the USDJPY carry trade – essentially forced selling of stocks (primarily Tech, given index concentration) and closing of borrowed yen. Along with headlines around Nvidia’s potential delay and retooling of its highly anticipated Blackwell chip, the confluence of the above ultimately culminated in the largest VIX spike since COVID in early August – and the resultant forced systematic selling has created some unique opportunities, a few of which we highlight below as new positions.

While the last few weeks have slightly reversed some of the overly stretched stats that we highlighted last month (i.e., index concentration near all-time highs, correlation near all-time lows, % of stocks outperforming index near all-time lows), we believe the relative broadening is likely just beginning and would re-highlight the study showing how the equal-weighted index tends to outperform over time (pending start date). Overall, it appears to be an opportune time to continue to evaluate and add high quality companies down the market cap spectrum and across various industries – which is what we are primarily focused on.

Our view remains that the heavily concentrated (mega-cap) indices are in the process of peaking (likely a multi-month “event”), with money just beginning to rotate into some of the ~bottoming areas like the auto/industrial/consumer supply chains. The rotation will likely create volatility in the meantime, particularly given the open question of whether the Fed is behind the curve or not (i.e., recession or soft-landing conversation).

Maybe ironically, we expect this broadening out to occur when interest rates begin to go down, as large capitalisation companies have asymmetrically benefited from higher rates being paid on cash (generally net cash positions, with termed our debt) relative to small capitalisation companies. We’ve already started to see Central Banks around the world begin the interest rate cutting process — and we expect the Fed will likely follow in September, with larger cuts likely in 2025.

We’ve utilised the now apparent volatility (no longer under the surface) to rotate into some attractive quality businesses, as well as scale generally smaller/mid-cap names in bottoming areas – notably, the electrification, automation, and re-industrialisation supply chains. These include areas like well-positioned analog semiconductor companies that are key enablers to everything from connectivity, to electrification, to automation, along with some semiconductor capital equipment companies that are key to both pushing forward the leading edge and reshoring critical supply chains. While these cyclical areas are ~bottoming, many (notably the auto supply chain) have been rangebound bouncing along the bottom due to the restrictive rate environment. At this point in the cycle, you’d typically see the public government spending side handing it off to the private lending side to spur the next wave of growth — often initiated by rate cuts, which may begin in September. But the sticky inflation environment has kept the Federal Reserve tight (even as other Central Bank’s cut), so this hand-off has not yet occurred and interest-rate sensitive areas (like Auto) continue to bounce along the bottom. We have utilised these seemingly attractive entry points to build positions for the turn, as the underlying secular trends — from electrification to reshoring and reindustrialisation — remain firmly in place as geopolitical necessities.

Sincerely yours,

Ryan Mahon and the TAMIM Team

Fund Performance

Portfolio Highlights

Broadcom Inc. (AVGO) is a global technology company that designs, develops, and supplies a wide range of semiconductor and infrastructure software solutions. The company operates in two main segments: Semiconductor Solutions and Infrastructure Software. Broadcom provides essential components and technologies to help enable the electrification, automation and robotics supply chain. Their semiconductor products, including system-on-chips (SoCs), wireless communication chips, and custom silicon solutions, are used in various applications such as data center networking, broadband access, telecommunication equipment, smartphones, and factory automation systems. Broadcom’s offerings in RF front-end modules, Wi-Fi, Bluetooth, and GPS technologies contribute to the advancement of connected and automated systems. Additionally, their focus on Ethernet switching, routing solutions, and fiber optic components supports the infrastructure needed for robotics and automation in industrial settings. By providing these critical technologies, Broadcom enables the development and implementation of smart, connected devices and systems that are fundamental to the ongoing trends in electrification, automation, and robotics across multiple industries.

As noted, Broadcom is a key semiconductor supplier into several key thematic areas we are focused on -- many of which they have a monopoly or oligopoly in, such as Ethernet switching. Over the course of the last few weeks (2H July into August), the stock is down over 30% -- primarily as a result of the confluence of macro variables we noted above. We initiated a position on the pullback and view the company as well positioned to enable and capitalise on the trends in connectivity, electrification and automation.

Teradyne, Inc. (TER) is a leading provider of automated test equipment and industrial automation solutions. The company designs, develops, manufactures, and sells products that ensure the functionality and reliability of semiconductors, wireless products, data storage, and complex electronics systems. Teradyne operates through four main segments: Semiconductor Test, System Test, Wireless Test, and Robotics. Their automated test equipment (ATE) is critical for speeding up the time-to-market for new electronic devices, ensuring they meet high standards of performance and reliability. In the robotics segment, Teradyne offers collaborative robotic arms and autonomous mobile robots that automate repetitive manual tasks, thereby enhancing efficiency and productivity in manufacturing environments. By integrating advanced testing and automation technologies, Teradyne plays a vital role in the electrification, automation, and robotics supply chains, helping industries deliver high-quality products quickly and cost-effectively.

Within its business lines, Teradyne primarily operates within a duopoly or oligopoly structure. They have continued to build up their Robotics division over the past several years, leaving them very well positioned in the trends toward automation and reshoring. Over the last year+, the stock has been largely rangebound as the Semiconductor Test market has been in a fairly significant downturn, but is now in the process of bottoming. Similar to Broadcom, Teradyne is also down over 30% over the last few weeks -- we re-initiated a position during the pullback and view the company as particularly well positioned in both the automation supply chain and the broader trend toward reshoring.

Texas Instruments (TXN) is a global semiconductor company that designs, manufactures, tests, and sells analog and embedded processing chips for various markets, including industrial, automotive, personal electronics, communications equipment, and enterprise systems. Their portfolio includes embedded processors, microcontrollers (MCUs), and connectivity products that enhance computing performance, motor control, real-time communication, and AI capabilities. TI’s technologies are integral to the development of smart, efficient, and safe robotics systems, as demonstrated by their role in Amazon Robotics’ autonomous mobile robots. Additionally, TI’s power conversion, sensing, and control solutions support energy systems and electric vehicles, contributing to the broader trend of electrification. By offering scalable, high-performance, and cost-effective semiconductor solutions, TI plays a pivotal role in advancing the capabilities of automation and robotics across various industries.

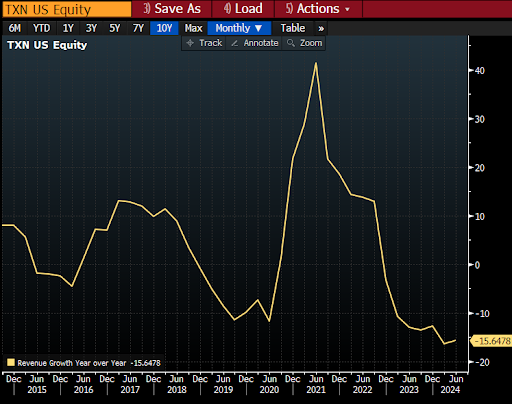

TXN is a position we added to over the last few weeks on relative weakness (off ~15% from its local high). As the graph illustrates below, TXN revenue has been in a protracted downcycle over the last almost 2 years, and unsurprisingly the stock has been rangebound as a result. On top of the downcycle in revenues (primarily industrial and automotive exposure, both of which are in the process of ~bottoming), TXN has been investing heavily on the capex side to further build out its domestic (US) 300mm fabrication facility capacity. While in the short run this capex suppresses TXN’s free cash flow, over the medium term it will further solidify its competitive advantage with local, resilient manufacturing capacity (reshoring beneficiary) and enhance gross margins and its cost structure advantage (300mm huge advantage in analog over 200mm wafers). Overall, they are particularly well positioned to capitalize on the next upcycle.

Fund Facts

Investment Parameters

| Management Style: | Active - Long/Short |

| Investments: | Equities (Long/Short) |

| Reference Index: | S&P Kensho Smart Transportation Index |

| Number of Securities: | 45-70 |

| Investable Universe: | MSCI (‘mobility’ universe) |

| Market Capitalisation: | US$ 500m-10bn |

| Cash Level: | 0-100% (typically <10%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.50% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate + 2.50% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.35% / -0.35% |

| Applications/Redemptions: | Monthly |

| Investment Horizon: | 5+ years |