Global Equities

Global Mobility

Investor updates

June 2024 | Investor Update

Dear Investor,

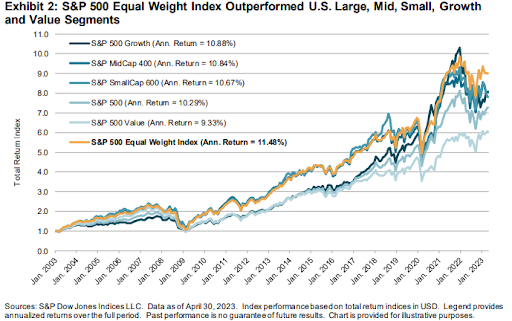

For the month of June, the Mobility portfolio was down 4.28%, while the Kensho Smart Mobility ETF (HAIL) was down 5.19%. While the market-cap weighted indices were up in June, the equal-weight S&P as well as the Russell 2000 (i.e., small cap) were both down ~1 to 1.5%. This dispersion highlights how “top heavy” the market-cap weighted indices have become – with the majority of the performance driven by a handful of large stocks. A few interesting stats on the market structure and these points:

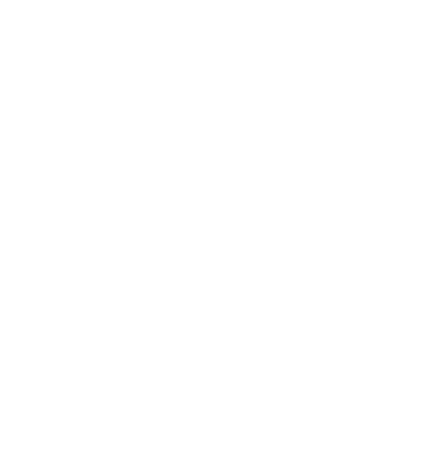

The percentage of S&P 500 stocks outperforming the S&P is near an all-time low

Source: Willie Delwiche, CMT, CFA

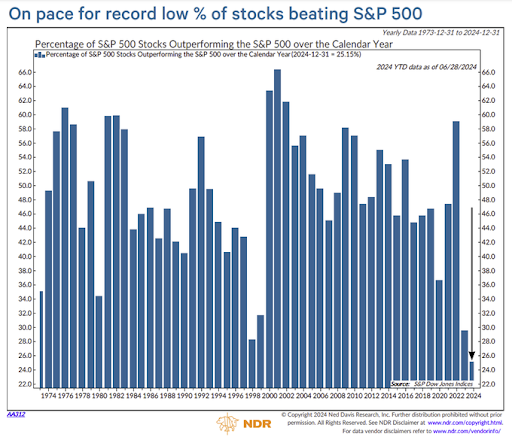

Concentration in the S&P 500 in the top names is near an all-time high

Source: Nautilus Research

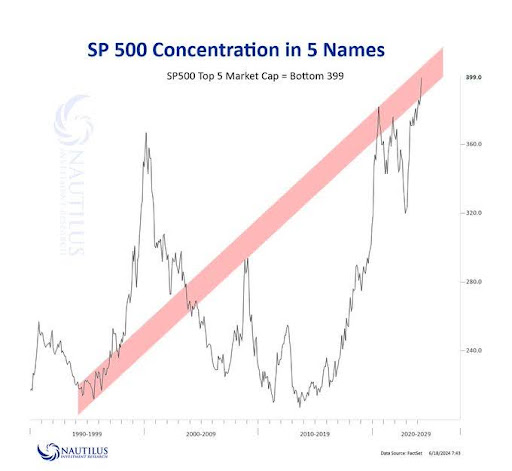

S&P 500 market-cap weighted vs. S&P 500 equal weighted correlation near an all-time low

Source: Tier1 Alpha

Based on the S&P Global study, the S&P 500 equal weight tends to outperform market-cap weight over time

Source: SPGlobal

With index concentration near an all-time high, index correlation near an all-time low, % of stocks outperforming the index near an all-time low, and the study highlighting how the equal-weighted index tends to outperform over time (pending start date), it appears to be an opportune time to evaluate high quality companies down the market cap spectrum and across various industries — which is exactly what we are doing (some details below).

Our view is that the heavily concentrated (mega-cap) indices are in the process of peaking (likely a multi-month “event”), with money just beginning to rotate into the bottoming areas like the auto/industrial/consumer supply chains. As liquidity begins to come back and flow into the market in July/August, we expect we’ll begin to see a more sustained rally — particularly in these bottoming areas now finally seeing inflows.

Maybe ironically, we expect this broadening out to occur when interest rates begin to go down, as large capitalisation companies have asymmetrically benefited from higher rates being paid on cash (generally net cash positions, with termed our debt) relative to small capitalisation companies. We’ve already started to see Central Banks around the world begin the interest rate cutting process — and we expect the Fed will likely follow, with larger cuts likely in 2025.

As we mentioned on prior updates, we utilised the volatility under the surface over the last few months to scale generally smaller/mid-cap names in bottoming areas — notably, the electrification, automation, and re-industrialization supply chains. These include areas like lithium and copper producers, along with well-positioned analog semiconductor companies that are key enablers to everything from connectivity, to electrification, to automation. While these areas are bottoming, they have been rangebound bouncing along the bottom due to the restrictive rate environment. At this point in the cycle, you’d typically see the public government spending side handing it off to the private lending side to spur the next wave of growth — often initiated by rate cuts. But the high, sticky inflation environment has kept the Federal Reserve tight (even as other Central Bank’s cut), so this hand-off has not yet occurred and interest-rate sensitive areas (like Auto) continue to bounce along the bottom. We have utilised these attractive entry points to build positions for the turn, as the underlying secular trends — from electrification to reshoring and reindustrialisation — remain firmly in place as geopolitical necessities.

Overall, we continue to see a lot of opportunities underneath the surface of this “top-heavy” market and we believe the turning point in market “breadth” will likely revolve around the interest rate path ahead. For more information, we’d recommend checking out the latest update call from mid-June, which delves into the latest trends and our thoughts in greater detail.

Sincerely yours,

Ryan Mahon and the TAMIM Team

Fund Performance

Portfolio Highlights

Tesla (TSLA)

Tesla is a pioneering electric vehicle, clean energy, and automation company that has revolutionised the automotive industry through its innovative approach to manufacturing and holistic vision of the electrification, automation, and robotics spheres. The company designs, develops, manufactures, and sells high-performance electric vehicles, solar panels, energy storage systems, and robotics. In the electrification supply chain, Tesla has vertically integrated many aspects of production, including battery cell manufacturing, to reduce costs and ensure supply (a similar approach as Apple in smartphones). For automation and robotics, Tesla heavily utilises advanced manufacturing techniques in its factories, employing sophisticated robots for tasks across the end-to-end process. The company’s commitment to automation extends beyond manufacturing to its vehicles, with Tesla a leader in developing autonomous driving technology (with a vision-first approach). Tesla now has over 5 millions vehicles on the road. These vehicles are essentially robots on wheels, gathering data. And, when they are ready, they can basically flip a switch and overnight these cars can become partial or full self driving. Additionally, Tesla is expanding into humanoid robotics with its Optimus project, further solidifying its position in the robotics supply chain. Through these initiatives, Tesla has positioned itself as a central player in the intersection of electrification, automation, and robotics, driving innovation across multiple industries.

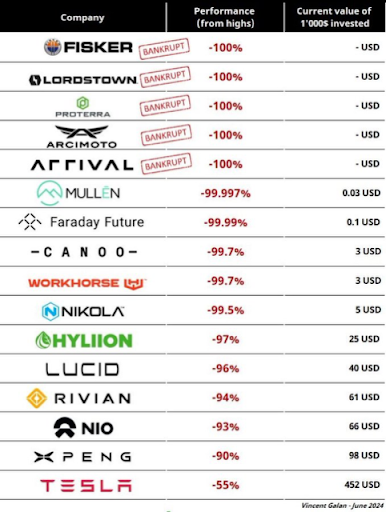

Only BYD in East and Tesla in the West have cost structures that we believe will be competitive in this “new world” order. As we’ve laid out historically, we continue to think majority of the other OEMs in the space will likely head toward zero -- similar to what happened with internal combustion engine OEMs in the early 20th century. The legacy auto OEMs will also end up being displaced over time as well -- as electric technology is simply superior to internal combustion and continues to improve. Further, both Tesla and BYD continue to separate themselves from the pack by now beginning to really lean into the software/AI side of their respective businesses -- which will ultimately power their autonomous driving experiences and the surrounding ecosystem.

Albemarle Corporation (ALB)

Albemarle Corporation is a global leader in providing essential elements for mobility, energy, and connectivity. As the world’s largest lithium producer, Albemarle plays a crucial role in the electric vehicle (EV) supply chain by supplying battery-grade lithium hydroxide, a key component in EV batteries. The company has established strategic agreements with major automakers to deliver lithium hydroxide for millions of future EVs through long-term supply contracts spanning from 2026 to 2030. Albemarle is committed to expanding its US domestic presence by opening new lithium mines and constructing a $1.3 billion processing facility in South Carolina capable of supporting the manufacturing of 2.4 million EVs annually and processing lithium from recycled batteries.

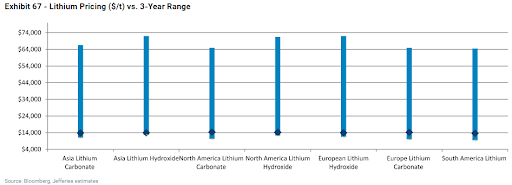

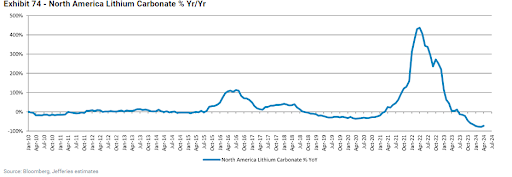

After correcting over 65% last cycle and over 80% this cycle, the price of lithium is beginning to bottom out -- which coincides with a bottoming out of the broader mobility supply chain. Unsurprisingly, Albemarle’s stock price is highly sensitive to the price of lithium and has experienced similar sized corrections each cycle. While the price hasn’t yet begun to move meaningfully higher yet, the downside is more defined and it has historically been beneficial to begin to position before the full turn.

Analog Devices (ADI)

Analog Devices (ADI) is a leading semiconductor company that provides innovative solutions for the electric vehicle (EV) and charging infrastructure market. They offer a wide range of products, including energy measurement ICs, battery management systems, power semiconductors for on-board EV chargers, and wireless battery management systems. ADI’s solutions enable longer EV range, improved battery lifetime, increased efficiency of electric powertrains, and faster charging times. Additionally, ADI is at the forefront of developing technologies for the automation supply chain, offering products like isolated gate drivers and power supply controllers for energy storage systems that support fast EV charging infrastructure.

Analog semiconductors in general are critical enablers of everything from connectivity, to electrification, to automation -- and Analog Devices is a leader in the space. The stock (and the analog group in general) has been consolidating for an extended period as the auto and industrial supply chains have been going through a significant inventory downcycle. The inventory cycle is beginning to bottom out (~Q2 2024), which historically tends to be a positive time to accumulate for the next upcycle.

Fund Facts

Investment Parameters

| Management Style: | Active - Long/Short |

| Investments: | Equities (Long/Short) |

| Reference Index: | S&P Kensho Smart Transportation Index |

| Number of Securities: | 45-70 |

| Investable Universe: | MSCI (‘mobility’ universe) |

| Market Capitalisation: | US$ 500m-10bn |

| Cash Level: | 0-100% (typically <10%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.50% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate + 2.50% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.35% / -0.35% |

| Applications/Redemptions: | Monthly |

| Investment Horizon: | 5+ years |