Australian Equities

Australia Small Cap Income

Investor updates

Below you will find this month’s commentary and portfolio update for TAMIM Australia Small Cap unit class.

July 2024 | Investor Update

We provide this monthly report to you following conclusion of the month of July 2024.

The TAMIM Small Cap Fund was up +2.96% (net of fees) during the month, versus the Small Ords up +3.49%.

Over the last 12 months the fund is up +18.70% net of fees versus the Small Ords up +9.30%.

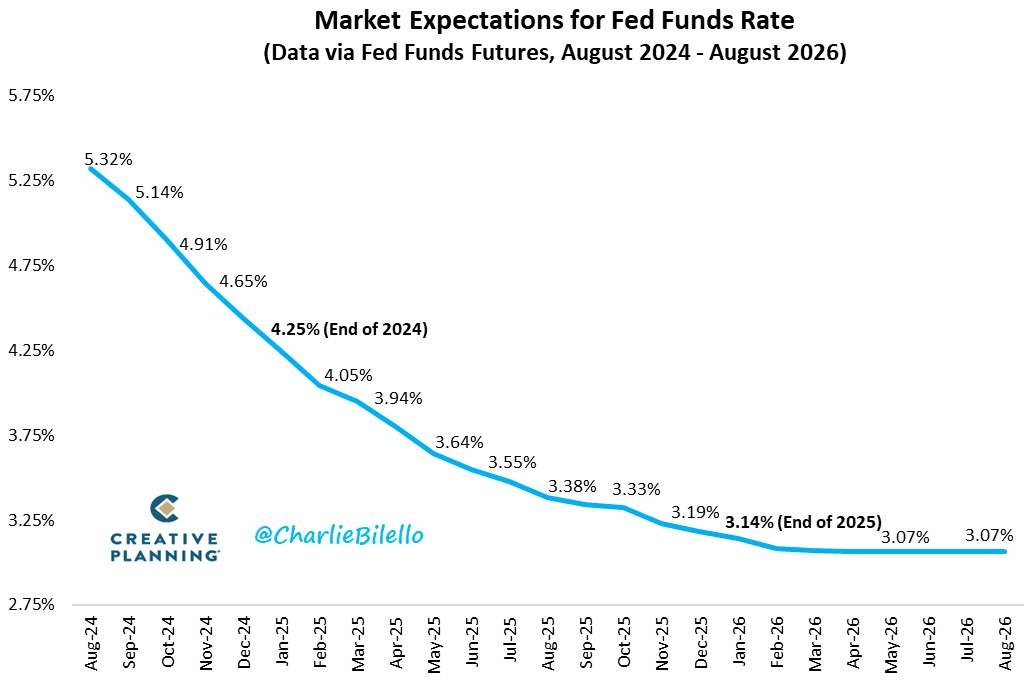

July saw equity markets rally on the back of a weaker than expected CPI report in the US and signaling from the Fed that rate cuts are now firmly on the table at the September meeting. The market is now expecting a 50bps rate cut in September followed by a 25bps rate cut for 6 consecutive Fed meetings. By mid next year the Fed fund rate is forecast to be 3.75-4.00%.

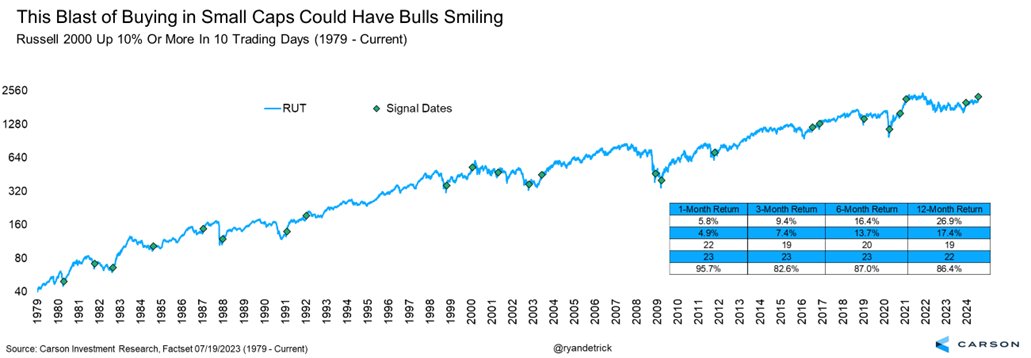

As we have foreshadowed for many months now, we expect mid and small cap companies to benefit from interest rate easing and this played out as the US small cap index, Russell 2000, was up more than 10% in 10 trading days. Since 1979 (when it started trading), this has happened only 23 other times. Future returns are quite strong, up nearly 27% a year later and higher 86% of the time.

Finally, as we head into the August reporting period, we expect this to be a strong catalyst period for our portfolio holdings and should determine the next leg up of returns in the short term and into next year. We believe many of our holdings have clear near term catalysts, and are significantly undervalued by the market, which in the past has been the reason why we have seen significant Takeover activity in the Fund.

We provide a brief commentary on portfolio updates during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in September.

Sincerely yours,

Ron Shamgar and the TAMIM Team.

Fund Performance

Portfolio Highlights

Bravura Solutions (ASX: BVS) has announced a proposed return of capital to shareholders.

Contingent on receiving the necessary approvals from shareholders at the upcoming Annual General Meeting (AGM) and securing a favourable Class Ruling from the Australian Taxation Office (ATO) the company intends to distribute up to $75.3 million or 16.7 cents per share.

This decision follows a thorough review of Bravura’s capital management strategy, following on from the previous management’s decision to raise capital in March 2023 and the significant transformation executed during FY24. The board has determined that the business is overcapitalised and aims to return excess capital to its shareholders within three months of the AGM, pending the requisite approvals.

This follows on from the July market update where Bravura announced an upgrade to its FY24 financial guidance. The unaudited operating earnings guidance has been increased to approximately $25 million, up from the previously forecasted range of $18 million to $22 million. Additionally, Cash operating earnings guidance stands at around $10 million.

CEO, Andrew Russell attributed this upgrade to the successful execution of Bravura’s transformation strategy, which has stabilised the business and surpassed budget expectations.

We have previously discussed how we believe Bravura is a turnaround story and with the company’s proactive capital management and upgraded financial guidance position the business continues to show signs of this being the case.

We estimate BVS can exit FY25 with cash Ebitda margins of 20% which will place the stock on 7x cash Ebitda pre capital return. We think over time as management prove their ability to grow the top line, the stock will re rate to a growth multiple with 100%+ upside. We believe a dividend payout policy will be announced during FY25.

Austco Healthcare Limited (ASX: AHC) is an international leader in healthcare communication solutions, dedicated to enhancing outcomes for patients, residents, and caregivers across various care environments.

The company’s innovative products and customer support reach over 60 countries, affirming its global footprint. Headquartered in Australia, Austco Healthcare operates through subsidiaries in six countries and supports over 5,000 healthcare facilities via its global reseller network.

Austco has continued to grow both organically and via acquisition.

The company has acquired several existing businesses and is looking to expand its foothold in Australia and increase its direct sales capability. Austco recently completed its acquisition of Amentco. Amentco is a security and healthcare solutions provider and is a certified Austco Nurse Call reseller. Amentco specialises in providing integrated nurse call, security, access control and complementary systems to small and medium-scale enterprises in public and private sectors.

Austco has two primary solutions:

Nurse Call System

Austco’s solutions go beyond traditional “button and light” systems, embodying cutting-edge technology.

The company’s premier nurse call system, Tacera, offers a comprehensive range of features designed to meet the needs of modern healthcare environments. This includes pendants, pillow speakers, call points, pull cords, annunciators, lights, touchscreen stations, and audio devices. Tacera’s versatility and advanced functionality make it a preferred choice for healthcare providers seeking reliable and efficient communication solutions. In addition to Tacera, Austco offers Medicom, a simpler and more cost-effective nurse call solution.

Medicom retains the essential features necessary for effective patient-caregiver communication, making it an ideal option for facilities with budget constraints without compromising on quality and reliability.

Alarm Management & Reporting Analytics

Austco’s expertise extends into alarm management and reporting analytics through its Pulse platform.

Pulse Mobile, a smartphone application, empowers nurses to manage alarms and control the nurse call system remotely. This capability enhances workflow efficiency and ensures that nurses can respond promptly to patient needs from anywhere within the facility. Pulse Reports, the reporting analytics component of the platform, provides healthcare staff with access to nationwide health system data.

The ability to run custom automated reports and measure performance against protocols from a single interface facilitates streamlined communication between departments and supports data-driven decision-making.

Historically, Austco’s revenue has primarily come from one-off contracts with hospitals, typically secured during the construction phases of these facilities.

Recognising the need for more stable and higher-margin revenue streams, Austco has been shifting its focus toward software sales and service and maintenance agreements (SMA). Post-pandemic, Austco experienced a resurgence in software sales, bolstered by the renewed ability to engage directly with customers. North America in particular has emerged as a lucrative market, experiencing significant growth in software and SMA revenue.

Management is optimistic about the sustained demand for higher-margin software and SMA offerings, as customers increasingly recognise the value of ongoing support and software upgrades throughout the lifecycle of their product deployments.

The availability and cost of raw materials posed significant challenges during the COVID-19 pandemic, affecting Austco’s supply chain and overall gross margin.

In 2023, the gross margin increased slightly from 52.5% to 53.4%, before declining in the first half of 2024 due to lingering supply chain issues. As Austco moves past the higher-cost inventory, there is optimism for a return to improved gross margins.

This improvement revealed itself in the company’s third quarter trading update with the Q3 gross margin jumping to 57.5%.

Following Austco’s third quarter trading update, the company provided further insights for the full financial year ending 30 June 2024.

On an unaudited basis, Austco expects its FY24 revenue to reach approximately $58 million, representing a 38% increase compared to FY23’s revenue of $42 million. Operating earnings are projected to be between $7.5 million and $8.0 million, marking an impressive increase of 108% to 122% over the FY23 operating earnings of $3.6 million.

The market reacted positively to the update with shares rising upon release.

The company’s order book has reached a record $46.2 million as of March 2024, highlighting the strong demand for Austco’s advanced healthcare communication solutions. The open sales orders represent commitments from customers that have yet to be fulfilled and recognised as revenue. The significant buildup of orders during the pandemic, due to site restrictions impacting product delivery, is now being addressed as operational conditions normalise.

This backlog indicates a promising future revenue stream as these orders are progressively fulfilled.

In a recent contract win, Austco secured a $5.0 million deal to supply the new Surrey Hospital in Vancouver, British Columbia, with its leading Tacera alarm management and clinical workflow solution. The new hospital will feature over 650 beds, including specialised units for intensive care and neonatal intensive care, and a new emergency department set to be the second largest in Canada. The hospital, designed to meet the growing healthcare needs of Surrey’s expanding population, will be equipped with over 513 full IP patient stations and 559 clinical workflow terminals.

Revenue recognition from this project is expected to commence in FY25.

Austco Healthcare’s resilience and innovation amidst the operational challenges posed by the COVID-19 pandemic have set the stage for substantial growth in the healthcare communication solutions industry.

The company’s strategic shift towards high-margin software and service agreements has fueled impressive financial growth, highlighted by its robust FY24 revenue and operating earnings projections.

With a record order book and notable contract wins, Austco’s future appears bright. Its advanced Tacera platform and extensive global presence underscore its commitment to enhancing patient care and clinical efficiency. As Austco navigates past supply chain challenges and capitalises on its technological advancements, it remains a compelling business to watch in the healthcare sector.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Australian Equities |

| Investment Universe: | Australian Small Cap |

| Reference Index: | ASX Small Ords |

| Number of Securities: | 20-40 (10-20 Value, 10-20 Growth) |

| Single Security Limit: | +/-5% |

| Market Capitalisation: | Small Cap |

| Leverage: | No |

| Portfolio Turnover: | <50% p.a. |

| Cash Level (typical): | 0-100% (0-50%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate + 2.50% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Distributions: | Semi-annual |

| Applications/Redemptions: | Monthly |

| Redemptions: | Monthly with 30 days' notice |

| Investment Horizon: | 3 - 5 years + |

Invest via TAMIM Fund

Request additional details by using the form or if you're ready to invest select the apply now button.

Invest via IMA

The TAMIM Australia Small Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.